Bitcoin

Oversold Bounce Targets $94K This Week

Credit : bitcoinmagazine.com

Bitcoin Bulls Stunned After Sellers Drop Worth to $80,000

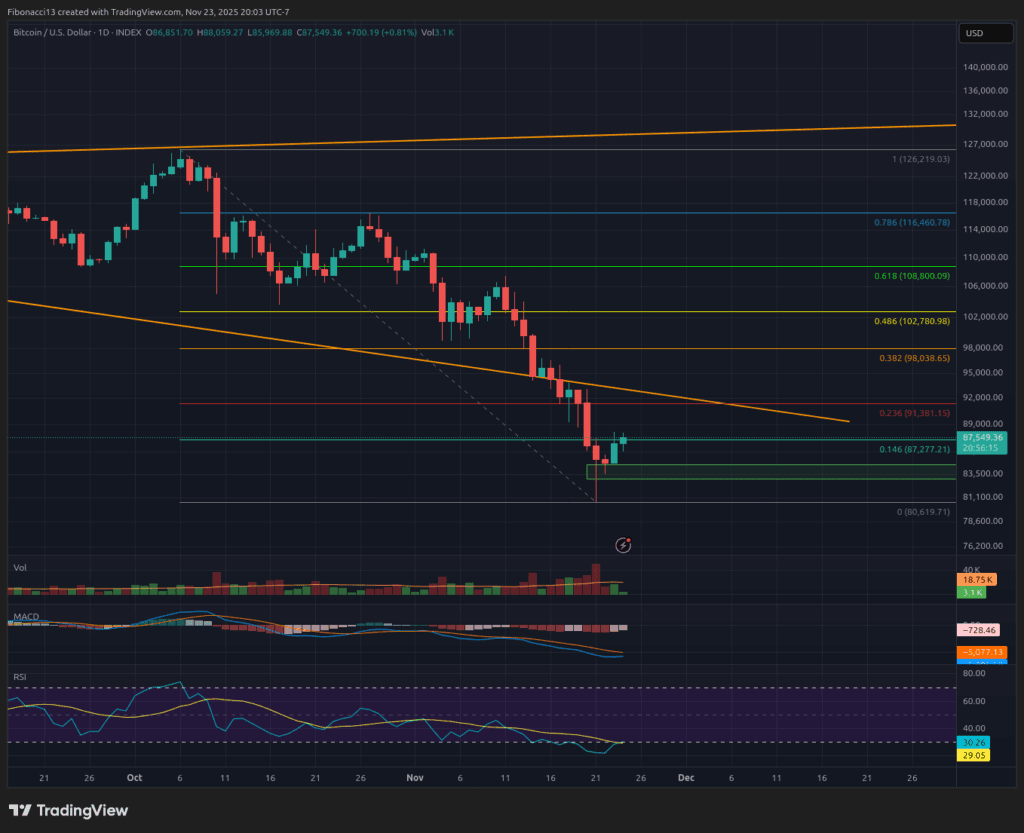

Final week we recognized the $84,000 space as the subsequent main help for bitcoin, and that’s precisely the place the worth headed. Bitcoin fell to virtually $80,000, however managed to climb again above the $84,000 help to finish the week at $86,850. This week, search for bears to take their foot off the accelerator a bit whereas comfortably controlling the worth motion. The day by day oscillators had been closely oversold final weekend, so a rebound is so as at the very least till Monday, presumably a bit additional out.

