Blockchain

More than 50 non-crypto native companies are building on Ethereum: Galaxy

Credit : cryptonews.net

It is a phase of the Empire publication. To learn full editions, subscribe.

Let’s face it: Ethereum is just not having a very good time. A part of it, as I wrote yesterday, is as a result of normal lack of momentum for Altcoins. There may be additionally solely a scarcity of optimistic sentiment – which is totally different from what we see for Bitcoin (even when it floats beneath $ 100,000).

In my dialog with Amberdata’s Greg Magadini, an element that had been omitted from yesterday’s version, was his ideas about Eth.

“The drag on Eth, for my part, is as a result of the worth proposition of EIP-1559 was making a provide fireplace was made invalid, or was made invalid as quickly as everybody began constructing their L2S and app chains and the truth that all transactions Van Ethereum are processed and withdraw to Ethereum. So then you definately run from a deflatoire to an inflatoire energetic. That could be a elementary purpose to fall ETH, “he defined.

In different phrases, the shortcoming of ETH to regain Momentum is at present indirectly related to the remainder of the market – particularly not the memecoin.

Okay, so this wasn’t my most optimistic intro, however now I actually wished to look extra on a optimistic have a look at Ethereum because of a Galaxy report from vice -president of analysis Christine Kim.

The report is geared toward what’s being constructed on Ethereum and is a pleasant refresher course – or within the look – to see how tasks use it.

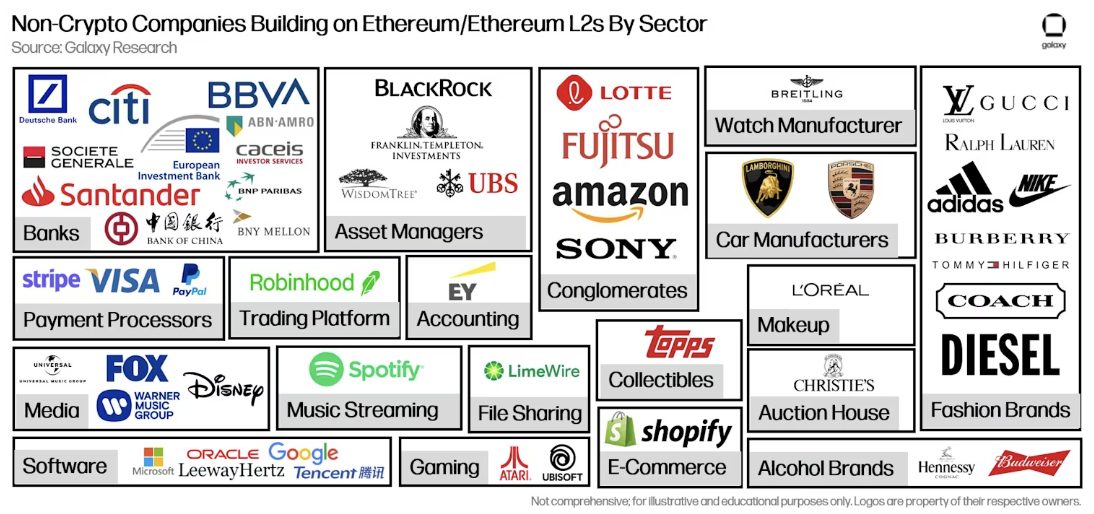

Kim famous that greater than 50 non-crypto firms have constructed on Ethereum or an Ethereum L2. That’s not a small quantity, particularly while you get in and uncover that round 20 of them are monetary establishments with 10 of them are banks.

The biggest use case, which shouldn’t be a shock for loyal Empire Readers, is real-world property. That’s the place you will have the monetary establishments to construct and experiment with Tokenized property – comparable to cash market funds (consider BlackRock or Franklin Templeton) or authorities bonds.

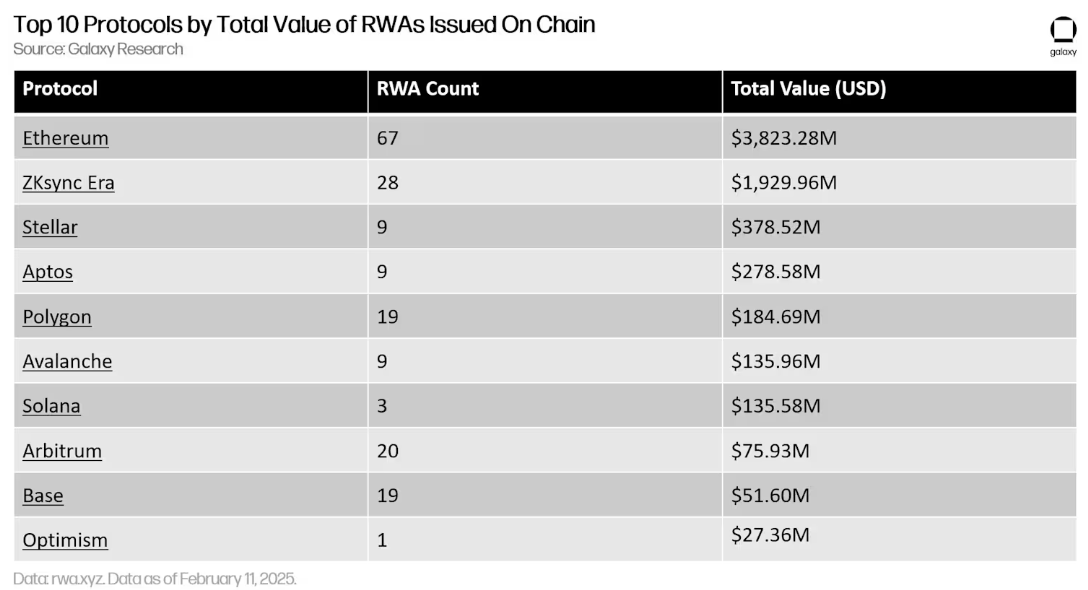

As you may see beneath, Ethereum doubles greater than the variety of RWAs revealed by Ethereum L2 Rollup ZKSync.

Now I do know that RWAs are usually not the horny Use case for crypto and I perceive the however I believe we will all agree that they present a part of the promise of crypto for non-crypto-drilling (so long as we preserve them away from the memecoins).

However okay, let’s proceed with one other Use Case Galaxy discovered: Gaming on Ethereum L2S.

NFTs haven’t made a comeback, which signifies that some firms that attempted to get some crypto publicity by them, they stopped publishing them years in the past. Affordable. However Galaxy found that there these days is A use case for NFTS for some non-crypto-native firms and that’s gaming.

“What’s most hanging in regards to the steady funding and growth of NFTs by non-Crypto-Native firms comparable to Atari, Lamborghini and Lotte’s Caliverse is that they’re being developed within the context of a bigger gaming software on chains,” Kim wrote.

“This emphasizes how the scalability of L2S helps to help crypto-Native use circumstances that require frequent interactions in chains comparable to gaming between giant retail manufacturers and firms,” she continued.

There are nonetheless many questions and worries about Ethereum and the place it goes from right here, and that’s one thing that I’m certain we are going to cowl once more quickly. However the Galaxy report exhibits that we nonetheless see many buildings taking place, and it’s interested in folks outdoors of crypto. And that, I believe, is just a little optimistic.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024