Altcoin

Pepe Whale offloads 150b tokens: what this means for the price

Credit : ambcrypto.com

- On the final day, Pepe fell by 6.5% because the bearish sentiments began.

- A Pepe Whale has bought 150 billion tokens price $ 1.14 million.

The final day, Pepe [PEPE] Has been the final sufferer of the reinforcing damaging sentiments on the cryptom markets. Because of the present situations, whales turned to sale.

In keeping with Lookonchain, A Pepe walvis has made an enormous deposit to trade.

In keeping with the report, this whale has bought 150 billion Pepe tokens price $ 1.14 million. The whale had solely spent $ 2,184 to purchase 1.5 trillion tokens for $ 43 million within the early levels.

To date the whale has bought 1.02 trillion tokens price $ 6.6 million.

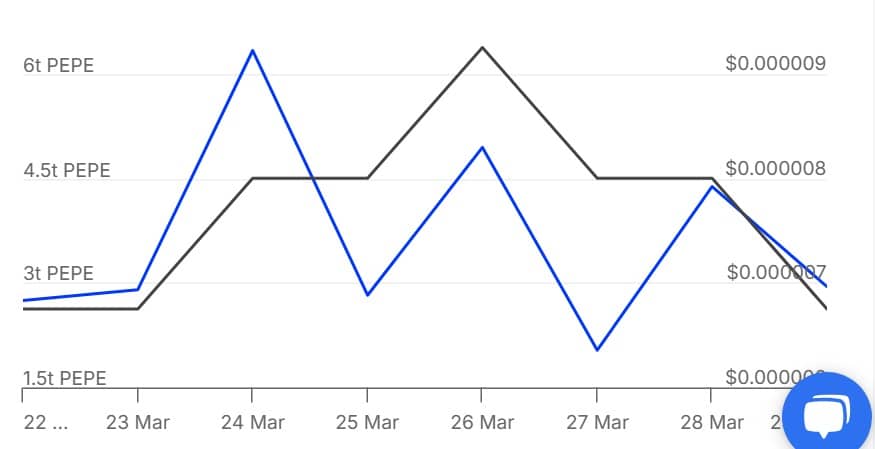

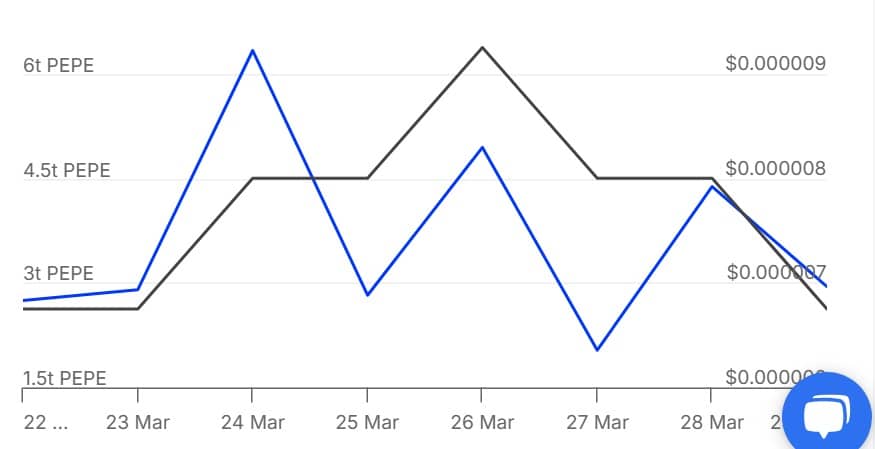

Supply: Intotheblock

Along with these transactions, whales bought greater than 2.95 trillion Pepe -Tokens prior to now day, in line with Intotheblock.

Though this can be a lower in 4 trillion, the gross sales exercise of huge holders was nonetheless significantly excessive.

When whales flip to the sale of an energetic one, this reveals an absence of market confidence, which displays sturdy areas. This transaction can additional dampen the damaging notion of the memecoin.

Affect on value playing cards

As anticipated, such a powerful gross sales facet has negatively influenced the worth diagrams of the memecoin. In truth, Pepe truly acted at $ 0.00000719. This meant a lower of 6.5% on each day graphs.

Equally, the memecoin has fallen on weekly and month-to-month graphs, with 1.2% and three.87% respectively.

The fixed dip has left holders of lengthy place with loss. As such, a dealer who went on Pepe with 10x leverage is now greater than $ 3.36 million, in line with Lookonchain.

Will the Memecoin see extra losses?

Supply: TradingView

In keeping with the evaluation of Ambcrypto, Pepe skilled sturdy bearish sentiments whereas sellers dominated the market.

This turned clear by the RSI, which made a bearish crossover final day. A Bearish Crossover suggests that there’s aggressive gross sales for all market contributors, in order that patrons are moved.

