Bitcoin

Record $16.5B BTC options expiry on Friday: Can Bitcoin leap above $90K?

Credit : ambcrypto.com

- BTC has to beat a powerful resistance with the vary of $ 88k – $ 90k to keep up Bullish Momentum amidst the $ 16.5 billion final result.

- A excessive focus of Bitcoin name choices close to $ 90k and falling quantity locations on potential worthwhile or a break within the rally.

A report -breaking $ 16.5 billion in Bitcoin [BTC] Choices are set to finish on March 28, which signifies that intense hypothesis is led to the subsequent main motion of the Activum.

Whereas merchants are bracing for this vital occasion, the choice market and technical indicators of essential alerts that may type the course of Bitcoin within the quick time period.

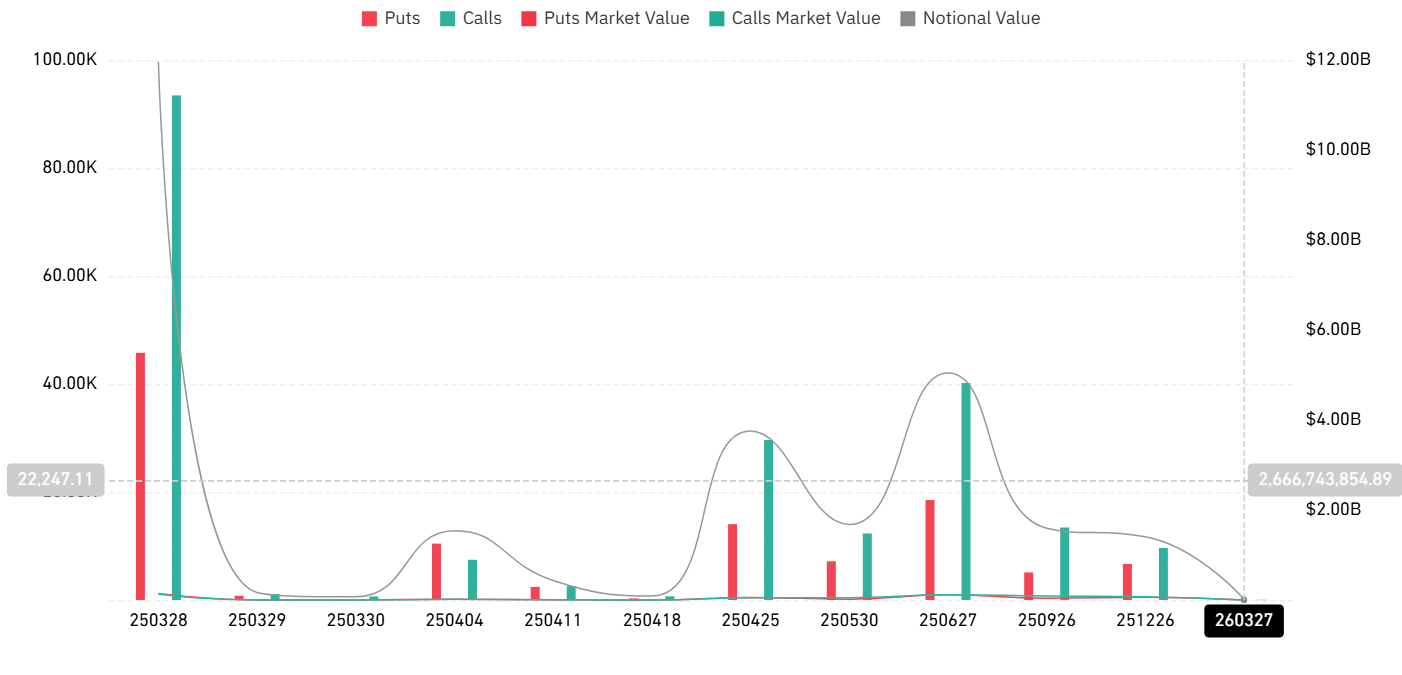

