Analysis

PENDLE Aims For 25% Rally, Despite Arthur Hayes $1.26M Sell-off

Credit : coinpedia.org

Following a sell-off of 350,010 Pendle (PENDLE) tokens value $1.26 million on Binance and Bybit, a publish from former BitMEX CEO and co-founder Arthur Hayes on X (previously Twitter) gained widespread consideration. On September 21, 2024, Hayes reported that Maelstrom (Hayes household workplace fund) had lowered its PENDLE stake. Regardless of the symbolic discount, PENDLE stays one in all their largest holdings.

Arthur Hayes PENDLE Holding

In response to the info of the on-chain analytics firm SpotonchainArthur Hayes at present owns a whopping 1.66 million PENDLE tokens, value $5.93 million. In his publish, Hayes additionally emphasised that they nonetheless absolutely imagine in PENDLE turning into a pacesetter within the crypto rate of interest derivatives house.

Furthermore, he added: “We lowered our place to finance a particular scenario. These keeping track of our wallets will get a glimpse of what that’s within the very close to future.”

Present value momentum

At the moment buying and selling round $3.53, PENDLE has skilled a value drop of over 2% within the final 24 hours. Nonetheless, curiosity from merchants and buyers within the tokens seems to have dropped considerably, resulting in a drop in buying and selling quantity of greater than 45% over the identical interval.

PENDLE Technical Evaluation and Upcoming Ranges

In response to knowledgeable technical evaluation, PENDLE is poised to interrupt the sturdy resistance stage at $3.70 and the 200 Exponential Transferring Common (EMA) on a every day timeframe. If it crosses this 200 EMA and closes a candle above the $3.70 stage, there’s a excessive probability that it may rise 25% to succeed in the $4.80 stage within the coming days.

Nonetheless, this bullish assertion solely holds true if PENDLE closes a every day candle above the $3.70 stage, in any other case it may fail.

Bullish statistics within the chain

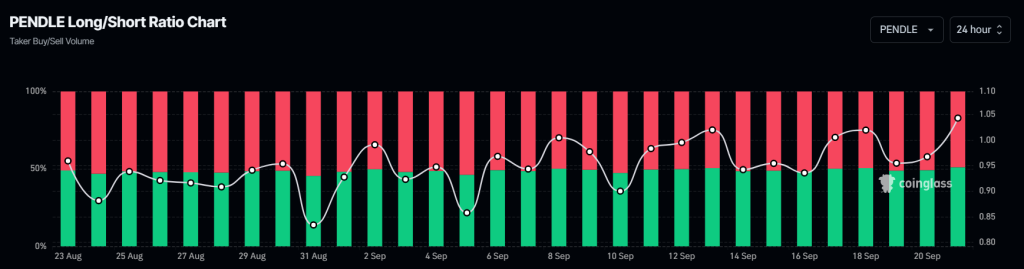

Along with this bullish technical evaluation, PENDLE’s on-chain metric additional helps its constructive outlook. Coinglass’ PENDLE lengthy/brief ratio at present stands at 1.042, the best since August 20, 2024 (a studying above 1 signifies bullish market sentiment amongst merchants). Moreover, future open curiosity has risen 4.5% during the last 24 hours and three.5% during the last 4 hours, indicating a build-up of extra lengthy positions.

Merchants and buyers typically reap the benefits of the mixture of rising open curiosity and lengthy/brief ratios above 1 as they construct lengthy positions. At the moment, 51.01% of prime merchants and buyers have lengthy positions, whereas 48.99% have brief positions.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024