Altcoin

Ripple at a critical moment like Amazon in 1997: Investment Pro

Credit : www.newsbtc.com

This text is on the market in Spanish.

Ripple Labs is approaching an important turning level with a doable preliminary public providing (IPO), a growth that has been speculated for a while. An preliminary public providing may very well be a transformative second paying homage to Amazon.com Inc.’s preliminary public providing (IPO). in 1997. Jake Claver, a Certified Household Workplace Skilled (QFOP), expresses this angle on a wire on X, suggesting that Ripple’s strategic maneuvers might mirror the trajectory that has propelled Amazon into a worldwide tech large.

Based on Claver, the corporate has solidified its place throughout the blockchain ecosystem via its sturdy cross-border fee options, which presently assist greater than 300 monetary establishments worldwide. The corporate’s use of XRP allows transactions which can be considerably sooner and more cost effective in comparison with transactions processed via the Society for Worldwide Interbank Monetary Telecommunication (SWIFT) community. Claver emphasizes: “This positions Ripple as a sooner, extra clear SWIFT 2.0.”

Regardless of these achievements, Ripple has confronted important challenges, most notably its authorized battle with the U.S. Securities and Change Fee (SEC). Nonetheless, latest court docket selections have favored Ripple, probably paving the best way for greater alternatives, together with a public providing. Claver notes: “The latest court docket rulings in favor of Ripple might open doorways to larger alternatives, reminiscent of an IPO.”

Why Ripple Appears Like Amazon in 1997

Drawing a parallel to Amazon’s evolution, Claver famous: “Simply as Amazon was often known as a web based bookstore earlier than its IPO, Ripple is understood for its blockchain options. However there may be potential for rather more.” He additional defined, “When Amazon went public, it raised $54 million, permitting growth into new markets.” Ripple can be poised to unlock probably large progress alternatives via a public itemizing.

Associated studying

Ripple’s strategic acquisitions, together with that of Metaco – now rebranded as Ripple Custody – exhibit its intention to develop its presence out there. Claver notes: “With acquisitions like Metaco, now Ripple Custody, they’re already exhibiting curiosity in increasing their attain. This may very well be only the start.”

The potential implications of Ripple’s alternative of an preliminary public providing (IPO) or a direct itemizing are multifaceted. Claver outlines that an IPO would supply Ripple with new capital, enabling fast scaling and entry to new markets reminiscent of tokenized safety, real-world property (RWAs) and decentralized finance (DeFi). He states: “An IPO would supply Ripple with contemporary capital, permitting them to scale rapidly and enter new markets reminiscent of tokenized securities, RWAs or DeFi.”

Moreover, the inflow of capital from an IPO might facilitate additional acquisitions, permitting the corporate to develop its providing and strengthen its portfolio. Claver makes a direct comparability to Amazon’s acquisitions, noting: “Ripple might use IPO funds to accumulate different corporations and develop its providing. Just like Amazon’s acquisitions of Complete Meals and Twitch, Ripple might enter new markets and strengthen its portfolio.”

Improved monetary sources would additionally enable Ripple to speed up its analysis and growth efforts. Claver explains: “Extra sources would allow Ripple to speed up R&D, enhance the XRP Ledger, and discover new functions reminiscent of sensible contracts, tokenized real-world property, and central financial institution digital currencies (CBDCs).”

Associated studying

Claver distinguishes between the 2 predominant routes to going public: an IPO and a direct itemizing. He explains: “An IPO includes the issuance of recent shares to boost capital, sometimes underwritten by funding banks, however includes prices reminiscent of underwriting charges and regulatory necessities. A direct itemizing, then again, doesn’t contain the issuance of recent shares; as an alternative, present shareholders promote their shares in the marketplace. This methodology is mostly cheaper and sooner than an IPO.”

Given Ripple’s sturdy monetary place, with greater than $1.3 billion in money reserves, Claver suggests a direct itemizing may very well be a viable choice. “Ripple might go for a direct itemizing as a result of it already has a powerful stability sheet,” he mentioned. “A direct itemizing gives transparency and avoids lock-up durations that restrict insider gross sales in a standard IPO.”

Along with the monetary mechanisms, Claver underlines that going public is a legitimizing pressure for Ripple. He attracts a parallel with the Amazon IPO and states: “Amazon’s IPO legitimized e-commerce. For Ripple, a inventory alternate itemizing would legitimize its position within the world monetary world and sign to banks and regulators that the itemizing is right here to remain.”

