Gaming

Off The Grid confidential letter sparks speculation around tokenomics

Credit : cryptonews.net

This can be a section of the drop e-newsletter. Subscribe to learn full editions.

The taking pictures sport of the grid has confronted with some rejection – and a few reward – about an alleged confidential letter.

The letter in query was reportedly e -mailed to the non-public traders of Gunzilla Video games with regard to his weapons that have been traded on Binance this week. Gun was launched on Monday and reached a market capitalization of $ 68 million inside a number of hours of launch, however that quantity has since fallen to $ 40 million.

The letter refers to a SAFT, or a easy settlement for future tokens, which implies that traders have given the corporate cash prematurely for tokens on a later, future date.

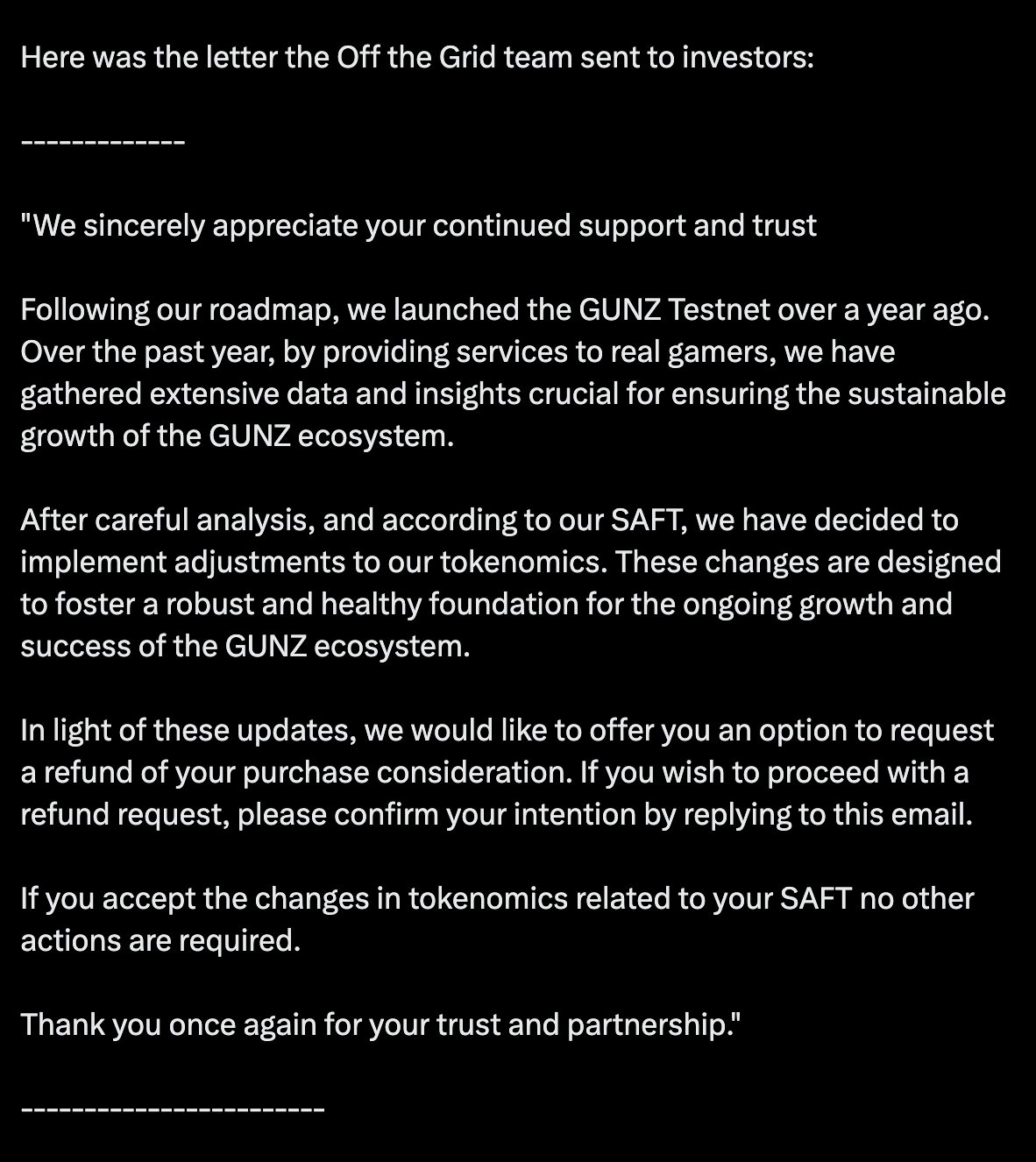

The copying textual content of the letter was positioned on X yesterday by a crypto dealer and acquired greater than 115,000 views in lower than someday. The bigger submit additionally included the damaging criticism of the dealer on the choice. Nevertheless, we now not know concerning the particulars of the SAFT.

The supposed textual content of that e -mail additionally refers to a change within the Vestingtokenomics of Gun – and affords traders an opportunity for a refund if they don’t wish to conform to the brand new situations.

