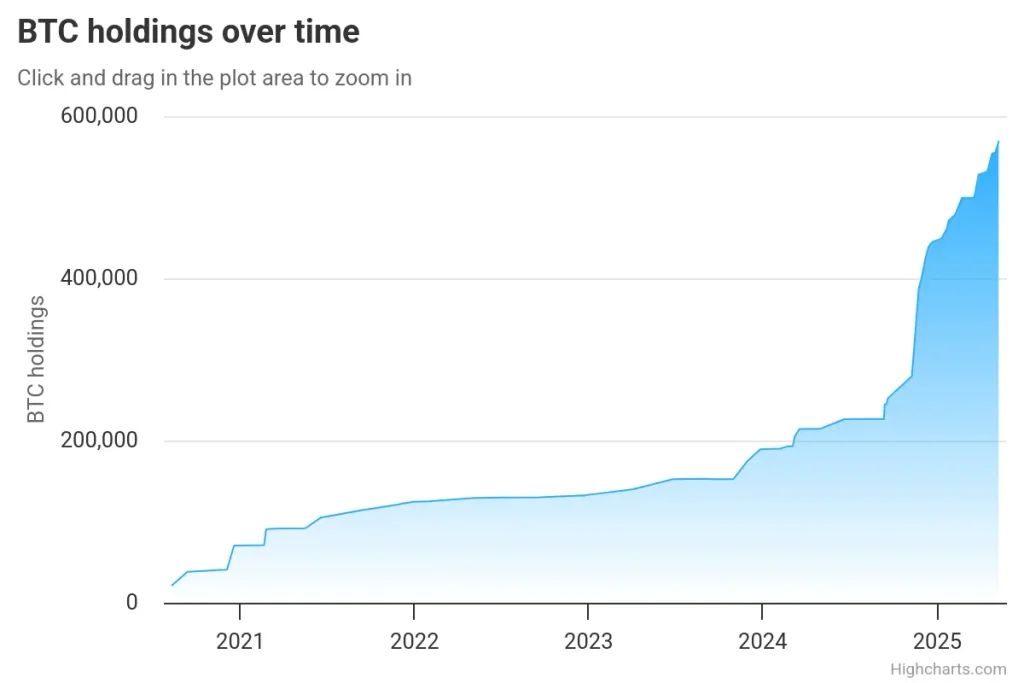

Micro technique doubles on Bitcoin. In his twelfth acquisition of 2025, the corporate has bought an extra 13,390 BTC For round $ 1.34 billion. This stimulates its whole property to a shocking 568,840 BTC – equal to 2.7% of the circulating vary of Bitcoin.

Invested with greater than $ 39.4 billion, the BTC inventory of MicroSstrategy is now valued at $ 59.23 billion, which generates non -realized revenue of just about $ 19.83 billion.

Company Bitcoin Adoption: MicroStrategy leads the prices

MicroStrategy is giant at public corporations that exceed Bitcoin with giant gamers comparable to Tesla, Coinbase, Galaxy Digital and Metaplanet. The corporate’s aggressive accumulation technique has made it the biggest firm holder of BTC worldwide.

Since January, MicroSstratey has added 122,440 BTC about 12 separate purchases. The newest acquisition happened on Might 12, 2025When it spent $ 1.34 billion to accumulate 13,390 BTC-markee, one other daring transfer in its long-term crypto funding plan.

- Additionally learn:

- Metaplanet will increase Bitcoin Holdings to six,796 BTC, which strengthens the place as the biggest firm holder in Asia

- “

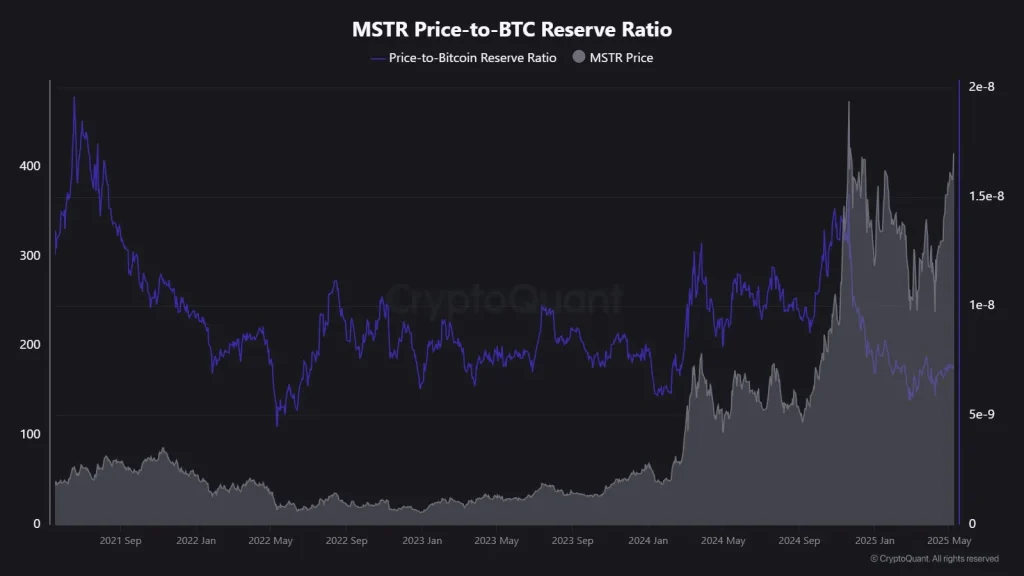

MSTR PRICE-BTC Reserve ratio: What it reveals

The Worth-BTC Reserve ratio MicroStratey is presently on 7.27. Which means that traders pay $ 7.27 for each $ 1 of Bitcoin that the corporate has. MSTR -Shares acts round $ 404.90after they’ve risen 34.92% 12 months-to-date and 3.21% This month alone – appointed by Bullish Sentiment round Bitcoin and COMPANY CRYPTO publicity.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, knowledgeable evaluation and actual -time updates on the most recent tendencies in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

MicroStrategy has 568,840 BTC, roughly 2.7% of Bitcoin’s circulating vary, with a worth of $ 59.23 billion.

Sure, micro technique is the biggest bitcoin holder of corporations that exceed Tesla, Coinbase and others with 568,840 BTC.

In keeping with the BTC value forecast of Coinpedia, the Bitcoin value may peak this yr at $ 168k if the Bullish Sentiment maintains.