Altcoin

Polkadot: Reasons why DOT can break THIS resistance level

Credit : ambcrypto.com

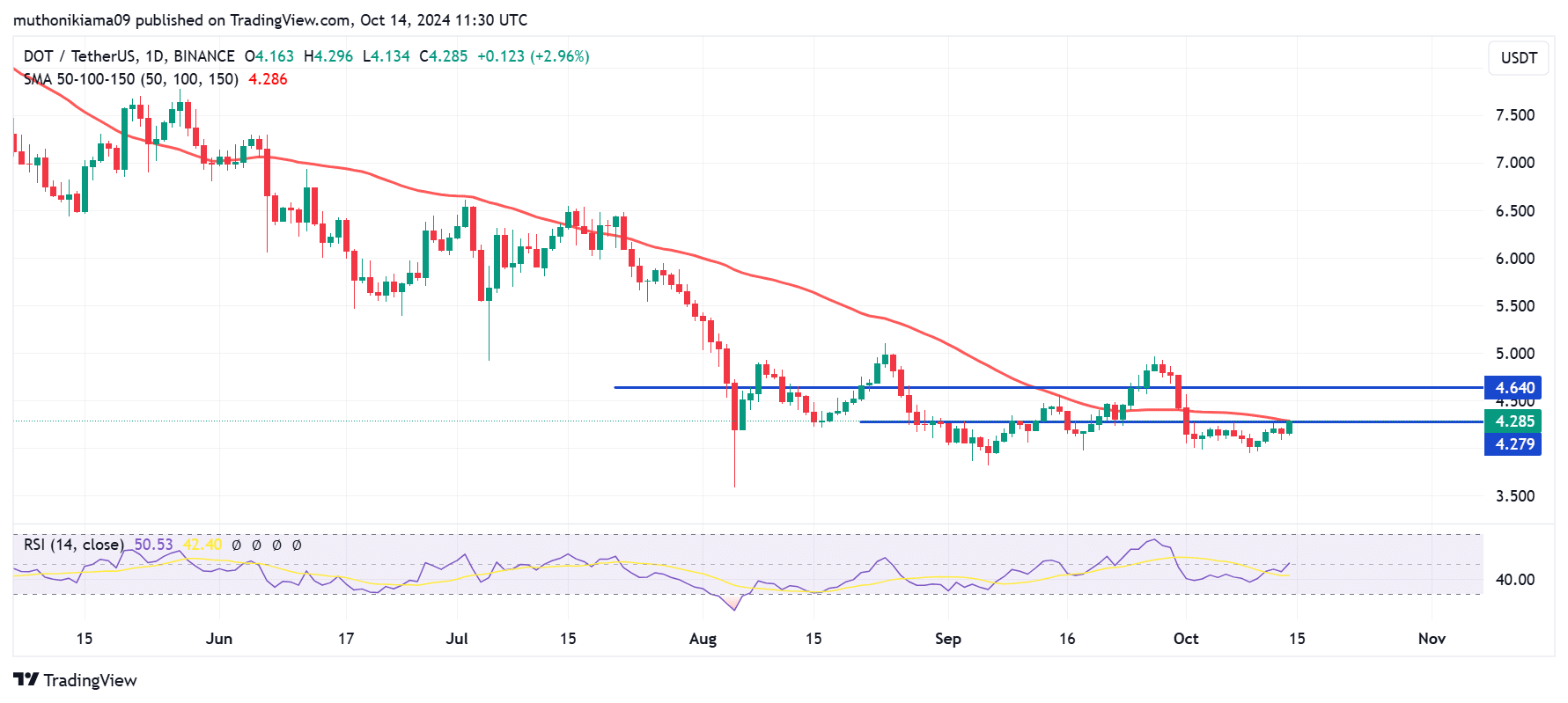

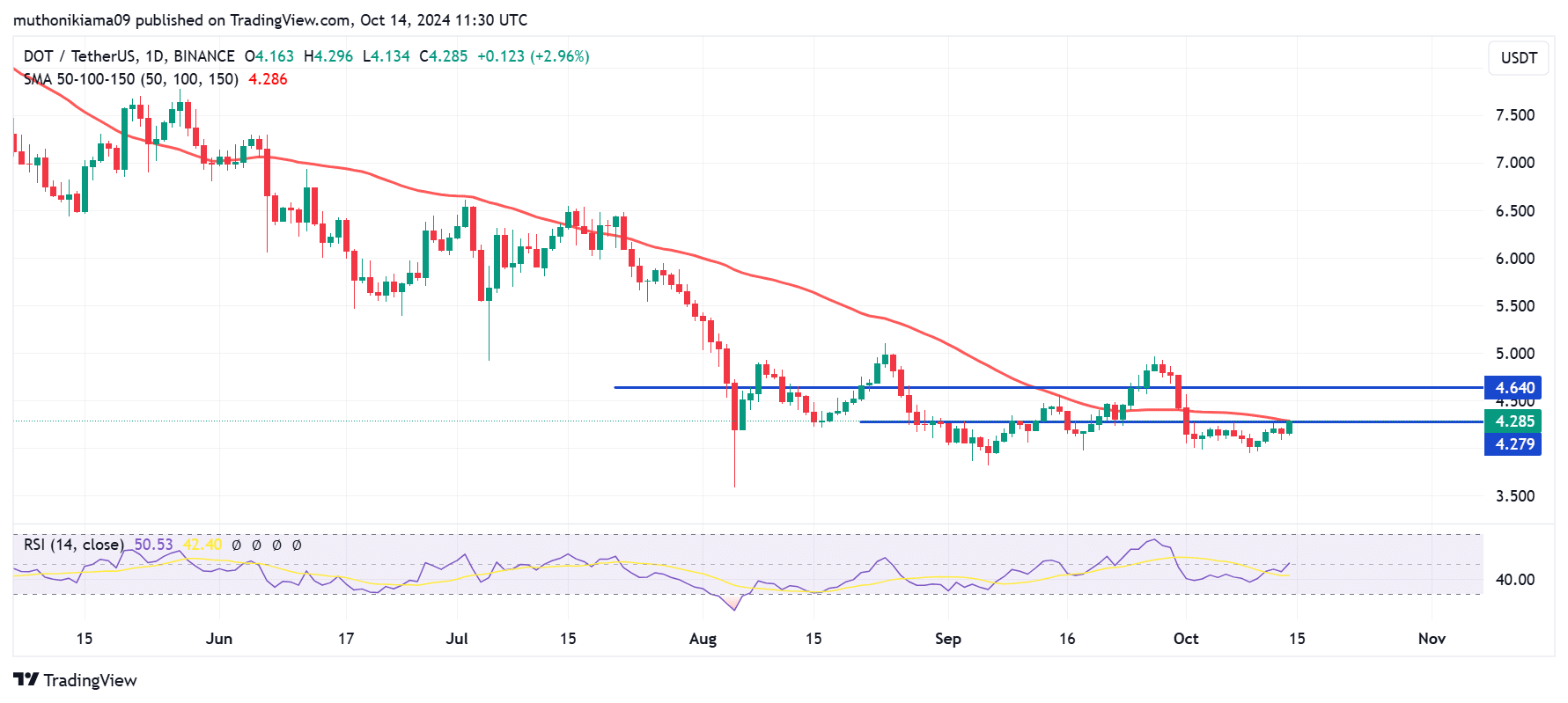

- Polkadot has confronted sturdy resistance at $4.27, however the RSI exhibits {that a} breakout is now attainable.

- The value has additionally touched the 50-day SMA, indicating that the short-term pattern is popping bullish.

Polka dot [DOT] was buying and selling at $4.25 on the time of writing, after gaining nearly 2% in 24 hours. The altcoin has confronted sturdy resistance above its present value, with each breakout try failing because of an absence of help from consumers.

Nonetheless, curiosity in Polkadot is now rising. CoinMarketCap exhibits that DOT buying and selling volumes have elevated by greater than 20% within the final 24 hours.