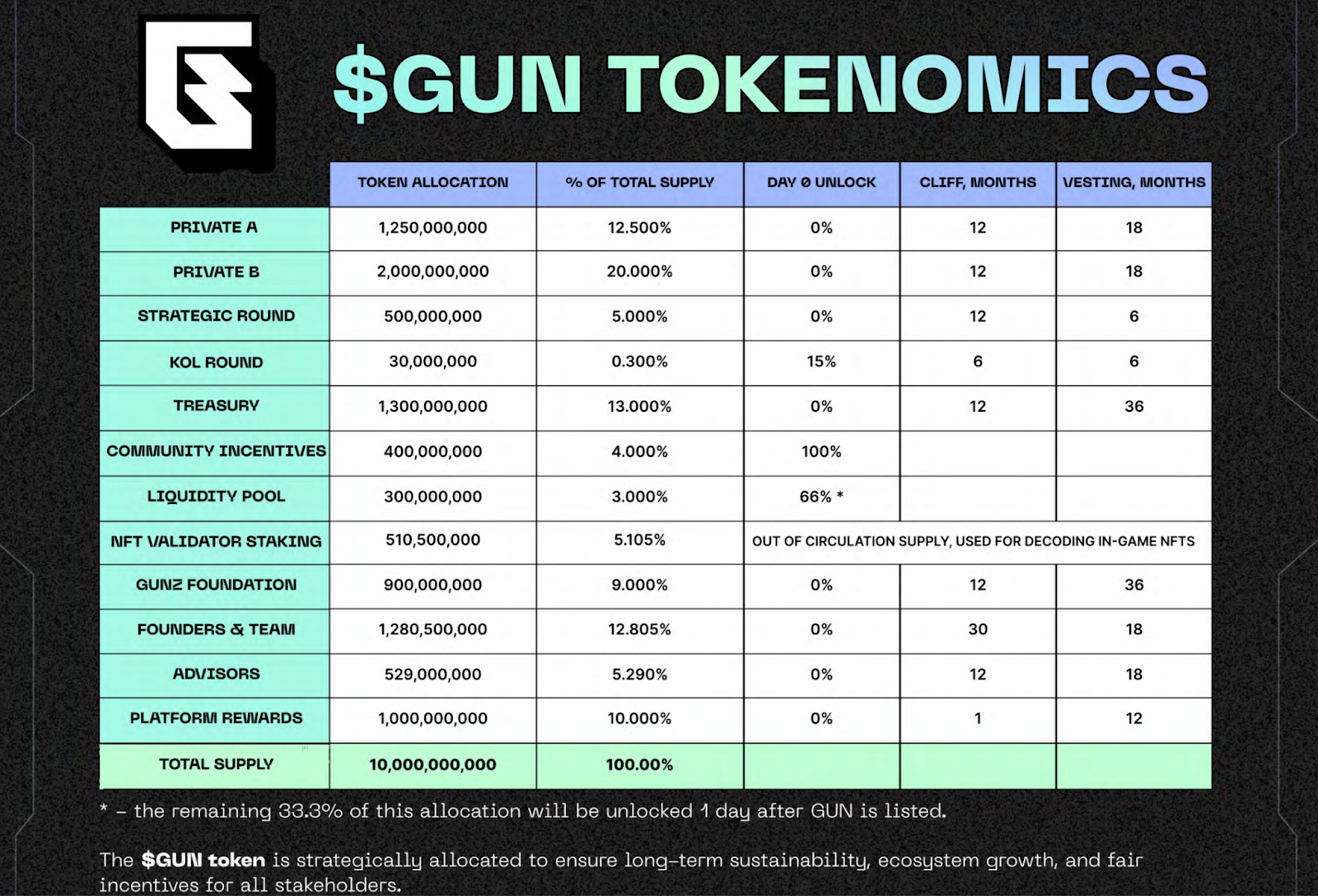

What precisely can these adjustments be? The dealer who leaked the alleged letter, Grail.eth, claims that seed spherical traders would get 5% of their weapons on the launch day, whereas strategic spherical traders would see 2% of their tokens unlocking within the launch.

Based on the general public pistool whit paper, the strategic spherical sees 0% of the tokens unlocked throughout the launch. The non-public A and B rounds have been granted the identical. Because of this the tokens of those teams won’t be unlocked for at the least a 12 months as a result of their tokens have a cliff of 12 months, with 18 months fortress.

Some merchants on Twitter speculate that the adjustments could be to finance the supply of token on Binance, though this isn’t confirmed by Gunzilla or Binance.

“We don’t cost itemizing prices for tasks talked about on Binance,” a Binance spokesperson informed Blockworks. “Anyway, deposits of challenge groups are reimbursed and designed to assist person shield customers by making certain that tasks are critical about constructing their tasks, holding them alive and persevering with to construct after point out on Binance. The down fee additionally serves to assist customers shield them by not supplying their obligations.”

Others have criticized the Gun tokenomics for assigning a substantial quantity to traders within the first place.

However not everybody sees these tokenomics in a unfavorable gentle.

I’m personally a fan of each challenge, which implies that traders wait longer to unlock their tokens. The “dump on retail” value promotion is enjoyable for anybody, and it could possibly kill pleasure round a brand new challenge whether it is launched shortly after a token.

“A uncommon case by which the challenge chooses its customers above VCS,” wrote AVA Labs Advertising and marketing Lead Avery Bartlett in response to the submit with the letter, whereas additionally admitted that he understood the criticism round it (Gunzilla makes use of his personal Avalanche L1).

In a DM, Bartlett informed Blockworks: “The individuals I do know didn’t get [a letter]. I acquired nodes on secondary and didn’t perceive, “steered that validator traders didn’t see any change of their tokenomics.

Theodore Agranat, director of Gunzilla of Web3, informed Blockworks that he “was unsure” when he was requested concerning the legitimacy of the letter.

“I do know which letter was despatched [a] confidentiality clause connected to it. So unsure, “he mentioned, including that he would converse together with his workforce.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024