Analysis

Retail Investors Buy $3,400,000,000,000 in Stocks – But Analyst Warns Insiders Are Selling Equity Market Rips: Report

Credit : dailyhodl.com

Retail buyers are stacking on the inventory market and deploy trillions of {dollars} in capital.

Information from the Nasdaq exhibits that particular person buyers have taken $ 3.4 trillion in shares within the first six months of 2025 within the midst of market volatility brought on by geopolitical tensions and Trump’s commerce warfare, report Marketwatch.

Within the meantime, the investor cohort additionally bought $ 3.2 trillion to shares throughout the identical interval, which pushed the entire buying and selling exercise between January and June to a report of $ 6.6 trillion.

On the subject of information from VanDatrack, The Monetary Instances report That retail buyers have been taken to purchase the dip and this yr $ 155 billion in US shares and listed funds yielded even when markets witnessed in April.

However whereas retail buyers are swallowing shares, the favored macro analyst Adam Kobeissi says that insiders of the corporate have used the inventory market to unload their participations.

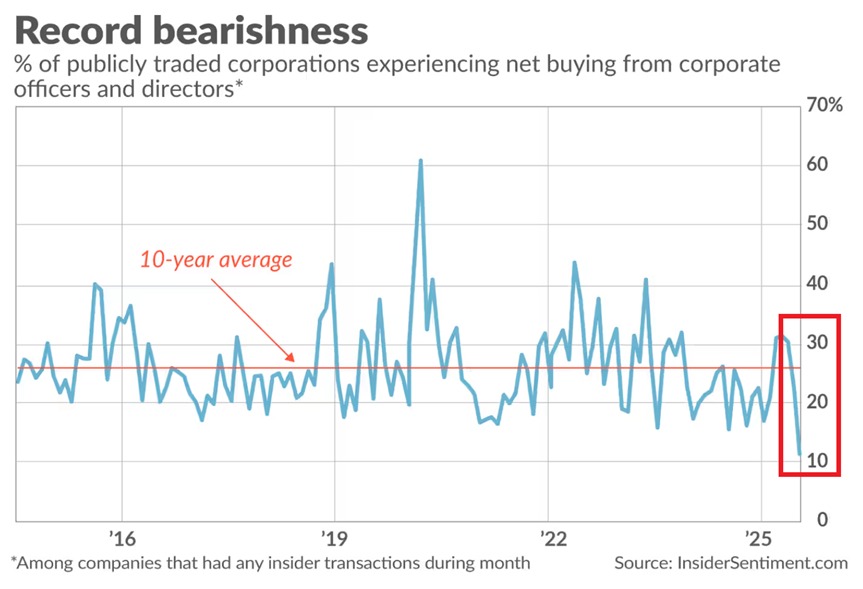

The founder and editor-in-chief of the Kobeissi letter tells Are 948,800 followers on the social media platform X that insiders present excessive aritory in comparison with the inventory market based mostly on information from InsiderSentiment.com, an organization that follows Netto Insider Buy and Gross sales Exercise at US Shares and Sectors.

“Insiders have beforehand been so bearish:

Solely 11.1% of firms with Insider actions see purchase greater than promoting by enterprise officers and administrators, the bottom share that’s registered. Up to now decade, this determine has by no means fallen beneath 15%.

Which means insiders have been internet sellers in nearly 90% of firms with current transactions. Insiders have been impartial or detrimental in 10 out of 11 S&P 500 sectors, the place utilities are the one sector that confirmed a constructive sentiment.

The sale was additionally vast about firm sizes, from small to giant CAP shares. An fascinating divergence. ”

In the meantime, insider sentiment out Company insiders and managers usually beat the market by shopping for the shares of their firm earlier than worrying and promoting costs earlier than the costs fall.

“They obtain a return that’s triple the advertising (common on a horizon of 1 month).”

Observe us on X” Facebook And Telegram

Do not miss a beat – Subscribe to get e -mail notifications on to your inbox

Verify value promotion

Surf the Each day Hodl -Combine

Generated picture: midjourney

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now