Policy & Regulation

New York lawmakers want to tax crypto sales and transfers

Credit : cryptonews.net

The US state of New York tries to tax the sale and transfers of crypto and non-fungal tokens (NFTs) beneath a invoice that was launched within the state assembly.

Meeting Invoice 8966, launched on Wednesday by Democratic Meeting -member Phil Steck, would add an excise responsibility of 0.2% about “digital belongings transactions, together with the sale or switch of digital belongings.”

The account, if accepted, would instantly take impact and apply to all gross sales and transactions from 1 September.

If established, the account might yield important tax revenues for the State, as a result of New York Metropolis is the world’s largest monetary and fintech-hub IS industries which have crypto embraced by shopping for billions of tokens or providing crypto-based monetary merchandise.

Crypto tax to finance college useful resource abuse packages

Steck’s invoice signifies that the financing of the crypto -tax sale have to be reserved to increase a “Prevention and intervention program for substance abuse to varsities within the Upstate New York.”

The invoice clarifies that it will change the tax legal guidelines of the state, and the brand new levy would apply to “digital currencies, digital cash, digital non-guidance sticks or different related belongings.”

There are a number of steps to go earlier than the account turns into regulation. It should cross an meeting committee earlier than it’s voted earlier than the whole assembly, it would then be despatched to the Senate and, if authorised, despatched to the governor who can endure the invoice or be veto.

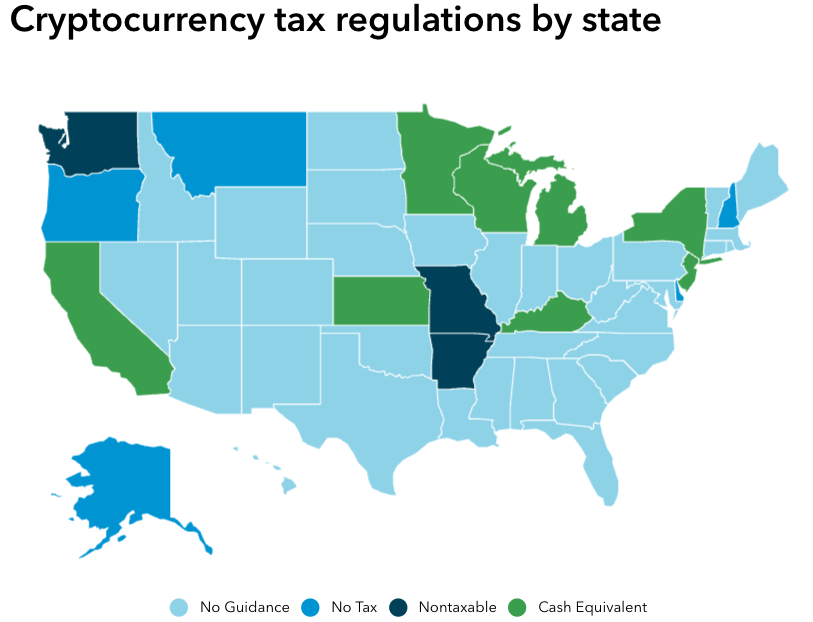

State taxes on crypto range vastly

Within the US, the federal and nationwide governments can each levy taxes, which implies that states that – or within the case of Texas are decreased, utterly cancel – canceled enterprise and earnings tax within the try to draw firms who wish to reduce their tax evaluation.

Most states do not need pointers on how their tax authorities deal with crypto, whereas others, corresponding to California and New York, deal with Crypto as money, whereas states corresponding to Washington tax -free crypto, based on Bloomberg Tax.

Crypto -tax legal guidelines per state from July 2022. Supply: Bloomberg tax

New York Dwelling to Crypto Bigtimers

New York, extra particularly New York Metropolis, has lengthy been house to the heavyweights of the crypto business due to its standing as a worldwide monetary heart.

Associated: Crypto guidelines of the White Home deliver SEC CFTC readability for our crypto firms: lawyer

Stablecoin -Emitents circle the web group and paxos, along with crypto -exchange Gemini and evaluation firm chain salysis, have its headquarters within the metropolis, whereas many different crypto firms function workplaces there.

New York was the primary US state to launch an in depth regime for Crypto and launched the Bitlicense in 2015 – a division allow that led many crypto firms to go away the state as a result of it was supposedly too heavy, whereas others, corresponding to Circle, Paxos and Gemini, the possibility to rearrange.

Business secrets and techniques: Ether might ‘rip like 2021’ if SOL merchants brace themselves for a lower of 10%

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024