Altcoin

Polka dot [DOT] traders can use THIS strategy to navigate DOT’s downturn

Credit : ambcrypto.com

- Polkadot continued its long-term downward development, hovering round its multi-year lows

- For DOT to regain a bullish outlook, it should discover a decisive shut above the 20-day and 50-day EMAs

from Polkadot [DOT] current value actions confirmed a steep bearish development. The altcoin approached its long-term help degree and returned to 2020 ranges.

DOT was buying and selling round $3.85 on the time of writing, up virtually 2% up to now 24 hours. Nonetheless, the general development remained bearish. Given continued promoting strain, can patrons discover the momentum to reclaim key resistance ranges?

DOT’s battle is approaching a serious degree of help

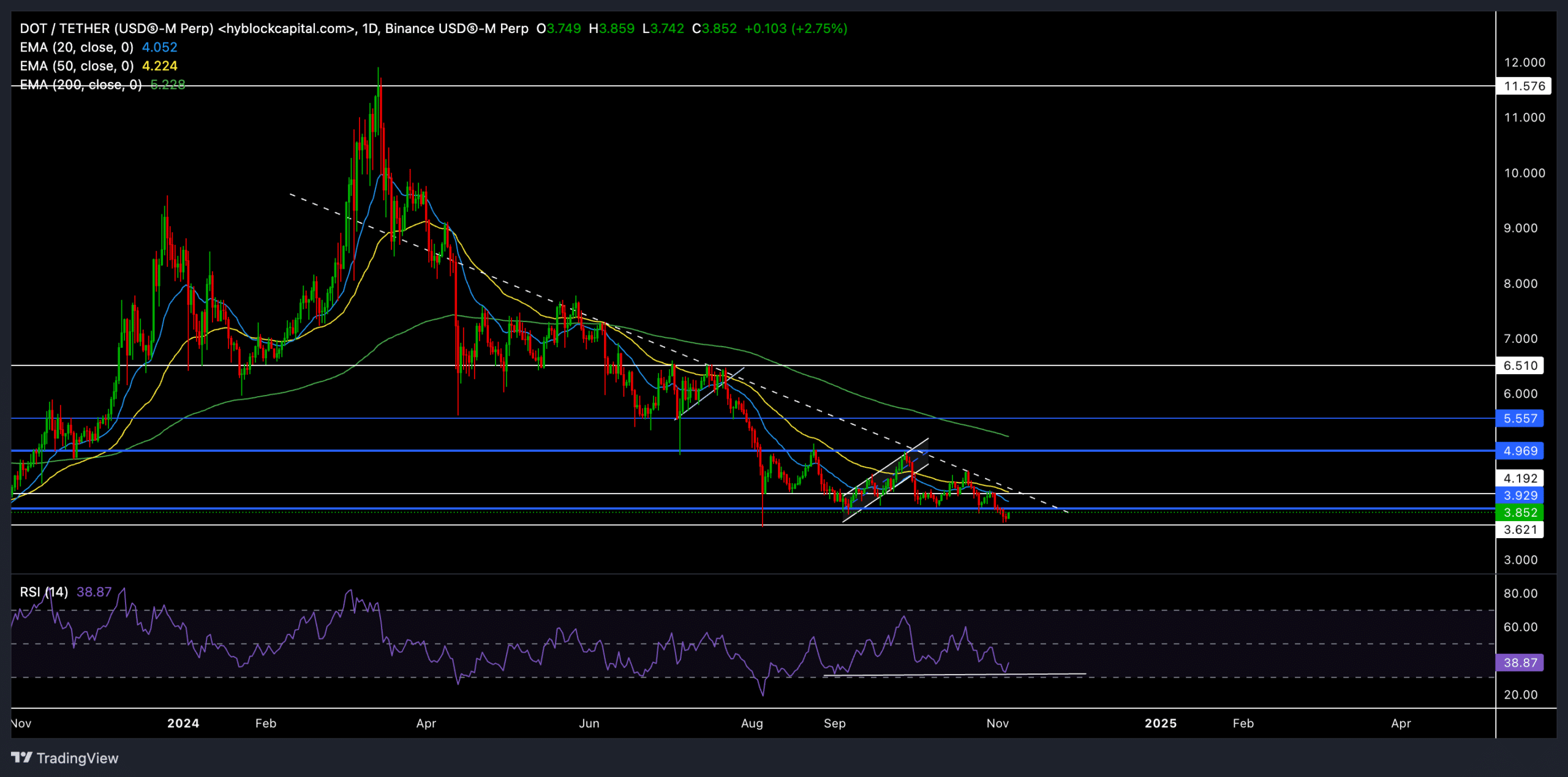

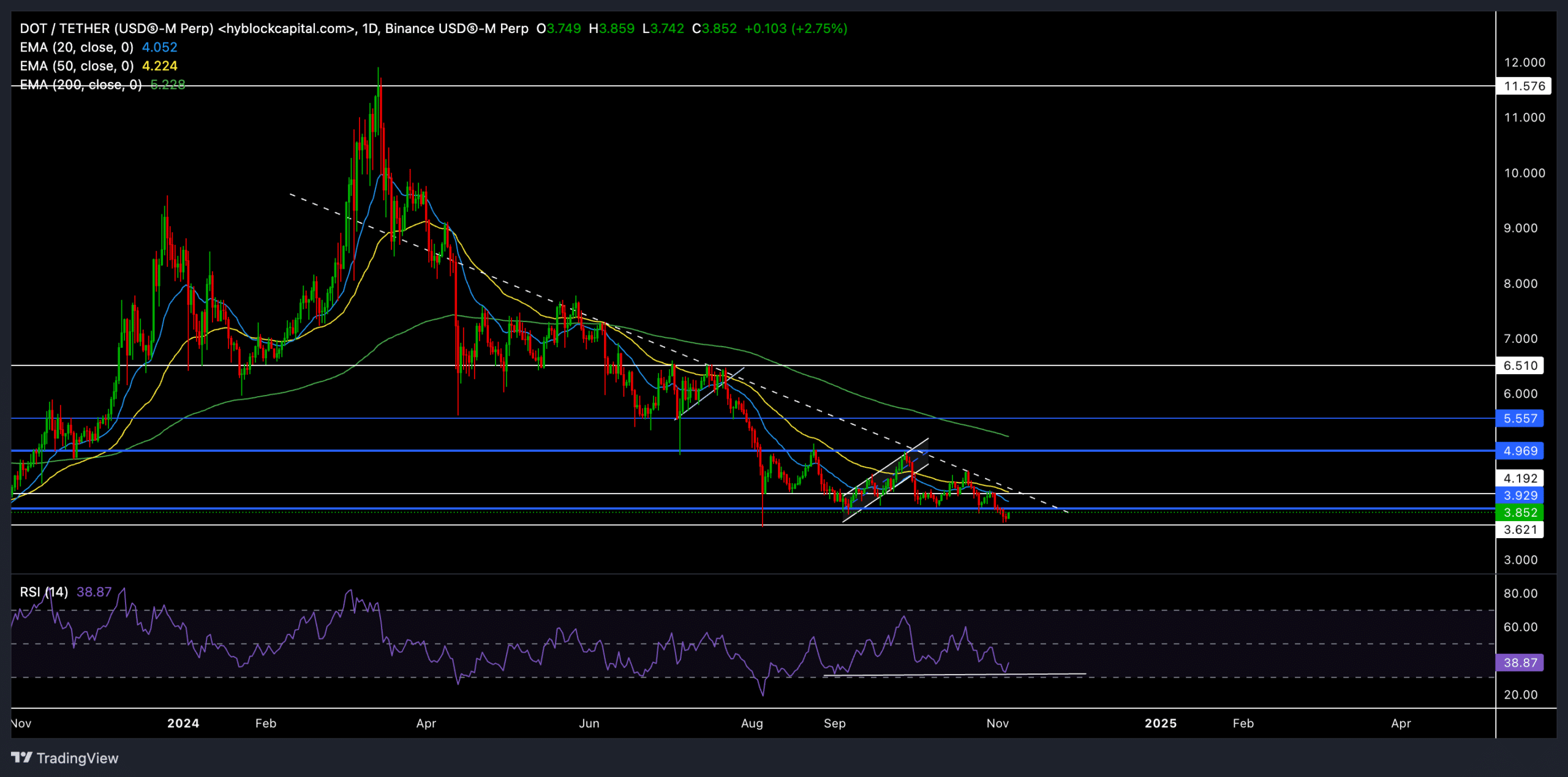

Supply: TradingView, DOT/USDT

DOT has fallen steeply in current months, constantly failing to interrupt above the $4.9 resistance degree. On the time of writing, the altcoin was buying and selling nicely beneath the 20-day EMA ($4.05), 50-day EMA ($4.22), and 200-day EMA ($5.23).

The repeated rejections of those transferring averages and the shortcoming to interrupt the 6-month trendline resistance (white, dotted) have intensified the promoting strain. DOT’s current decline beneath the $3.9 help degree (now resistance) introduced it nearer to the multi-year low of round $3.6 – a vital degree to control.

DOT’s value actions indicated excessive volatility within the close to future. If the altcoin can collect sufficient bullish momentum to leap again above the $3.9 resistance degree, it might check the 20/50-day EMAs. Regaining these EMAs is essential for patrons to realize a near-term benefit and will doubtlessly open the best way to check increased resistance at $4.9.

Nonetheless, the bearish outlook remained robust as a result of general downward development. A decline beneath the important thing help at $3.6 might speed up the decline and push DOT to discover new lows.

Furthermore, on the time of writing, the RSI was studying 40. Right here it’s price noting that the current increased lows of the RSI indicated a bullish divergence with the decrease lows of the worth motion.

Essential ranges to look at

Assist: The speedy help degree was discovered at $3.6 – a multi-year low that’s psychologically essential. If this degree turns into decrease, it might result in an additional decline.

Resistance: The primary resistance degree to look at was $3.9, adopted by the 20-day EMA of $4.05 and the 50-day EMA of $4.22. A decisive transfer above these ranges might give DOT patrons an opportunity to regain some market management.

