Bitcoin

Parabolic Bitcoin Rally Is Coming—Here’s What To Watch

Credit : bitcoinmagazine.com

One of many dominant tales that this cycle has been that “this time is totally different.” With institutional adoption that reforms the provision and provide dynamics of Bitcoin, many declare that we are going to see the form of euphoric bladder that outlined earlier cycles. As a substitute, the concept is that good cash and ETFs will clean out volatility, which replaces mania with maturity. However is that actually the case?

Sentiment drives markets even for establishments

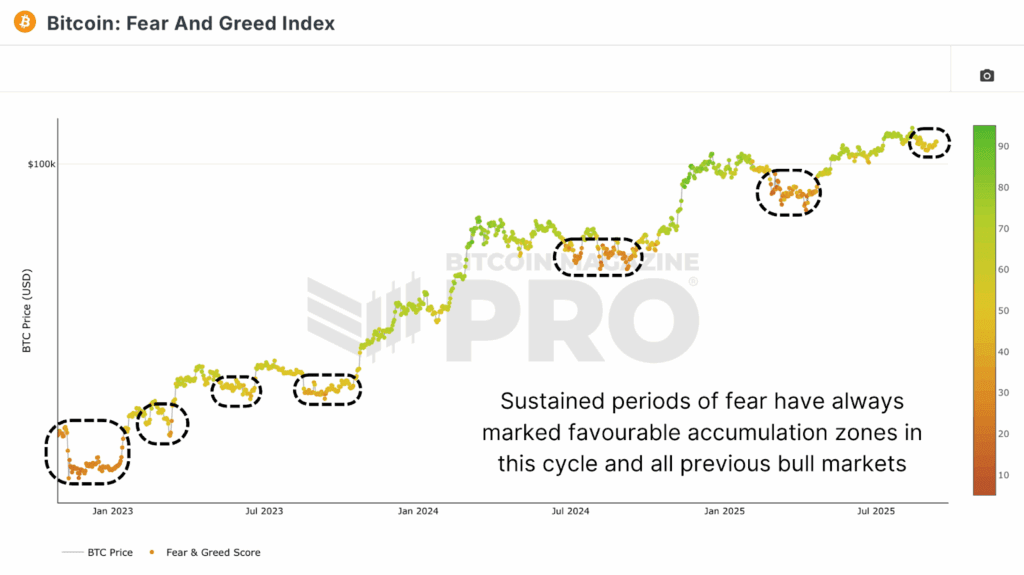

Skeptics typically reject instruments such because the Anxiety and greed index If too simplistic, claiming that they can’t catch the nuance of institutional flows. However closing sentiment ignores a elementary fact that establishments are nonetheless run by folks, and folks stay inclined to the identical cognitive and emotional prejudices that stimulate market cycles, no matter how deep their pockets are!

Though the volatility is crammed in in comparison with earlier cycles, the relocation of $ 15,000 to greater than $ 120,000 is way from Underwhelming. And essential is that Bitcoin has achieved this with out the form of deep, intensive drawings marked previous bullmarkets. The buildup of the ETF tree and the treasury has shifted the dynamics of supply lighting, however the fundamental suggestions loop of greed and hypothesis stays intact.

