Altcoin

Quantitative open interest hits eight-month high as QNT targets THIS level

Credit : ambcrypto.com

- Quant’s open curiosity has risen to its highest degree in eight months.

- As extra bullish indicators emerge round QNT, the altcoin may rise in the direction of the 1,618 Fib degree.

Quantitative [QNT]On the time of writing, it was buying and selling at $114, having outperformed most altcoins, with 24-hour beneficial properties of over 15%. Throughout this era, buying and selling volumes elevated by 130% per 12 months CoinMarketCapindicating that curiosity within the altcoin was remarkably excessive.

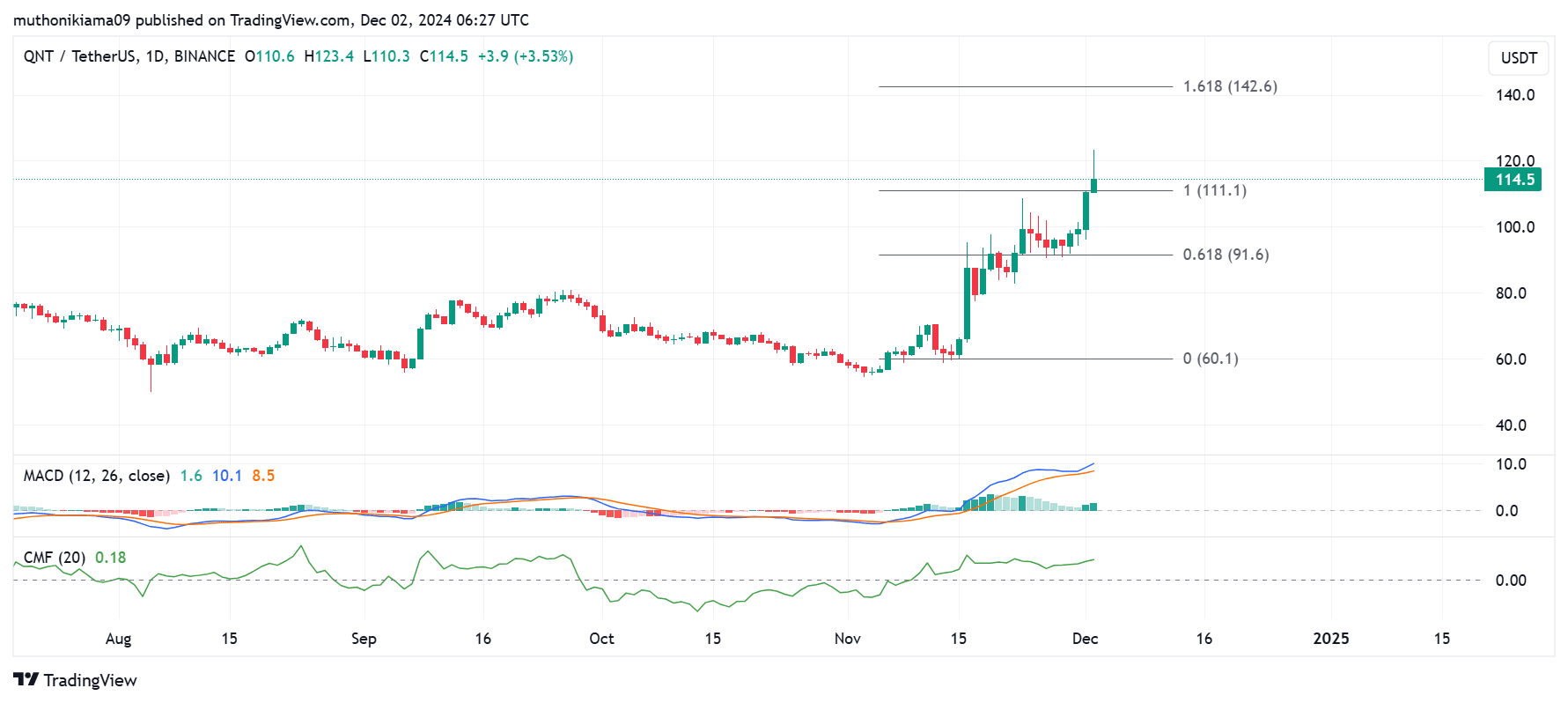

Quant’s uptrend may proceed resulting from a number of bullish indicators. The Chaikin Cash Circulate (CMF), with a worth of 0.18, is displaying excessive shopping for stress. Moreover, the CMF is tilting north, indicating extra consumers are coming into the market.

On the similar time, the Shifting Common Convergence Divergence (MACD) exhibits that momentum is bullish. The MACD line has been on an upward pattern since mid-November, sustaining its place above the sign line as the worth rose.

If the MACD line continues to rise upward and the MACD histogram bars stay above the sign line, QNT may rise additional. Merchants ought to look ahead to the exhaustion of this rally because the MACD line creates a promote sign by falling under the sign line.

Supply: TradingView

If consumers stay energetic and the uptrend continues, QNT may rise 27% to its subsequent goal on the Fibonacci degree of 1,618 ($142).