Derivatives information revealed THIS

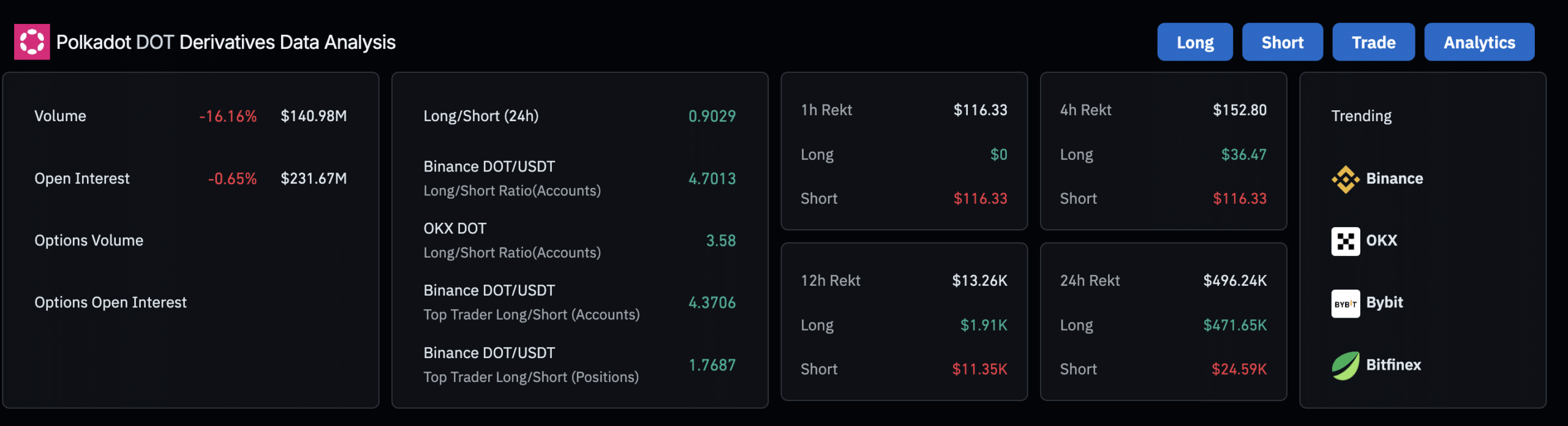

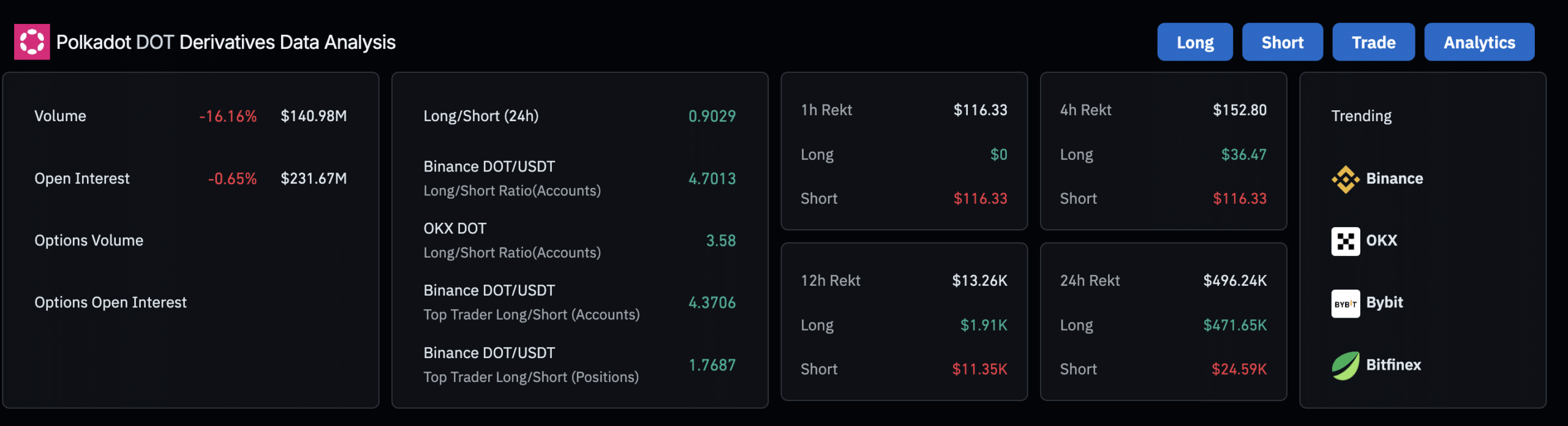

Supply: Coinglass

Derivatives information confirmed combined emotions amongst DOT merchants. The 24-hour lengthy/quick ratio was 0.9029, which is barely in favor of quick positions and signifies some warning amongst merchants. Nonetheless, Binance and OKX’s lengthy/quick ratios had been considerably bullish, with Binance at 4.7013 and OKX at 3.58 – an indication that merchants on these platforms could also be hopeful of a restoration.

Merchants ought to preserve an in depth eye on broader market developments, particularly Bitcoin’s actions.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024