Bitcoin

Modest Bounce as Stellar Integration Expands RWA Reach

Credit : www.coindesk.com

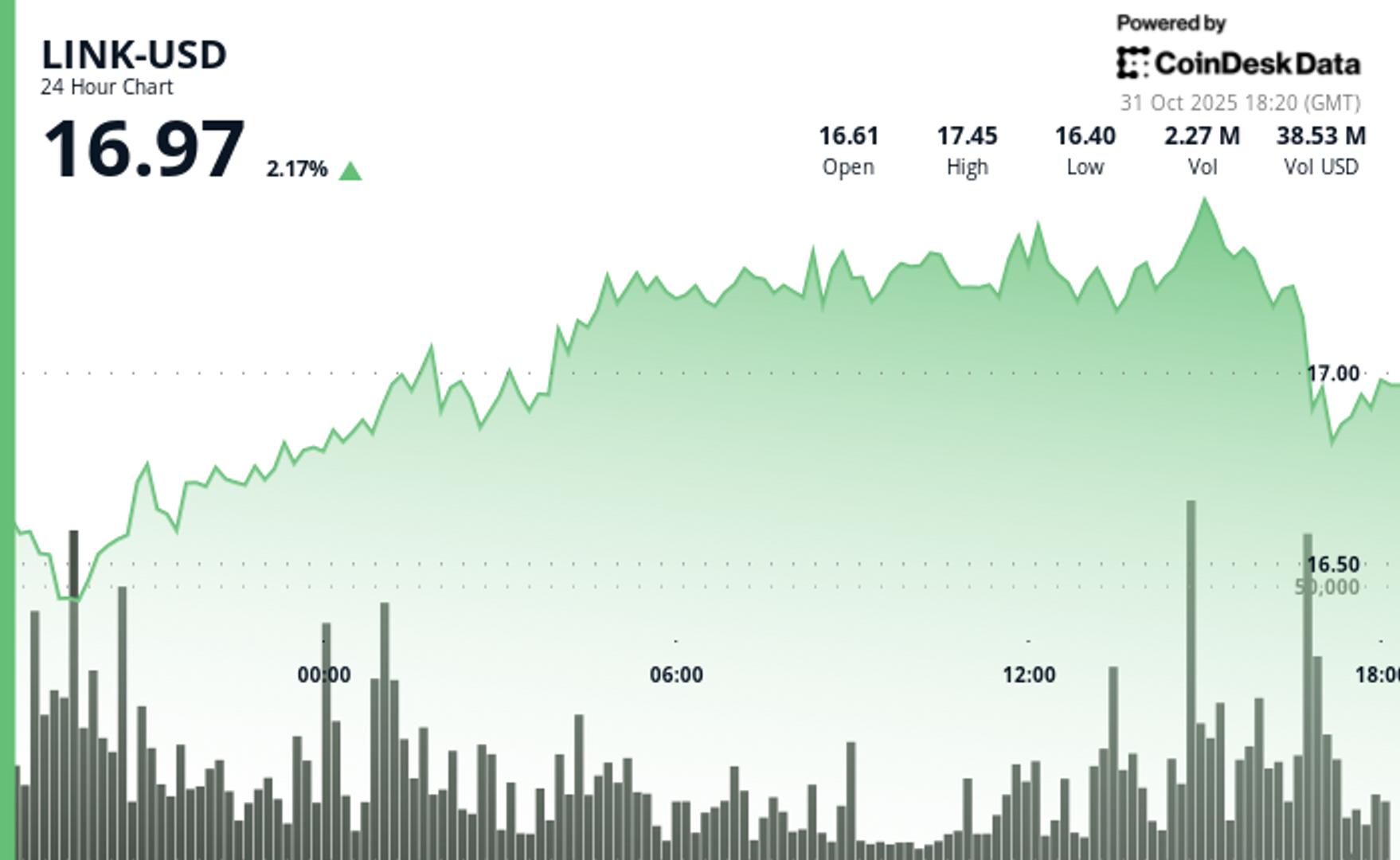

The native token of oracle community Chainlink rose 3.6% on Friday, recouping a few of Thursday’s losses as merchants stepped round the important thing help stage.

LINK briefly surpassed the $17 stage with a surge in buying and selling quantity — some 3 million tokens modified fingers throughout a morning breakout — pointing to renewed accumulation, CoinDesk Analysis’s market insights software urged. Nonetheless, weak point throughout US buying and selling hours noticed LINK fall again beneath $17. Not too long ago, the token traded at $16.96.

On the information entrance, payments-focused Stellar (XLM) has introduced the combination of Chainlink’s Cross-Chain Interoperability Protocol (CCIP), knowledge feeds and knowledge streams. This transfer offers builders and establishments constructing on Stellar entry to real-time knowledge and a trusted cross-chain infrastructure for tokenized property.

With over $5.4 billion in quarterly RWA quantity and a quickly rising DeFi footprint, Stellar’s adoption of Chainlink tooling indicators a rising demand for safe, interoperable monetary infrastructure.

Key technical ranges to take a look at:

LINK now affords near-term help at $16.37 with upside targets at $17.46 and $18.00. Whether or not the token can construct on Friday’s restoration could rely on broader market flows and the fallout from dip shopping for.

- Assist/Resistance: Stable help stays at $16.37 after a number of profitable checks, whereas resistance at $17.46 reveals repeated rejection patterns.

- Quantity evaluation: 78% quantity improve throughout breakout try confirms institutional curiosity, explosive gross sales quantity indicators place rebalancing.

- Chart Patterns: The late session flush out sample creates a traditional oversold setup for accumulation methods.

- Targets and Danger/Reward: If we keep above $16.89, we’re focusing on a retest of $17.46 with an increase to $18.00, whereas draw back threat is proscribed to $16.37 help.

Disclaimer: Parts of this text had been generated utilizing AI instruments and reviewed by our editors to make sure accuracy and compliance our requirements. For extra data, see CoinDesk’s full AI coverage.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now