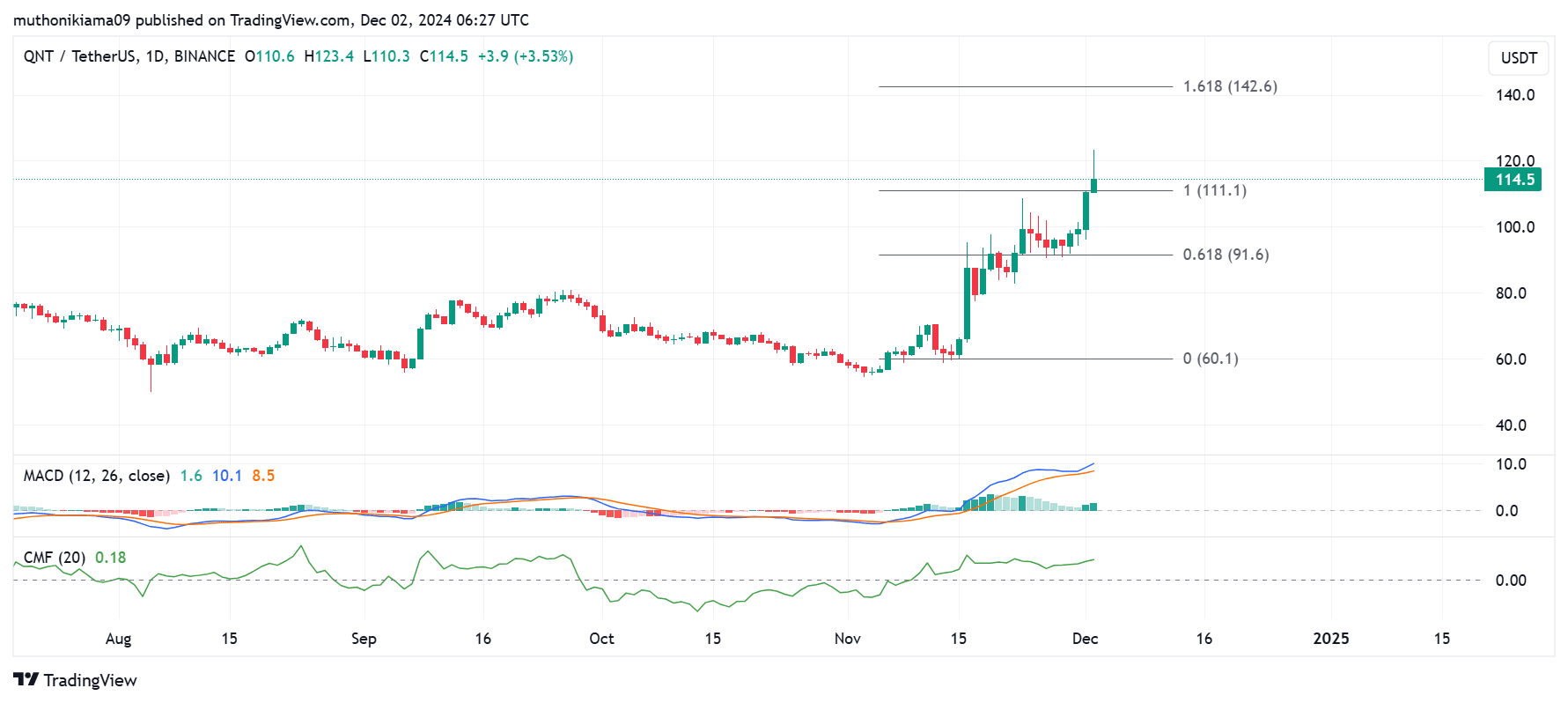

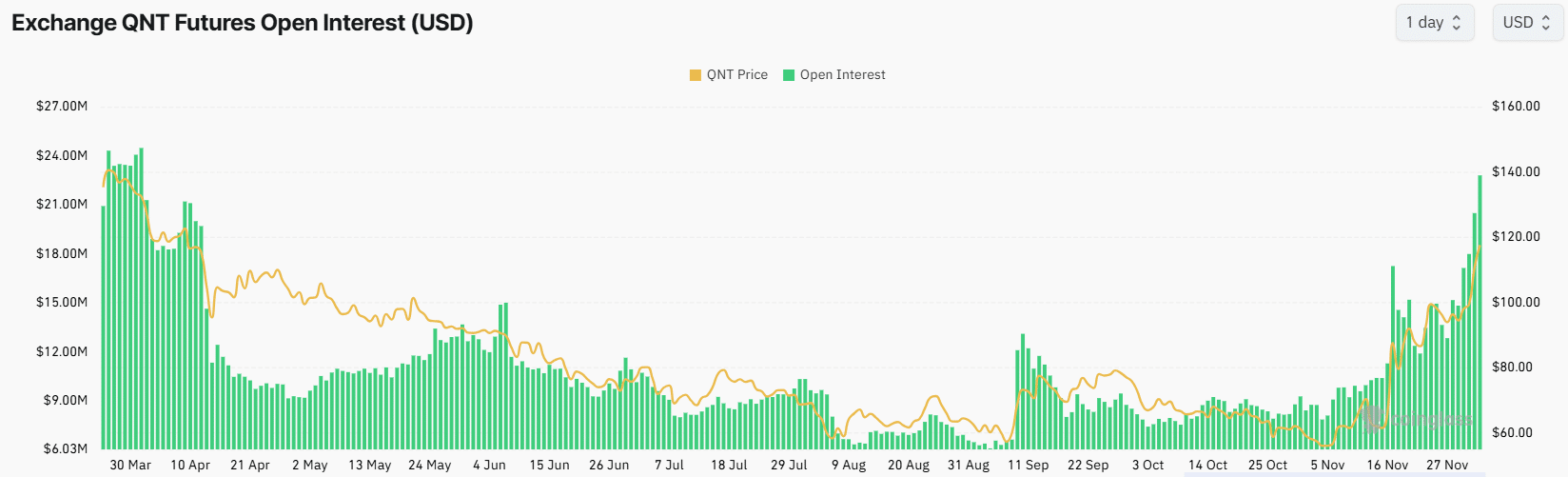

Open curiosity reaches an eight-month excessive

Along with technical indicators, exercise within the derivatives market helps the bullish thesis after Quant’s open curiosity (OI) reached $22 million at press time, the best degree since April.

Supply: Coinglass

Primarily based on previous tendencies, Quant’s OI tends to rise as the worth rises. Subsequently, as extra merchants open new positions on QNT, this might result in upward momentum. On the similar time, merchants ought to be careful for a drop on this metric, because it may point out that QNT has reached a neighborhood high.

