Policy & Regulation

No HMRC letter? UK crypto investors may still owe taxes, expert warns

Credit : cryptonews.net

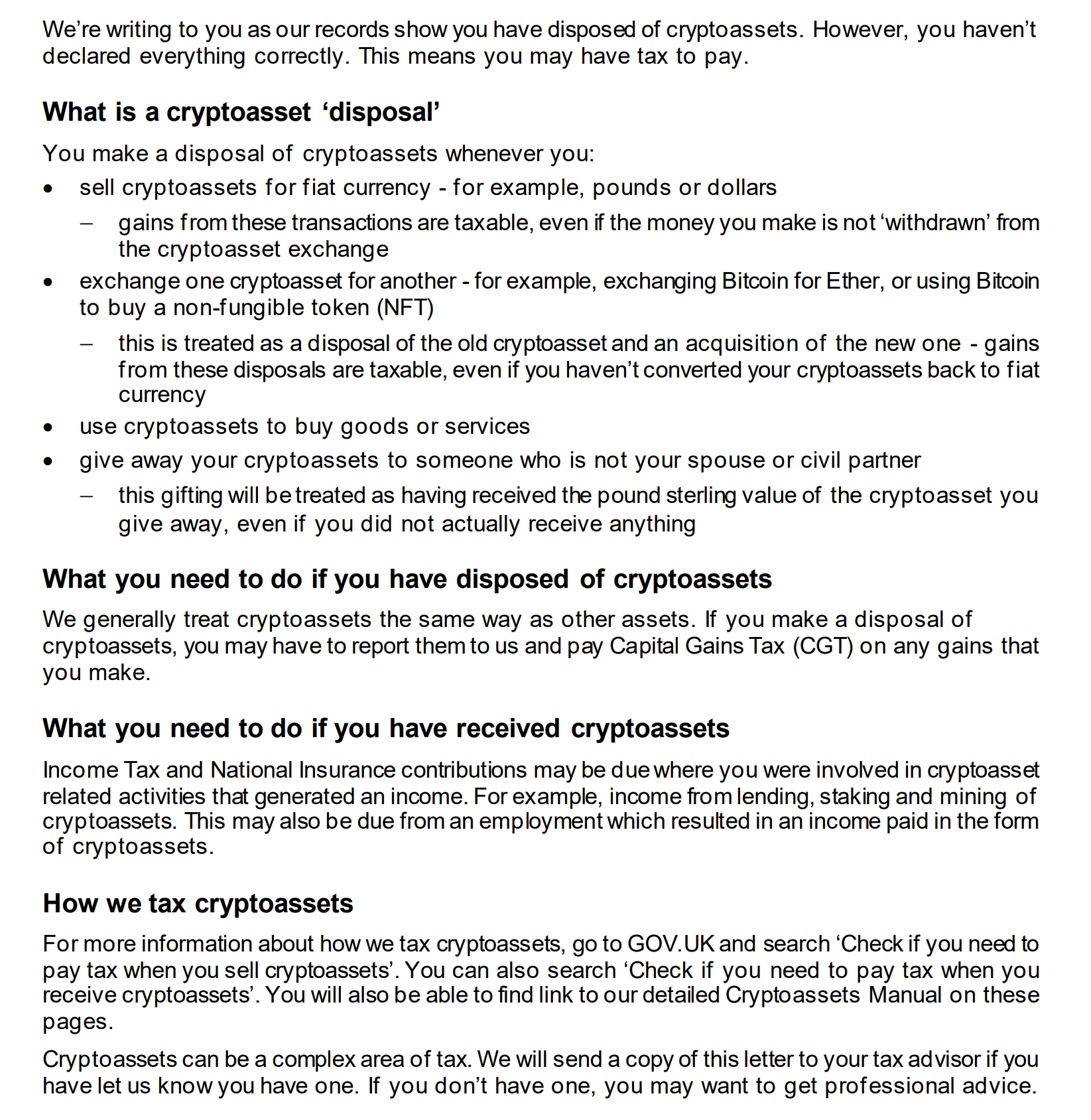

UK crypto traders may face tax payments even when they haven’t acquired warning letters from HM Income & Customs (HMRC), because the company steps up efforts to trace unreported revenue from digital belongings.

