Altcoin

Polygon: analysis of the impact of derivatives on their price momentum

Credit : ambcrypto.com

- Spot markets are seeing promoting stress and derivatives merchants stay bullish, conserving POL on a bullish trajectory.

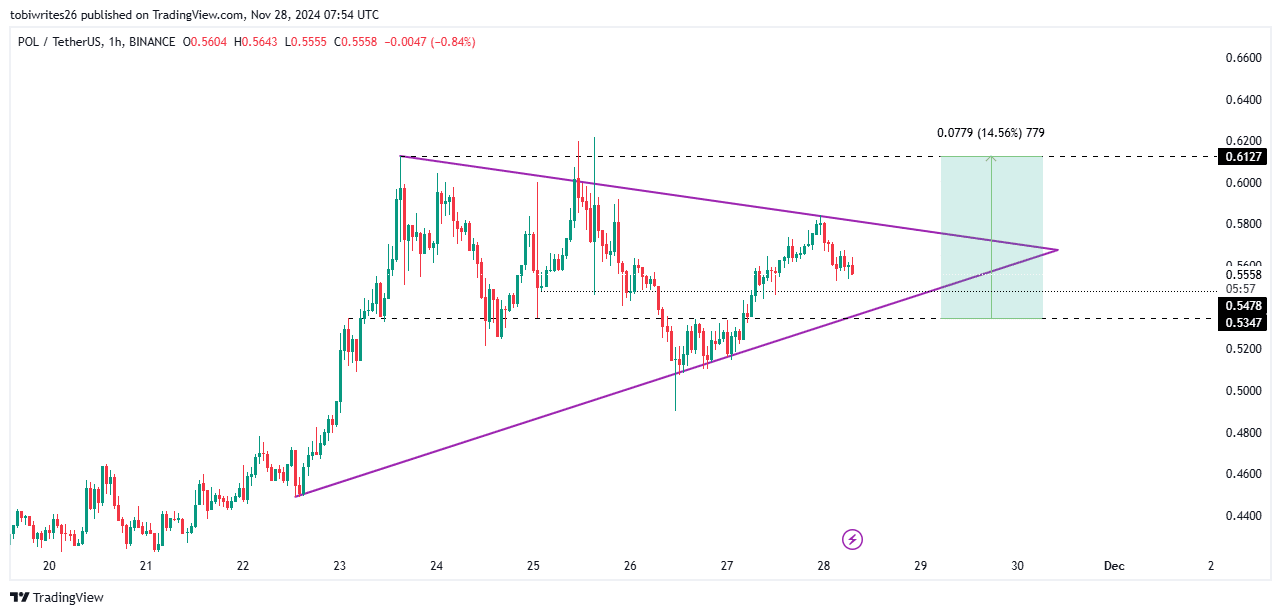

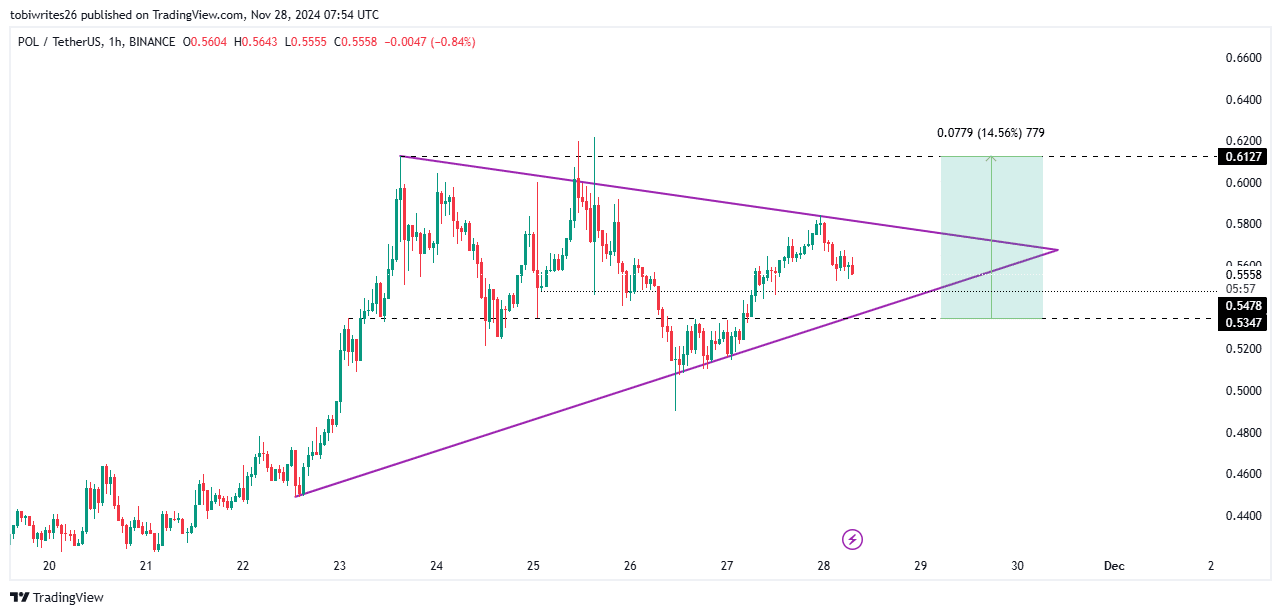

- The technical chart reveals that POL is in an accumulation part as indicated by the symmetrical triangle sample.