Quant’s funding charges have additionally been optimistic since mid-November, suggesting lengthy merchants are behind the rising OI.

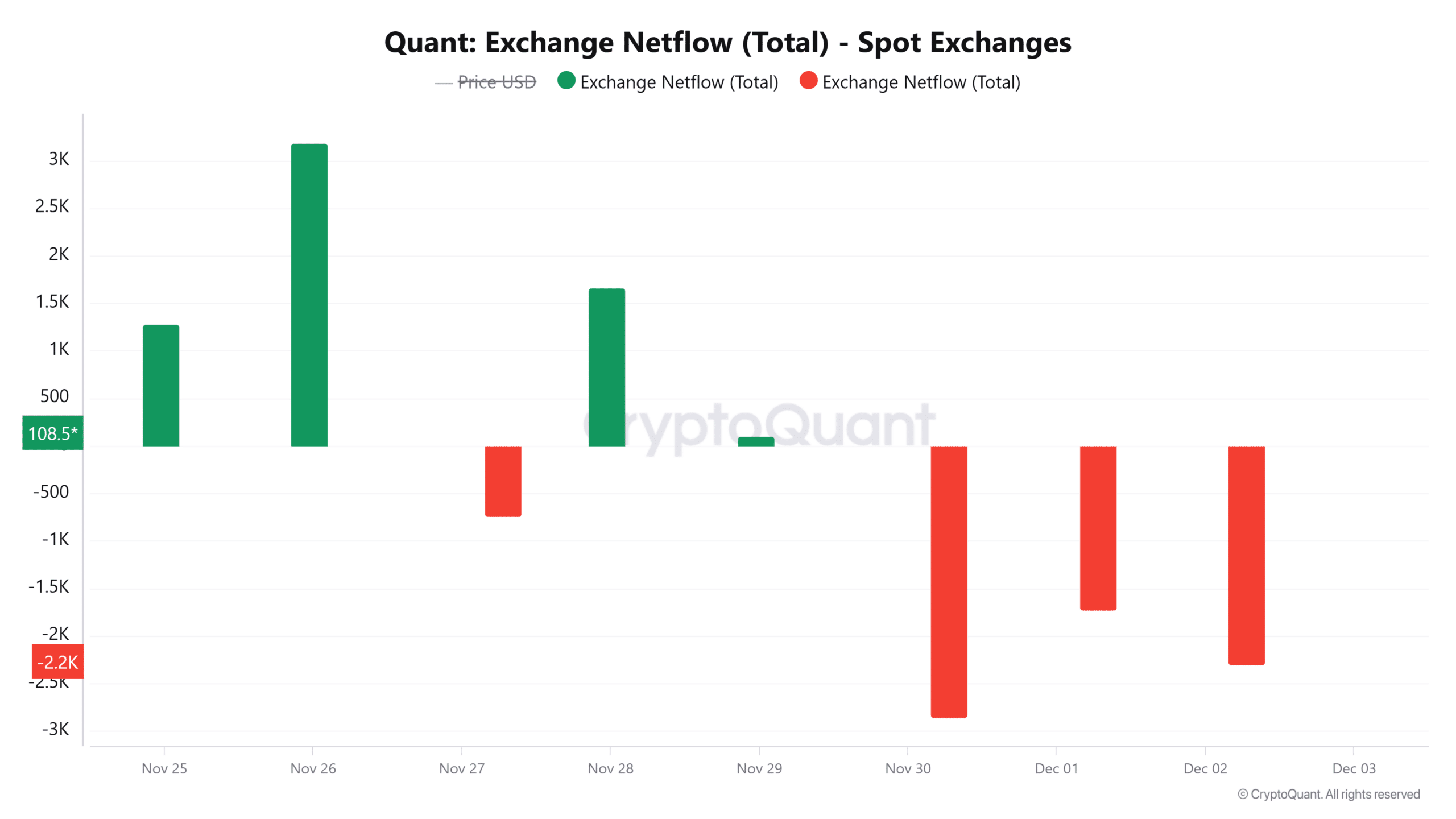

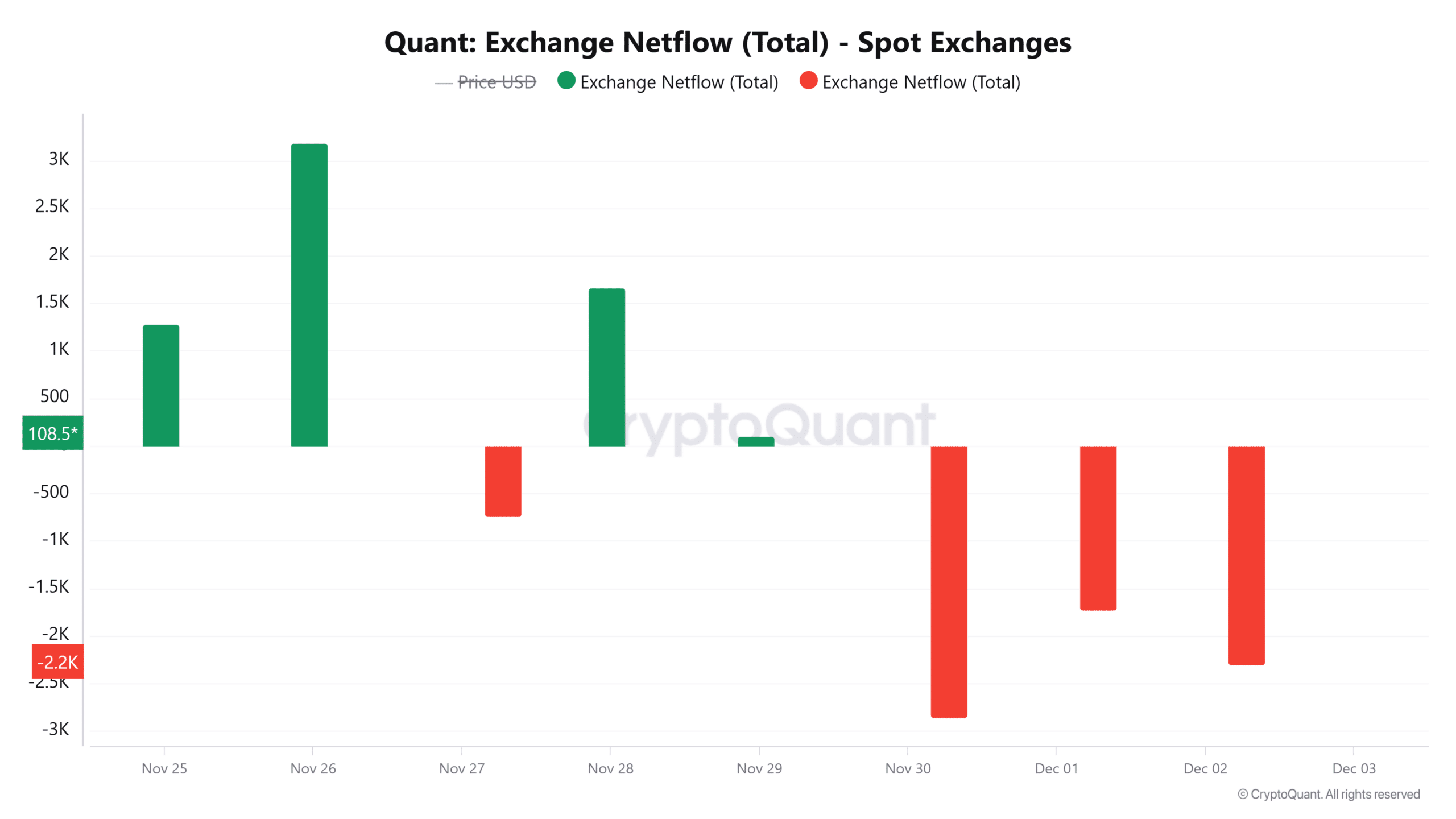

Quant’s trade internet flows present THIS

Inventory move information exhibits that revenue taking shouldn’t be excessive sufficient to disrupt Quant’s uptrend. That is after holders withdrew greater than 18,400 QNT, price about $1.8 million, from spot exchanges this weekend.

Knowledge from CryptoQuant exhibits that trade internet flows for QNT have been adverse over the previous three days, indicating that extra merchants are withdrawing their funds from the exchanges.

Supply: CryptoQuant

The decreased promoting stress may bode nicely for the QNT token, because it suggests merchants count on extra income for the altcoin regardless of a spike in profitability.

Learn Quants [QNT] Worth forecast 2024–2025

Per InTheBlokthe win fee of QNT wallets has elevated from 4.96% to 26% in a single month.

