Policy & Regulation

MiCA goes live in Europe as the crypto regulatory framework starts with stablecoins

Credit : cryptonews.net

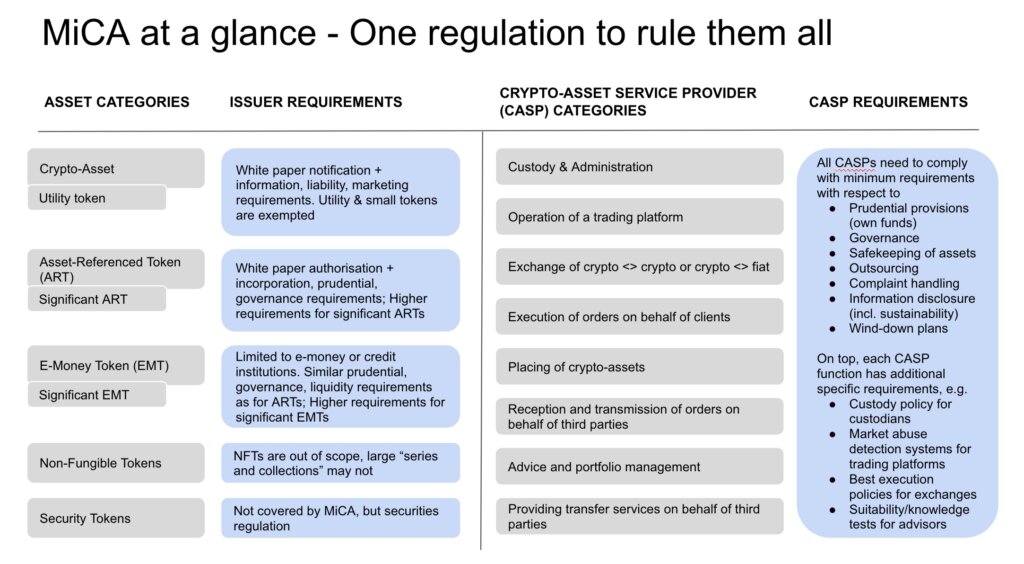

MiCA is now stay throughout the European Union, marking a milestone for digital asset supervision. Business individuals now function inside an EU-wide framework that features stablecoins, token issuances and providers corresponding to custody and change.

Because the Bretton Woods Fee wrote, the method concerned years of session and negotiations, culminating in a rulebook that addresses oversight gaps and promotes transparency.

Corporations issuing e-money tokens (EMTs) should be included within the EU or have related e-money licenses, whereas asset-referenced tokens face greater disclosure and governance necessities after they attain sure quantity or consumer thresholds. The measures additionally embody stricter guidelines on reserve administration, redemption and disclosure, signaling the bloc’s concentrate on monetary stability in digital asset markets.

Patrick Hansen, coverage director at Circle, wrote an intensive piece explaining how stablecoin issuers have little selection however to conform or lose entry to the complete EU market. Tether, the world’s largest stablecoin issuer, tellingly selected the latter possibility Crypto that the competitors is pissed off by the totally different strategy to stablecoins. He mentioned,

“Each day you get up, you scratch your head and you do not perceive why these few Italian guys are doing significantly better than you. After all you get pissed off, proper?

So you understand, if your corporation mannequin is named Kill Tether, then you understand you could rethink your product.

Expectations for crypto firms within the EU

Crypto-asset service suppliers (CASPs) that provide actions corresponding to brokerage, change or custody face licensing necessities that may enable them to function in all member states as soon as they’re licensed in a single jurisdiction. This shift replaces the earlier patchwork of nationwide laws, decreasing limitations for firms pursuing cross-border progress and offering a passport-like mechanism just like the strategy used within the EU’s conventional monetary providers.

Some firms are anticipated to consolidate or forge partnerships as it may be tougher for smaller firms to satisfy compliance obligations. Buying and selling platforms should additionally set up controls in opposition to market abuse and insider buying and selling. Authorities might ban the providing of tokens if disclosures or danger administration procedures seem incomplete.

MiCA formally excludes protocols that run “in a completely decentralized method” from its scope, however many operations might not meet the brink for true decentralization.

The identical ambiguity exists round large-scale NFT collections, which might be deemed fungible by regulation, requiring compliance with White Paper and issuer obligations. There may be additionally uncertainty round ‘privateness cash’, which can be delisted if full identification of the holder proves not possible.

Total anticipated affect of MiCA

Business responses from Bretton Woods and Circle point out a shared understanding that the sensible success of MiCA relies on technical requirements and enforcement practices. Corporations are adapting their product choices, specializing in readability in disclosures and compliance with token issuance and reserve administration guidelines. As Hansen famous, adoption of the framework may entice tasks looking for certainty, particularly if issues about enforcement actions elsewhere persist.

There are broader questions on world adoption. The US has but to formalize regulation of stablecoins, and enforcement patterns, whereas showing progressive, range extensively throughout Asia. The European mannequin may affect different jurisdictions, resulting in a ‘race to the highest’ in shopper safety and alignment with worldwide requirements.

In response to Bretton Woods, a coordinated strategy would promote the passportability of stablecoins and restrict the dangers of regulatory arbitrage. Some lawmakers have mentioned a MiCA 2.0, indicating that non-fungible tokens, DeFi or extra know-how options may ultimately be revisited underneath an up to date directive. Officers notice that any new iteration will rely upon the regulation’s preliminary outcomes.

Hansen factors to MiCA’s similarities with different EU know-how initiatives, the place regional requirements in the end influenced industrial and authorized frameworks overseas. Whether or not MiCA turns into a regular world reference will rely upon its implementation in apply, the position of nationwide authorities and the way successfully the measures defend markets whereas enabling firms to innovate. In the meantime, business strikes to safe a MiCA license proceed, with main banks and exchanges adapting their operations or buying smaller gamers.

Many count on MiCA to convey better institutional involvement, aided by uniform licensing and shopper safety. Nonetheless, the price of compliance stays an element that would shift exercise to well-capitalized platforms. Buyers may see broader adoption of regulated providers, whereas smaller groups may concentrate on specialised niches or transfer to areas the place obligations are much less stringent. Policymakers have vowed to regulate the end result, believing {that a} united EU place on crypto may strengthen capital formation and consumer safety.

Because the framework applies, stablecoin issuers and CASPs will face earlier enforcement deadlines than different market individuals, with the remainder of the principles being carried out over the course of the 12 months. Regulators may also situation binding implementation requirements that make clear timelines, technical disclosures and working circumstances for token tasks.

Hansen confirms that firms planning to navigate the European panorama are cooperating with authorities and making ready compliance methods accordingly. He believes that MiCA has created an surroundings of clear obligations for individuals, and that its skill to encourage accountable progress underneath constant guidelines will measure the way it shapes the crypto markets.

Implementation will proceed in phases because the EU refines technical tips and screens licensed entities. The end result will present whether or not MiCA is a workable mannequin that balances innovation with supervision.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now