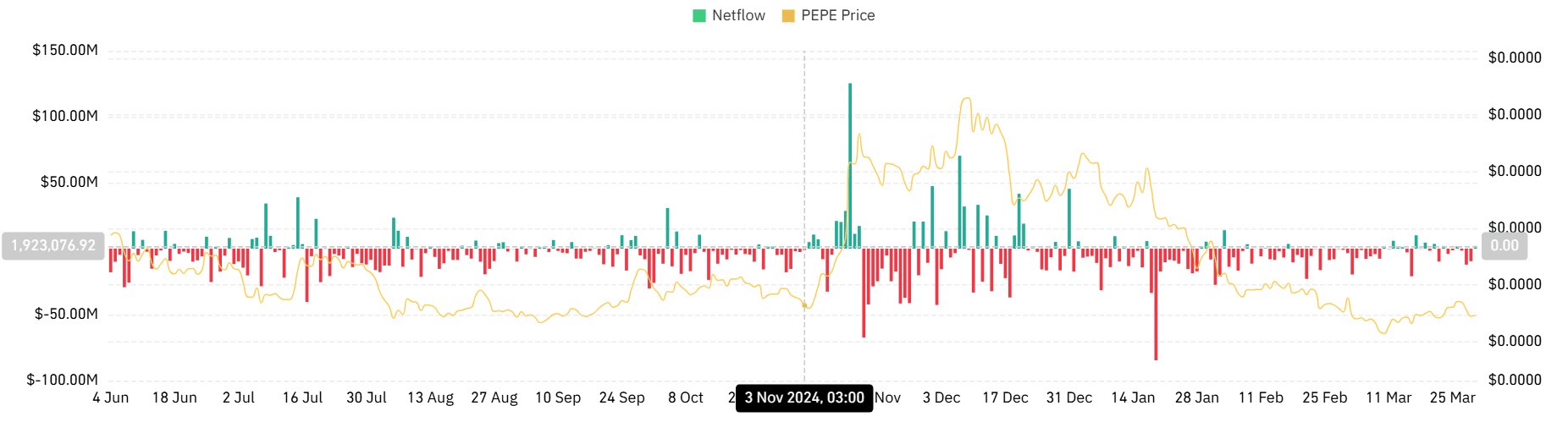

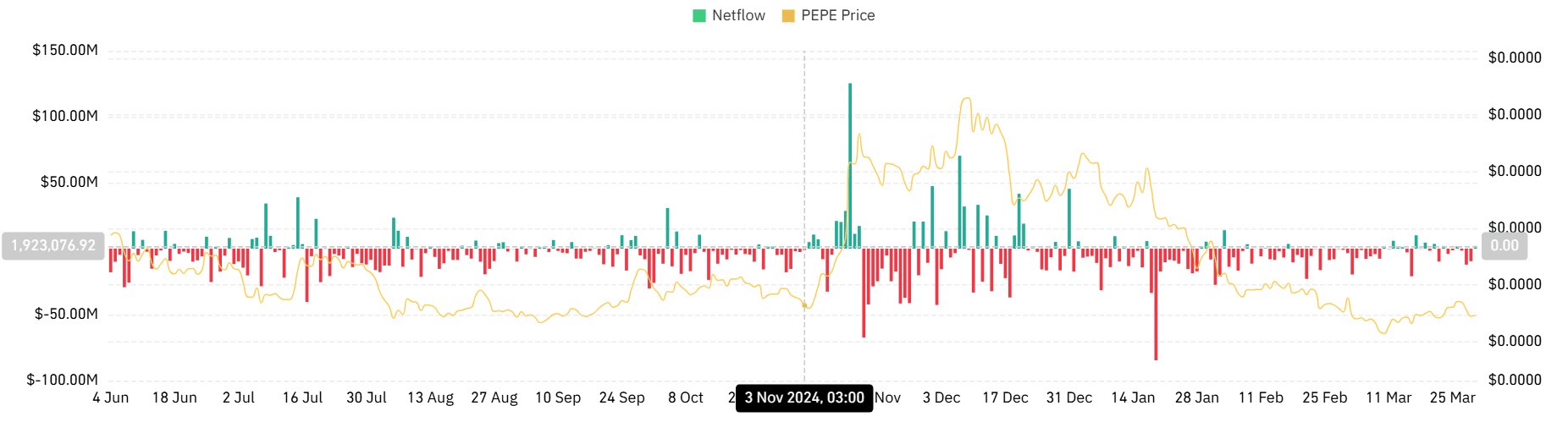

Supply: Coinglass

This gross sales strain is additional confirmed by a optimistic place Netflow. In keeping with Coinglass information, Pepe’s Netflow has turn out to be optimistic and has hit $ 1.87 million for the primary time in 4 days.

This shift means that there’s extra trade charge influx than outskirts, which is a mirrored image of sturdy bearish sentiments.

In conclusion, Pepe experiences sturdy bearish -by -the -season whereas traders shut their positions. That’s the reason, with whales and retailers, it displays an absence of belief amongst all market contributors.

When these two mix, the memecoin will most likely see extra losses on its value charts. Thus the lengthy -term gross sales exercise might see the memecoin fall under $ 0.0000070 to $ 0.0000069.

A reversal right here, with patrons who re -introduce the market, will reclaim the Memecoin $ 0.0000073.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September