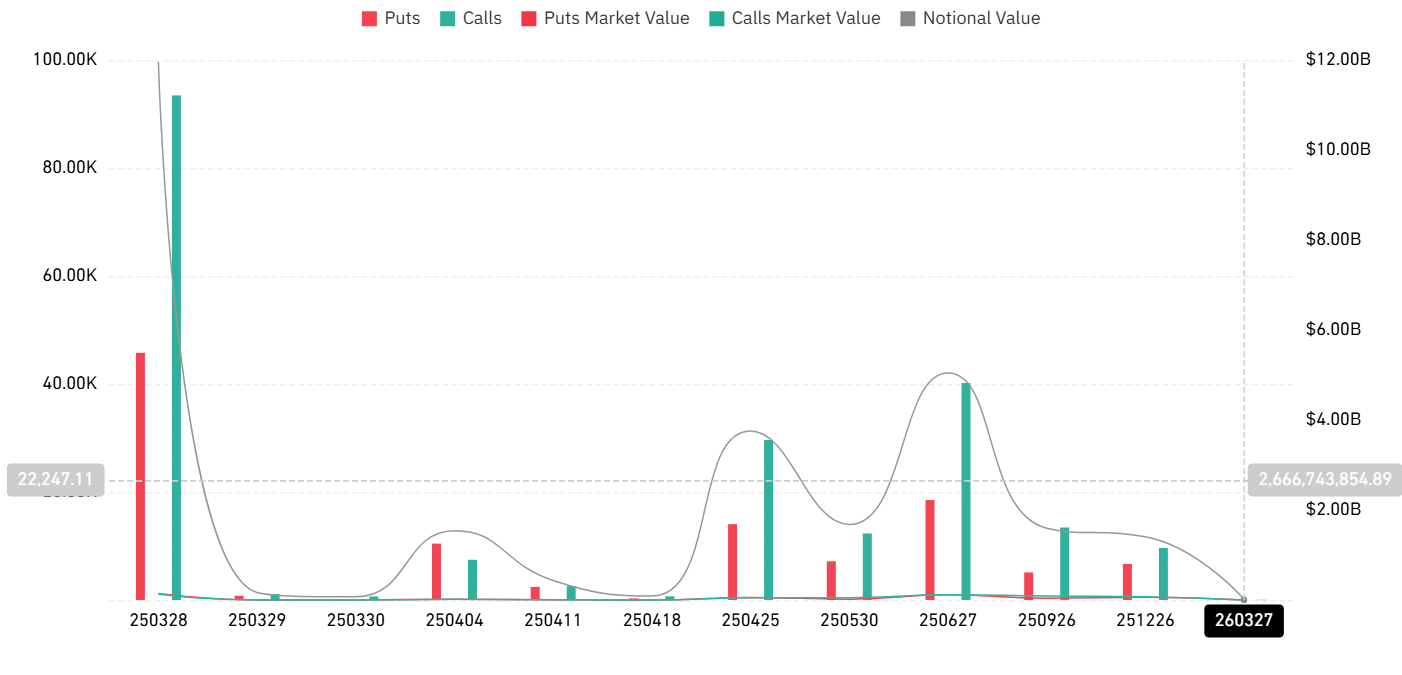

Choice market sees Bullish Tilt, however heavy clusters live on

Knowledge of Coinglass Reveals mass open curiosity (OI) close to the train worth of $ 90K, with a exceptional tilt to Name choices.

The fictional worth of the excellent contracts has reached a report excessive, which emphasizes an elevated market barking.

Supply: Coinglass

Attention-grabbing is that there’s a giant focus of on -call choices across the manufacturers of $ 90k and $ 95k, suggesting that bulls are playing on an outbreak outdoors these resistance ranges.

Nonetheless, there’s additionally a substantial put cluster close to the $ 80k $ 82k vary, which signifies that a failure to climb over $ 90,000 could cause downward strain if merchants aggressively coated their positions.

