Bitcoin

One reason why Bitcoin’s March 2024 ATH WON’T stand for too long

Credit : ambcrypto.com

- The BTC CDD steered that the development was nonetheless under crucial ranges

- Lengthy-term holders have accrued roughly 1 million BTC since July

In March 2024, Bitcoin hit a brand new all-time excessive. It has since sparked debate amongst buyers about whether or not this was the height of the bull market or not. Whereas some argue that this may very well be the final word summit, knowledge on the chain suggests in any other case.

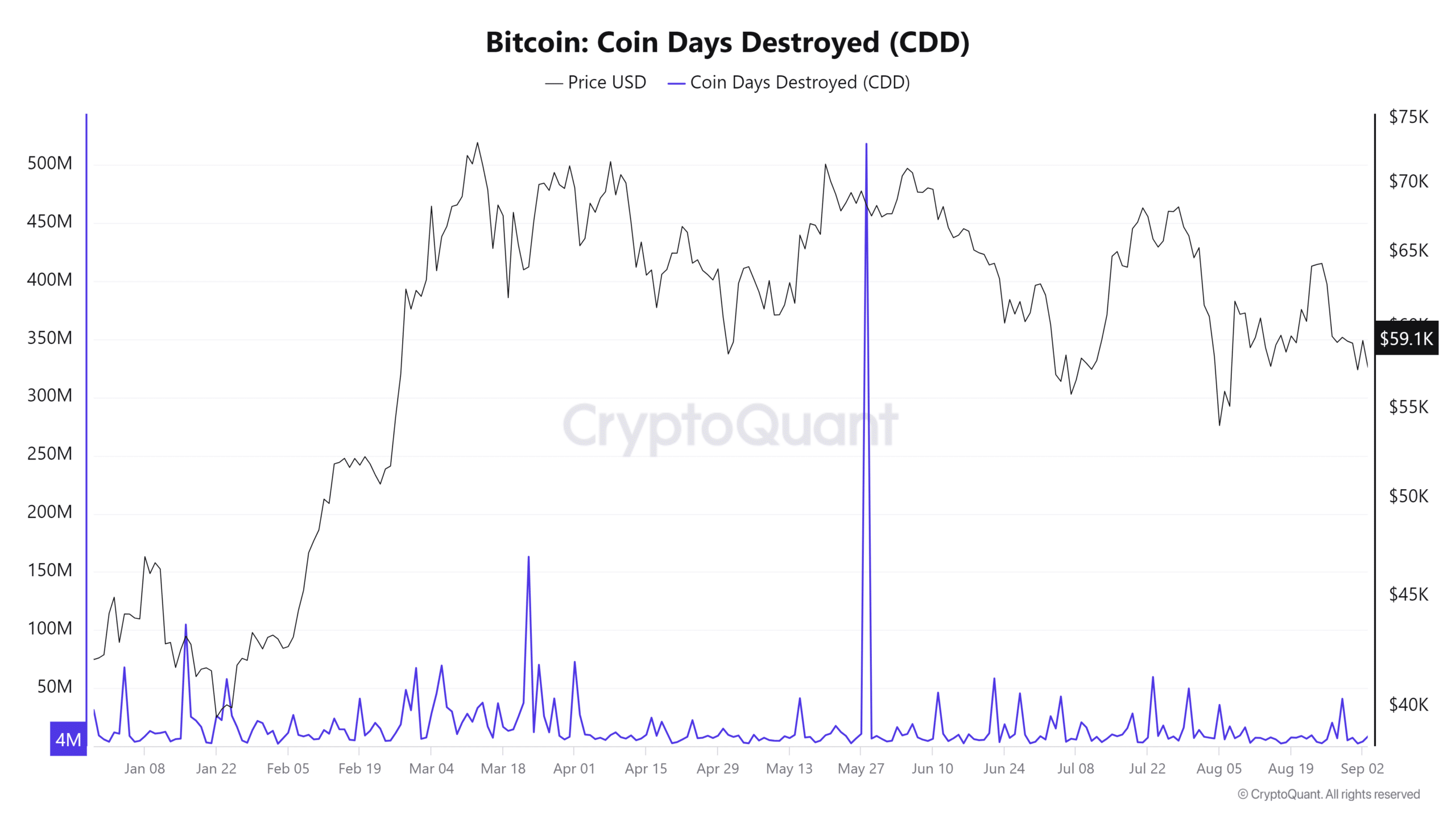

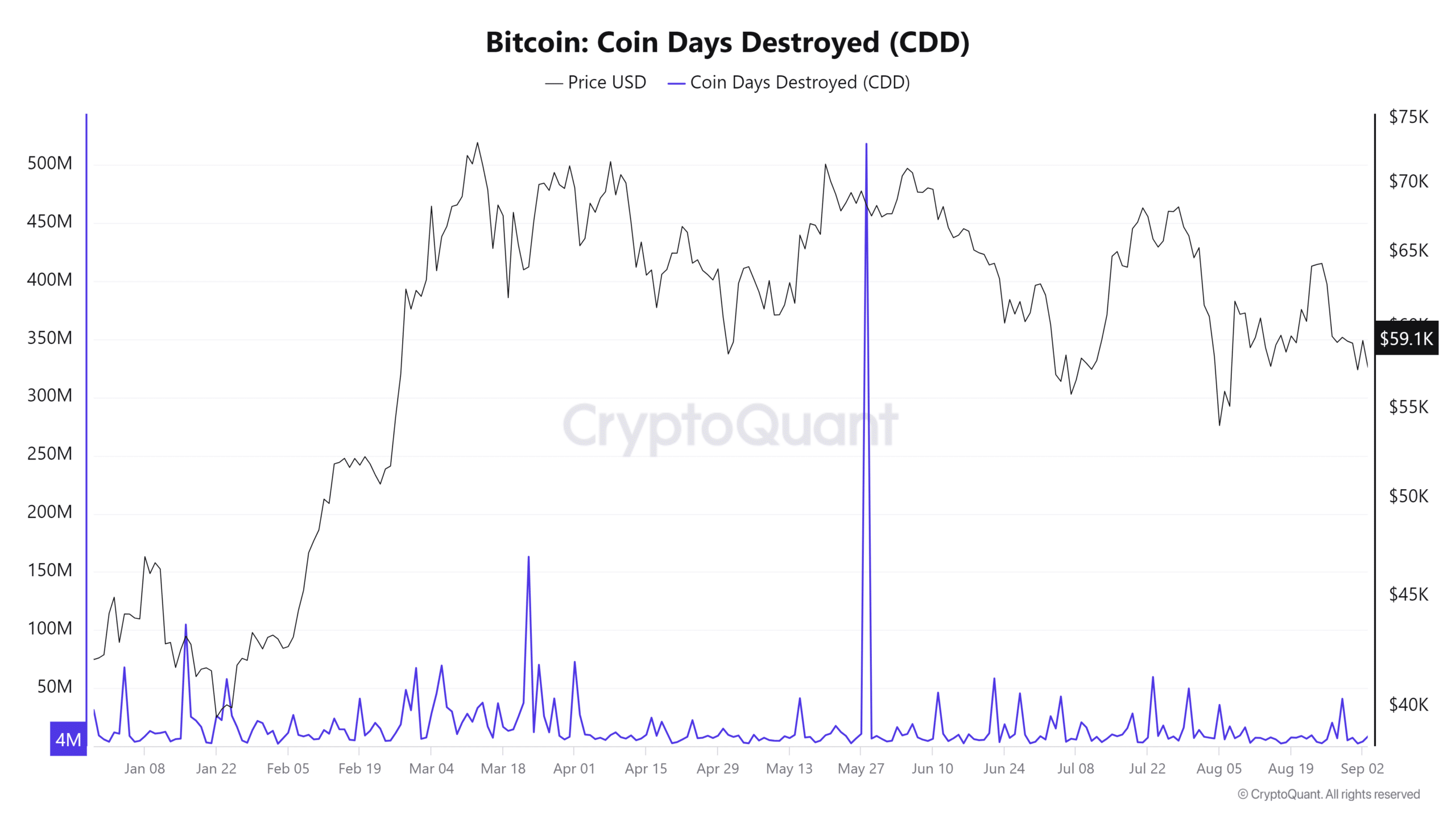

In truth, statistics like Coin Days Destroyed (CDD) appeared to point that the market should have room for additional upside.

Bitcoin’s high already in?

In March 2024, Bitcoin noticed a notable spike within the Coin Days Destroyed (CDD) metric, indicating that some long-term holders have been taking income round all-time highs. Nevertheless, further analysis revealed that the CDD has not but reached the crucial ‘purple zone’. This zone often alerts the eventual market high.

