Bitcoin

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Credit : bitcoinmagazine.com

Bitcoin’s current value motion has been nothing wanting thrilling, however past the market buzz lies a wealth of on-chain knowledge that provides deeper insights. By analyzing metrics that measure community exercise, investor sentiment, and BTC market cycles, we will achieve a clearer image of Bitcoin’s present place and potential trajectory.

There’s nonetheless loads of upside left

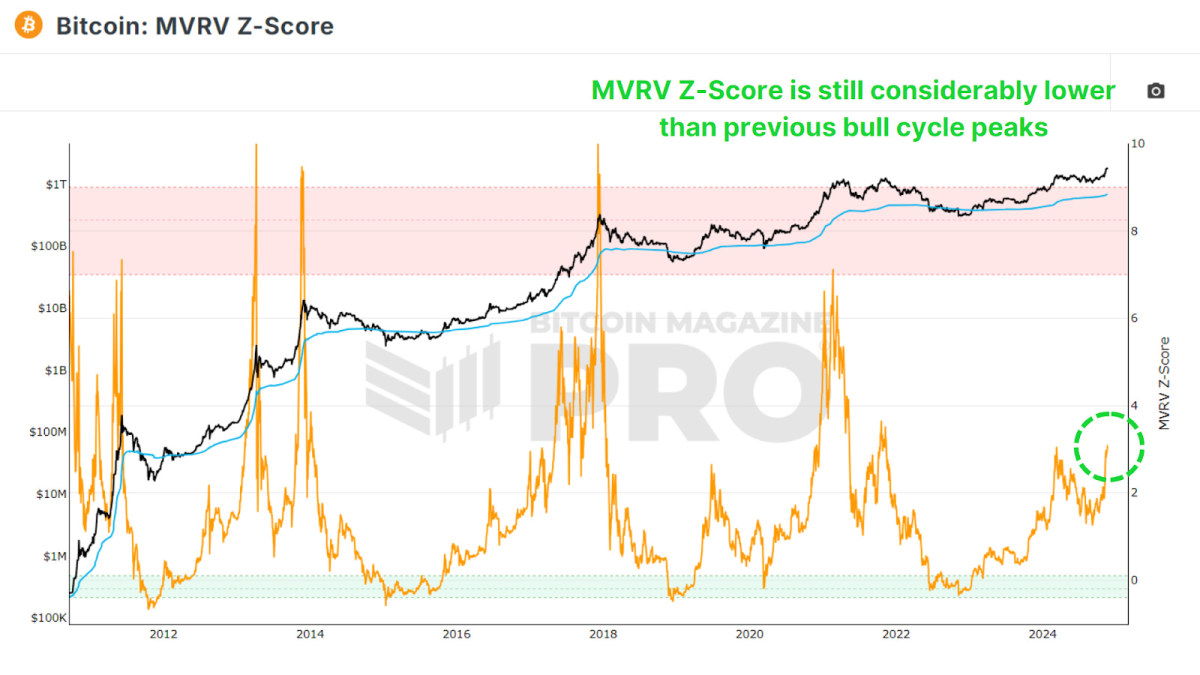

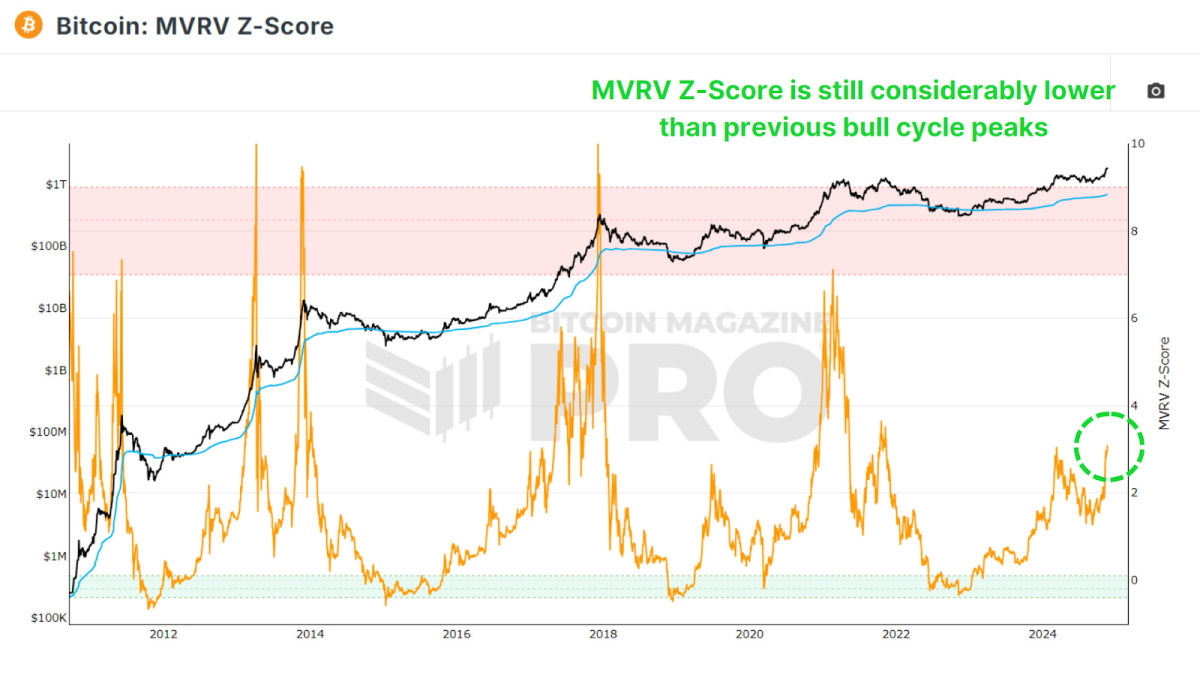

The MVRV Z-Score compares Bitcoin’s market cap, or the worth multiplied by the circulating provide, to the realized cap, which is the typical value at which all BTC final traded. Traditionally, this measure signifies overheated