Altcoin

More pain for Bitcoin? Open interest rate $ 40 billion as longs crowd

Credit : www.newsbtc.com

After he reached a brand new Excessive (ATH) of $ 124,474 on 13 August on 13 August, Bitcoin (BTC) got here to $ 113,000, with the following massive assist zone round $ 110,000. Analysts warn that extra drawback can nonetheless be for the highest cryptocurrency.

Bitcoin to fall extra? Busy lengthy commerce provides trace

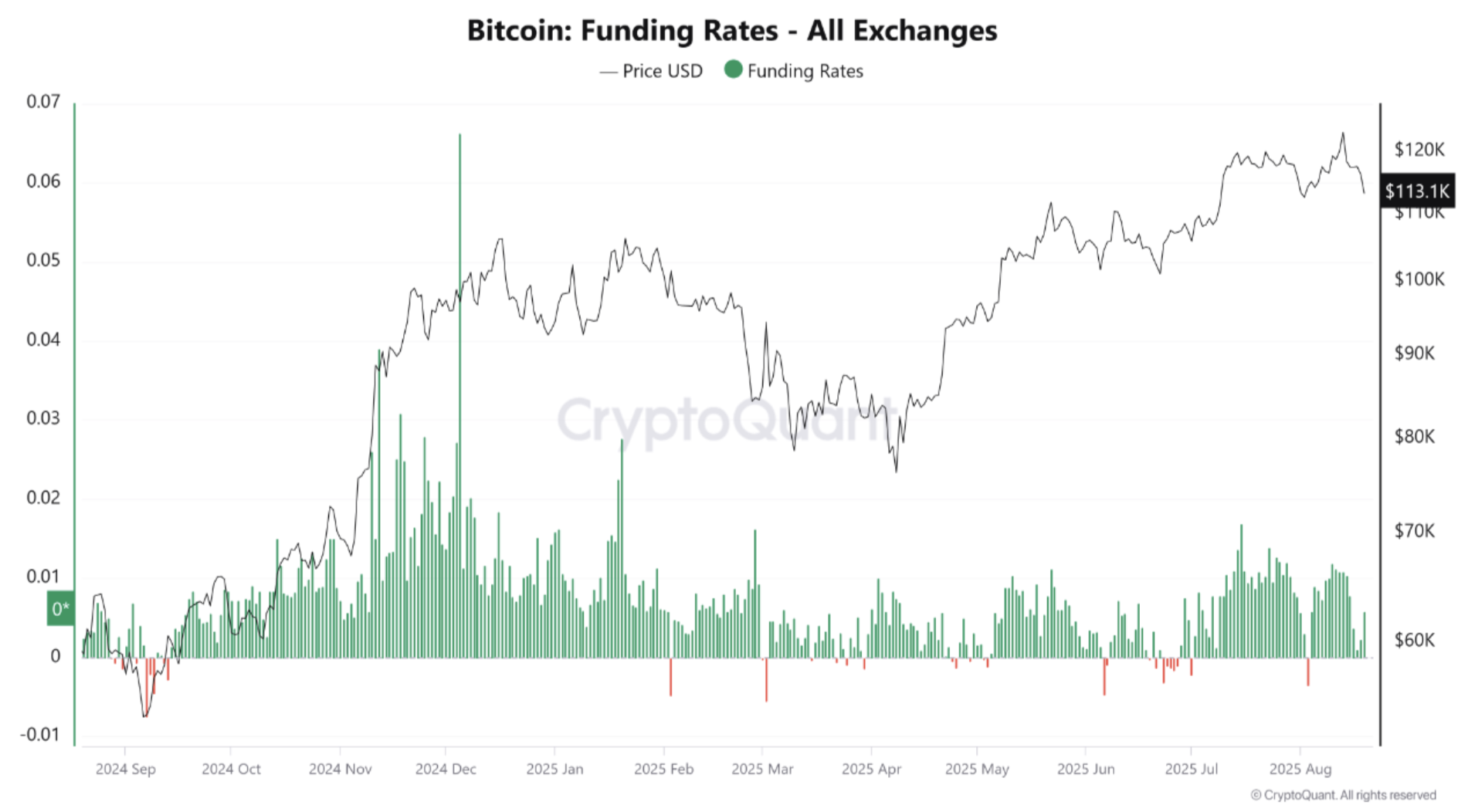

In accordance with a cryptoquant Quicktake -post from worker XWIN Analysis Japan, Bitcoin Open Curiosity has risen over $ 40 billion in all gala’s, nearly ATH territory. This enhance exhibits that each whales and merchants accumulate within the brief time period in lifting tree positions.

Associated lecture

The graph under emphasizes the latest peak in BTC Open Curiosity, which now hangs at $ 40.6 billion. In comparison with August 2024 ranges of $ 15 billion, the open rate of interest has grown by greater than 150%.

The cryptoquant worker added that regardless of this enhance within the financing share, it has remained constructive and a robust lengthy bias has been proven. Though this displays market optimism, it additionally signifies a busy commerce, the place most members guess on additional BTC valuation.

Because of this, the chance of an extended squeeze – pressured liquidations of lengthy positions as a result of aggressive leverage – has elevated. Xwin Analysis Japan defined of their evaluation:

A sudden fall in worth could cause a cascade of pressured gross sales, reinforcing volatility. In different phrases, Bitcoin’s brief -term actions stay on the mercy of speculative streams.