The latest favorable authorized rulings in Ripple’s case towards the SEC have considerably strengthened its place, making the prospect of a public itemizing extra possible. Claver concludes: “Ripple is at a important juncture, very like Amazon earlier than its 1997 IPO. If Ripple follows an analogous path, we may very well be witnessing the rise of a brand new tech large. Whether or not via an preliminary public providing or a direct itemizing, this transfer might drive important progress for Ripple and the blockchain trade.”

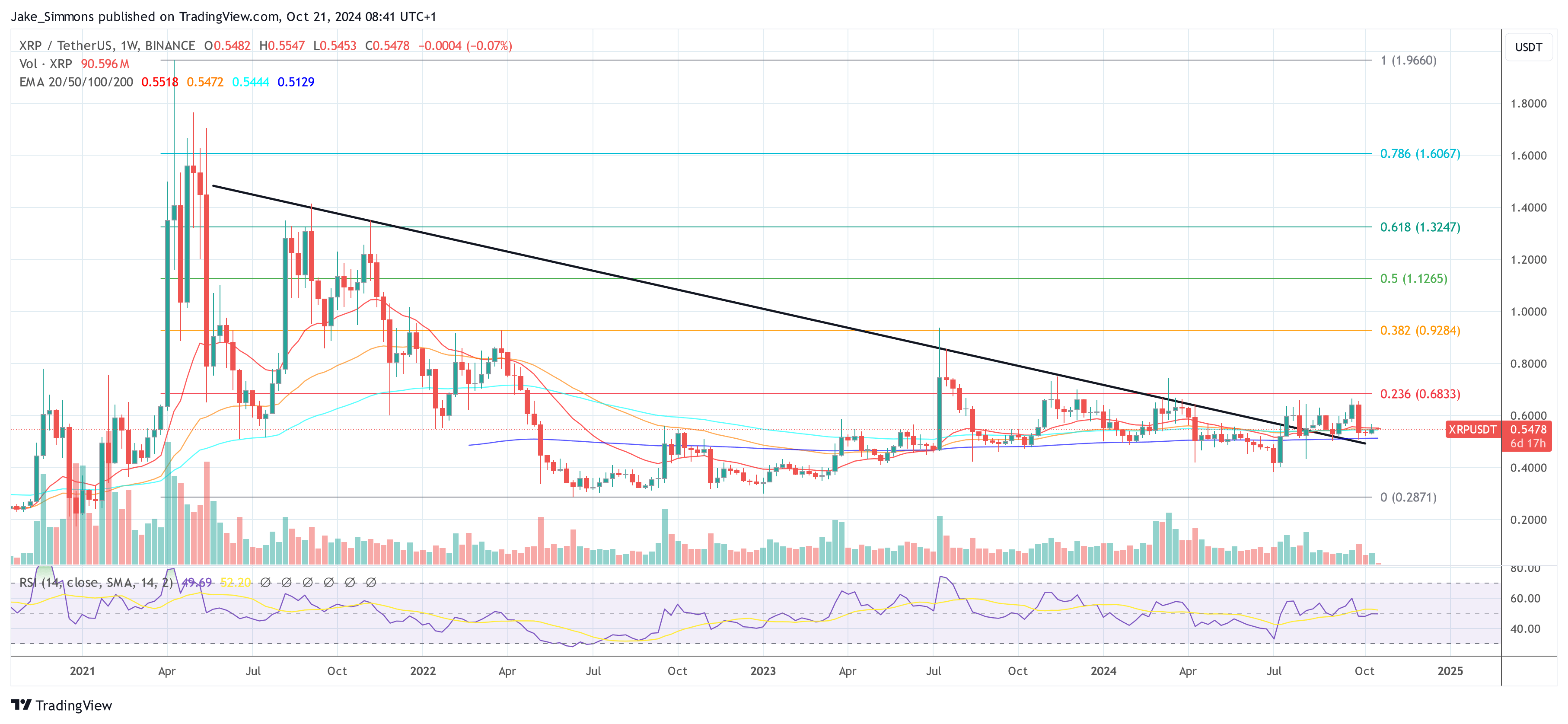

On the time of writing, XRP was buying and selling at $0.5478.

Featured picture from Shutterstock, chart from TradingView.com

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September