markets when it enters the purple zone, whereas the inexperienced zone signifies widespread losses and potential undervaluation.

At the moment, regardless of Bitcoin’s rise to new all-time highs, the Z-score stays in impartial territory. In earlier bull runs, Z-scores have reached highs of seven to 10, nicely above the present degree of round 3. If historical past repeats itself, this means important room for additional value development.

Miner profitability

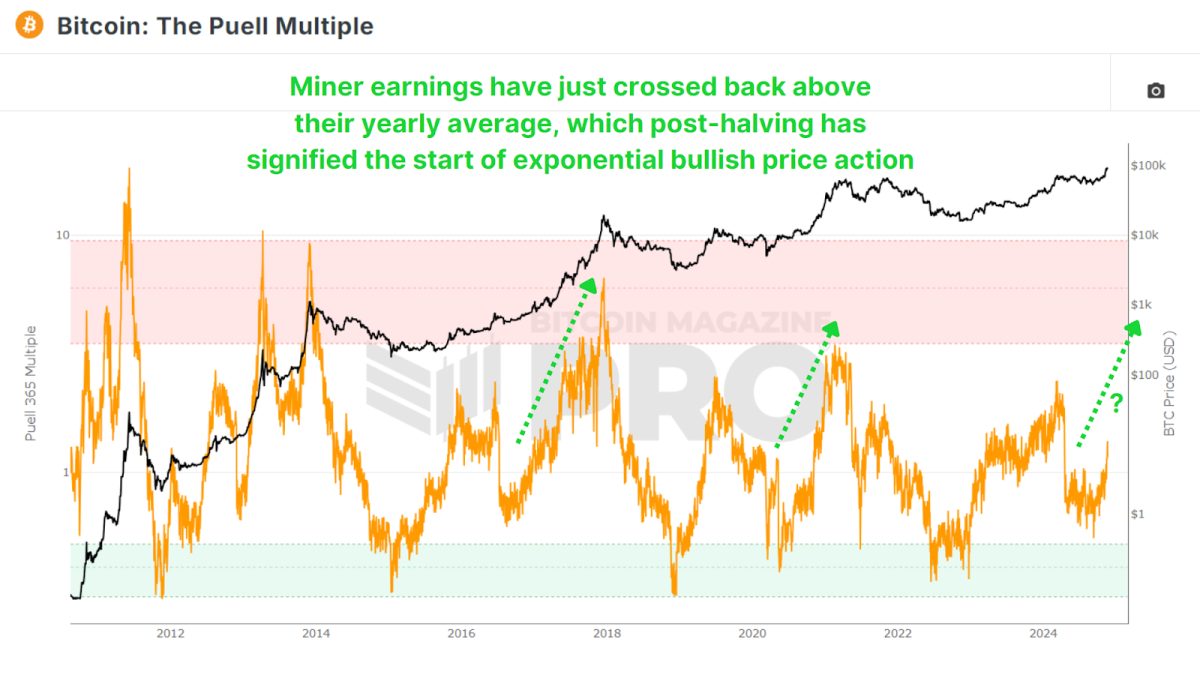

The Puell multiple evaluates miners’ profitability by evaluating their day by day USD turnover to their one-year shifting common. After the halving, miners’ revenues fell by 50%, resulting in a multi-month interval of decrease revenues because the BTC value consolidated for many of 2024.

