Blockchain

New wallets boost EVM chains despite overall market losses

Credit : cryptonews.net

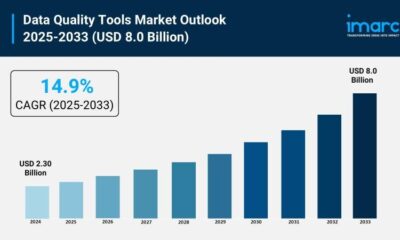

Regardless of the full market losses, the demand for capabilities on chains stays sturdy. Varied EVM-compatible L1 and L2 chains make a rise in new portfolios.

New energetic portfolios go to varied EVM-compatible chains, which displays the demand for actions in chains. Regardless of the general market assortment, Web3 exercise and apps are energetic, in order that broader acceptance builds up.

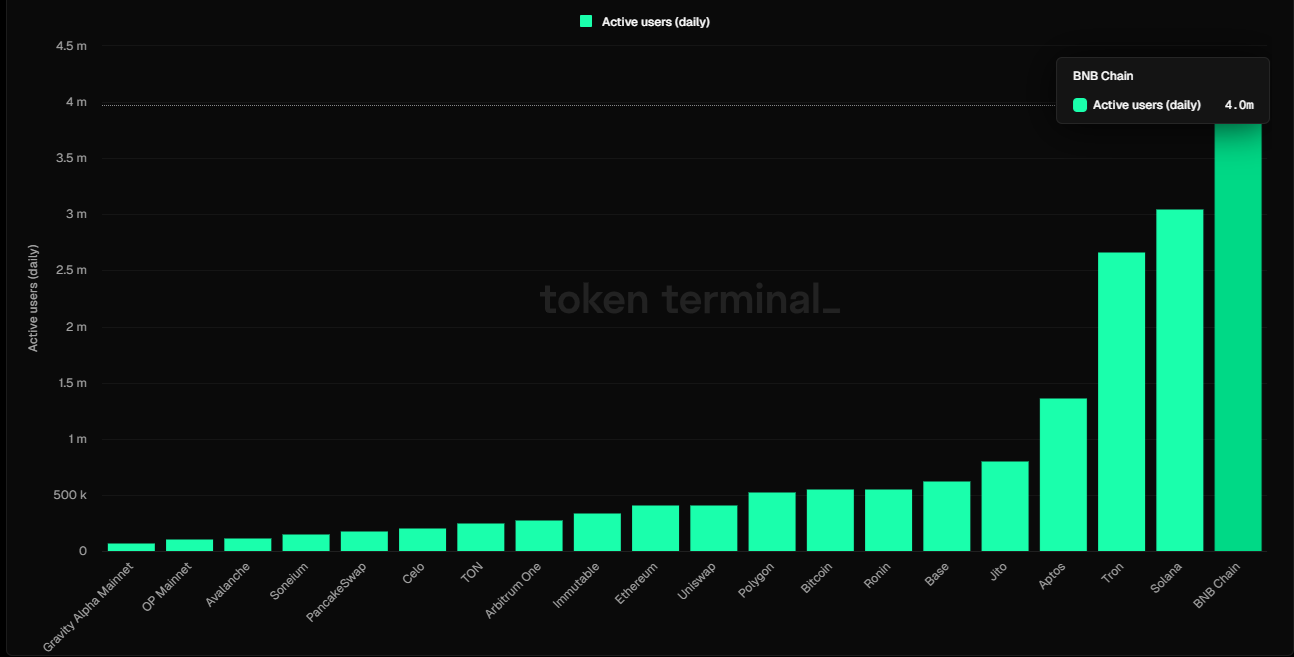

The exercise continued to move to BNB Sensible Chain and Base, in response to a delay by Solana Meme. BNB Sensible Chain grew to become the chief with 4m energetic each day customers, with solely 2.7 m for Solana. Based mostly on distinctive deal with infoUp to now week, Binance added one other 2 meters of portfolios.

BNB Sensible Chain surpasses Solana in each day energetic addresses, normally linked to pancake wap exercise. | Supply: tokenminal

Principally, the chief was in a brand new pockets, with an extra 2.8 million addresses that got here to the community final week. Fundamental distinctive deal with Went vertically in current weeks and added to 30 million new addresses all through the month of February. The continual shift to the bottom confirmed the rising demand for affordable actions on the chain, along with a excessive out there liquidity for defi-investments and passive revenue.

All L2 chains had a weekly involvement with greater than 9 million weekly energetic portfolios, which grew the second week in a row. The L2 -Ecosystem stays near peak exercise, with greater than $ 10.5 billion in Stablecoin -Liquidity to stimulate commerce. Decentralized commerce nonetheless reaches 18.5% of the trade exercise, which demonstrates the robustness of decentralized actions within the chains, even with decreased ETH costs and deteriorated sentiment.

Essentially the most energetic chains with new consumer progress attempt to keep away from the destiny of ‘useless networks’, whereby exercise has solely adopted AirDrop campaigns. A number of the greatest progress charges began constructing their app assortment throughout the Bull market of 2021 and have tried to return.

Ethereum -Ecosystem stays related

Different very energetic chains with a consumer influx present former stars from the web3 bull cycle from 2021 are nonetheless related. Customers flowed in Polygoon and Ronin, in addition to the EVM-compatible L1 chain Avalanche.

Polygon has just lately expanded its use, with among the main apps primarily based on Dapadar info. Polygoon exercise depends upon the Moonvil -Gaming -Ecosystem, the Polymarket Prediction -app and Legacy video games that retain reputation.

Final week additionally noticed a shift to Sonic (previously Fantom), as a result of the community was talked about on a big scale on social media. Sonic additionally grew as a result of it provided his personal model of Meme tokens, a brand new begin of the delay exercise of Pump.Enjoyable.

The current enlargement of customers follows the sturdy demand for DEX commerce. The TOP DEX is stimulating all EVM chains, particularly Uniswap. Pancakes WAP elevated visitors and the brand new consumer flows to BNB Sensible Chain, whereas the idea benefited from the main DexAerodrome.

One of many causes for the exercise of EVM-compatible chains is the comparatively low fuel value of Ethereum. Fuel prices are as little as $ 0.04, whereas common transactions on Ethereum are lower than $ 1. This led to a rise in new Ethereum customers and added 752K new addresses final week.

Smaller chains get on token -based visitors

Analysts within the chain have famous that exercise in smaller chains displays new token launches and DEX exercise. Based mostly on dex exercise, Solana remains to be the very best community for tokenization, however base is organized for a brief second.

Based mostly on Dexscreener -Polarity, Sonic is now within the prime 5 of chains that function a token platform with excessive Dex exercise. | Supply: Dexscreener

Based mostly on Dexscreener, the at the moment energetic chains replicate their trending tokens. Sonic is now within the prime 5 token ramps, whereas Arbitrum is again within the prime 15. PulSechain and Ton are simply behind Sonic, who’re in their very own model of Tokenmakers.

The usage of bone use additionally modifications the panorama for essentially the most energetic networks. Solana seized 82% of bone customers, however Bnbchain and Base have just lately elevated their share. Fundamental remains to be the smallest bone -driven chain, the place nonetheless beneath 10k customers with bots. The comparatively decrease competitors generally is a issue when driving DEX exercise.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now