Altcoin

PancakeSwap: Assessing whether CAKE buyers have the firepower to move up

Credit : ambcrypto.com

- CAKE was at a important juncture, with the present sample performing as a barrier to additional good points.

- A profitable break above these ranges might reaffirm a bullish pattern, whereas a failure might expose CAKE to additional draw back dangers.

PancakeSwap [CAKE] has been on a gentle upward pattern over the previous two months, after hitting a 10-month low in August.

The current bullish momentum helped the coin climb increased, however can consumers reap the benefits of this momentum to beat key resistances?

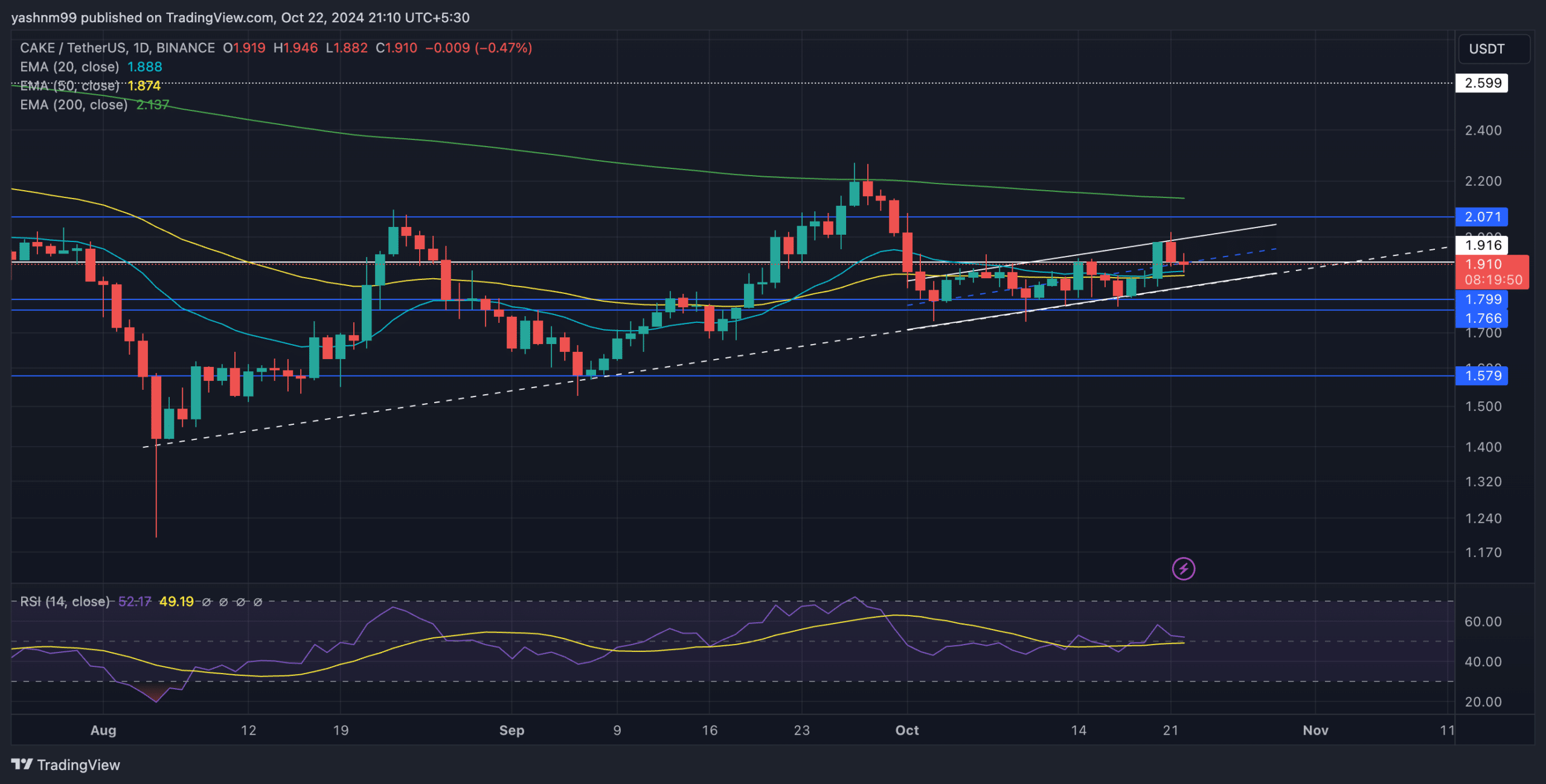

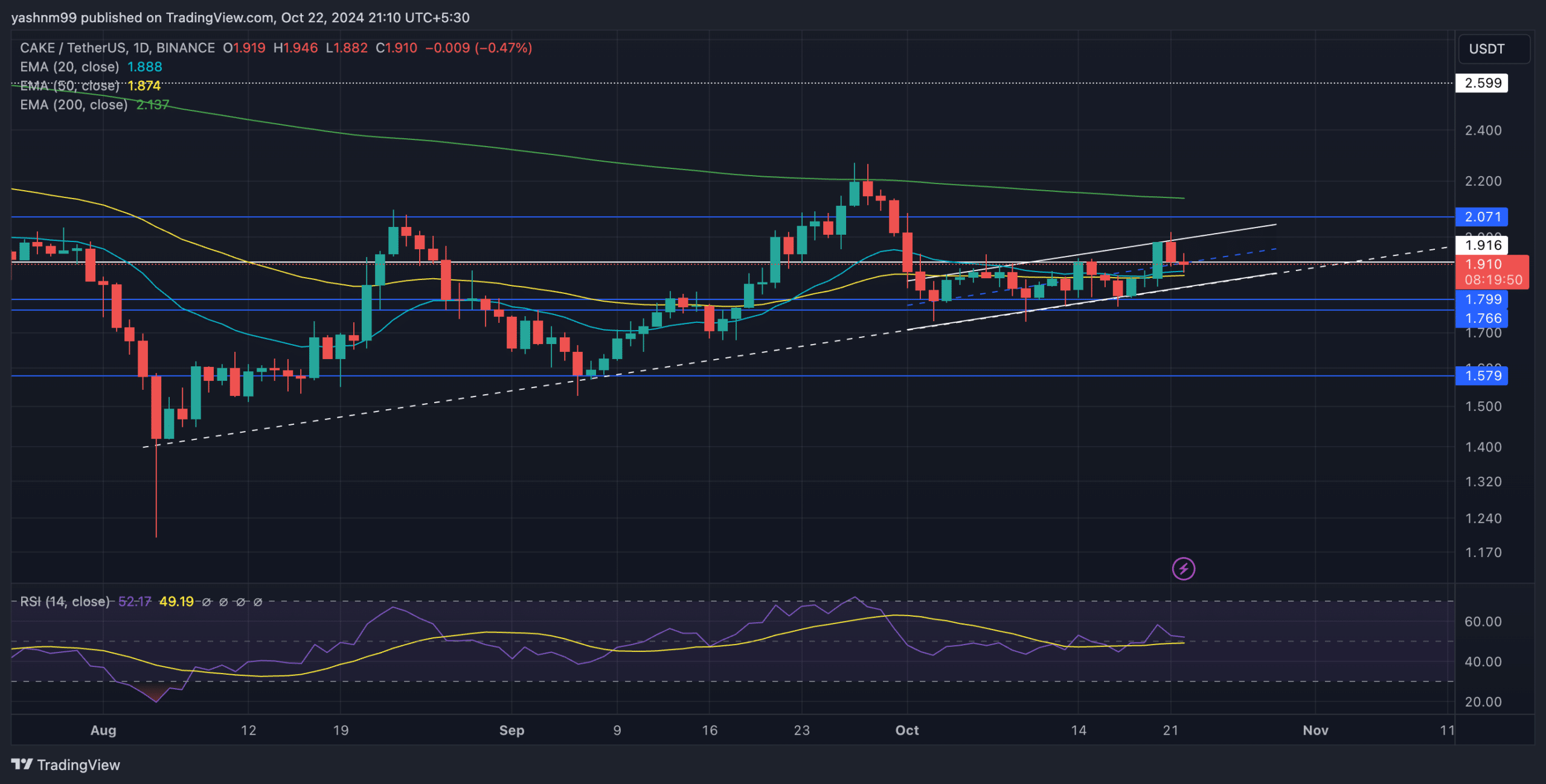

Latest Worth Motion and EMA Overview

Supply: TradingView, CAKE/USDT

CAKE’s value motion has been rising over the previous two months, forming trendline assist that has saved the coin’s momentum intact.

Regardless of this regular uptrend, CAKE has struggled to surpass the 200-day EMA, at present at $2,137.

On the time of writing, CAKE was buying and selling at $1.9, simply above the 20-day EMA at $1.887 and the 50-day EMA at $1.873. These EMAs have been fast assist ranges, with value hovering alongside their boundaries.

The present upchannel on the day by day chart resembled a traditional bearish flag construction, doubtlessly exposing CAKE to additional losses if the value fails to carry above the trendline assist.

Any breakdown beneath the parallel strains and the $1.7 assist might push the coin in direction of the $1.5 area.

Ought to the market witness a sudden spike within the bullish edge, a decisive shut above the present sample might enable CAKE to check increased ranges.

The Relative Energy Index (RSI) was round 50, indicating impartial market sentiment with comparatively equal shopping for and promoting stress. A decisive transfer beneath 50 might point out a renewed bearish angle.

The $1.7 degree was a vital assist aligned with the decrease restrict of the upward channel. A break beneath this degree might expose CAKE to additional losses.

A break above the present sample might enable the coin to retest the resistance at $2,071 and finally problem the 200-day EMA at $2,137.

