Altcoin

MicroStrategy Decouples from Bitcoin and Approaches ATH – Here’s How

Credit : ambcrypto.com

- MSTR has outperformed and decoupled from BTC.

- Since September, the worth has risen 68%, nearly the ATH.

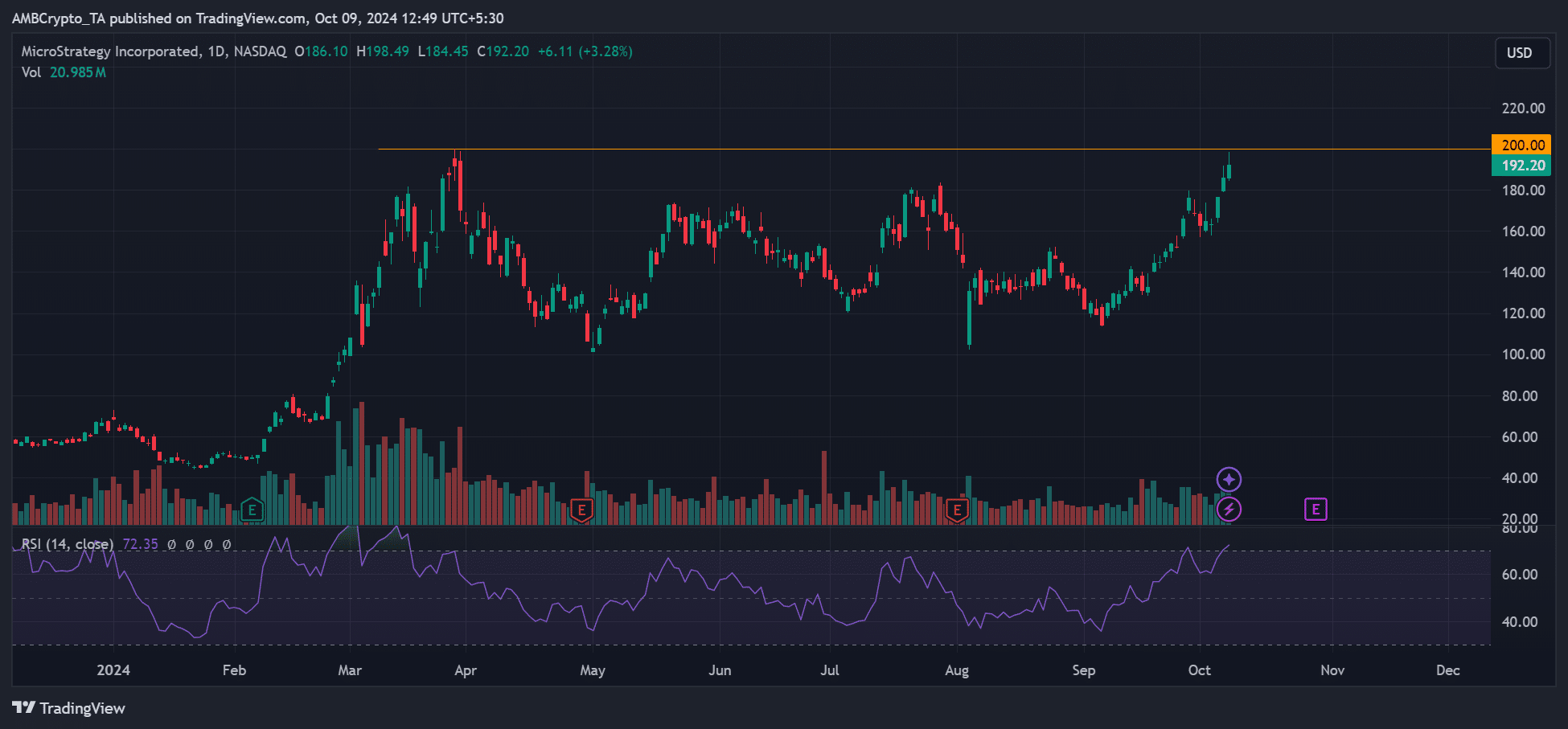

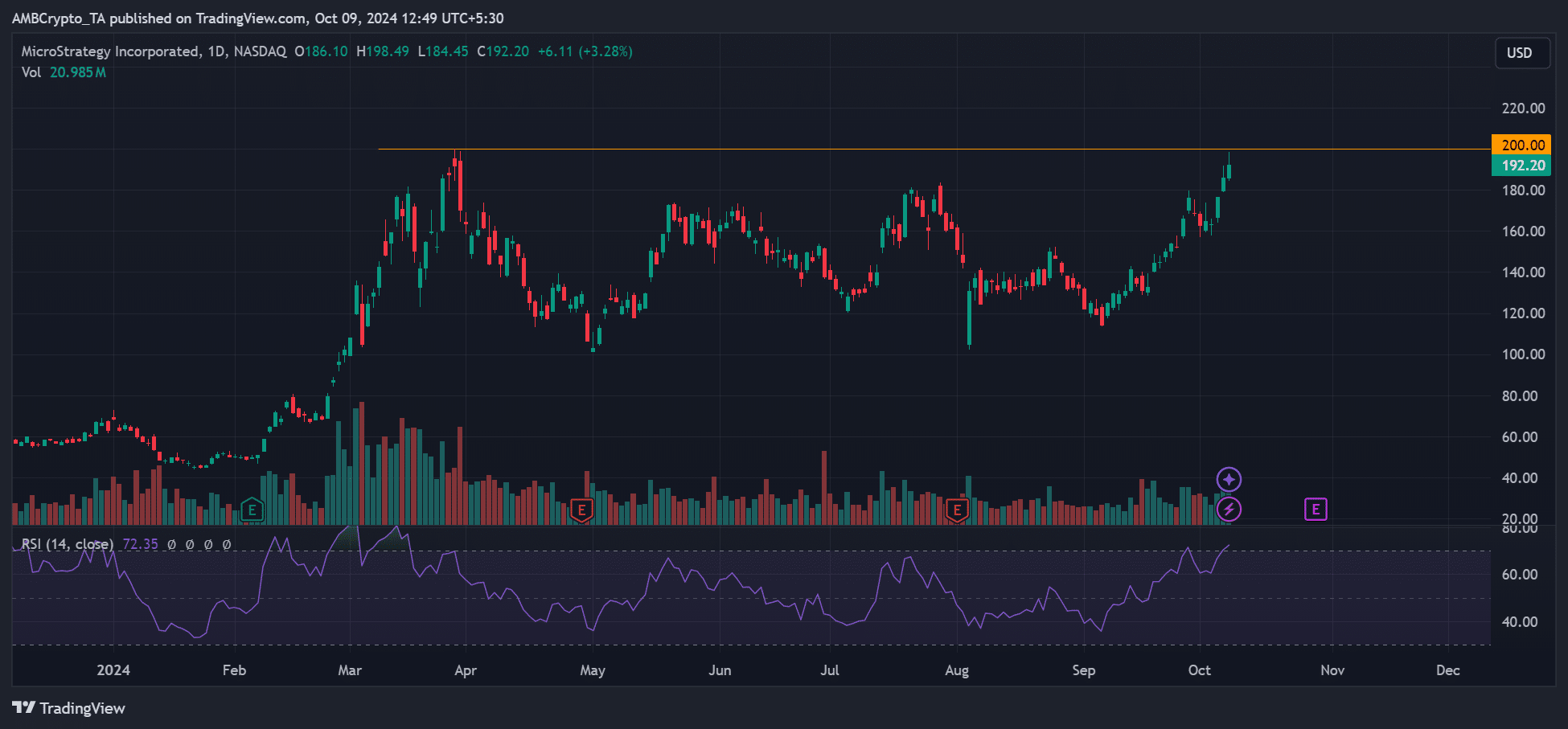

MicroStrategy [MSTR]has hit a six-month excessive of $198, just under the ATH of $200. The newest revival coincided with the cryptic message from its founder, Michael Syalor.

In his newest X (previously Twitter) afterSaylor wore gladiator-like apparel, a Bitcoin [BTC] pendant and a sword.

This may be interpreted as his willingness to publicly defend and defend BTC amid fiscal instability and fiat-driven inflation.

Saylor is maybe probably the most notable BTC bull to be Uber-bullish on the asset. He believes BTC is probably the most superior asset and retailer of worth in human historical past, given its regular provide and resistance to censorship.

His place shaped the premise for BTC’s treasury technique, which he pioneered with MicroStrategy.

The Bitcoin-focused software program supplier now has almost $16 billion in BTC (252,000 cash), having acquired over $1.5 billion in Q3 2024.

A $16 billion BTC inventory sparks an MSTR rally

MicroStrategy’s MSTR rally has been linked to the corporate’s large BTC provide noted by CryptoQuant.

“Since MicroStrategy began shopping for $BTC on August 11, 2020, shares are up 1,208%, whereas Bitcoin itself is up 445%.”

That mentioned, MSTR’s large BTC provide, acquired primarily by means of debt (convertible notes), has made it extremely correlated with the digital asset.

