Ethereum

Odds of Bitcoin, Ethereum starting October on a positive note are…

Credit : ambcrypto.com

- BTC and ETH noticed a rise in lengthy liquidation quantity with the worth drop over the past buying and selling session.

- Belongings began the brand new month with constructive actions.

Bitcoin [BTC] and ether [ETH] September ended on a unstable observe, with each property declining. Quick place merchants dominated the market, rising lengthy liquidation volumes.

Regardless of these declines, the dearth of a big sell-off signifies a constructive signal for the market.

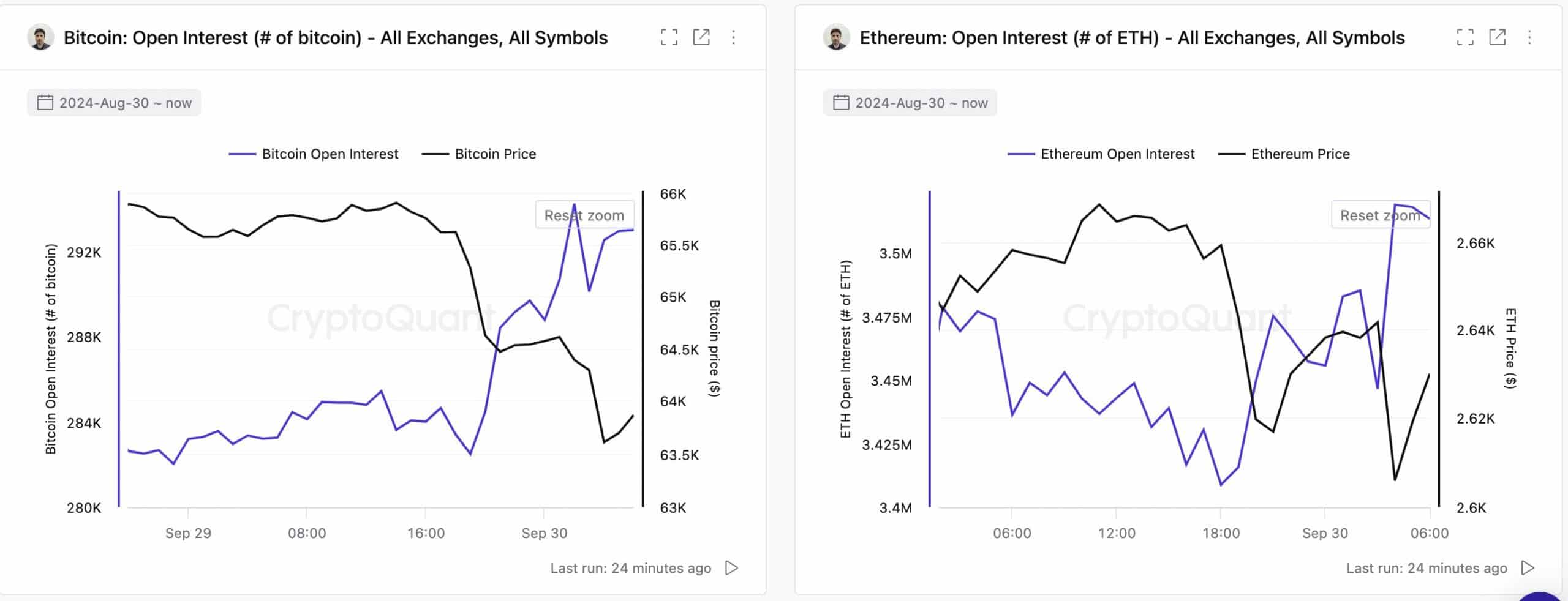

The open curiosity of Bitcoin and Ethereum is falling

In keeping with CryptoQuantThe open curiosity (OI) of Bitcoin and Ethereum noticed a notable decline over the past buying and selling session. Bitcoin open curiosity fell from $18.6 billion to $18.1 billion, indicating merchants have been closing futures positions.

This drop in OI typically signifies decrease liquidity, volatility and curiosity in derivatives buying and selling, probably resulting in an extended/brief squeeze.