What this implies is that whereas the March peak represented a major interim peak, it was seemingly not the final word peak of the present cycle. In keeping with this, the development within the CDD metric indicated that there’s nonetheless potential for additional value will increase within the coming months.

Supply: CryptoQuant

CDD is a crucial on-chain metric that tracks the motion of older, long-held Bitcoin. It supplies perception into when long-term holders are promoting, offering a clearer image of market maturity and doable future developments.

The truth that the CDD has but to peak implies that the bull market should have room to develop. Primarily as a result of long-term buyers are cautious, however not getting out fully.

Lengthy-term holders proceed to build up Bitcoin

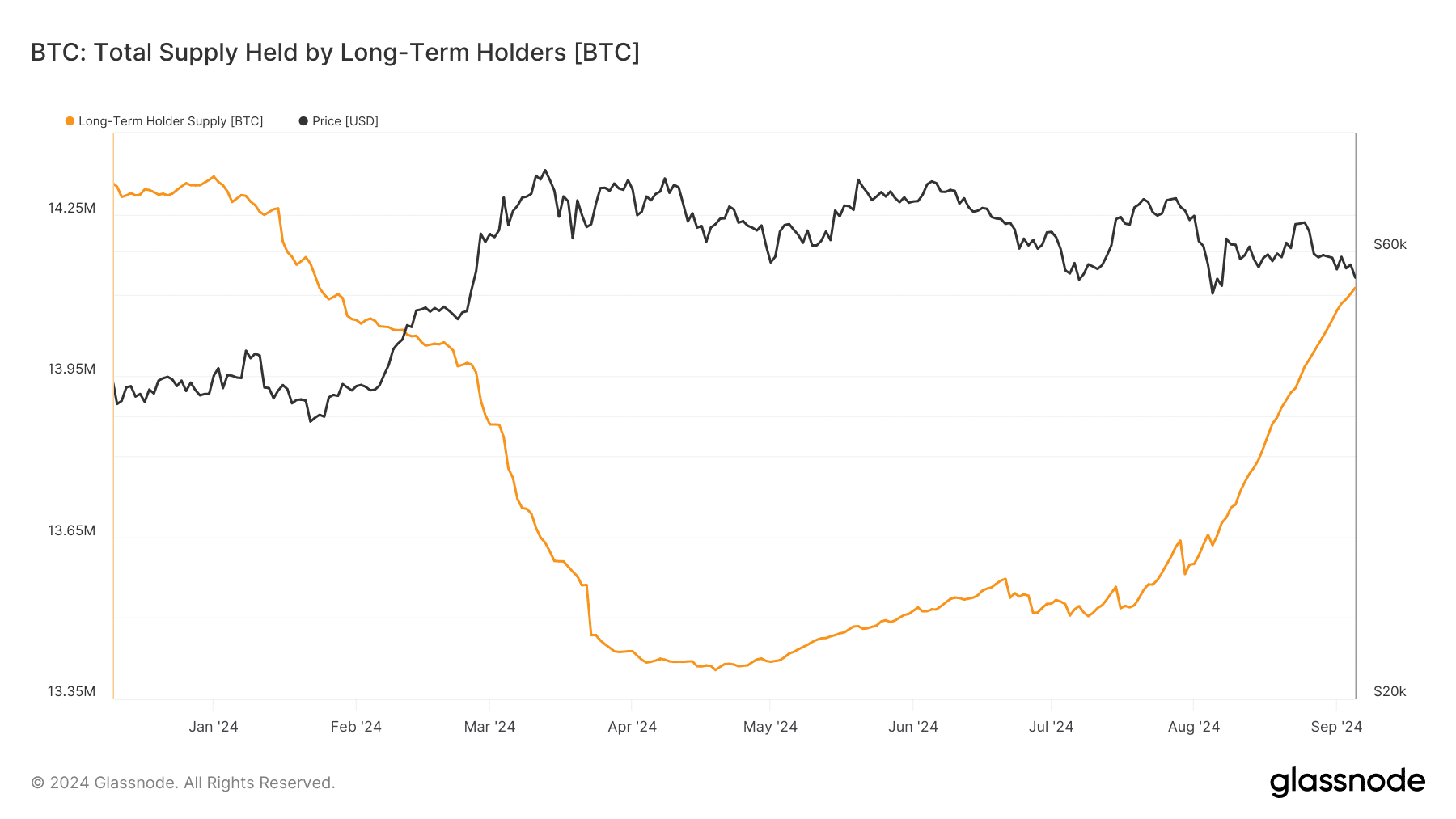

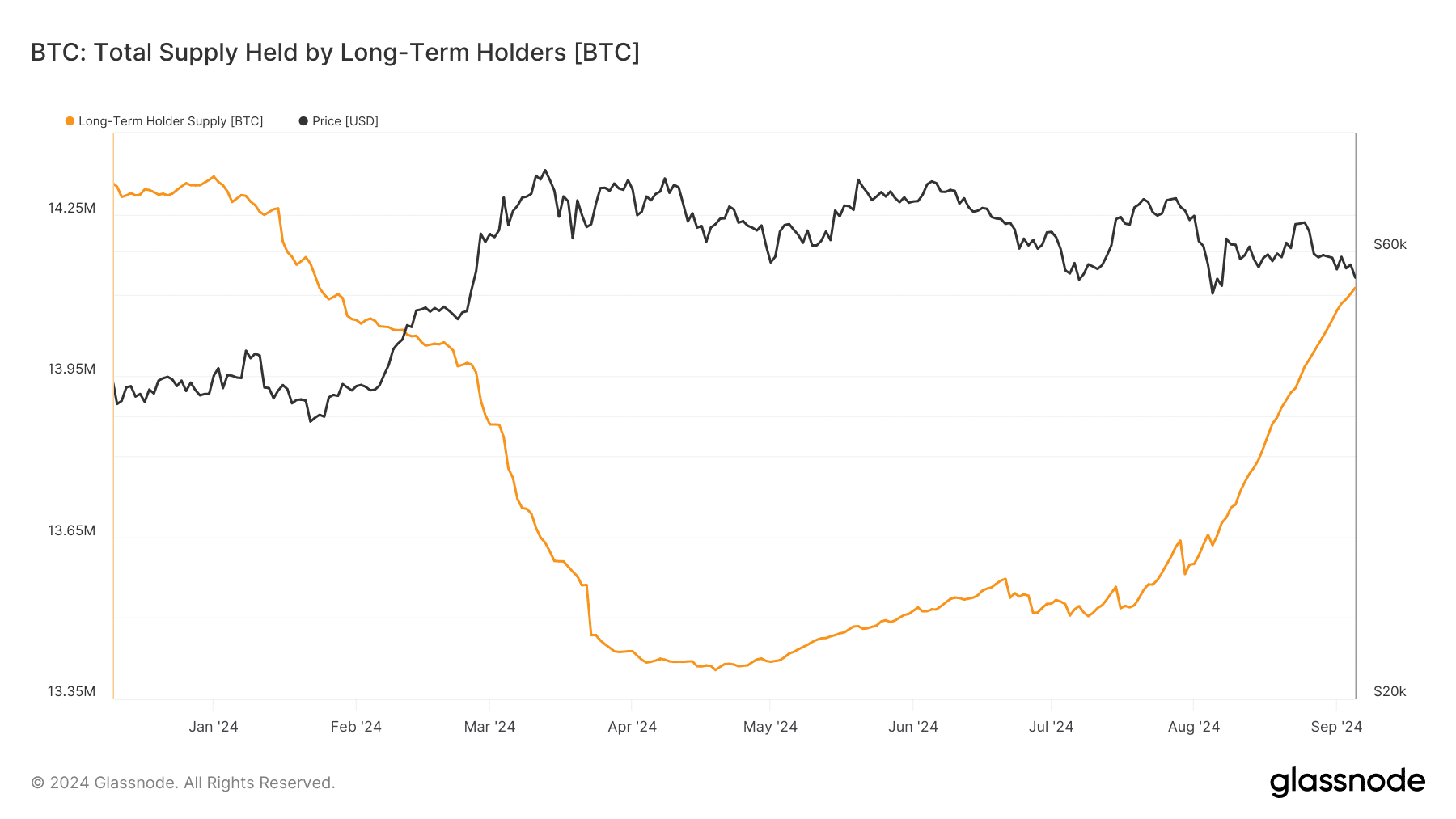

An evaluation of Bitcoin Lengthy-Time period Holders (LTH) supplies knowledge Glass junction additionally revealed optimistic sentiment consistent with the development noticed within the Coin Days Destroyed (CDD) metric.

In keeping with the identical story, these long-term holders began rising their accumulation in July, when the value of Bitcoin began to fall.