Market bubbles are a timeless actuality

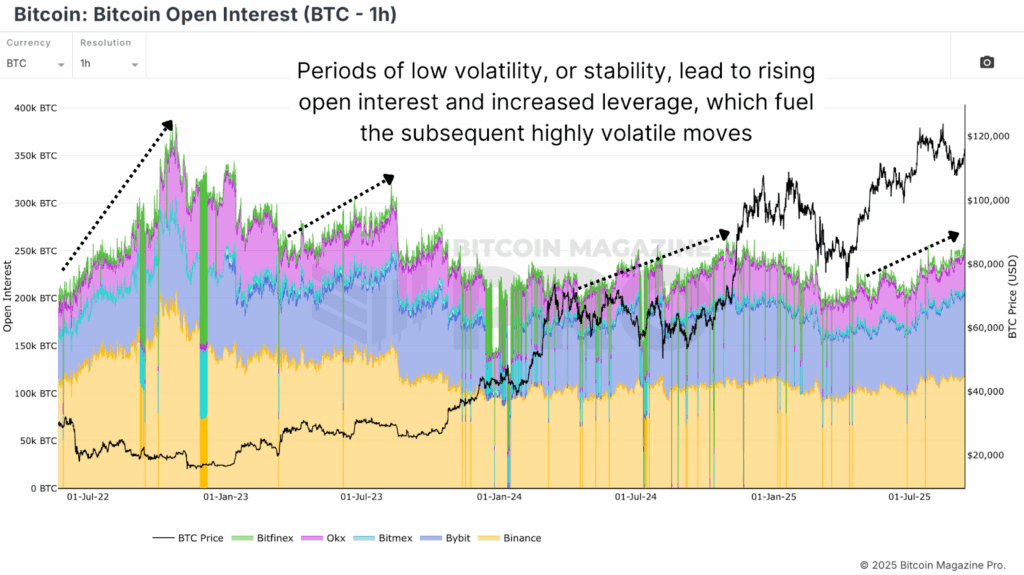

It’s not solely Bitcoin that’s inclined to parabolic runs, bubbles have been a part of markets for hundreds of years. The asset costs have repeatedly elevated additional than the essential rules, fed by human conduct. Research constantly present that stability itself typically causes instability, and that silent intervals are encouraging leverage, hypothesis and finally destroyed worth motion. Bitcoin has adopted the identical rhythm. Intervals of low volatility see Open interest Climbing, lever construction and speculative bets are rising.

In distinction to the conviction that “superior” traders are immune, analysis by the London College of Economics suggests the other. Skilled capital can speed up bubbles by stacking, chasing, searching Momentum and strengthening actions. The housing disaster of 2008 and the DOT-Com-Buste weren’t despatched within the retail commerce, however led by establishments.

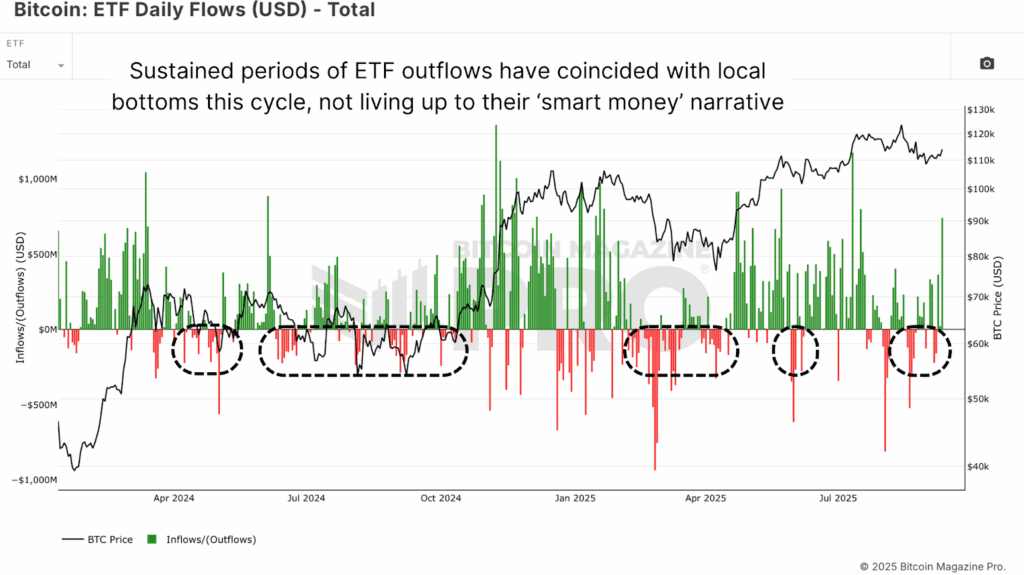

ETF flows This cycle nonetheless affords a strong instance. Intervals of Netto outflows of spot ETFs really coincided with native market bases. As a substitute of completely timing the cycle, these flows reveal that ‘good cash’ is simply as delicate to herd conduct and development after funding as retail merchants.

