Ethereum

‘Recipe for Ethereum to reach $10K’ – How ETFs can help ETH soar

Credit : ambcrypto.com

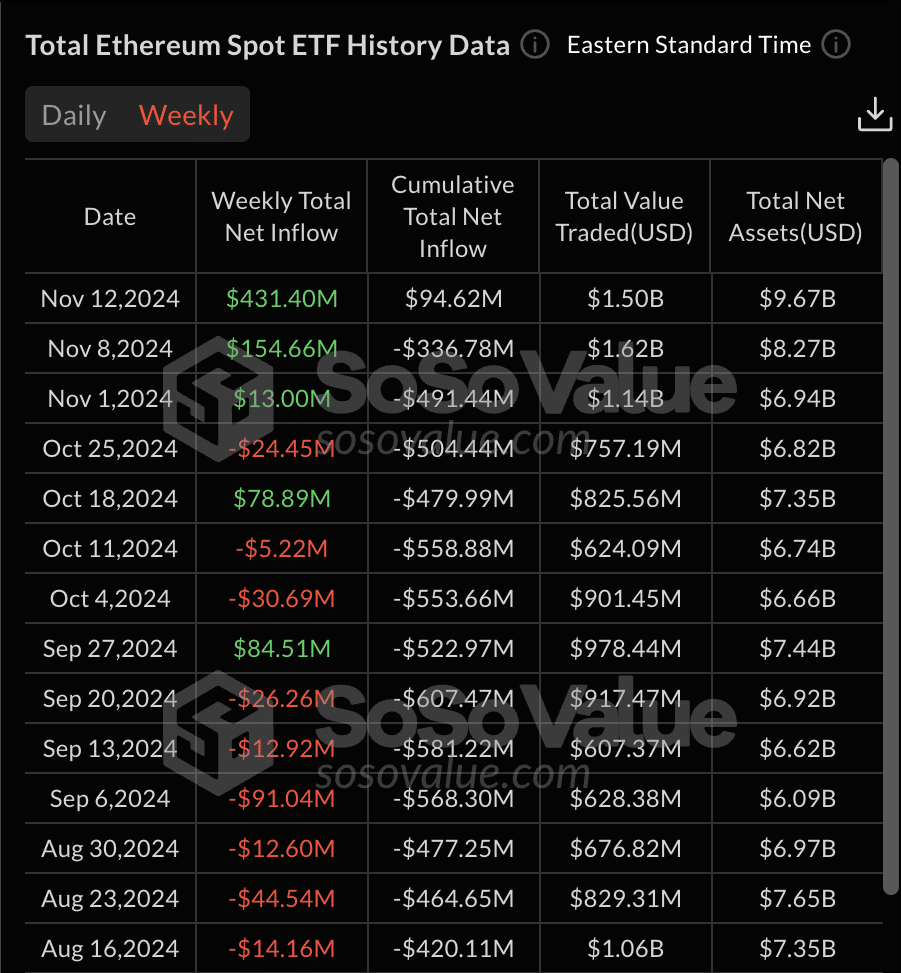

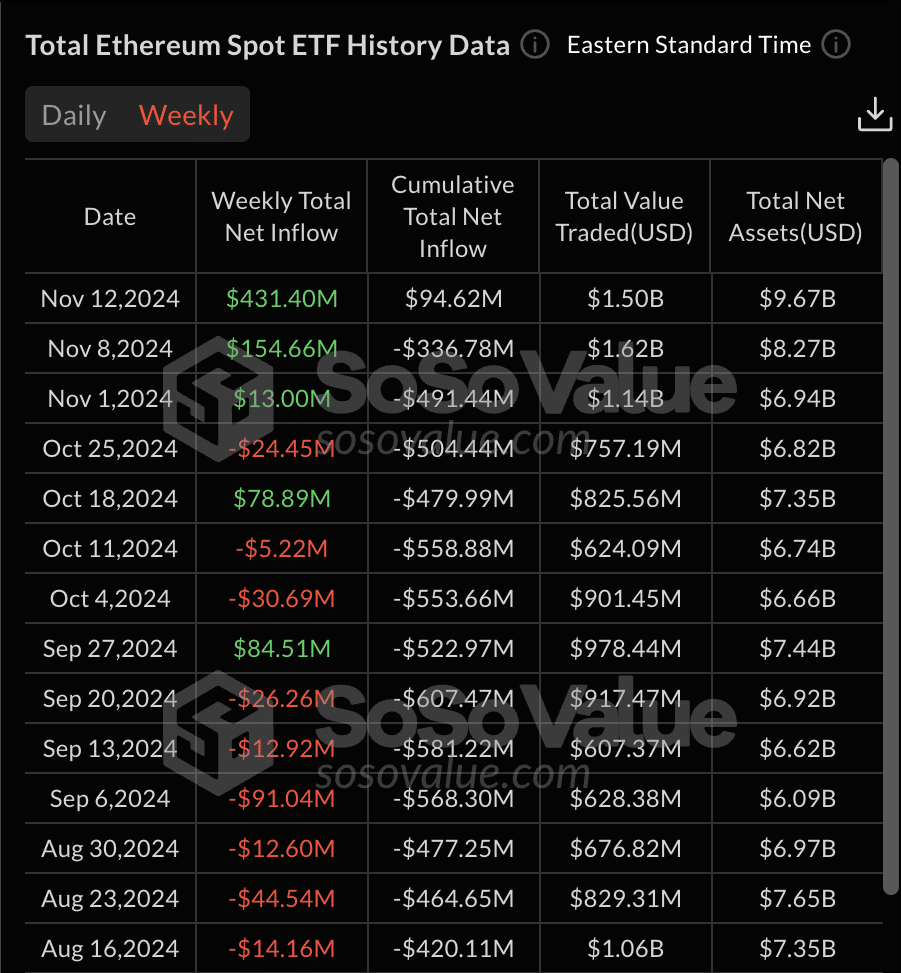

- Cumulative inflows into Ethereum ETFs turned constructive for the primary time since July.

- Blackrock’s ETHA has been ranked as among the best ETF launches this yr.

On November 12, Ethereum [ETH] ETFs had been groundbreaking, finally shifting complete web inflows in a constructive path – for the primary time since their launch.

Supply: SoSo worth

Facts of SoSo Worth revealed each day web inflows of $135.92 million, bringing cumulative inflows to $94.62 million.

Buying and selling exercise additionally elevated, with complete traded worth reaching $582.18 million and complete web belongings rising to $9.67 billion.

Of the 9 ETFs, 5 noticed inflows. In the meantime, solely Grayscale Ethereum Belief [ETHE] an outflow was recorded, whereas the remaining funds confirmed no new inflows.

Executives weigh in

The most recent improvement caught the eye of business leaders on X (previously Twitter).

Nate Geraci, President of the ETF Store, marked the web constructive flows mark an vital milestone for ETH ETFs as they’ve:

“Overcoming $3.2 Billion in Outflows from ETHE.”

Furthermore, Geraci be which incorporates 19 of this yr’s prime 50 ETF launches Bitcoin [BTC]ETH, or MicroStrategywith 12 within the prime 18 – a powerful determine of a complete of 610 launches.

Moreover, the Ethereum Belief from iShares [ETHA] ranked because the sixth finest ETF launch of 2024

Bankless co-founder Ryan Sean Adams, too commented on improvement. He famous that ETHE’s dominant outflows primarily offset ETFs’ upward strain.

Nonetheless, now that the influx is popping constructive for the primary time, this might point out a shift.

Adams even predicted that this shift could be a…

“Prescription for an ETH rocket to $10k.”

Ethereum ETFs hit report inflows

This newest milestone comes a day after ETFs had a report day on November 11, recording inflows of $295 million.

This inflow, led by business giants akin to Constancy and BlackRock, marked almost triple the earlier peak of $106.6 million recorded on launch day.

Eric Balchunas, Bloomberg senior ETF analyst, noted on X that had been ETFs,

“Trending in the proper path.”

The analyst additional anticipated a constructive development for the ETFs, stating:

“Sunny days forward, though nonetheless a number of nation miles behind BTC ETFs.”