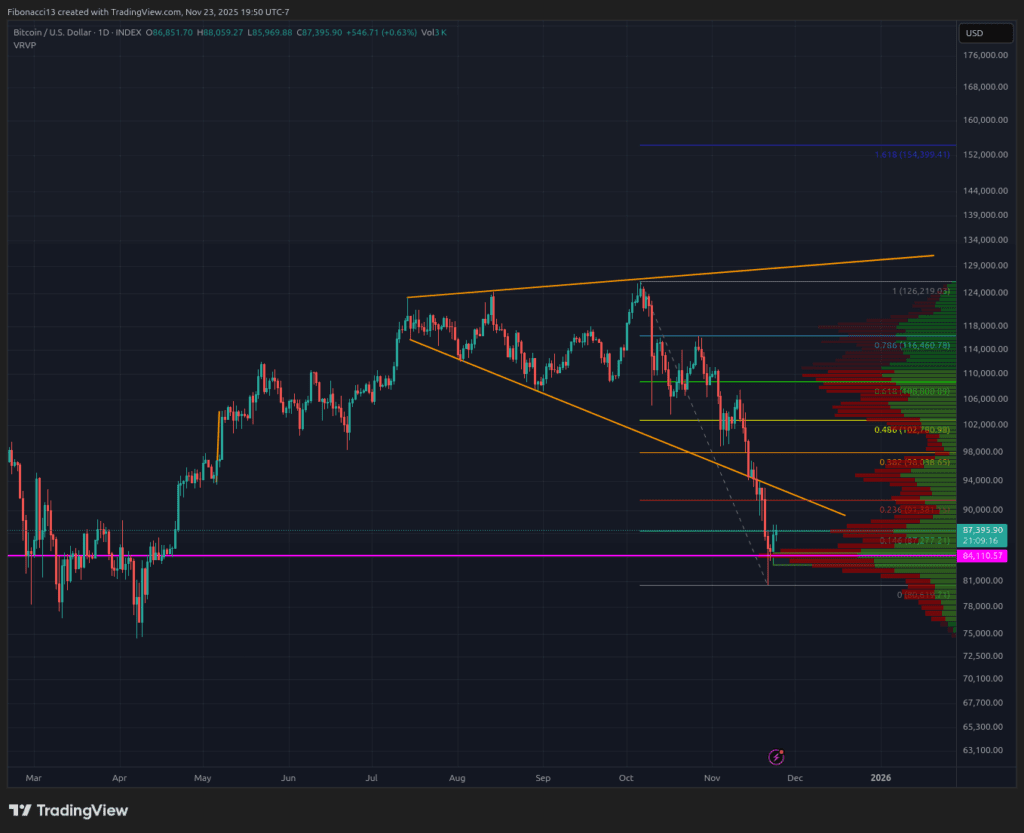

Main help and resistance ranges now

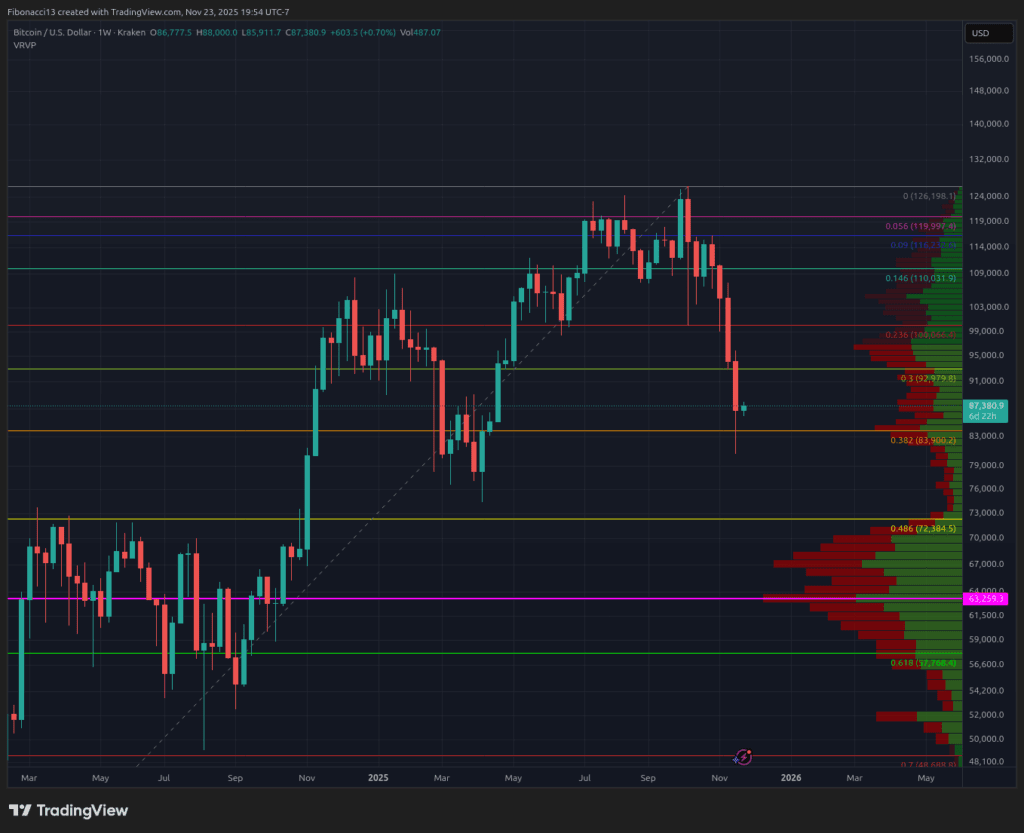

Help at $84,000 on the weekly shut, so that is the extent bulls wish to keep above by means of this week’s shut. If $84,000 is misplaced, the bulls are $75,000, which is unlikely to be too robust a help stage, and under that we have now a excessive quantity help zone between $72,000 and $69,000. It is laborious to see the worth dropping under $70,000 too shortly, so anticipate some rebounds from this space even when the worth would not in the end maintain. Beneath we have now the $58k gang help and 0.618 Fibonacci retracement at $57,700.

Resulting from final week’s worth evaluation, the resistance ranges have now modified heading into this week. Bulls will primarily look to beat the $91,400 resistance stage on the 0.236 Fibonacci retracement. Above this, we should always now see robust resistance at $94,000 on the excessive quantity junction. If worth manages to interrupt this zone, $98,000 lies above it as the ultimate barrier to ascertain this excessive quantity node as help. If this occurs, there are nonetheless resistance ranges at $103,000 and one other resistance stage at $109,000 on the 0.618 Fibonacci retracement. Lastly, $116,500 is left as the ultimate resistance layer stopping the worth from reaching new highs.

Outlook for this week

The day by day RSI reached a really oversold stage final Friday, so it’s not shocking that the worth moved from these lows into the weekend. This week, search for the worth to attempt to problem the $91,400 resistance stage and presumably $94,000 if it could climb above. So long as the worth can keep above $84,000, it ought to attempt to attain these goal ranges. With all of the promoting main as much as final Friday, one other main sell-off shouldn’t be anticipated, but when the low of $80,000 is misplaced, the worth might fall to $75,000 this week.

Market temper: Extraordinarily Bearish – The bulls lie on the canvas. Little hope stays for a significant rally or new highs after the lack of main help ranges.

The approaching weeks