However at the same time as Bitcoin has soared to new highs, the a number of signifies a rise in profitability of solely 30% over historic averages. This implies that we’re nonetheless within the early to mid levels of the bull market, and evaluating the patterns within the knowledge, it seems that we’ve the potential for explosive development, just like 2016 and 2020. With a reset after the halving will see consolidation, and at last a reclamation of the 1.00 a number of degree, signifying the exponential part of value motion.

Measuring market sentiment

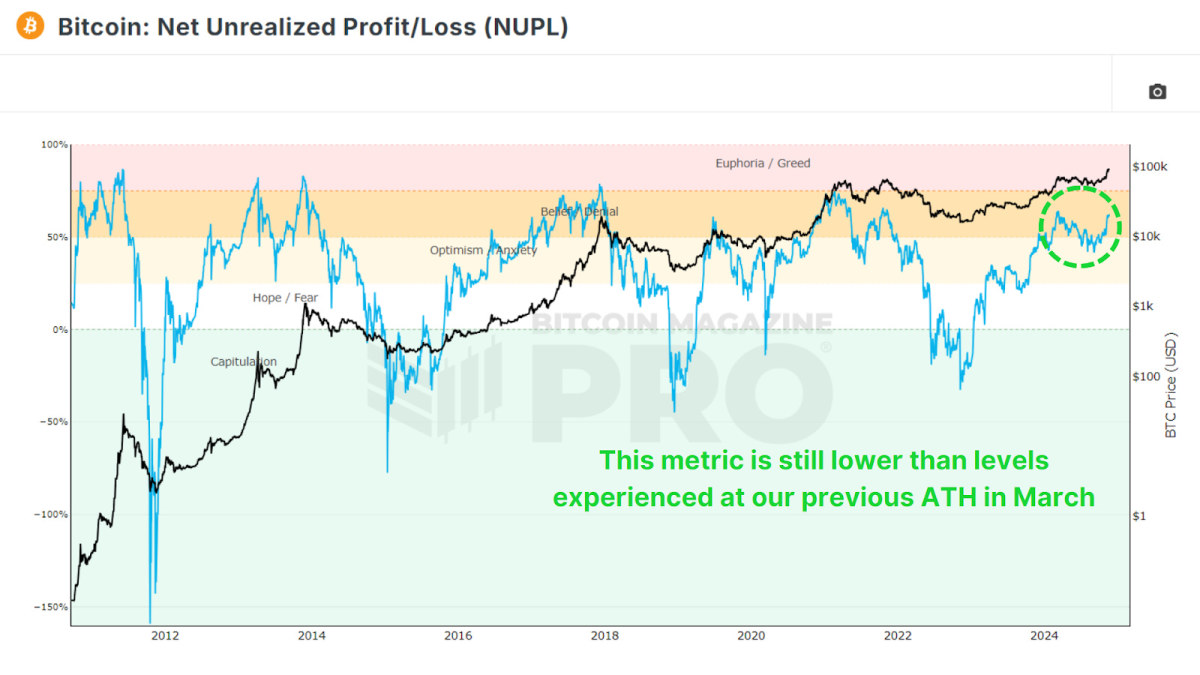

The net unrealized gain and loss (NUPL) Metrics quantify the general profitability of the community and map sentiment throughout phases comparable to optimism, religion and euphoria. Just like the MVRV Z-Rating in that it’s derived from realized worth or investor price foundation, it appears on the present estimated revenue or loss for all holders.

At the moment, Bitcoin stays within the ‘Perception’ zone, removed from ‘Euphoria’ or ‘Greed’. That is according to different knowledge indicating that there’s loads of room for value appreciation earlier than market saturation is reached. Particularly contemplating that this metric remains to be at a decrease degree than this metric reached earlier this 12 months in March once we hit the earlier all-time excessive.

