Blockchain

Palau, German lender WIBank launch blockchain bonds

Credit : cryptonews.net

Blockchain bonds have gotten more and more well-liked as an increasing number of monetary business gamers look to enhance effectivity and transparency within the $130 trillion sector. The most recent is the island nation of Palau, which has issued a blockchain bond to faucet native capital for infrastructure tasks.

In Germany, regional lender WIBank examined the waters with a €5 million ($5.4 million) blockchain bond as a part of the area’s DLT (Distributed Ledger Expertise) trials.

Palau makes use of blockchain financial savings bonds

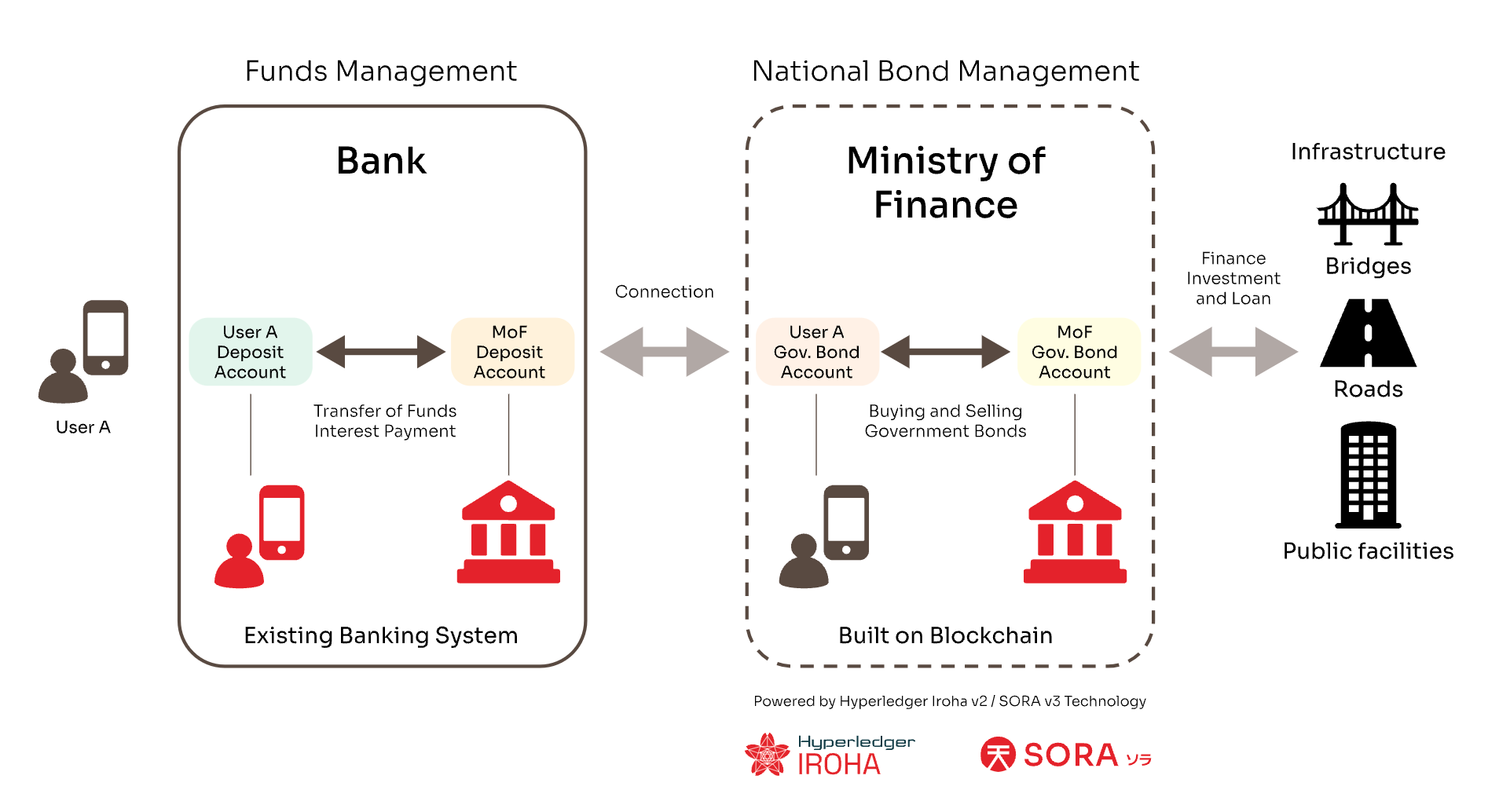

Palau is exploring blockchain financial savings bonds to lift capital for its infrastructure tasks. It has partnered with Soramitsu, a Tokyo, Japan-based blockchain providers firm, for this initiative. The Japanese Ministry of Financial system, Commerce and Business (METI) additionally participated.