Supply: Glassnode

Between July 19 and September 6, the provision of Bitcoin within the palms of long-term holders grew considerably, from roughly 13.5 million BTC to greater than 14.1 million BTC. This accumulation development means that long-term holders stay assured in Bitcoin’s long-term prospects regardless of the latest value decline and will not be exiting their positions.

This rising provide is an indication that long-term holders are profiting from decrease costs, reinforcing the idea that the market nonetheless has room for additional upside potential. Particularly as these key buyers proceed to carry and accumulate, relatively than promote.

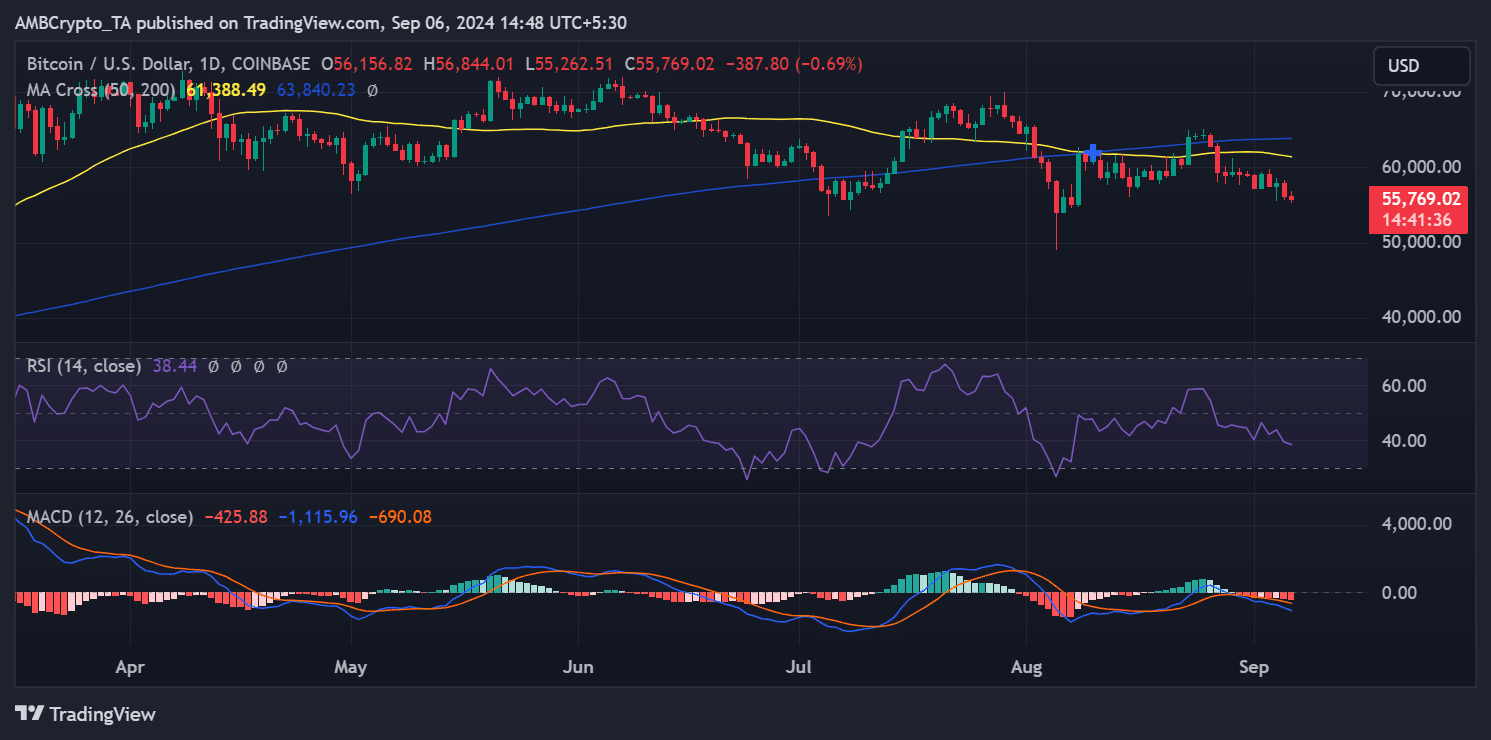

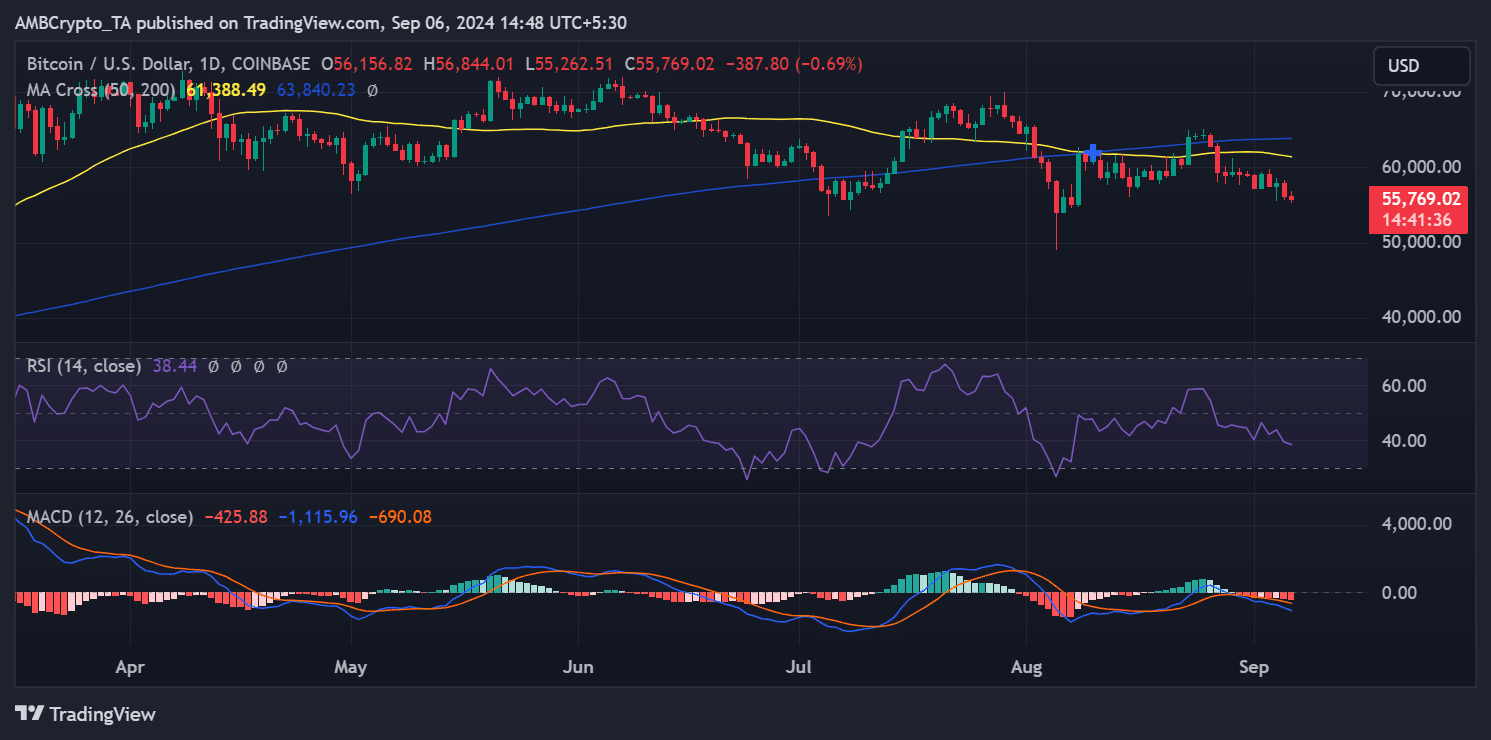

BTC continues to say no within the charts

Bitcoin’s value wrestle continues, with AMBCrypto’s evaluation of the every day chart exhibiting a decline of greater than 3% within the final buying and selling session. The decline dropped the value to about $56,000. On the time of writing, the decline appeared to proceed with a further 0.7% drop, bringing the value to round $55,700.

Supply: TradingView

The Relative Power Index (RSI) for Bitcoin had fallen barely under 40, indicating that it has entered the oversold zone. Merely put, promoting strain could have peaked, which might point out a possible value rebound within the close to time period.

– Learn Bitcoin (BTC) value prediction 2024-25

Regardless of the continued value decline, the optimistic development in Bitcoin’s Lengthy-Time period Holder (LTH) provide might promote additional accumulation at this value degree.

As long-term holders proceed to construct their positions, this might help the value. This might probably result in stabilization and even restoration because the market processes the downward development.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now