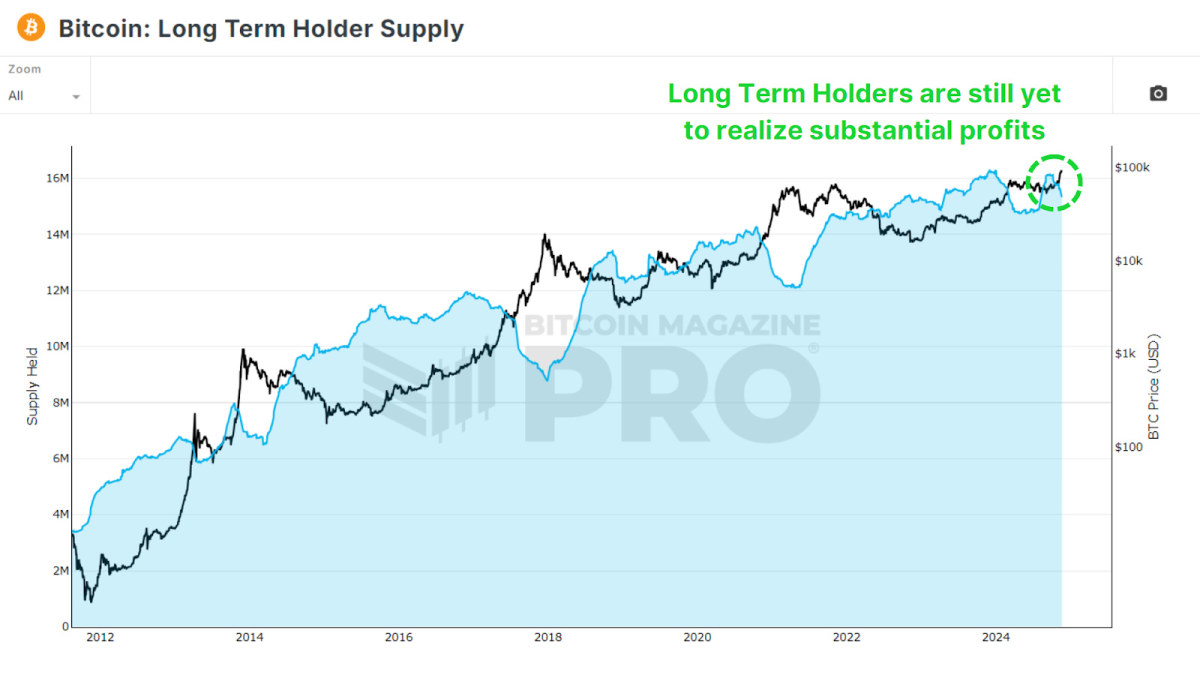

Lengthy-term holding developments

The share of Bitcoin held for greater than a 12 months, represented by the 1+ years of HODL golfstays exceptionally excessive at round 64%, which remains to be increased than at some other level in Bitcoin historical past previous to this cycle. At earlier value peaks in 2017 and 2021, these values fell to 40% and 53% respectively, as long-term holders began making earnings. If one thing related have been to occur throughout this cycle, we might nonetheless must switch hundreds of thousands of bitcoins to new market individuals.

Thus far, solely about 800,000 BTC has been transferred from the Long-term container supply to newer market individuals throughout this cycle. As much as 2-4 million BTC have modified arms in current cycles, highlighting that long-term holders have but to be absolutely paid out. This means a comparatively nascent part of the present bull run.

Following ‘Sensible Cash’

The Currency days destroyed Metrics weigh transactions based mostly on coin holding time, specializing in whaling exercise. We will then multiply that worth by the BTC value at the moment to see the worth Value days destroyed (VDD) Multiple. This provides us a transparent perception into whether or not the most important and brightest BTC holders are beginning to make earnings on their positions.

Present ranges stay removed from the purple zones sometimes seen throughout market tops. Because of this whales and ‘sensible cash’ haven’t but misplaced important parts of their property and are nonetheless ready for increased costs earlier than realizing substantial earnings.

Conclusion

Regardless of the rally, on-chain metrics overwhelmingly counsel that Bitcoin is way from overheating. Lengthy-term buyers stay largely steadfast, and indicators just like the MVRV Z-score, NUPL and Puell A number of all level to room for development. That mentioned, some profit-taking and new market individuals are signaling a transition into the mid- to late-cycle part, which may probably final by means of most of 2025.

It’s important for buyers to stay data-driven. Emotional selections, fueled by FOMO and euphoria, could be pricey. As an alternative, observe the underlying knowledge that fuels Bitcoin and use instruments just like the metrics mentioned above to information your individual investments and evaluation.

For a extra in-depth take a look at this matter, watch a current YouTube video right here: What’s happening in the chain: Bitcoin update

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024