Polygon [POL] has not too long ago made spectacular positive aspects. Over the previous month, the asset rose 66.28%, with weekly and each day will increase of 27.43% and a couple of.02% respectively.

With robust market sentiment and continued accumulation, POL seems poised to transcend its present each day achieve of two.02% and preserve its upward momentum.

Derivatives merchants are pushing POL towards bullish momentum

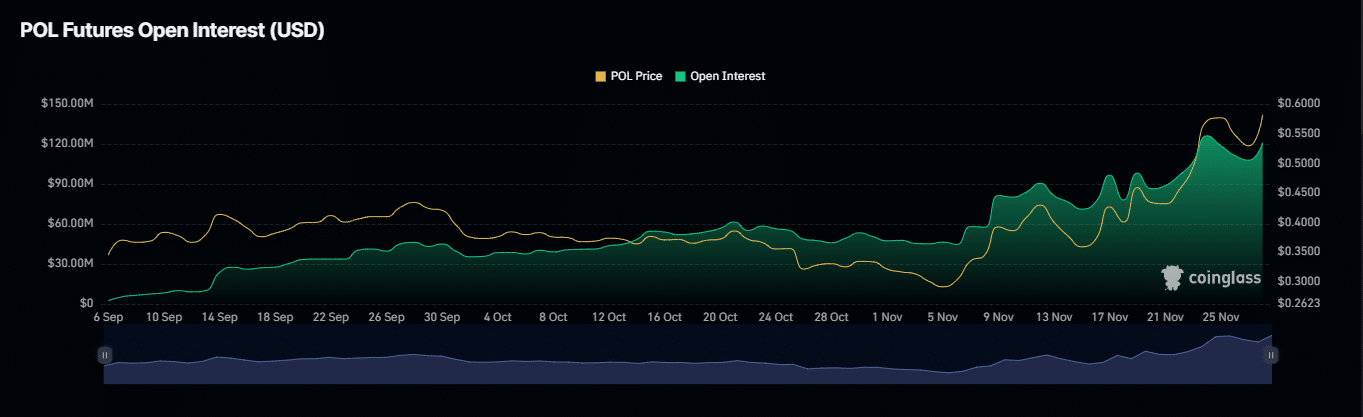

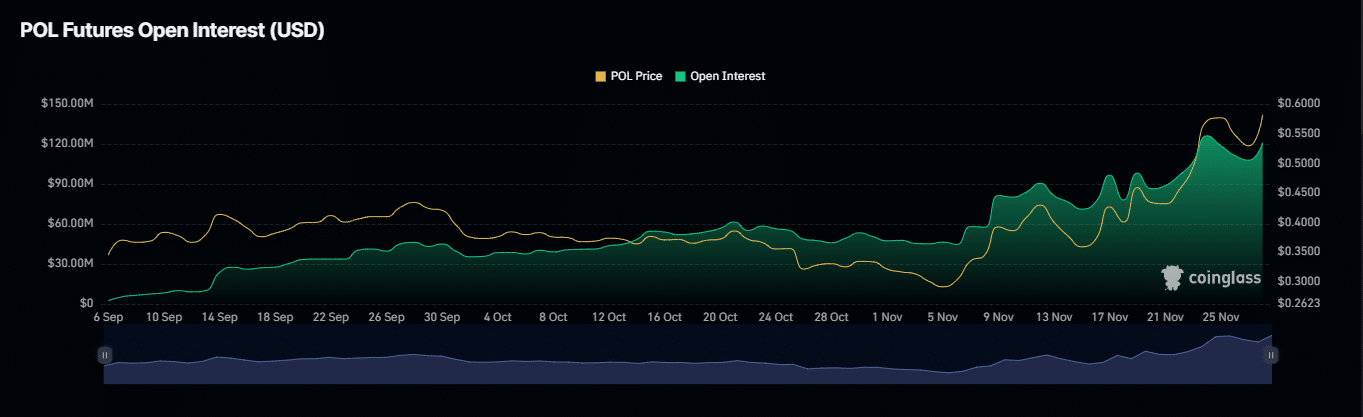

Knowledge from Coinglass reveals that as buyers accumulate POL, derivatives merchants have additionally joined the development.

Open Curiosity (OI), which measures the entire variety of unsettled futures contracts, rose 1.82% to $115.87 million. This development underlines elevated exercise within the derivatives market, with lengthy positions dominating and POL approaching its earlier document in OI.

Supply: Coinglass

The Open Curiosity Weighted Funding Price, a metric that displays financing prices and directional bias primarily based on OI, signifies that POL is more likely to rise additional after a big improve and a studying of 0.0023%.

These numbers level to a bullish outlook, pushed by derivatives merchants, whilst AMBCrypto notes that spot merchants proceed to promote.

