Policy & Regulation

Robinhood sues New Jersey, Nevada over sports contract threats

Credit : cryptonews.net

The Robinhood buying and selling platform has sued supervisors in Nevada and New Jersey in an try to steer attainable enforcement measures from the States about his sporting occasion contracts.

In just a few complaints on Tuesday in opposition to Gaming supervisors of Nevada and New Jersey and their legal professionals normal, Robinhood Derivatives mentioned it started to supply the occasion contracts within the States after federal courts made the Kalshi prediction market earlier this yr to supply contracts.

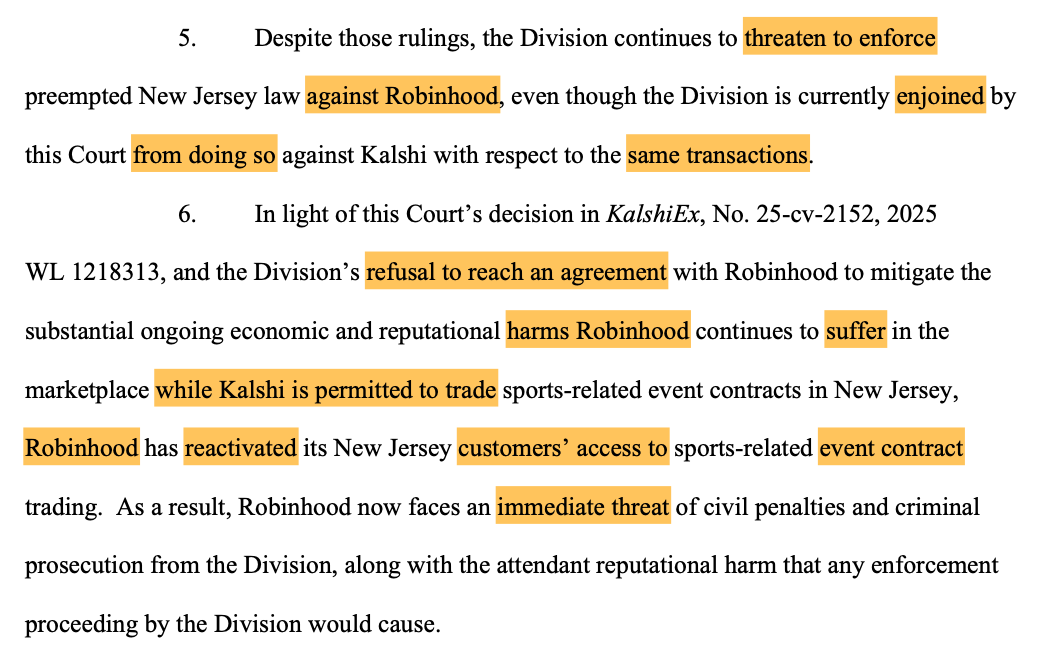

Robinhood claimed in separate lawsuits that after these statements Nevada and New Jersey continued to attempt to cease the corporate, though the courts stopped “doing this in opposition to Kalshi with regard to the identical transactions.”

Kalshi sued in Nevada and New Jersey gaming regulators in March and claimed that Staken-and-Hoofd letters from the States have been disputed on providing its sports activities betting contracts as a result of it’s regulated by the Commodity Futures Buying and selling Fee.

Federal courts in each states selected Kalshi’s facet and stopped the regulators to take enforcement measures in opposition to the corporate. Each lawsuits are nonetheless underway.

Robinhood claims injury if it shouldn’t be allowed to supply contracts

Robinhood claimed that if the regulators are allowed to take motion in opposition to it, however not Kalshi, it can lose on the platform within the sporting occasion contract.

Occasion contracts enable customers to wager on the end result of occasions akin to sports activities video games or election outcomes, and to have their roots in the usage of block chains for transparency and coping with fixing the reality of the contract.

An emphasised fragment of Robinhood’s swimsuit in New Jersey claims that it has opened occasion contracts for commerce; In any other case it will be harmed. Supply: Courtlistener

Robinhood mentioned his platform facilitates the location and liquidation of occasion contracts for his customers, appearing on Kalshi.

It mentioned that, in view of the “refusal of every state to acknowledge what this court docket has already held – that his endangered enforcement of the Research Act might be preceded by the federal legislation – Robinhood had no selection however to make this lawsuit to guard its clients and his actions.”

Regulators refused Robinhood’s arguments

Robinhood claimed in his lawsuits that the gaming controllers from each states have denied his claims that it needed to be allowed to supply occasion contracts after the courts had chosen Kalshi’s facet.

It mentioned in his lawsuit in New Jersey that contact with the Sport Honoration division of the State to elucidate that it needs to be supplied the contracts through Kalshi with the choice of a federal court docket with which Kalshi might provide them.

“Division officers advised Robinhood that they may not conform to chorus from enforcement motion, even whereas the order of this court docket existed about Kalshi,” the corporate mentioned. The accused regulatory officers don’t reply to a request to fulfill the problem, regardless of ‘completely different follow-ups’.

Associated: Banklobby fights to alter the good act: is it too late?

Robinhood mentioned {that a} related state of affairs in Nevada passed off after an area federal court docket had chosen Kalshi’s facet, whereby his criticism claimed that the Gaming Management of the State advised the corporate that if it will contemplate the contracts, it will contemplate “deliberate violations” of the legislation

It mentioned that the supervisor refused his proposal to quickly provide its clients within the state within the state the identical contracts supplied on Kalshi.

In each complaints, Robinhood requested the courts to hold out an order to forestall the supervisors from taking motion in opposition to it and has requested a quickly limiting order in opposition to every.

Journal: Will Robinhood’s tokenized -shares actually take over the world? Execs and cons and downsides

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024