Supply: CryptoQuant

Equally, Ethereum’s open curiosity additionally noticed a slight decline, though much less important than Bitcoin’s. As of now, BTC’s open curiosity has returned to $18.3 billion, and ETH’s OI has risen to $9.4 billion, reflecting renewed market exercise.

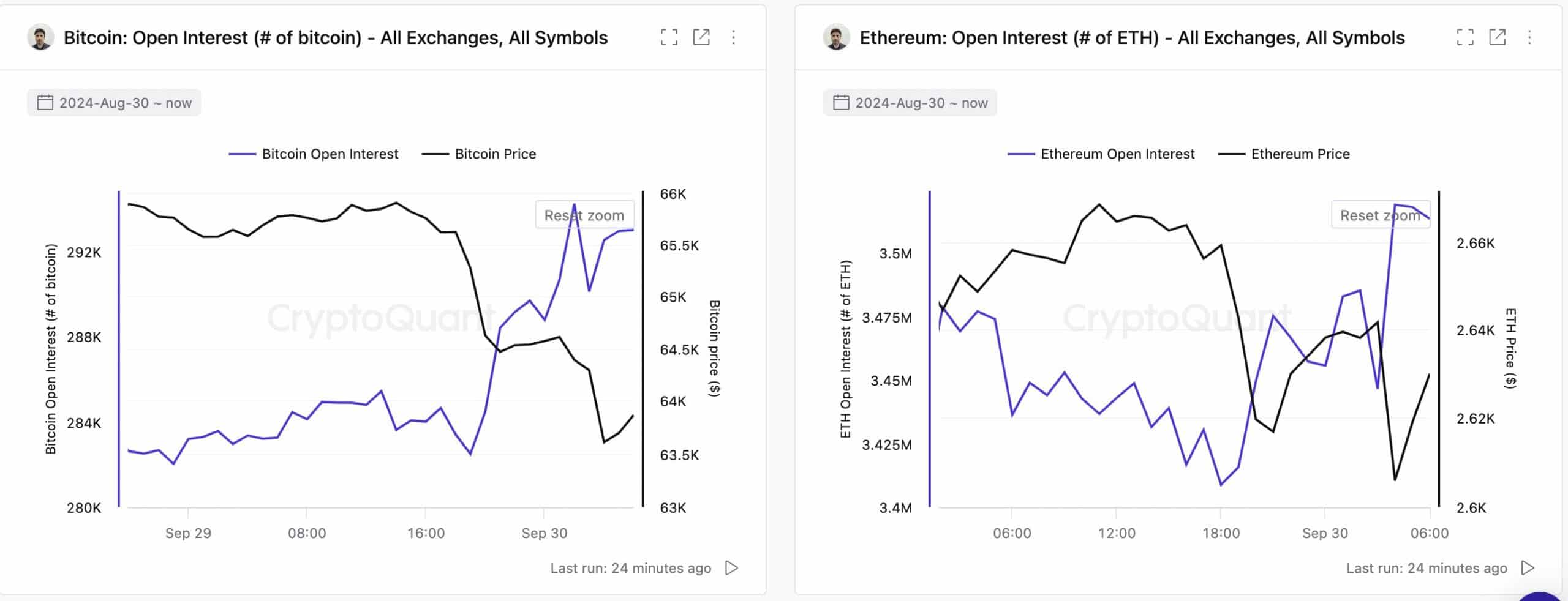

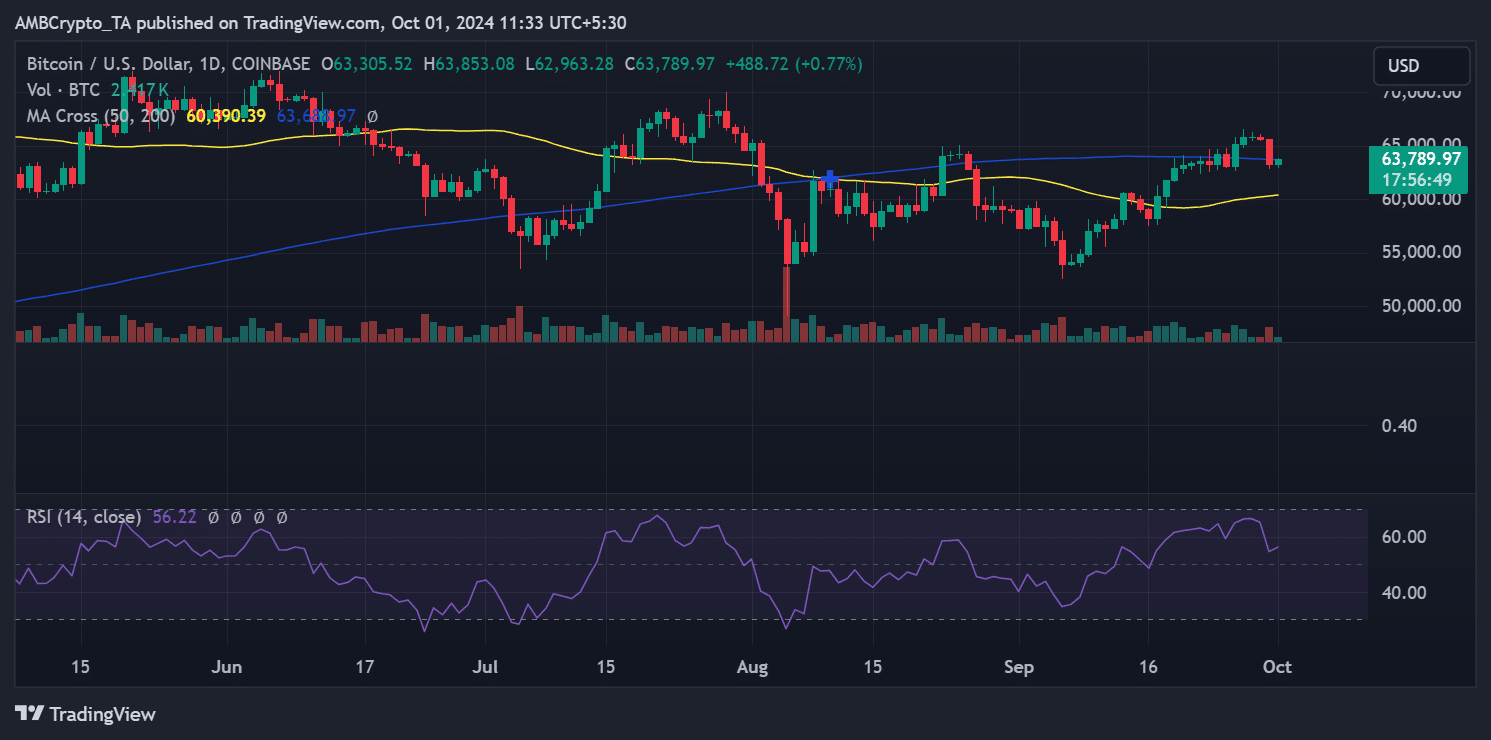

Bitcoin and Ethereum costs comply with OI traits

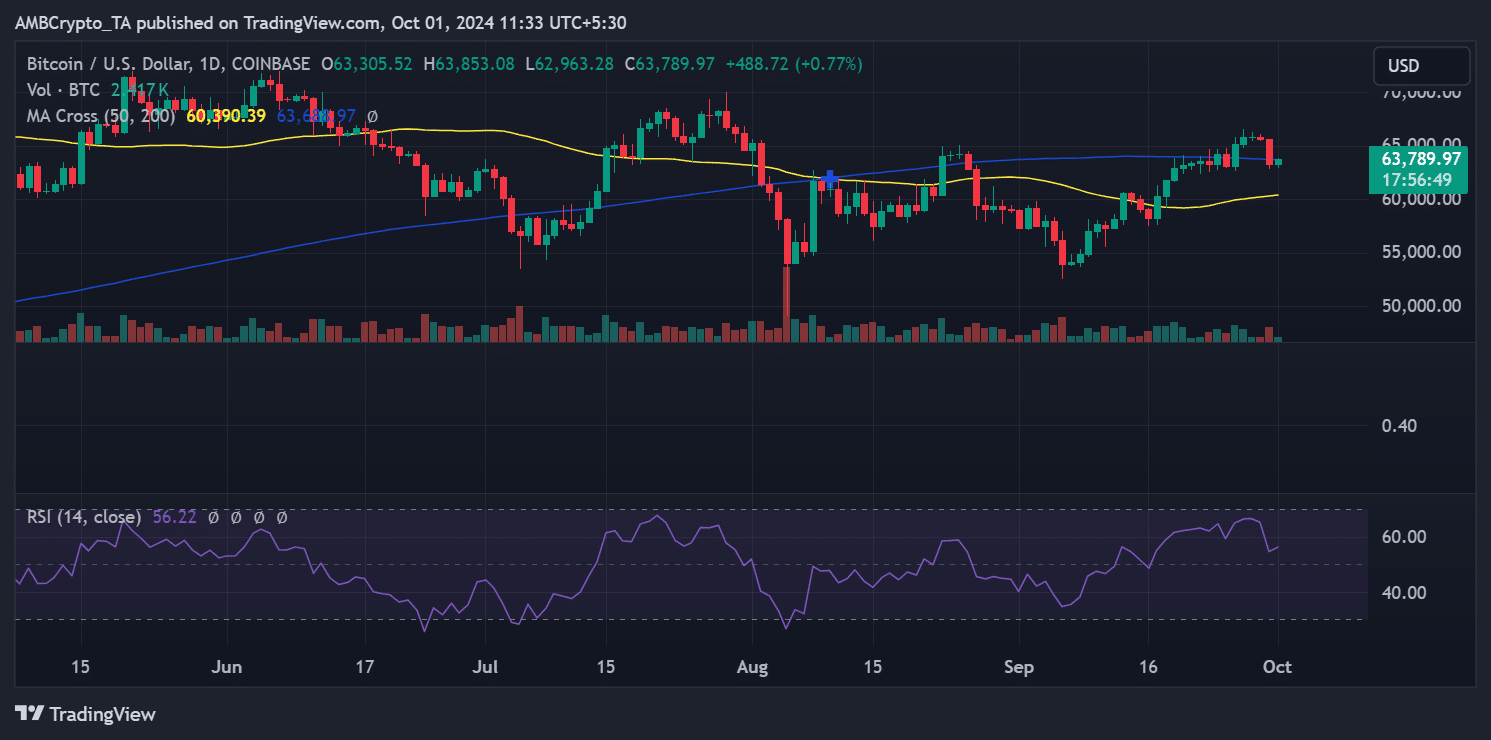

The drop in open curiosity had a direct influence on each Bitcoin and Ethereum costs. Bitcoin noticed a decline of three.50%, from $65,600 to $63,301, falling under the 200-day shifting common.

Supply: TradingView

