Altcoin

Nasdaq files with SEC to act Hedera ETFS: What about Hbar?

Credit : ambcrypto.com

- Hbar is confronted with robust bearish sentiments and immerses 9.18% in 24 hours.

- Nasdaq Recordsdata 19B-4 kind with SEC to state the Hedera Etfs of Grayscale.

Within the midst of an elevated institutional demand for crypto-assets, inventory market-related funds have develop into very talked-about. For the reason that launch of Bitcoin [BTC] ETFs earlier final 12 months, most Altcoins entered the charts.

In latest developments, Hedera [HBAR] has seen nice help for the subsequent ETF.

Supply: Nasdaq

As such, the Nasdaq Stock Market LLC has submitted a 19B-4 kind to the US Securities Alternate Fee (SEC) to say and commerce the Spot Hedera Alternate-Traded Fund of Grayscale.

Normally a 19B-4 software is the second section earlier than the popularity by the SEC. As soon as acknowledged, it’s revealed within the federal register pending the approval of SEC.

The latest submission of Nasdaq on behalf of Grayscale comes shortly after Nasdaq has submitted one other Hedera ETF on behalf of Canary Capital.

The second submission positions Hedera in a positive place amongst altcoins to get approval based mostly on its community improvement and the progress of the ecosystem.

If permitted, the ETF buyers will facilitate to get publicity to HBar with out having to own the crypto immediately.

What it could imply for HBB

The approval of Hedera’s ETFs particularly can be a sport change, particularly as a result of Altcoin’s community continues to battle.

Insofar as Hedera’s lively accounts have fallen by 93% within the final three months from 621K to 39k. This reveals a falling community use and acceptance charge, that are central to the continual development of the Altcoin.

That’s the reason ETF would give room for different customers and buyers, though not directly it is going to enhance the demand charge, which can in the end have an effect on HBBer’s development positively.

Supply: Hashscan

Though the excellent news of a possible ETF was anticipated to positively affect HBar’s market sentiments and value motion, this isn’t but.

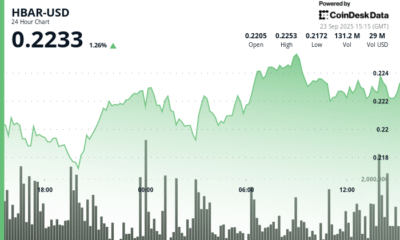

In reality, from this letter. Hedera traded at $ 0.2272. This meant a lower of 9.18percentup to now day.

The sharp lower regardless of these developments means that the Altcoin Beerarish is experiencing sentiments, as evidenced by Hedera’s aggregated open curiosity, which fell from $ 145 million to $ 103 million up to now day.

Supply: Coinalyze

Traders subsequently actively appeared to shut their positions to lock revenue or different are strongly liquidated because the market went again. Such habits of buyers displays a scarcity of belief as a result of they count on costs to fall additional.

The prevailing market situations counsel that buyers see an ETF as a protracted -term guess. That’s the reason these ETFs should first obtain sec -approval to have an actual influence on Hedera’s value actions.

The markets stay within the brief time period.

If these situations live on, HBar might fall to $ 0.21. Nevertheless, if buyers contemplate the submission as a bullish sign and switch to build up, Hedera would reclaim $ 0.25.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024