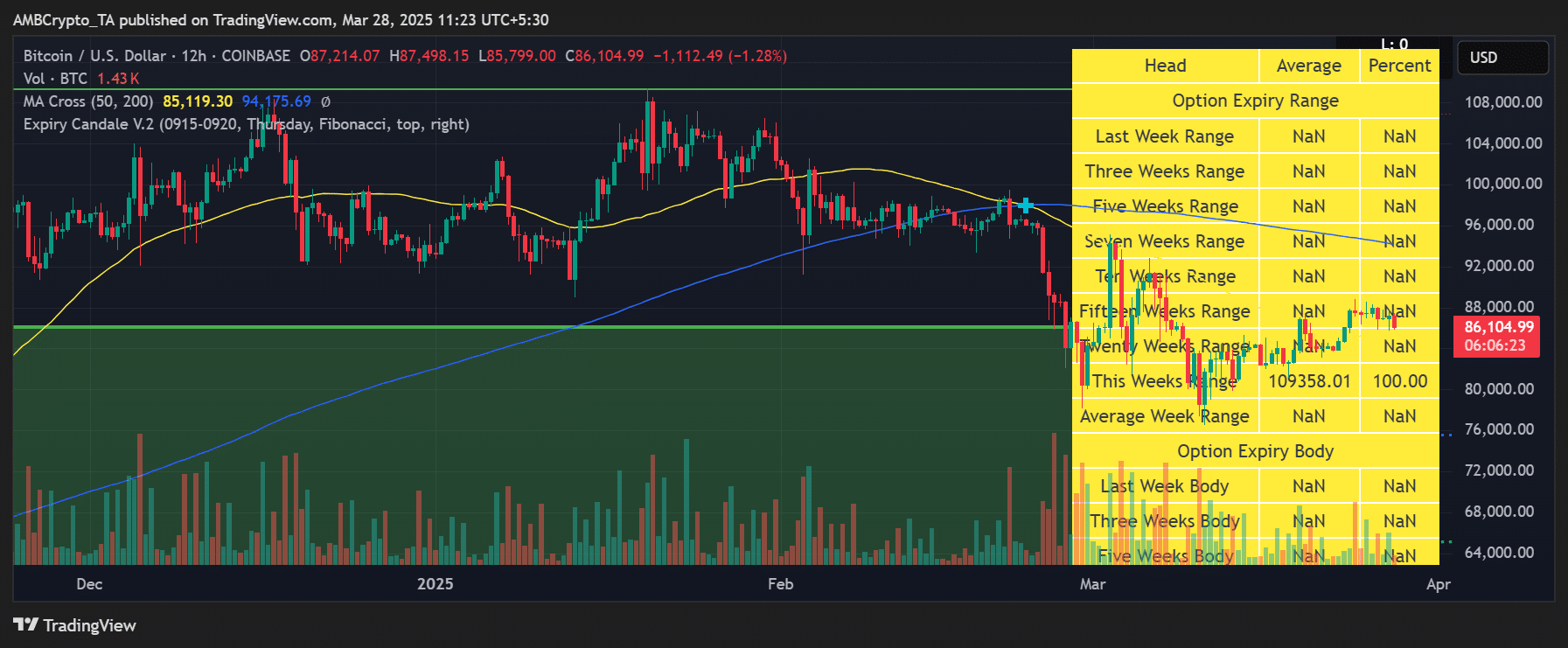

The technical association of Bitcoin Hints with warning regardless of the momentum

