Analysis

No Short-term Rally, Bitcoin Bull Cycle is Over: CryptoQuant CEO Issues Warning

Credit : coinpedia.org

The value of Bitcoin obtained caught in a spread, with its final commerce above $ 90,000 on March 7. By the top of the earlier yr, Bitcoin had surpassed the $ 100,000, however this milestone was quick -lived as a result of the value dropped quickly. Since then, Bitcoin has been on a downward pattern, even under $ 80,000.

As an addition to the struggles of the market, President Trump’s fee announcement exerted additional stress on the crypto house, so that the majority cryptocurrencies undergo along with Bitcoin.

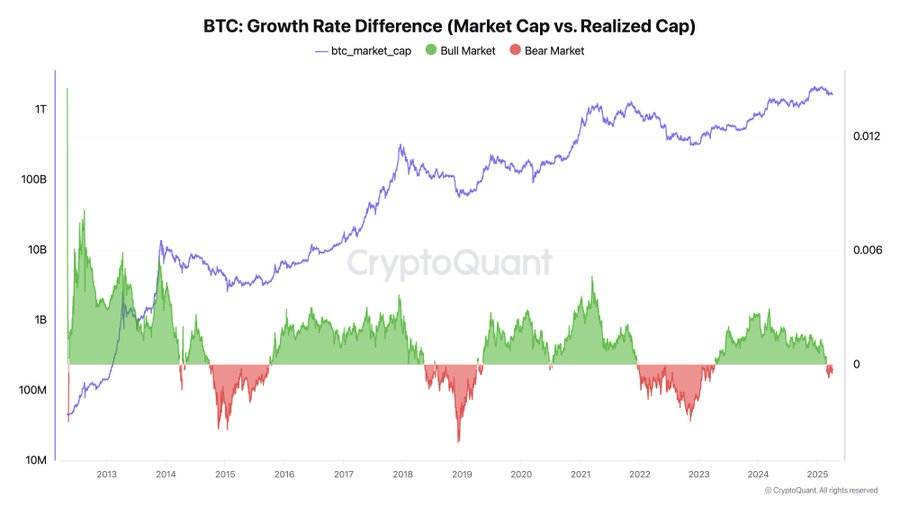

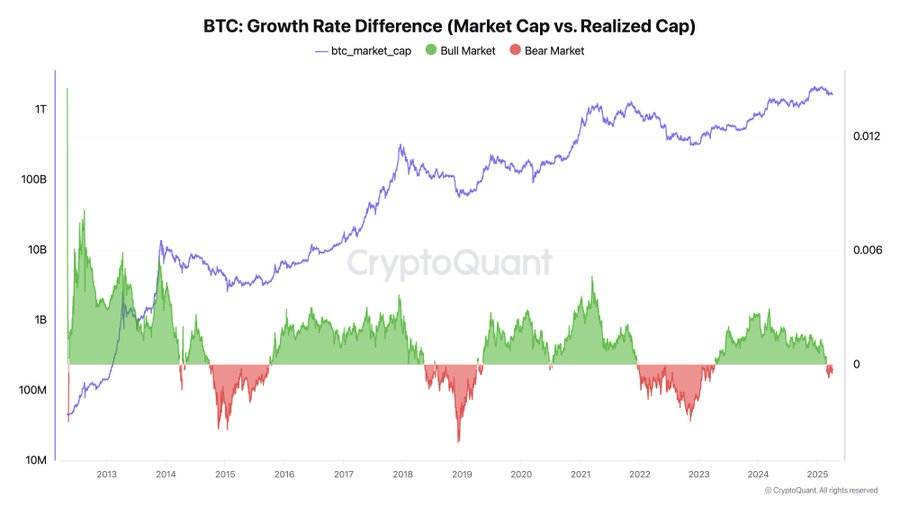

According to the Tucryptoquant CEO Ki Young Ju, Bitcoin Bull Market appears to be over, primarily based on knowledge evaluation of chains. An important metric is realized CAP, which measures the precise capital that enters the market by following when BTC is bought (a pockets entered) and bought (a pockets left behind).

“However when the gross sales stress is excessive, even massive purchases can’t transfer the value. There are simply too many sellers. When Bitcoin traded, for instance, close to $ 100k, the market hardly noticed enormous volumes, however the worth barely moved,” he defined.

When the realized cap grows, however market capitalization (primarily based on the newest buying and selling worth) stays flat or drops, it signifies that cash flows in, however the costs don’t reply – it is a Bearish board. In the mean time that’s precisely what occurs.

If small quantities of latest capital prizes are up, alternatively, it’s a bullish market. However presently even massive quantities of capital aren’t enough to relocate the value of Bitcoin, which signifies a bear market. Traditionally, actual market covers take no less than six months, so a quick restoration is unlikely.

“In brief: when small capital drives up costs, it’s a bull market. If even massive capital can’t push the costs up, it’s a bear. The present knowledge clearly level to the final. Gross sales stress can illuminate at any time, however traditionally, actual reversations take no less than six months-thing a short-term rally appears unlikely,” he concluded.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now