Bitcoin

On-Chain Data Reveals Panic Among Short-Term Investors

Credit : coinpedia.org

Bitcoin has a noticeable gross sales strain previously two weeks. Between April 5 and April 8 alone, the main cryptocurrency fell by greater than 9.01%. Any further BTC acts solely 2.48% increased than the place it began initially of the month. However what actually drives this dip?

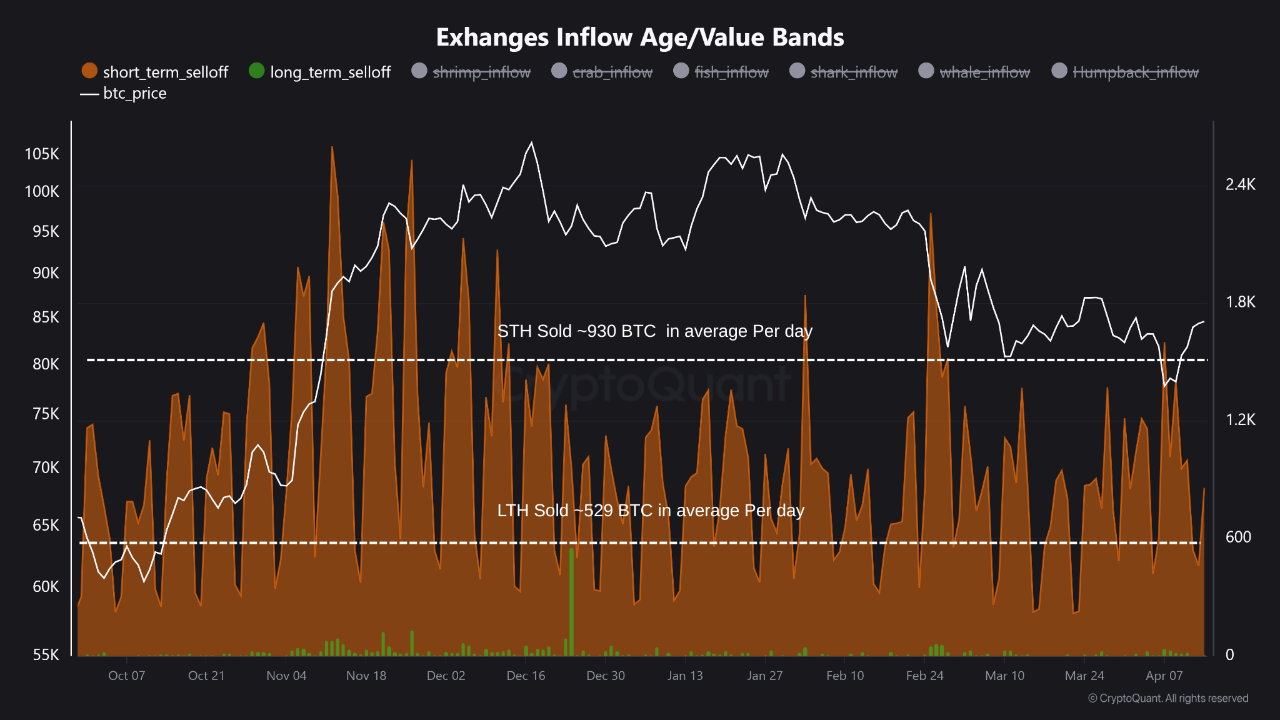

In accordance with information on the Cryptoquant chain, the first perpetrators are brief -term holders and smaller wallets. That is what the information reveals.

Quick -term holders lead the sale

A comparative evaluation of alternate exercise reveals a big hole between short-term and long-term holders. Holders within the brief time period will ship not less than 401 extra BTC to alternate day by day than their lengthy -term controls.

Cryptoquant information point out that holders are loading round 930 BTC within the brief time period to alternate every single day, whereas lengthy -term holders transfer solely 529 BTC. This implies that lengthy -term traders stay extra confidence in the way forward for Bitcoin, regardless of latest volatility.

