Bitcoin

MicroStrategy’s $42B BTC plan – A big win for MSTR?

Credit : ambcrypto.com

- MicroStrategy plans to buy $42 billion price of BTC over the subsequent three years.

- One analyst predicted that MSTR will develop into extra like an American spot BTC ETF.

Michael Saylor’s firm, MicroStrategy, introduced plans to amass $42 billion Bitcoin [BTC] over the subsequent three years, simply earlier than the 2028 halving cycle.

“Right now we’re asserting a strategic objective to boost $42 billion in capital over the subsequent three years, consisting of $21 billion in equities and $21 billion in mounted earnings, what we name our “21/21 Plan.”

This has bolstered Saylor’s very bullish stance on BTC, as he expects the asset to achieve $3 million to $49 million within the subsequent twenty years. He has too supported Trump’s pro-crypto stance, with newest try and eradicate capital features tax on BTC.

Does MSTR change to BTC ETF?

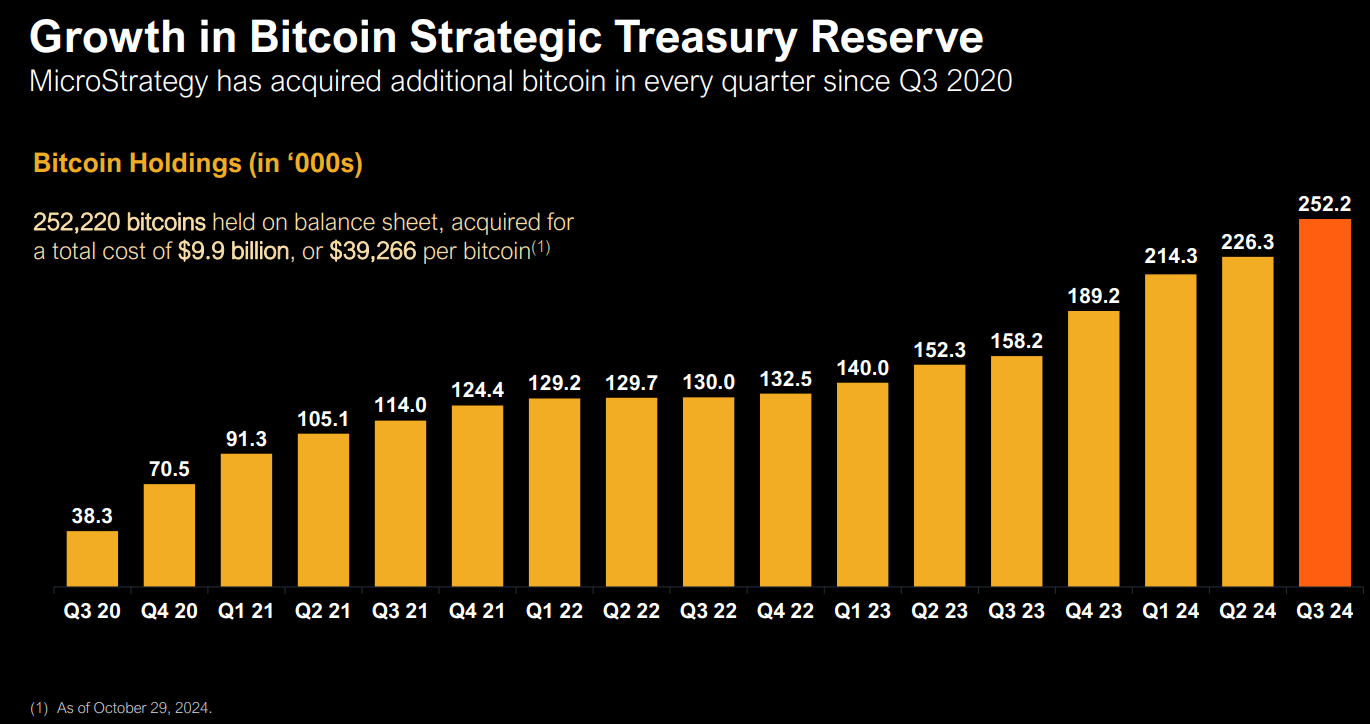

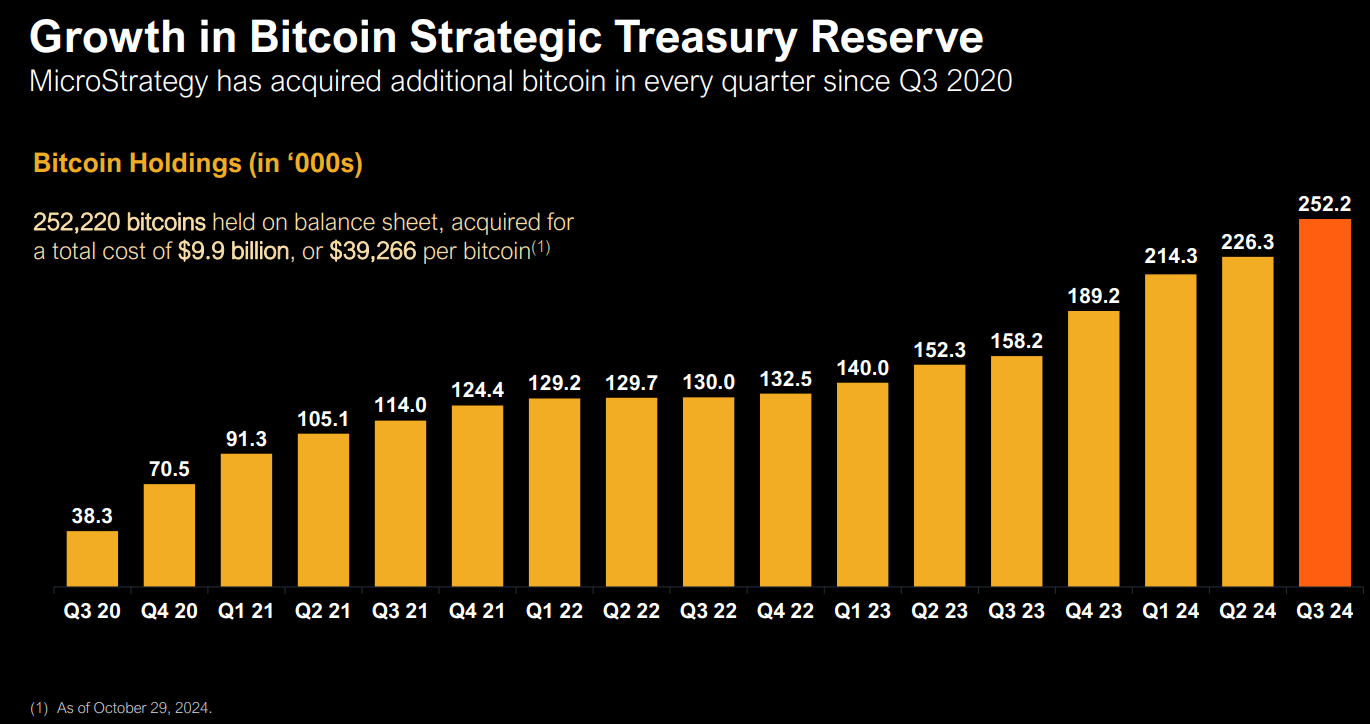

As of October 2024, MicroStrategy owned 252,220 BTC, acquired for $9.9 billion. The corporate’s BTC provide was now price over $18.15 billion at present costs, translating into $8 billion in unrealized features.

Supply: MicroStrategy

Nevertheless, a part of the corporate’s $42 BTC acquisition plan can be executed by a $21 billion ATM (at-the-market) inventory issuance program, which some analysts consider would change the inventory’s MSTR to a BTC ETF.

One of many analysts, Quinn Thompson, founding father of the macro-focused crypto hedge fund Lekker Capital, said,

“By ripping off the band-aid and asserting an enormous ATM shelf like this, they’re turning $MSTR right into a de facto ETF.”

This is able to permit the corporate to difficulty shares on the secondary market at any time to fund the acquisition of BTC, just like the way in which US spot BTC ETFs work. In line with Thomspon, this might increase MSTR much more.

The fairness program, along with the intention to difficulty convertible bonds (debt) to buy BTC, summarizes the corporate’s long-term imaginative and prescient to develop into a ‘Bitcoin financial institution,‘ as revealed in mid-October.

That mentioned, MSTR holders appeared to be the actual beneficiaries of the most recent replace. MSTR has been the best-performing S&P inventory because the introduction of the BTC technique in 2020. This has seen MSTR outperform and will even downplay the corporate’s final third-quarter lack of $19.4 million.