Capital flows can ignite the subsequent soar from Bitcoin

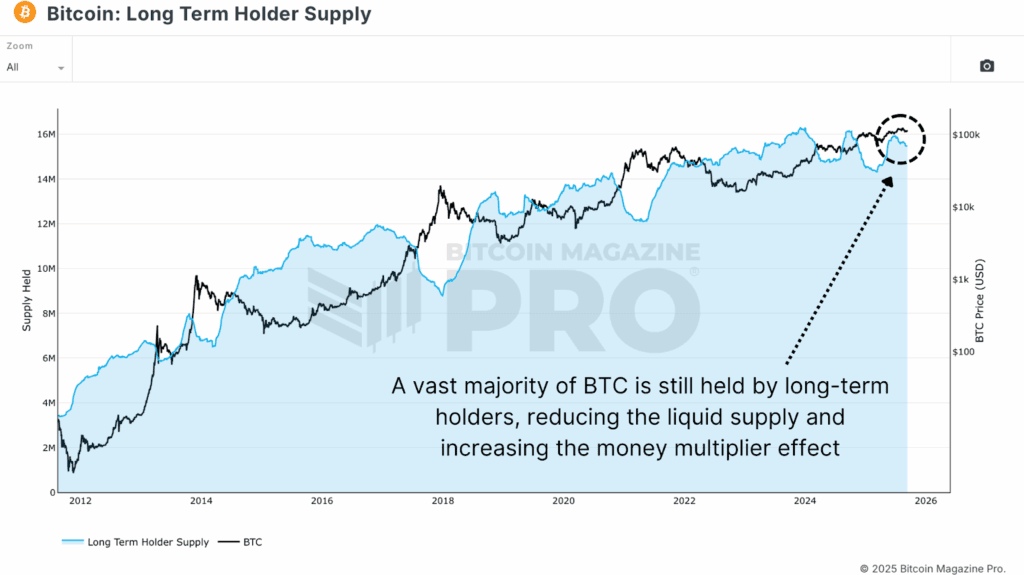

In the meantime, take a look at international markets to see how capital rotation might ignite one other parabolical leg. Since January 2024, the market capitalization of Gold has risen by greater than $ 10 trillion, from $ 14 T to $ 24T. For Bitcoin, with a present market capitalization of roughly $ 2T, even a fraction of that sort of influx can have a serious impact because of the cash extra. Of About 77% of the BTC in the hands of long -term holdersSolely roughly 20-25% of the vary is straightforward to fluid, leading to a conservative cash extra 4x. Which means a brand new influx of $ 500 billion, solely 5% of Gold’s current enlargement, might translate into a rise of $ 2 trillion out there capitalization of Bitcoin, which suggests costs for greater than $ 220,000.

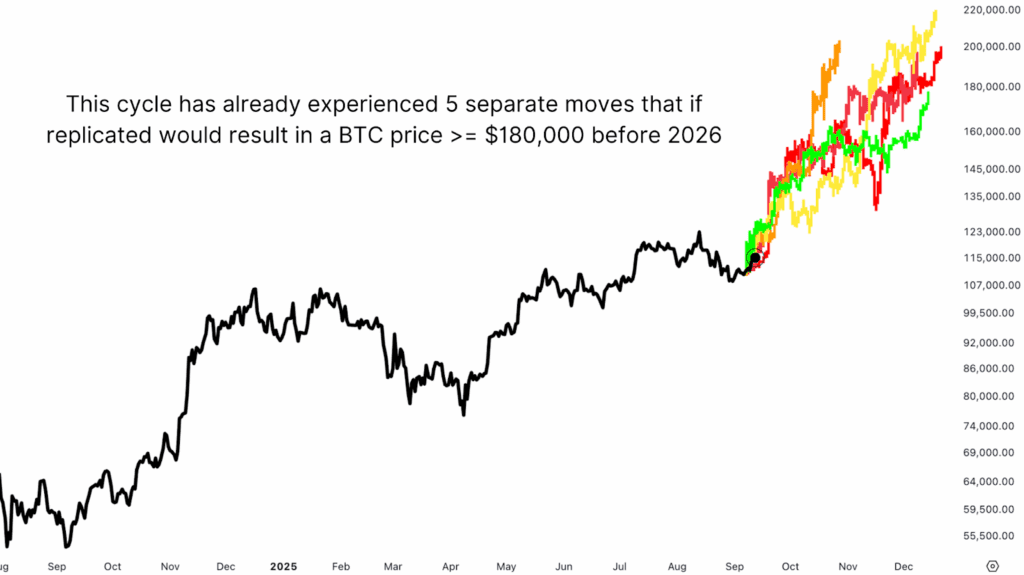

Maybe the strongest case for a blowoff is that now we have already seen parabolic rallies inside this cycle. For the reason that backside of 2022, Bitcoin has had a number of 60-100%+ in lower than 100 days. Overlapping that fractals on the present worth promotion affords reasonable contours of how the value might attain $ 180,000 $ 220,000 earlier than the top of the 12 months.

The parabolic potential of Bitcoin stays unchanged

The story that has eradicated institutional adoption underestimates parabolic blowoff tops each the construction of Bitcoin and human psychology. Bubbles aren’t an accident with hypothesis within the retail commerce; They’re a recurring attribute of markets in historical past, typically accelerated by superior capital.

This doesn’t imply certainty, markets by no means work that method. However rejecting the opportunity of a parabolic prime ignores centuries of market conduct and the distinctive mechanics that make Bitcoin one of the reflexive property in historical past. If there’s something, “this time is totally different” can solely imply that the rally might be bigger, sooner and dramatic than most anticipate.

Go to deeper information, graphs {and professional} insights in Bitcoin -Perrends Bitcoinmagazinepro.com.

Subscribe to Bitcoin Magazine Pro on YouTube For extra knowledgeable market insights and evaluation!

Disclaimer: This text is just for informative functions and shouldn’t be thought-about as monetary recommendation. All the time do your personal analysis earlier than you make funding selections.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now