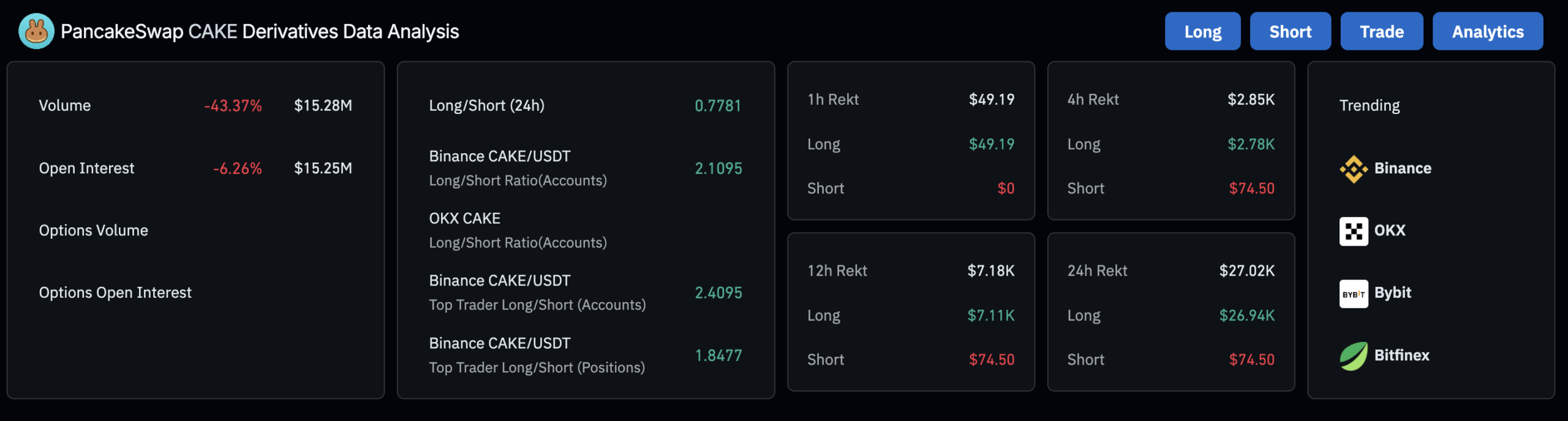

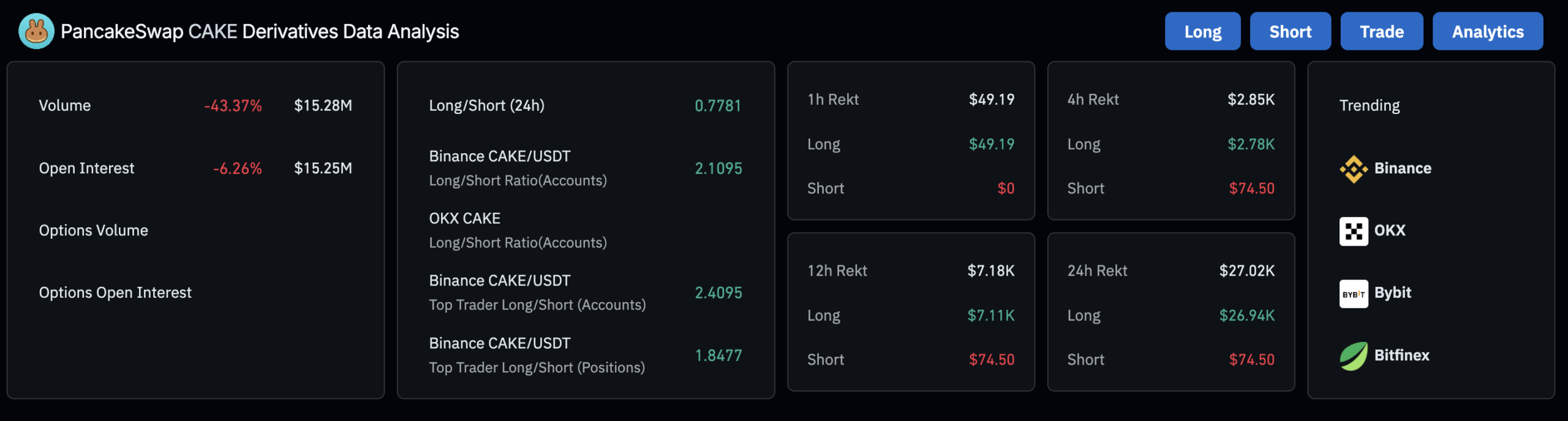

CAKE’s derivatives knowledge and market sentiment

Supply: Coinglass

Derivatives knowledge indicated cautious sentiment amongst merchants. Open Curiosity fell 6.26% to $15.25 million, whereas buying and selling quantity fell 43.37% to $15.28 million, reflecting diminished buying and selling exercise following current volatility.

Apparently, Binance’s Lengthy/Quick ratio for CAKE/USDT was 2.1095, displaying a slight bullish bias amongst merchants.

OKX’s Lengthy/Quick ratio additionally stood at 2.4095, indicating that merchants on these platforms have been optimistic concerning the coin’s short-term prospects.

Learn PannenkoekSwap [CAKE] Worth forecast 2023-24

Prime merchants on Binance have maintained a comparatively bullish place, with a protracted/brief ratio of 1.8477, indicating that main merchants are positioning themselves for a possible upward transfer.

Nonetheless, merchants ought to regulate broader market sentiment as Bitcoin’s value motion might affect CAKE’s trajectory.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024