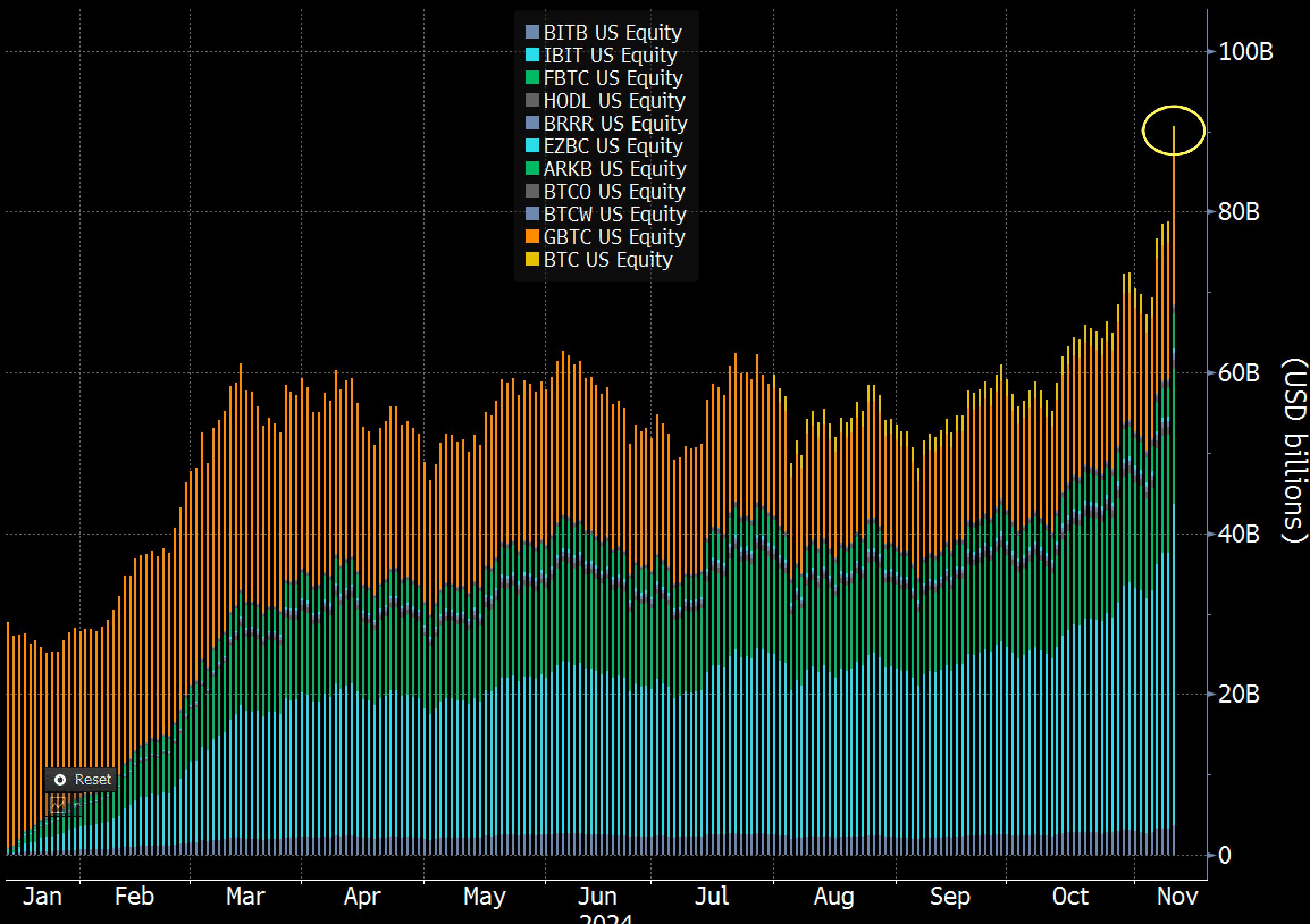

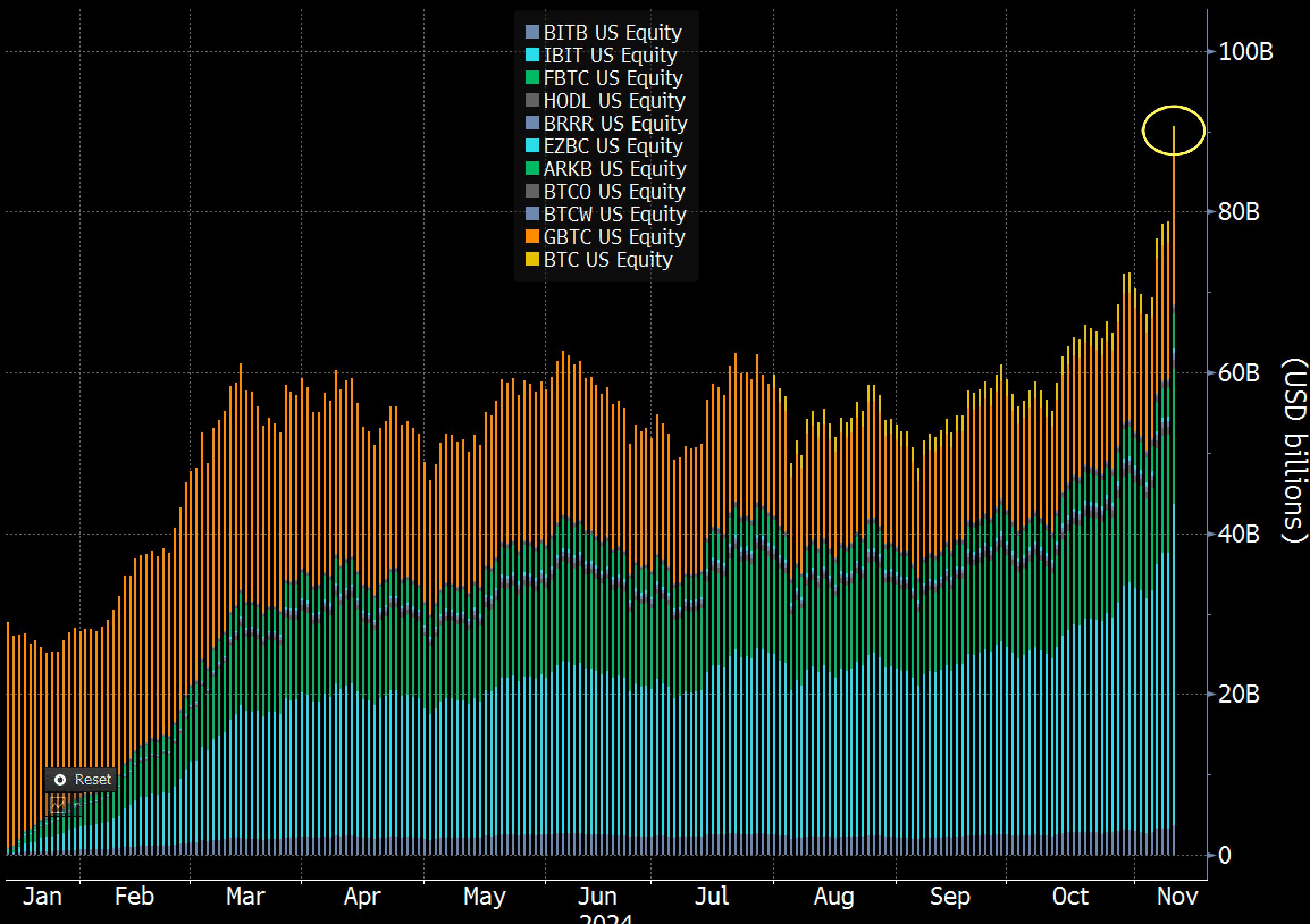

How are BTC ETFs doing?

Within the meantime, BTC ETFs additionally achieved its personal report. Balchunas revealed on X that Bitcoin ETFs crossed the $90 billion mark in belongings beneath administration, after a considerable improve of $6 billion.

This included $1 billion in new inflows and $5 billion in market appreciation. This improve means that Bitcoin ETFs had been now 72% of the best way to surpassing gold ETFs in complete belongings.

Supply: Eric Balchunas/X

As one other signal of demand, IBIT reached $1 billion in buying and selling quantity in simply 25 minutes – quicker than the day prior to this, when it broke a report.

Balchunas described the continued curiosity in BTC ETFs as a “feeding frenzy” that exhibits no indicators of slowing down.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024