Equally, Ethereum fell 2.13%, from $2,657 to $2,601, remaining under the 200-day shifting common, however nonetheless above the 50-day shifting common.

Supply: TradingView

On the time of writing, each property have seen a slight rebound. Bitcoin was buying and selling at $63,789 up 0.7%, whereas Ethereum gained over 1% to commerce round $2,639.

Alternating currents stay steady

Regardless of the latest declines, there was no important sell-off. Information from CryptoQuant reveals that Bitcoin recorded a detrimental outcome exchange flowindicating a balanced circulate of BTC between exchanges and private wallets.

Alternatively, Ethereum noticed a slight improve alternating currentwith 14,000 ETH flowing onto the exchanges over the past buying and selling session.

Nonetheless, this quantity was not sufficient to trigger a serious sell-off. At the moment, the circulate has turned detrimental once more, with greater than 23,000 ETH withdrawn from the exchanges, indicating lowered promoting stress.

Learn Ethereum (ETH) Value Prediction 2024-25

Conclusion

Whereas Bitcoin and Ethereum suffered notable declines within the remaining days of September, the dearth of a serious sell-off and the slight restoration in costs point out a comparatively steady market.

Open rate of interest traits and foreign money flows point out that traders should not speeding to exit their positions, pointing to potential for a near-term restoration.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now