Policy & Regulation

Russia Approves Crypto Tax Law, Redefining Digital Currency Rules

Credit : cryptonews.net

Russia’s new cryptocurrency tax legislation classifies digital currencies as property, exempts mining from VAT and mandates detailed reporting, signaling a seismic shift in regulation.

Russia’s new crypto tax guidelines sign a significant shift in digital forex laws

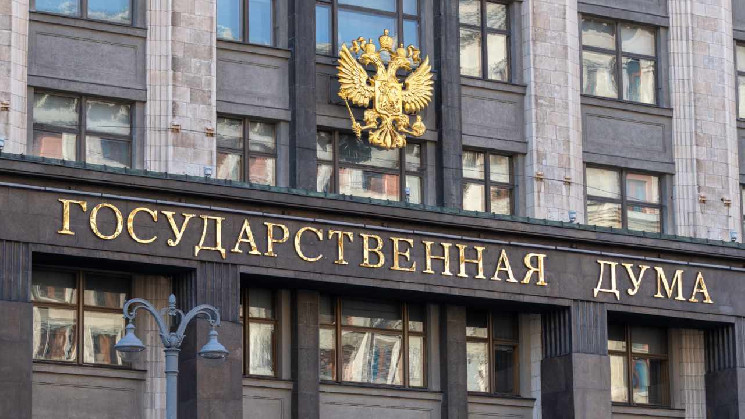

The Federation Council, Russia’s higher home, on Wednesday authorised a government-initiated invoice outlining the tax framework for digital currencies. This laws, which was adopted throughout a plenary session, follows its earlier approval within the Duma, the decrease legislative chamber, the day earlier than.

The brand new legislation classifies digital currencies, together with currencies used as fee devices beneath experimental authorized regimes, as property beneath the Russian Inner Income Code. This classification exempts digital forex mining and gross sales transactions from value-added tax (VAT), easing monetary obligations for trade members. As well as, providers offered by licensed organizations that facilitate transactions inside these experimental regimes can even be exempt from tax.

One key provision requires mining infrastructure operators to report knowledge on people utilizing their methods to tax authorities. Revenues from digital forex mining are acknowledged as taxable revenue and kind the premise for private revenue tax. Corporations engaged in mining actions pays the usual company tax fee, mentioned Danil Volkov, head of the Russian Finance Ministry’s division.

Throughout the legislative course of, a invoice have to be learn a number of instances within the State Duma, obtain approval from the Federation Council, and obtain the president’s signature to turn into legislation. With anticipated approval from President Vladimir Putin, the laws will formally set up an in depth tax framework for digital currencies in Russia.

The legislation displays Russia’s broader initiative to manage the cryptocurrency market amid mounting world criticism. Mining revenue can be taxed based mostly on the worth of property on worldwide exchanges. Private tax charges for digital currencies will stay at 13% for many earners, rising to fifteen% for annual incomes above 2.4 million rubles from 2025. These measures goal to make sure transparency, authorized readability and alignment with nationwide financial targets, selling managed revenue. progress within the sector whereas contributing to authorities revenues.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024