Altcoin

Mixed Signals in the DOT Market: What’s Next for Polkadot Prices?

Credit : ambcrypto.com

- The worth of DOT represents an necessary threshold; if it may break by way of present provide ranges, a rally might ensue.

- Technical indicators ship blended indicators: some point out a bullish shift, whereas others point out continued bearish stress.

This previous month, Polkadot’s [DOT] Efficiency was mediocre, with dominant bearish sentiment resulting in an 18.97% decline.

The subsequent transfer for DOT stays unsure as conflicting numbers preserve market sentiment divided, creating room for volatility in upcoming buying and selling classes.

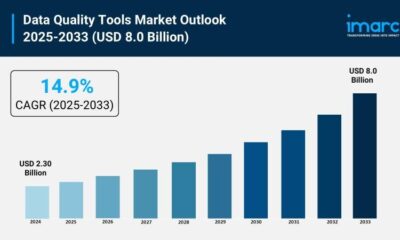

DOT is caught between an important ranges

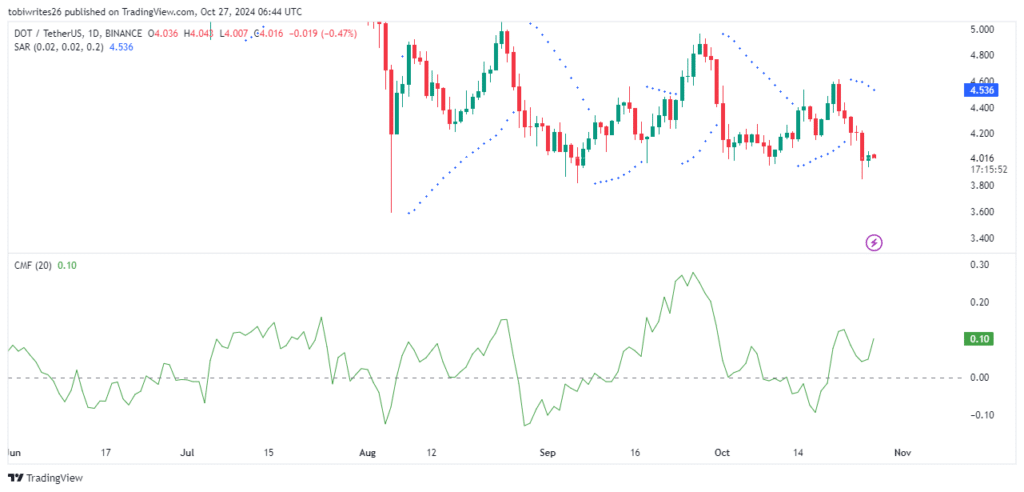

DOT is presently buying and selling between two key ranges that would decide the worth within the coming classes.

After not too long ago leaving a help stage at 3,959, DOT might rise to 4,615 or 4,964 if this help holds. Nonetheless, there’s a provide zone instantly above that, which might create promoting stress and push the worth down, probably pushing DOT again to its August lows.

Supply: buying and selling view

To evaluate the potential transfer, AMBCrypto analyzed technical indicators however discovered blended indicators, leaving the outlook unsure.