Along with these rising volumes, a number of indicators counsel that the pattern may reverse.

High the explanation why DOT can overcome resistance

Bulls are gearing as much as help DOT’s breakout above the USD 4.27 resistance stage. This value has been appearing as a powerful resistance for nearly two weeks, exhibiting an absence of curiosity amongst consumers.

The Relative Energy Index (RSI) exhibits that momentum is shifting. The RSI stood at 50, indicating that market sentiment has shifted from detrimental to impartial.

The rising RSI additionally crossed above the sign line, indicating {that a} bullish pattern is underway.

Supply: TradingView

DOT has additionally reached the 50-day Easy Transferring Common (SMA) at $4.28. If the value strikes above this stage, short-term sentiment will flip bullish, with the value poised to rise to check the following resistance at $4.64.

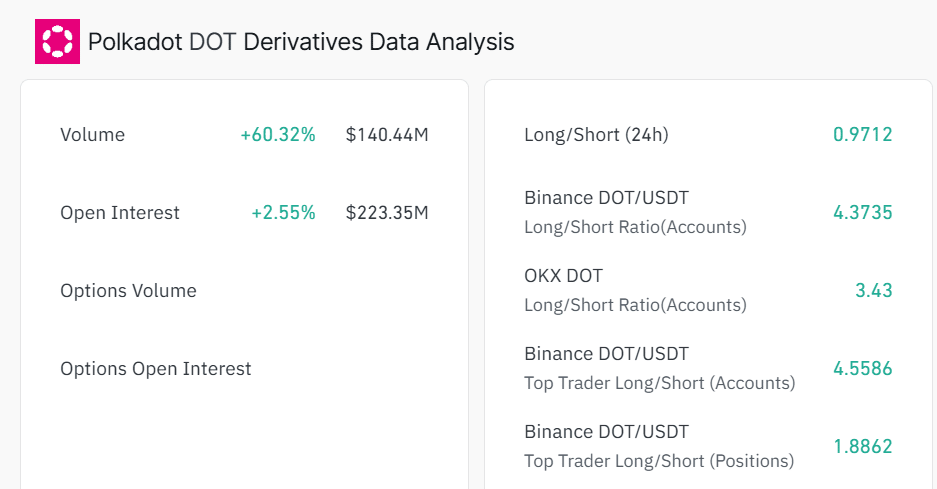

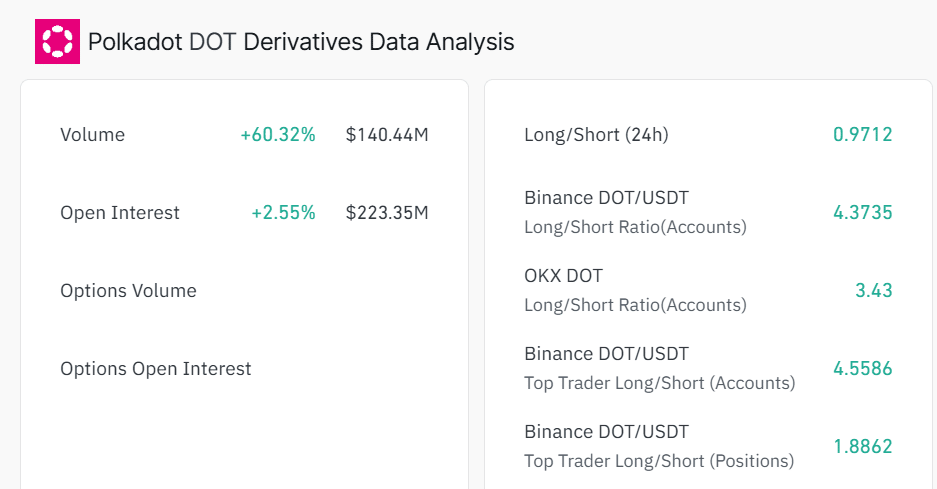

Analyzing derivatives knowledge

A have a look at knowledge from Coinglass exhibits that derivatives merchants are opening and holding their positions on DOT. Buying and selling volumes are up over 60%, whereas Open Curiosity is up round 2% to $223 million.