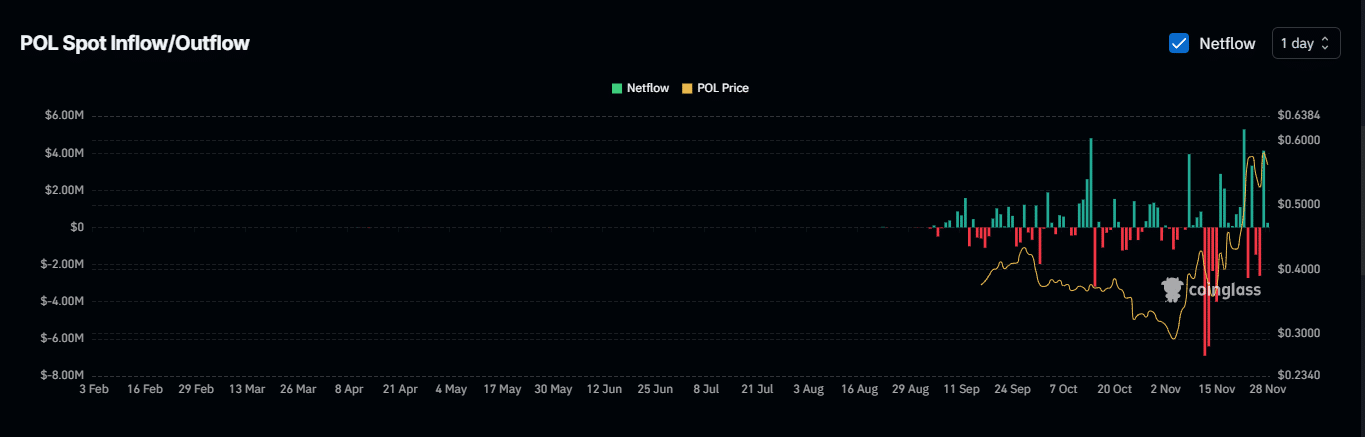

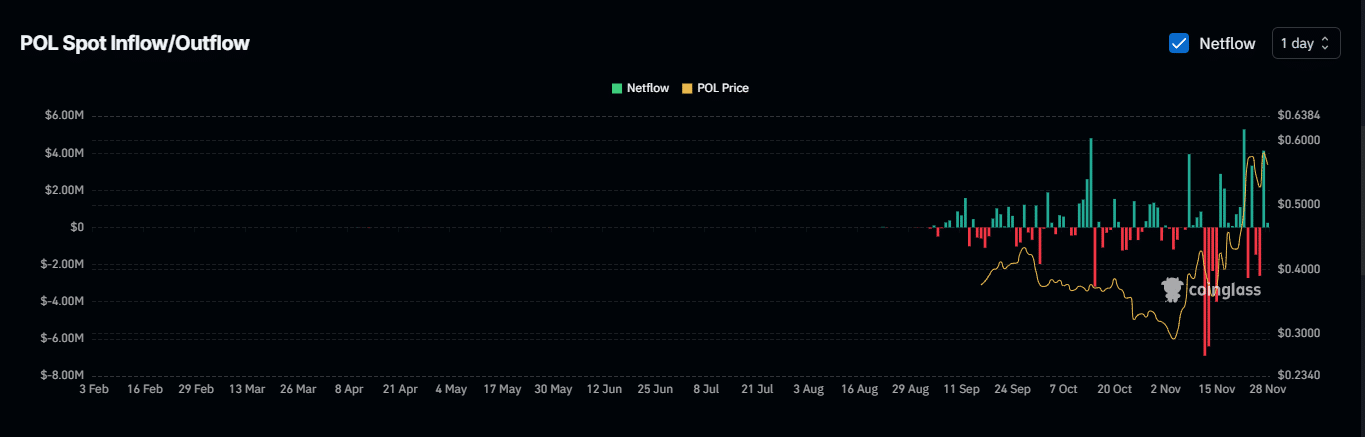

Can POL face up to the promoting stress?

Spot merchants have began itemizing POL on exchanges, indicating declining curiosity within the asset.

Change Netflow, a benchmark that tracks whether or not merchants are holding or promoting for the long run, reveals $4.1 million in POL moved to exchanges for potential sell-offs previously 24 hours.

Supply: Coinglass

Regardless of this, AMBCrypto discovered continued accumulation on the technical chart. If this continues, market members shopping for at a reduction may take up provide from spot merchants, particularly as promoting stress will increase.

A decline earlier than a transfer up?

On the chart, POL is anticipated to expertise a small decline earlier than resuming its upward transfer regardless of being in a bullish symmetrical triangle on the 1-hour chart. This decline is probably going as a result of promoting stress from spot merchants.

Is your portfolio inexperienced? View the POL revenue calculator

The value is anticipated to reverse as soon as it reaches the help stage of 0.5478. Nonetheless, if the promote orders are crammed shortly, the value may fall additional to 0.5347, from the place it will proceed its upward momentum, probably gaining 14.56% and reaching a goal of 0.6127.

Supply: TradingView

After reaching this stage, the asset could proceed to rise, particularly if total market sentiment stays bullish and shopping for exercise from derivatives merchants continues.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024