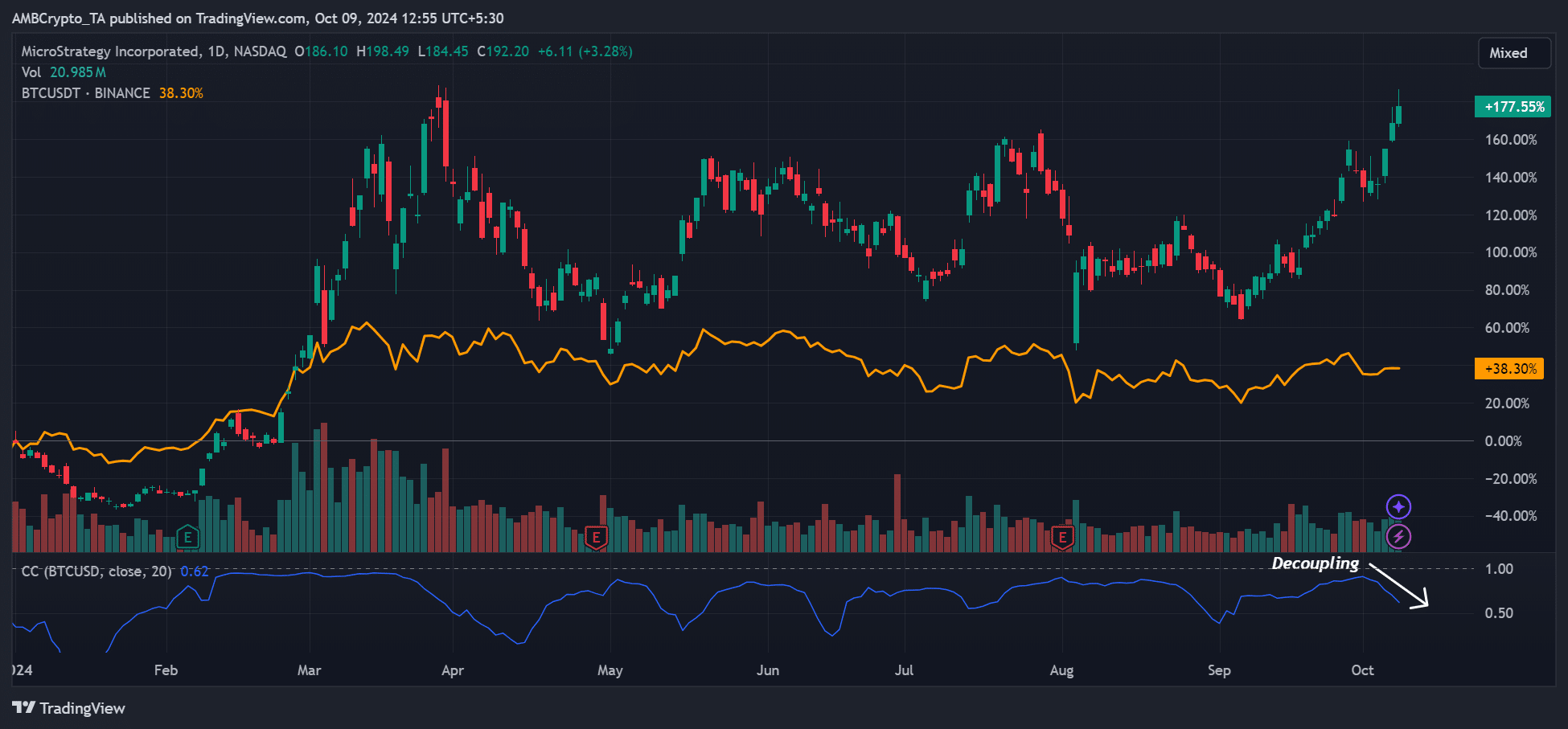

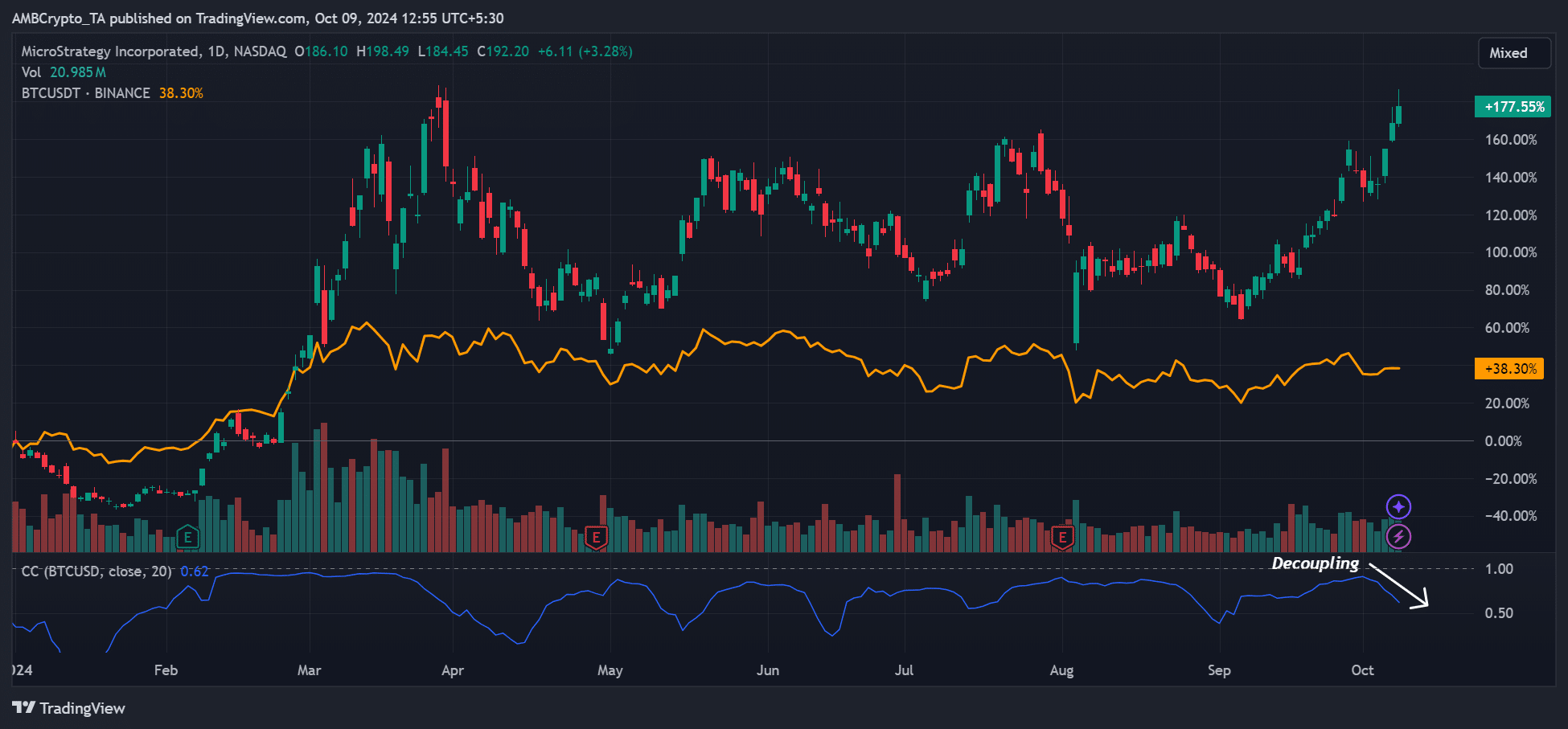

Nonetheless, the inventory’s latest rally marked an entire disconnect from BTC.

Supply: MSTR vs BTC, TradingView

Since September, the MSTR has risen 68%, from $114 to nearly $200. Quite the opposite, BTC rose 18% throughout the identical interval and was scuffling with essential help on the time of writing.

The rally even handed BTC critic Peter Schiff surprise.

“What is going on on with $MSTR? Over the previous three days, the worth rose by 18%, whereas #Bitcoin rose just one%.”

On a YTD (year-to-date) foundation, MSTR rose 177%, whereas BTC was up 38%. This underscored that MSTR buyers noticed extra positive factors than their BTC counterparts.

This additionally meant that MSTR was buying and selling at a premium to BTC.

Nonetheless, MSTR’s RSI was signaling an overbought sign on the time of writing, which might complicate the short-term outlook, particularly forward of earnings season.

Supply: MSTR, TradingView

Some market observers have questioned why buyers would select MSTR to not directly maintain BTC somewhat than buy the asset immediately. However Jeff Park from Bitwise viewed MSTR as a simultaneous lengthy and quick world carry commerce.

“$MSTR is concurrently lengthy and quick world carry. Taking over debt at low charges to spend money on Bitcoin is an extended world carry. Bitcoin in itself is a brief world carry.”

From a perspective, carry buying and selling includes borrowing from low-interest currencies to spend money on high-interest property. MicroStrategy’s BTC inventory was acquired by way of debt.

Nonetheless, BTC can be thought-about a dangerous asset and a hedge towards inflation linked to fiat currencies. Subsequently, MicroStrategy’s transfer might be seen as a guess towards world inflation – a brief world carry.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September