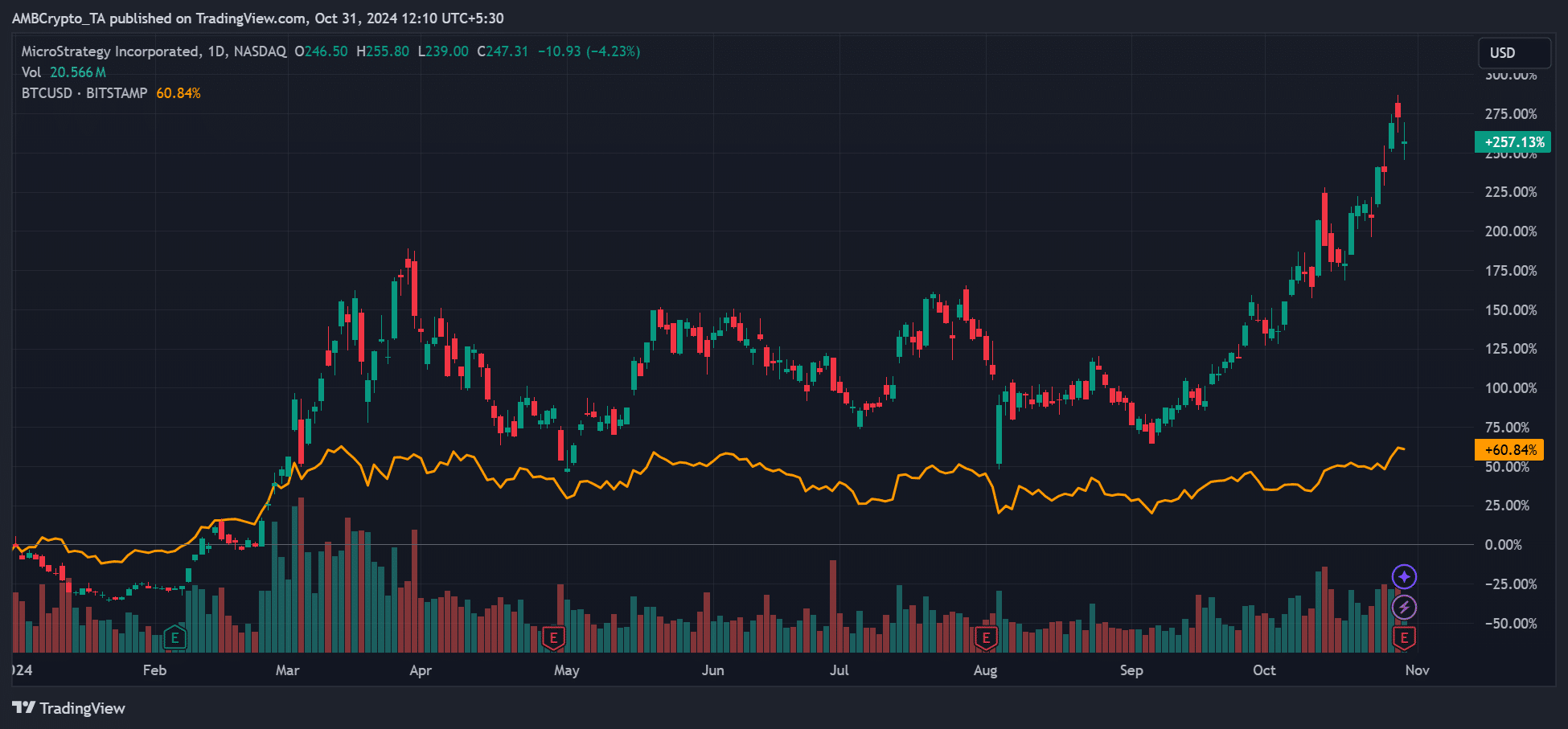

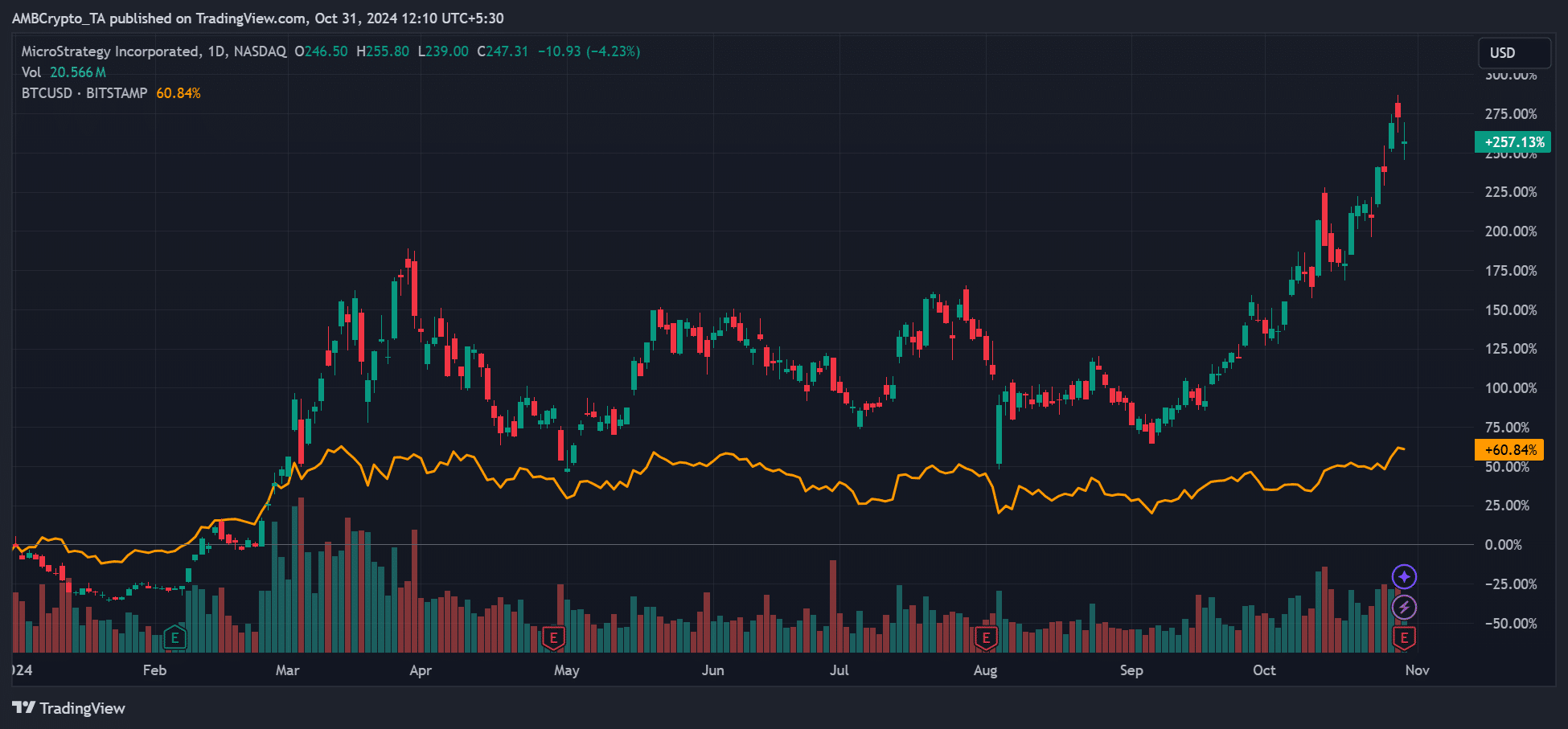

12 months-over-year (YTD), MSTR rose +250%, greater than 4x BTC’s achieve of 60%. Within the third quarter, MSTR rose about 20%, whereas BTC ended the quarter with a achieve of lower than 1%.

Supply: MSTR vs BTC, TradingView

Briefly, from an investor returns perspective, it was higher to carry MSTR than BTC.

Curiously, the inventory was anticipated to publish a further 7% rally after its newest earnings report, Bitwise’s head of alpha methods, Jeff Park, famous. Citing the MSTR choices information, Park declared,

“As we enter $MSTR earnings, there may be an explosive scenario: Nov 1 Vol is ~115%, implying a 7.2% transfer.”

On the time of writing, MSTR was valued at $247, and it stays to be decided whether or not it’ll set a brand new annual file as Park predicted amid BTC’s tight consolidation above $72K.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now