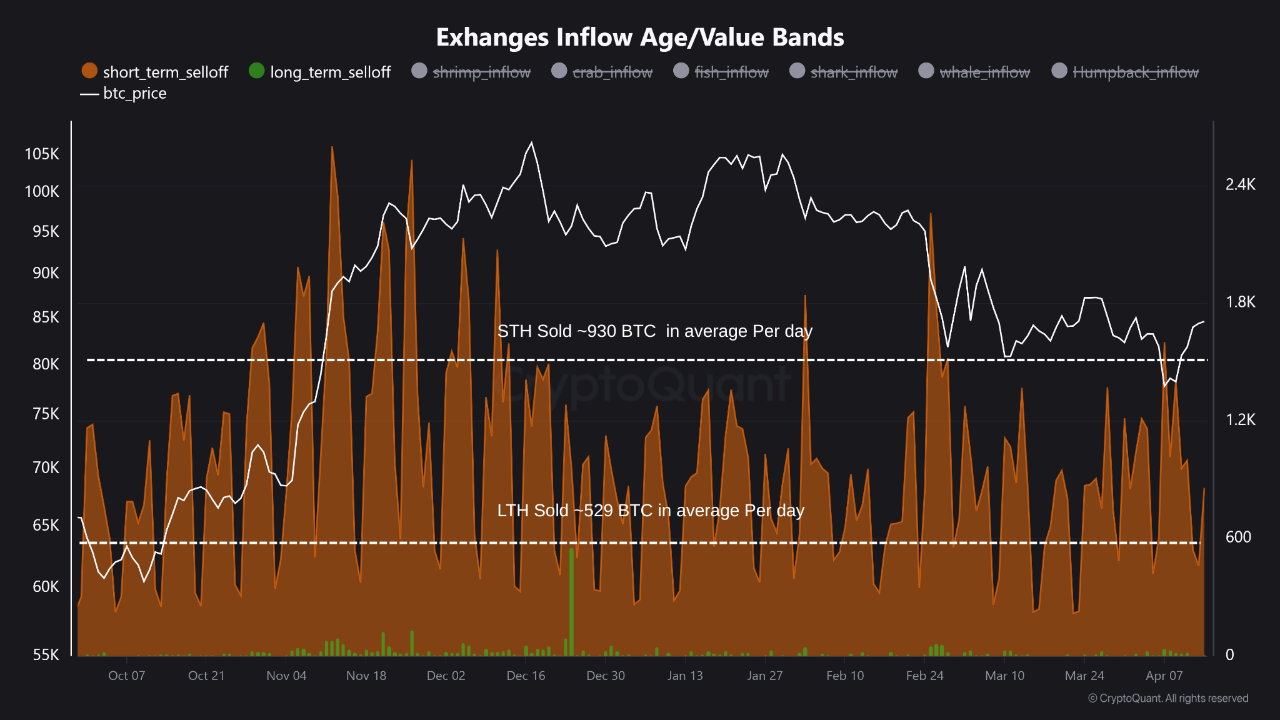

Pockets Cohorten Breakdown: Who sells probably the most?

One other evaluation layer breaks down Bitcoin holders in 5 wallet-size classes: shrimp, crabs, fishing, sharks and whales. It seems that the smaller gamers present extra concern concerning the BTC course of in comparison with the most important traders.

Right here is the demolition of day by day alternate influx by pockets:

- Shrimp (<1 BTC): ~ 480 BTC

- Scratching (1-10 BTC): ~ 102 BTC

- Fish (10-100 BTC): ~ 341 BTC

- Sharks (100-1,000 BTC): ~ 402 BTC

- Whales (> 1,000 BTC): ~ 70 BTC

This conduct emphasizes a putting development – whereas smaller traders are promoting out, whales stay largely unguided. Their minimal exercise suggests robust belief in the long run in the way forward for Bitcoin.

- Additionally learn:

- Crypto -Worth forecast 2025: Bitcoin set for Q3 Restoration, says Coinbase

- “

Is that this a traditional shackout for the subsequent rally?

This gross sales development at holders within the brief time period and small portfolios appears to be a short lived wave of panic gross sales earlier than a possible restoration. Whales and lengthy -term holders usually are not in panic. This implies that sensible cash sees energy within the bigger entire. Traditionally, such tubers have typically preceded robust bullish rebounds within the Bitcoin market.

Regardless of the latest version, the Bitcoin market has made the three.1% revenue final week, with a rise of 0.7% alone within the final 24 hours. This restoration, though modest, means that the worst of the latest dip could be behind us.

Bitcoin reached however secure

Since April 12, Bitcoin has been appearing inside a good attain between $ 82,711.41 and $ 86,460.73. On the time of writing, BTC is at $ 84,412.

Within the brief time period, volatility can live on, as a result of smaller traders proceed to reply to uncertainty. Nonetheless, the shortage of great gross sales strain of whales and lengthy -term holders signifies underlying market energy. If historical past is a information, the present dip may decide the stage for the subsequent step from Bitcoin up.

The market could also be shaky, however conviction amongst main gamers shouldn’t be cracked – maybe that’s an important.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, skilled evaluation and actual -time updates on the most recent traits in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

Bitcoin was confronted with a gradual gross sales strain of holders within the brief time period and threatened a lower of 9.01% between 5 and eight April.

In accordance with the BTC value prediction of Coinpedia, 1 BTC may peak at $ 168k this 12 months if the Bullish sentiment maintains.

With an elevated acceptance, the worth of 1 Bitcoin may attain a top of $ 901,383.47 in 2030.

In accordance with our newest BTC value evaluation, Bitcoin can attain a most value of $ 13,532,059.98

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024