Final week the Monetary Occasions revealed that HMRC issued nearly 65,000 ‘nudge letters’ within the 2024-2025 tax yr, greater than double the quantity despatched the yr earlier than. The letters urge traders to overview their filings and voluntarily disclose crypto-related features earlier than potential audits start.

Nonetheless, tax consultants warn that the company’s growing use of inventory market knowledge and worldwide reporting agreements signifies that traders who haven’t acquired a letter shouldn’t assume they’re at nighttime.

“Failure to report cryptocurrency transactions to HMRC is against the law, no matter whether or not you have got been contacted,” Andrew Duca, founding father of crypto tax platform Awaken Tax, advised Cointelegraph. “So even when you have not acquired a warning letter, the truth that HMRC has issued so many this yr ought to function a wake-up name,” he added.

Duca famous that HMRC sometimes identifies non-compliance by evaluating financial institution information, trade information and self-assessment types. Discrepancies, similar to undeclared deposits or transfers, might end in letters or formal investigations.

Larger earners and traders with massive onchain portfolios are notably prone to be focused as knowledge sharing between exchanges and regulators will increase, he mentioned.

Instance of an earlier nudge letter from 2024. Supply: kc person content material

Associated: Learn how to File Crypto Taxes in 2025 (Information for US, UK, Germany)

HMRC is tightening crypto supervision

Exchanges working within the UK and serving UK purchasers overseas are legally required to offer transaction knowledge to HMRC. With the OECD’s Crypto-Asset Reporting Framework (CARF) coming into impact in 2026, the company will robotically have entry to data from international buying and selling platforms.

“It’s a lot better to be proactive and report in your actions now, moderately than ready for HMRC to name you out on it,” Duca mentioned.

He famous that crypto actions change into taxable not solely when digital belongings are transformed into kilos, but additionally when they’re swapped between tokens or generate revenue by way of staking, airdrops or yield farming. Solely purchases made with fiat cash or transfers between private wallets are exempt.

To calculate income, HMRC applies a three-tier ‘spooling’ methodology. This consists of first reviewing same-day transactions, then transactions inside a 30-day interval, and eventually utilizing common prices for older purchases. For lively merchants, this course of can change into very advanced, and Duca recommends utilizing specialised tax software program designed for crypto reporting.

Associated: New York State Senator Proposes Tax on Crypto Mining Power Consumption

What to do should you contact us

Duca mentioned that traders who obtain a letter from HMRC ought to search skilled recommendation instantly. Specialist accountants may help put together correct transaction stories and negotiate with tax authorities if underpayments are made. Failure to reply might end in fines or additional investigation.

“Utilizing crypto tax software program can even assist you to generate correct stories on all of your actions as precisely and effectively as doable,” Duca mentioned. “Lastly, it’s a must to be keen to pay. In case you owe taxes, it’s a must to pay them.”

Duca added that decentralized exchanges (DEXs) and chilly wallets aren’t exempt from HMRC reporting necessities. “You’re legally required to report on all DEX transactions, chilly pockets exercise and sizzling pockets transfers,” he mentioned.

In the meantime, US senators are exploring updates to crypto tax coverage, together with exempting small transactions from tax and clarifying how staking rewards are handled.

Throughout a Senate Finance Committee listening to earlier this month, lawmakers debated whether or not each day crypto funds ought to appeal to a capital features tax and learn how to pretty classify revenue from staking companies. Coinbase’s vp of tax affairs, Lawrence Zlatkin, urged Congress to cross a de minimis exemption for crypto transactions beneath $300.

Journal: Again to Ethereum – How Synthetix, Ronin and Celo have been born

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024