Supply: Coinglass

The Lengthy/Brief ratio stood at a impartial stage of 0.97, exhibiting that the market shouldn’t be strongly biased towards both lengthy or brief merchants.

Nonetheless, on Binance there seems to be a considerably bigger variety of lengthy merchants than brief merchants, with a Lengthy/Brief ratio of 4.37.

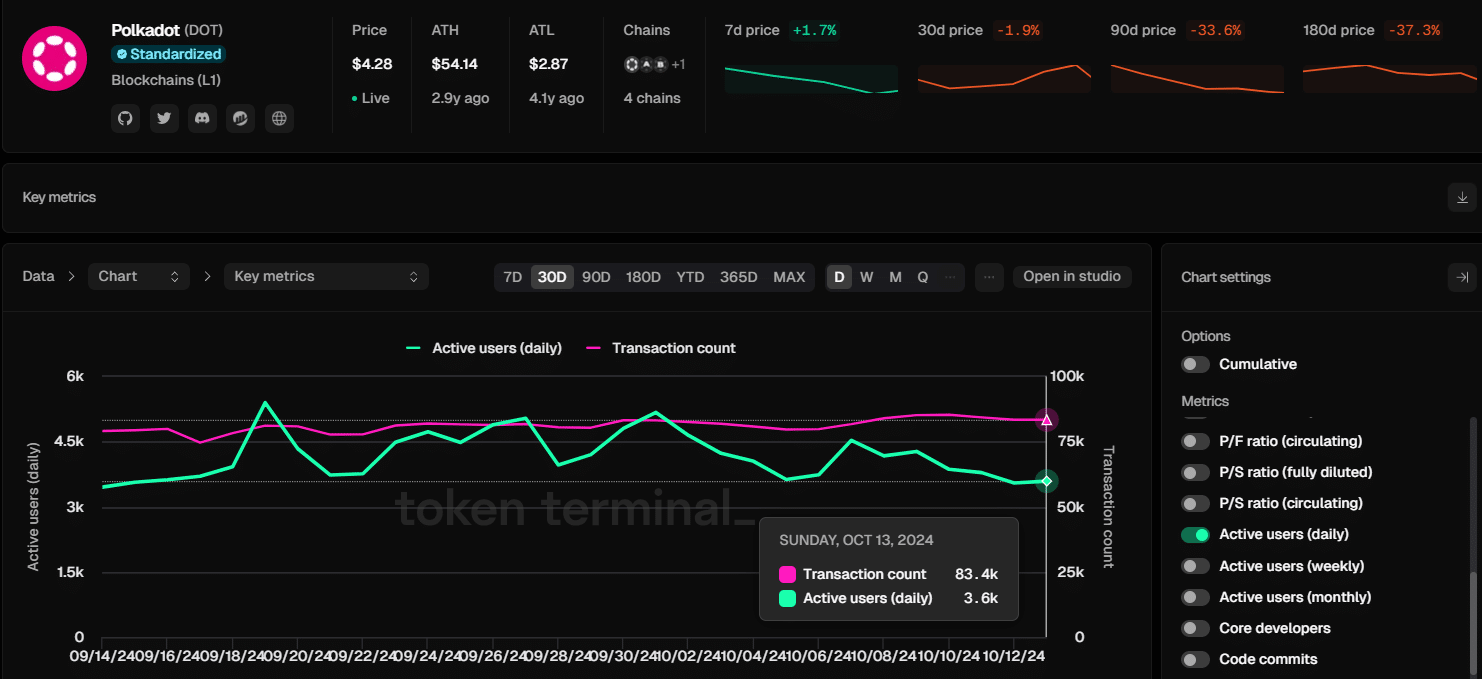

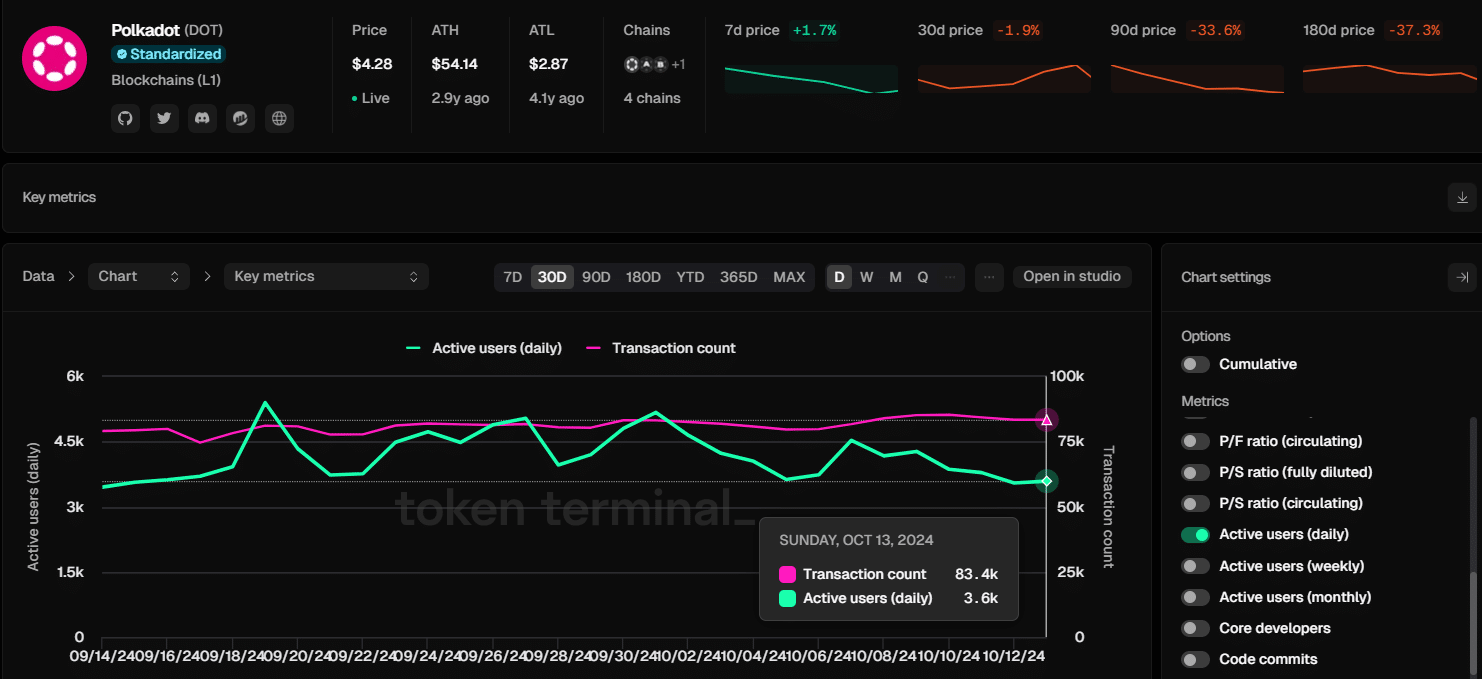

Polkadot networking exercise

One of many elements that might hinder Polkadot’s breakout above resistance is a drop in community exercise.

In response to Token Terminal, there was a notable decline within the variety of day by day energetic addresses, indicating declining utilization.

Because the starting of the month, the variety of day by day energetic addresses has dropped from 5,200 to about 3,600. Then again, the variety of day by day transactions has remained comparatively flat, with out main modifications.

Supply: Token terminal

Learn Polkadots [DOT] Worth forecast 2024–2025

Lowering community utilization tends to scale back the demand for a token. It additionally indicators declining confidence in Polkadot, additional dampening market sentiment.

Knowledge from Market Prophet exhibits that sentiment round Polkadot was predominantly detrimental over the previous month. If this sentiment doesn’t change, DOT will doubtless proceed to endure from suppressed efficiency.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024