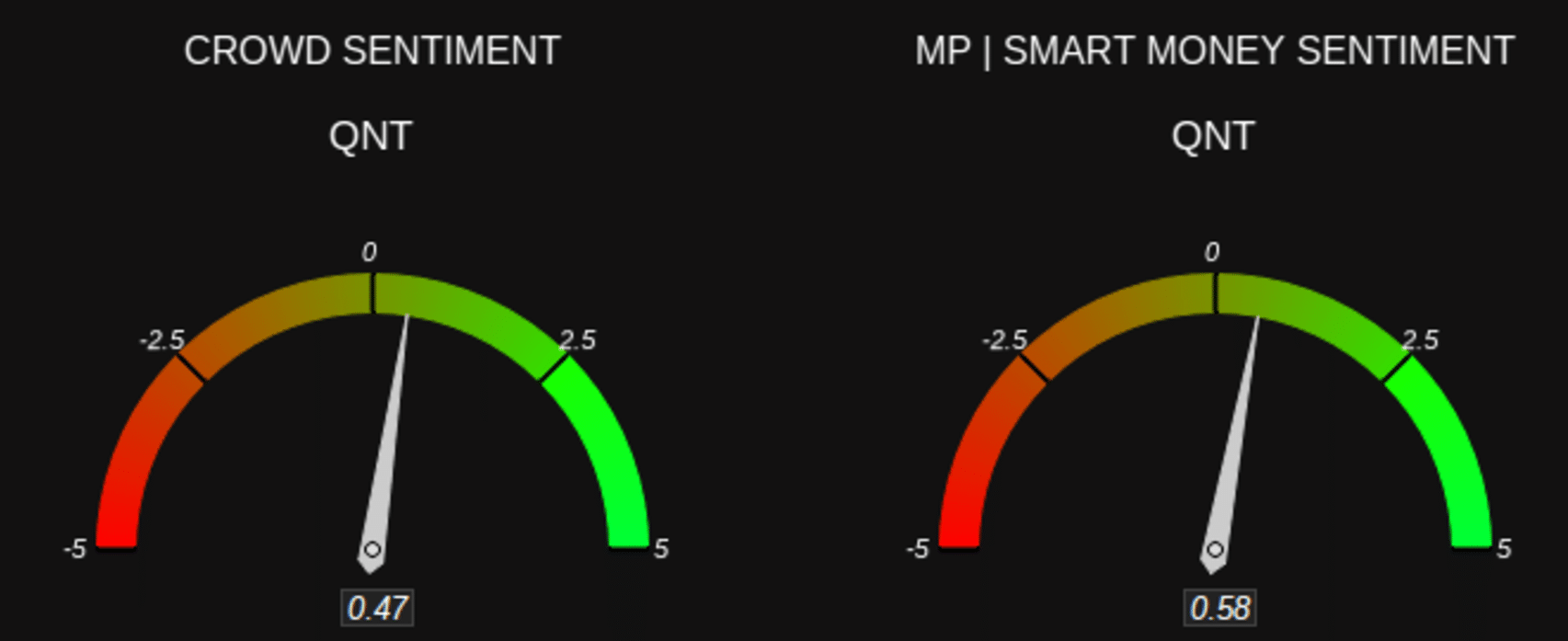

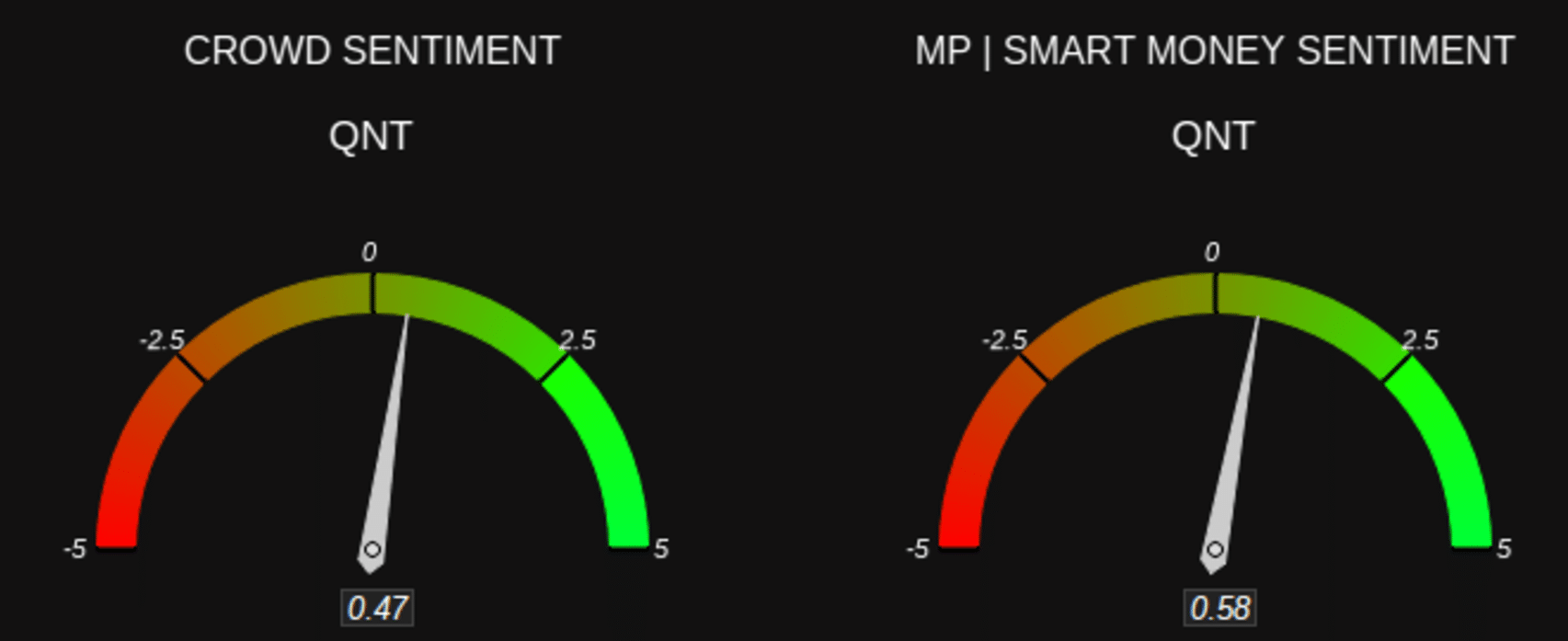

These bullish indicators have improved market sentiment round QNT, with Market Prophit displaying that each public and sensible cash sentiment across the altcoin is bullish.

Supply: Markt Profhit

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024