Policy & Regulation

Operation Chokepoint 2.0 Policies Rolled Back

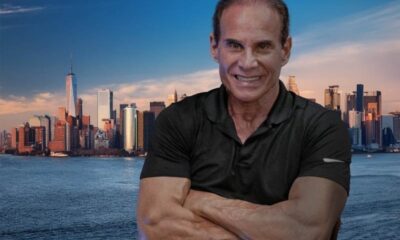

Credit : cryptonews.net

David Sacks, the Crypto Tsar of the White Home, at the moment celebrated a giant win. He introduced that the Federal Deposit Insurance coverage Company (FDIC) follows the American workplace of the Present of the Foreign money (OCC) when eradicating “repute danger” as a consider financial institution surveillance. This variation successfully rolls again the controversial operation ChokePoint 2.0 coverage, which had led to the unfair debit of cryptom firms.

Sacks mentioned this can be a massive step ahead for crypto. Operation ChokePoint 2.0, which was supported by figures similar to Senator Elizabeth Warren, used imprecise standards similar to “repute danger” to deal with crypto firms. This meant that establishments may very well be punished on adverse publicity, whether or not it’s true or not. The brand new coverage change will make financial institution standards extra goal and honest, in order that political affect harms the crypto sector.

Sacks has additionally credited Senator Tim Scott for his management in pushing these adjustments, primarily as a result of Monetary Establishment Reform and Modernization (FIRM) Act. This step is predicted to create a greater surroundings for crypto firms and sooner or later can result in larger costs for digital property.

Eleanor Terrett of Fox Enterprise added extra context and defined why “laws by enforcement” didn’t work. She defined that through the years, Ripple has spent between $ 150 million and $ 200 million in authorized prices, however to finish in the identical place wherein it was when the SEC indicated for the primary time in 2020. The SEC has in all probability additionally issued taxpayer {dollars}.

That is the explanation why enforcement laws are the least efficient technique to obtain regulatory readability:

Together with the nice, @ripple has disabled someplace between $ 150 million – $ 200 million in authorized prices to finish in kind of the identical place wherein the @Secgov introduced the … https://t.co/7quom21xyr

– Eleanor Terrett (@eleanorterrett) March 25, 2025

XRP holders had been additionally negatively influenced, as a result of inventory exchanges eliminated the token, inflicting its worth to fall. Many different crypto initiatives additionally turned hesitant to construct within the US for worry of being the goal by the SEC. Terrett criticized SEC chairman Gary Genler for concentrating brokers on crypto firms, whereas lacking giant points, similar to FTX, 3AC and Celsius, who actually triggered buyers harm.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024