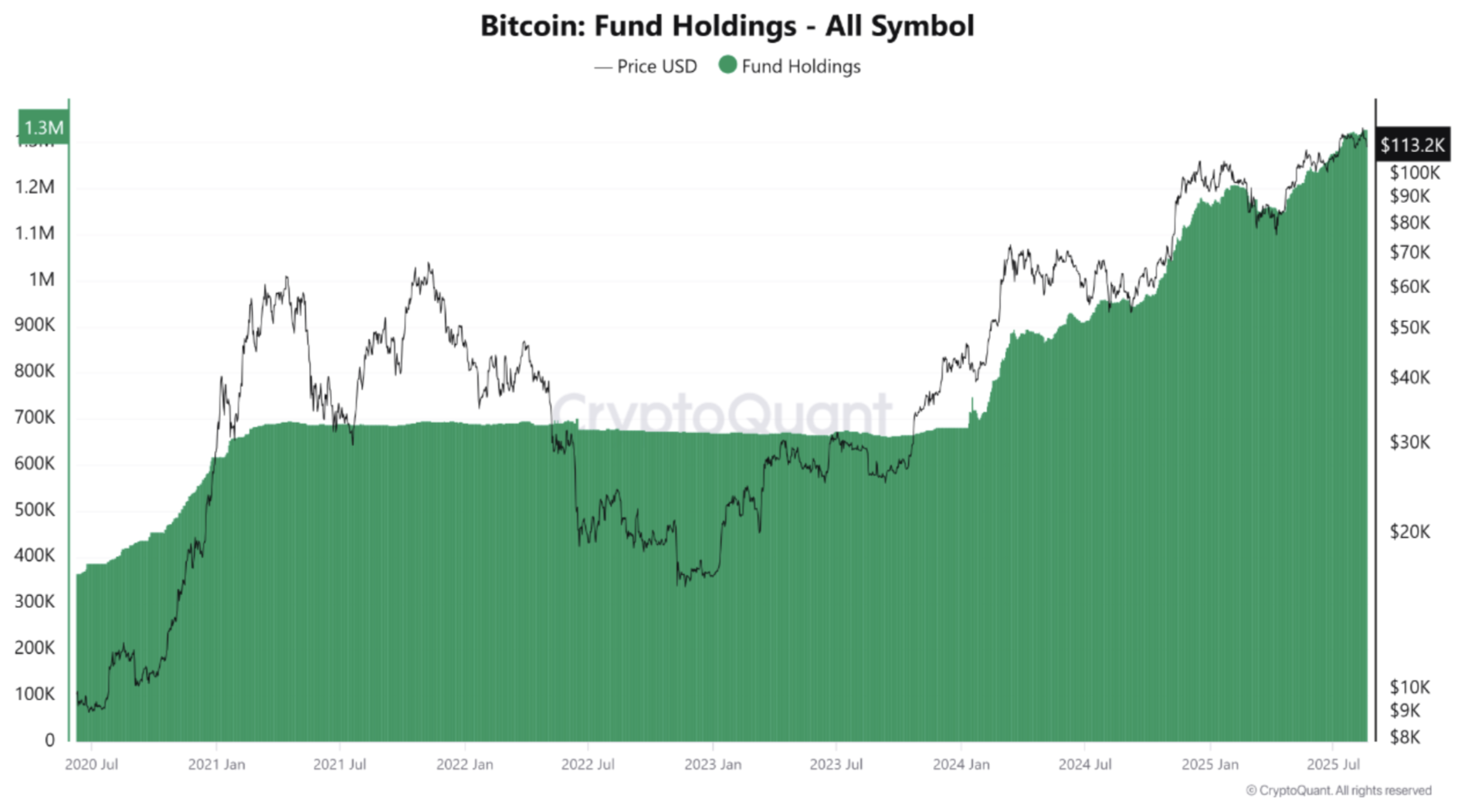

BTC Fund Holding is rising as a result of establishments

Regardless of speculative foam of extreme leverage available in the market, BTC fund holdings proceed to rise by Bitcoin-exchange-related funds (ETFs) and institutional buyers, greater than 1.3 million in response to the newest information.

Spot ETFs and enterprise treasury that take in BTC, it gives digital actively a structural bid that reduces its accessible provide. In accordance with facts From Sosovalue, Bitcoin ETFs within the US presently represents $ 146 billion in net-assetiva what 6.47% of BTC market capitalization.

Associated lecture

That stated, this week alone greater than $ 645 million outflowing from Spot Bitcoin ETFs, after two consecutive weeks of influx of a complete of just about $ 800 million. Among the many ETFs, BlackRock’s IBIT leads with $ 84.78 billion in internet belongings from 19 August.

But not all alerts are Bearish. Whereas BTC, for instance, slipped beneath $ 115,000, his spot commerce quantity streamed Past $ 6 billion, giving Bulls hope for a possible rebound.

Likewise, technical analyst AO is just lately prompt That BTC can mirror the Gold course of, with an formidable goal of $ 600,000 early 2026. On the time of the press, BTC acts at $ 113,845, a fall of 1.5% within the final 24 hours.

Featured picture of Unsplash, graphs of cryptoquant and tradingview.com

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now