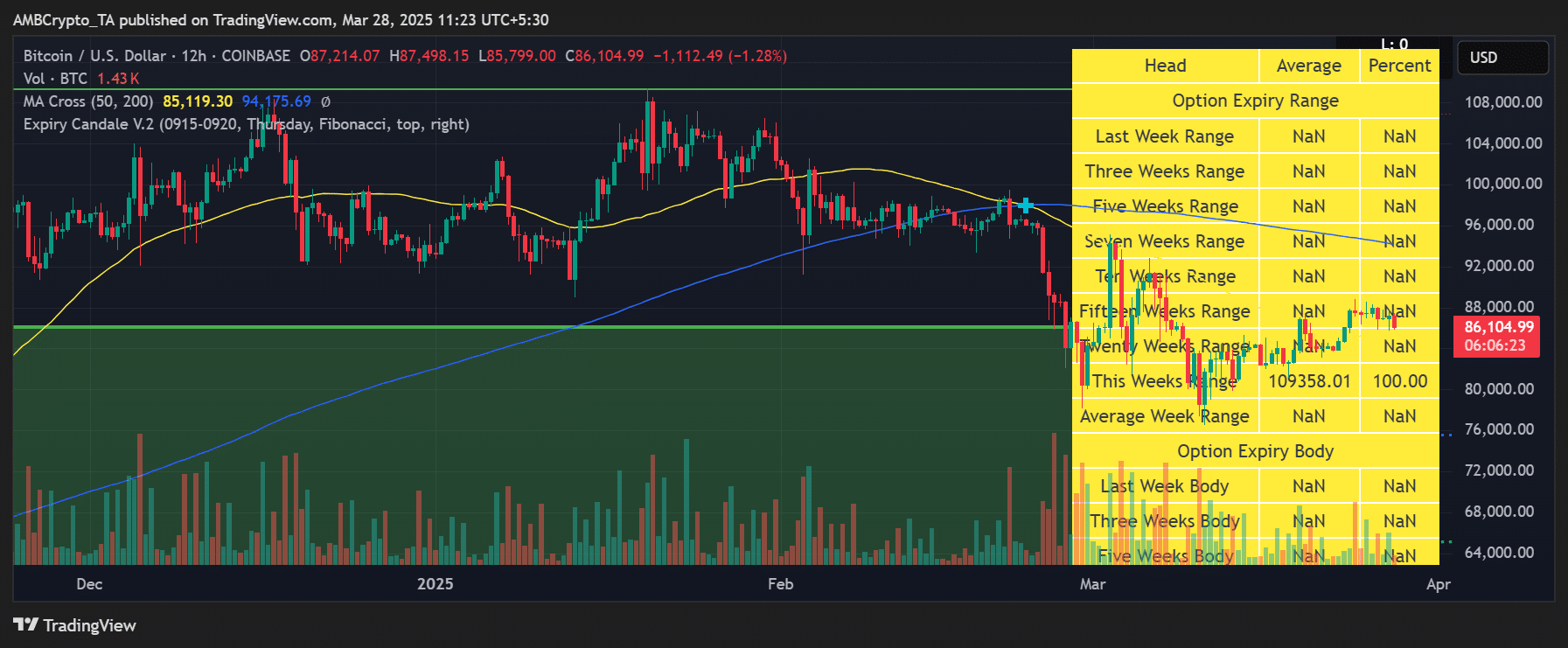

On the BTC/USD graph of 12 hours, Bitcoin traded round $ 86,100 and struggled to keep up up momentum.

The 50-day MA at $ 85,119 acted as assist within the quick time period, whereas the 200-day MA loomed at $ 94,175 overhead as an vital resistance.

Supply: TradingView

Including to the uncertainty is the Fandnijkstaarse -indicator, which marks the present weekly decay vary at $ 109,358, nicely above the present worth.

Traditionally, choice -expiration date occasions can introduce volatility spikes, however typically fail to push BTC additional than a very powerful psychological ranges, until the quantity follows.

Low quantity and excessive threat: can Bitcoin bulls keep the push?

Volum statistics counsel weakening participation, as mirrored within the comparatively muted buying and selling exercise regardless of elevated OI.

This divergence signifies that though positions are stacked, the precise perception stays low. Even small worth shifts could cause liquidations and exaggerated actions in such an atmosphere.

Within the meantime, information on the chain reveals some assist close to the $ 85K area. If Bitcoin succeeds in sustaining this degree because of the expiry date, it may function a launch platform for a retest of $ 90k. Nonetheless, a break beneath can invite gross sales within the quick time period, particularly with a heavy leverage.

Conclusion

As Bitcoin approaches the subsequent $ 16.5 billion choices, all eyes are aimed toward whether or not bulls can reclaim $ 90k or that the expiration date will generate a short lived withdrawal.

With heavy OI, combined alerts and skinny quantity, the subsequent 48 hours will be decisive for the development of BTC in Q2 2025.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now