No Clear Sample of Merchants: Combined Indicators for DOT

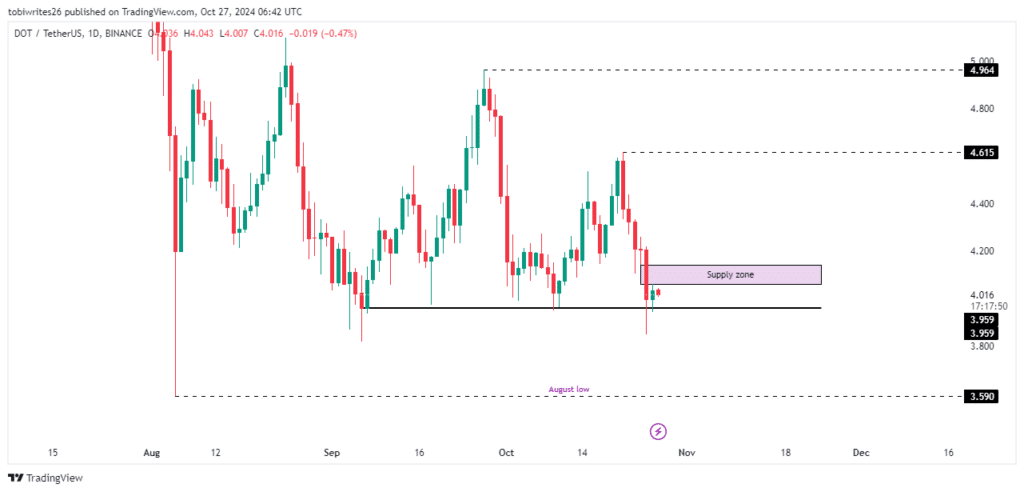

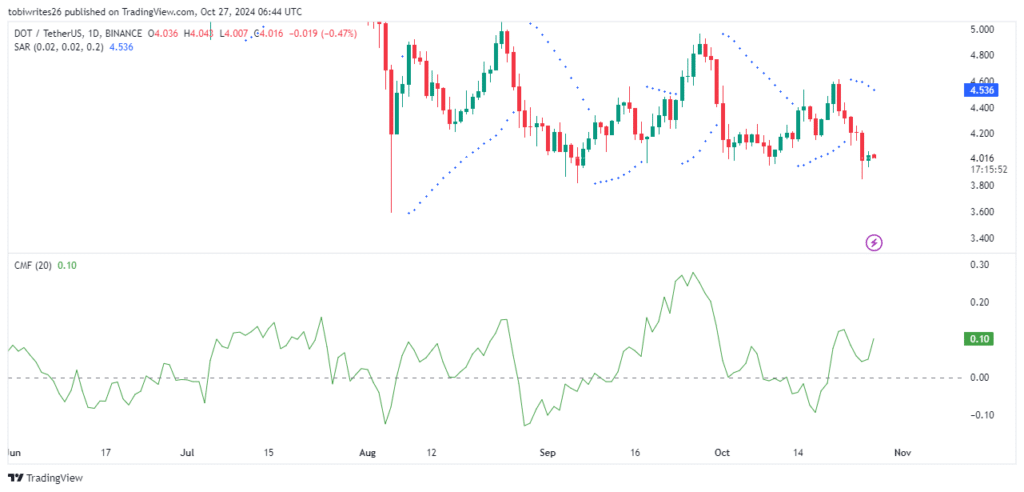

Two key indicators, the Chaikin Cash Circulation (CMF) and Parabolic SAR (Cease and Reverse), current a mixture of bullish and bearish indicators for DOT, leaving its future route unsure.

The Chaikin Cash Circulation (CMF), which assesses the circulate of liquidity into or out of an asset, has proven a rise, with a present worth of 0.11. A constructive CMF worth signifies growing shopping for stress, which generally aligns with potential upward worth motion for DOT.

This studying signifies that if this momentum continues, DOT might push by way of its present provide zone and probably help a rally.

Conversely, the Parabolic SAR, a trend-following indicator that indicators reversals, reveals bearish sentiment. That is indicated by a number of dots above the DOT worth, indicating continued promoting stress and a possible continuation of the downtrend.

When the parabolic SAR dots seem above the worth of the asset, it signifies resistance and the potential for additional worth declines.

Supply: buying and selling view

With these two indicators suggesting opposing developments, AMBCrypto turned to on-chain actions to supply further perception into DOT’s subsequent step.

There’s gradual shopping for stress for Polkadot

Knowledge from Mint glass signifies a constructive funding fee for DOT, indicating a rise in long-term curiosity from merchants. In keeping with the most recent studying, DOT’s funding fee is 0.0109%.

Learn Polkadots [DOT] Value forecast 2024-25

A constructive funding fee implies that merchants who take lengthy positions pay those that take quick positions to take care of worth equilibrium. This pattern typically signifies underlying bullish sentiment, as extra merchants wager on worth will increase, which might push the DOT increased.

If this shopping for stress continues, DOT might break by way of its present provide zone and proceed increased.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now