Palau is an island nation within the western Pacific Ocean. It consists of 500 small islands and has roughly 20,000 inhabitants. Tourism is the principle business. Palau’s financial system is intently intertwined with the US, with the Financial institution of Hawaii being one of the vital well-liked banks on the island. This inevitably results in the channeling of capital from locals by way of financial institution deposits to the US and different nations in Micronesia.

The Palau authorities desires to faucet this market and cut back capital outflows with the brand new blockchain financial savings bonds, known as Palau Make investments.

“The financial savings bond initiative permits us to finance essential tasks resembling housing, small and medium enterprise improvement and infrastructure with home capital,” mentioned President Surangel Whipps Jr.

“By investing in these areas, we are going to stimulate job creation, broaden enterprise alternatives and promote a vibrant financial system.”

The undertaking begins with a prototype of a financial savings bond, which can introduce native buyers to the system and the way it works. Neither Soramitsu nor the Palauan authorities have revealed how lengthy this course of will take earlier than they absolutely subject the bonds. However as soon as they launch, buyers should purchase them via an app on their telephone.

The bond might be issued on a Hyperledger Iroha 2-based permissioned blockchain community developed by Soramitsu. The corporate has in depth expertise in creating blockchain functions for governments. It has been working with the Central Financial institution of Cambodia for years, culminating within the launch of Bakong, a blockchain-based fee system, in 2020. Additionally it is engaged on the same undertaking with the Central Financial institution of Laos and on the central financial institution’s digital foreign money financial institution (CBDC). feasibility research with the Philippines, Papua New Guinea and Vietnam.

Germany’s WIBank points a €5 million blockchain bond

In Germany, regional improvement financial institution Wirtschafts und Infrastrukturbank Hessen (WIBank) has issued a €5 million bond on a public blockchain.

WIBank is a subsidiary of Landesbank Hessen-Thuringia, popularly referred to as Helaba, a regional financial institution that serves virtually half of all German financial savings banks as a central clearing home.

The bond was settled utilizing Set off, a system developed by the German central financial institution to allow the settlement of DLT-based securities transactions with central financial institution cash. Set off connects the blockchain containing the tokenized property (on this case the Ethereum Layer-2 community Polygon) to the standard fee infrastructure, identified in Germany as TARGET2, for atomic transactions. Set off enjoys the advantages of DLT expertise with out the danger of digital foreign money.

The atomicity of the method, achieved via supply versus fee transactions, eliminates counterparty danger. As a result of the transaction depends on central financial institution cash as a substitute of digital property, credit score danger can be decreased.

Helaba, WIBank’s mum or dad firm, acted as money settlement agent, whereas Bankhaus Metzler, Germany’s second oldest financial institution, was the only investor. Deloitte and the Munich legislation agency Annerton have been additionally concerned. Cashlink, a pacesetter in asset tokenization in Germany, tokenized and settled the bond on the general public blockchain.

Christian Forma, Head of Finance at WIBank, believes that the expertise gained by the lender “opens up new alternatives for the additional improvement of current monetary merchandise together with modern applied sciences. This minimizes dangers and optimizes processes for each us and our buyers.”

WIBank joins different German banks exploring blockchain bonds to extend effectivity and enhance transparency. Final month, Frankfurt-based KfW, the world’s largest nationwide improvement financial institution, issued a €50 million ($54.6 million) bond settled by way of the Set off answer. This adopted a €100 million ($109.3 million) blockchain bond issued in August.

However whereas these bonds have gotten more and more well-liked, they’re nonetheless a distinct segment market restricted to a couple contributors. The €100 million ($109.3 million) bond, for instance, attracted simply six buyers, all purchasers of bookrunner DZ Financial institution.

In some jurisdictions, bond issuers are integrating their blockchain merchandise with typical channels to make bonds out there to a bigger investor base. For instance, in Hong Kong, HSBC (NASDAQ: HSBC) just lately built-in the HKMA’s Central Moneymarkets Unit (CMU) in issuing a HK$1 billion ($130 million) digital bond on its Orion blockchain platform.

Watch: Liquid Noble democratizes valuable metals investing

title=”YouTube video participant” frameborder=”0″ enable=”accelerometer; autoplay; clipboard-write; encrypted media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross- origin ” allowfullscreen=””>

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now