The widening wedge sample we have been watching for therefore many weeks lastly and definitively broke down final week. The goal for this sample is round $70,000, so even when we see a rally this week and subsequent, the worth ought to ultimately reverse and head decrease to check $70,000. The US authorities, which returned to work final week, did nothing to assist the markets. Within the coming weeks, it could be troublesome to foretell when financial information will or won’t be obtainable, as a lot of it has been postponed because of the shutdown. The market is split over whether or not or not the Federal Reserve will minimize charges at its subsequent assembly, they usually themselves look like conflicted about balancing inflation issues and labor market points.

Terminology information:

Bulls/bullish: Consumers or traders who anticipate the worth to go greater.

Bears/Bearish: Sellers or traders who anticipate the worth to fall.

Help or help stage: A stage at which the asset needs to be priced, at the very least initially. The extra help that’s touched, the weaker it turns into and the extra possible it’s that the worth won’t maintain.

Resistance or resistance stage: Reverse help. The extent that the worth is more likely to reject, at the very least initially. The extra instances resistance is touched, the weaker the resistance turns into and the extra possible it’s that the worth will fail to cease.

Fibonacci Retracements and Expansions: Ratios primarily based on what is called the golden ratio, a common ratio referring to development and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).

Quantity profile: An indicator that reveals the full quantity of purchases and gross sales at particular worth ranges. The management level (or POC) is a horizontal line on this indicator that reveals us the worth stage at which the best variety of trades befell.

Excessive quantity node: An space within the worth the place rather a lot is purchased and bought. These are worth areas with numerous transactions and we anticipate them to behave as help when the worth is greater, and resistance when the worth is decrease.

RSI oscillator: The Relative Power Index is a momentum oscillator that strikes between 0 and 100. It measures the pace of worth and modifications within the pace of worth motion. When the RSI rises above 70, it’s stated to be overbought. When the RSI is under 30, it’s thought-about oversold.

Widening wedge: A chart sample consisting of an higher trendline that acts as resistance and a decrease trendline that acts as help. These pattern strains should differ from one another to validate the sample. This sample is a results of rising worth volatility, which generally leads to greater highs and decrease lows.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now