Bitcoin

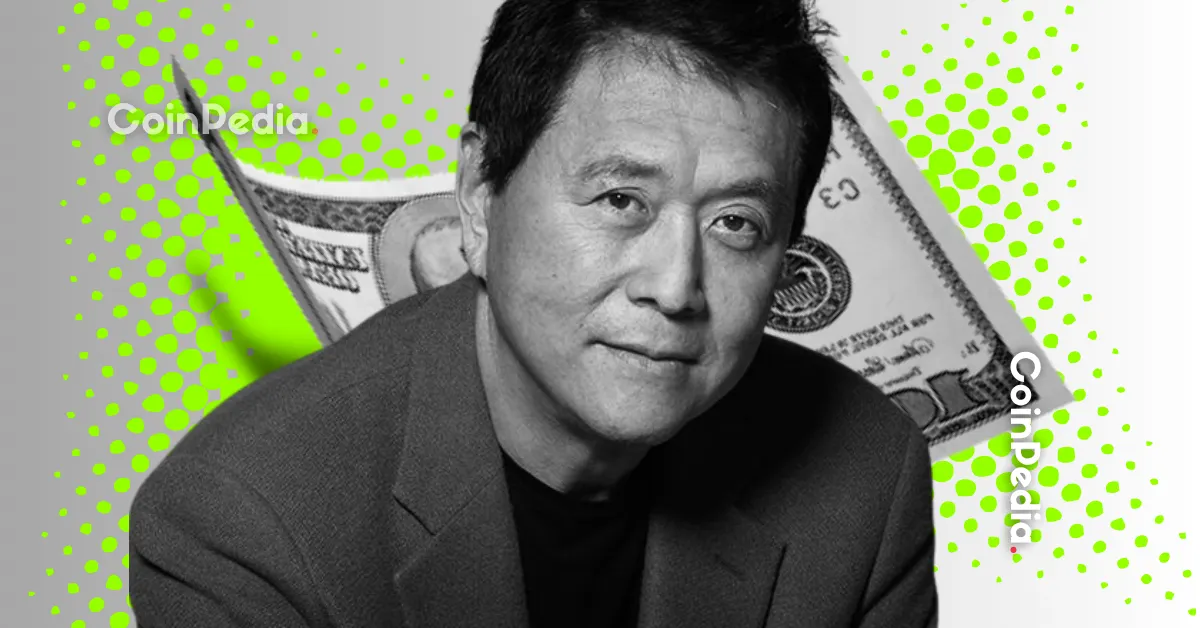

‘Rich Dad Poor Dad’ Author Warns of “End of US Dollar,” Crypto, Gold and Silver to Surge

Credit : coinpedia.org

With markets reaching document highs, traders can believe. However the creator of “Wealthy Dad Poor Dad,” Robert Kiyosaki, has once more warned that conventional financial savings might now not be secure. He factors out the rising dangers in conventional monetary programs and advises traders to show to actual property.

Right here he advises that it is best to make investments as a substitute.

Is the US Greenback Doomed?

In a latest submit on

“END of the US Greenback? Addition to my pile of gold, silver, Bitcoin and Ethereum” he stated, urging individuals to guard their cash by investing in actual property and be “winners”, not “savers” of the USD.

Criticizing the Federal Reserve

Kiyosaki has lengthy criticized the Federal Reserve’s behavior of printing cash to resolve financial crises, arguing that it solely worsens the issue somewhat than fixing it. He has warned that America’s debt-driven economic system is turning into dangerously unstable, constructed on what he calls “faux {dollars}.”

As an alternative of saving money, Kiyosaki urges individuals to spend money on gold, silver and Bitcoin, which he sees as actual, secure and sustainable property throughout financial turmoil.

Forecasts and market alerts

Earlier in June he had warned of the largest monetary crash, which might wipe out hundreds of thousands of traders. He stated that if the markets crash, cash will circulate into gold, silver and Bitcoin. Lately too pointed to Warren Buffett’s sudden reward for gold and silver as a attainable warning signal of an impending crash within the inventory and bond markets and presumably a melancholy.

Kiyosaki has predicted that gold might attain $5,000, silver $500, and Bitcoin $500K to $1 million by 2025. He doubled in Could 2025, to predict gold would attain $25,000.

Bitcoin Rally Stalled, Gold Surges

Bitcoin just lately reached a brand new excessive above $126,000 earlier than falling to round $121,000. Ethereum is presently buying and selling round $4,492, down greater than 3% previously 24 hours.

Whereas Bitcoin’s rally has slowed, gold continues to rise. On Monday, tokenized gold property surpassed $3 billion in market capitalization, whereas bodily gold briefly climbed above $4,000 per ounce for the primary time. The rise is probably going fueled by sturdy inflows into gold-linked ETFs. Gold shares are additionally on a historic run.

- Additionally learn:

- Who Controls the Bitcoin Market in 2025? Possession and provide distribution

- ,

Market highs masks a weak greenback

The Kobeissi letter has highlighted that many property, from secure havens to cryptocurrencies, are hitting all-time highs, pushed not solely by rising asset values but in addition by a weakening US greenback, which has fallen about 10% this 12 months, its worst efficiency in additional than 40 years.

Persistent inflation and anticipated rate of interest cuts additional undermine confidence in fiat forex.

USD reveals power

In the meantime, the USD is gaining power because the USD Index reaches its strongest degree since early August. President Trump just lately stated the US is experiencing “nearly no inflation” as markets attain document highs.

Nevertheless, some specialists see this in another way. A number of Fed officers stay cautious on inflation issues and markets are pricing in additional price cuts this 12 months.

By no means miss a beat within the Crypto world!

Keep knowledgeable with breaking information, professional evaluation, and real-time updates on the newest developments in Bitcoin, altcoins, DeFi, NFTs, and extra.

Steadily requested questions

Whereas the US greenback isn’t collapsing, it’s beneath vital stress: the greenback index is down 10% this 12 months, which market analysts say is the worst efficiency in a long time.

Kiyosaki and different specialists typically advocate inflation-proof property corresponding to gold, silver and Bitcoin to guard buying energy throughout financial uncertainty.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict editorial tips based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We intention to supply well timed updates on the whole lot crypto and blockchain, from startups to trade majors.

Funding disclaimer:

All opinions and insights shared symbolize the creator’s personal views on present market circumstances. Please do your individual analysis earlier than making any funding choices. Neither the author nor the publication accepts duty in your monetary selections.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our website. Adverts are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now