Altcoin

SAND breaks out of bullish pattern, 15% rally in sight?

Credit : ambcrypto.com

- SAND’s Open Curiosity is up 5.6% over the previous 24 hours after a bullish breakout.

- The important thing liquidation ranges had been at $0.255 and $0.27, with merchants over-leveraged at these ranges.

The general cryptocurrency market is experiencing a outstanding restoration.

In the midst of that is the digital gaming platform The Sandbox [SAND] has damaged out of a robust bullish sample and has shifted sentiment from a downtrend to an uptrend.

SAND technical evaluation and key ranges

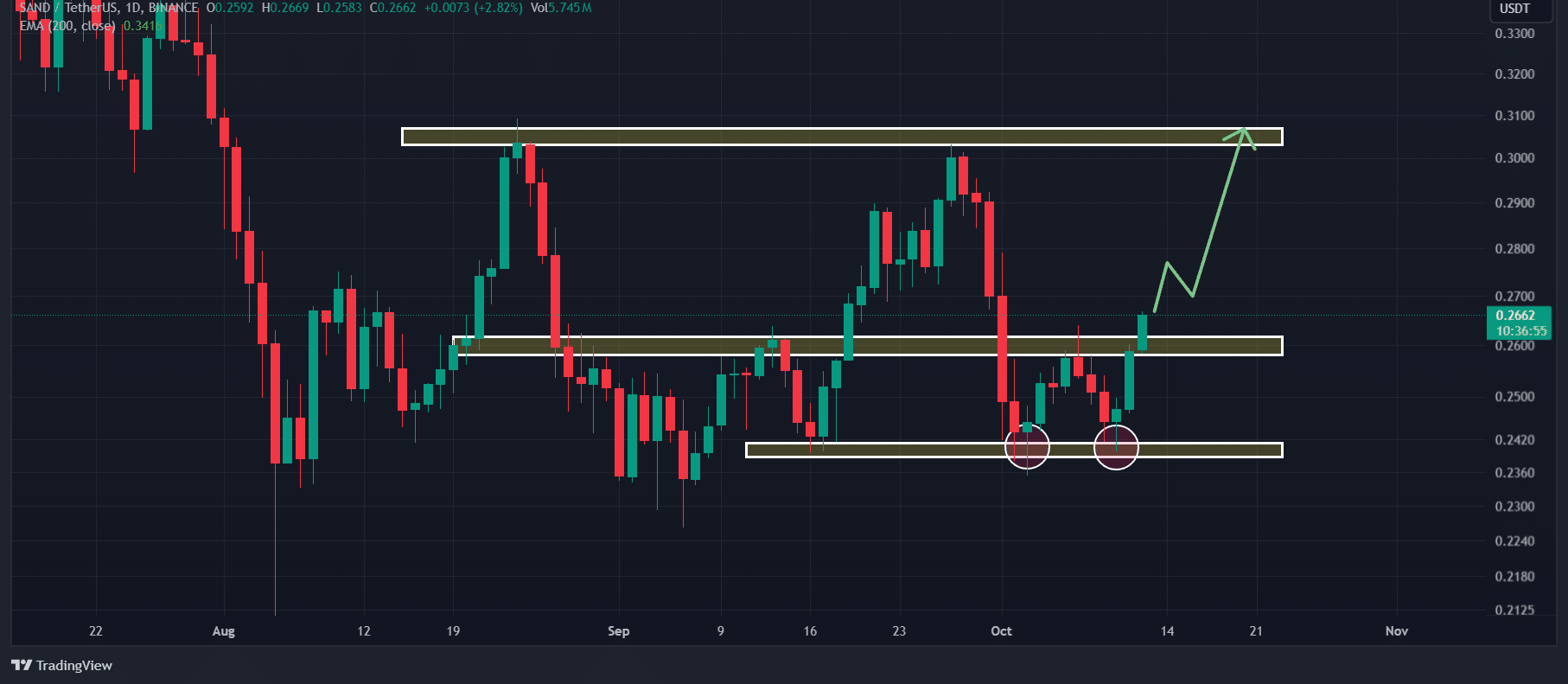

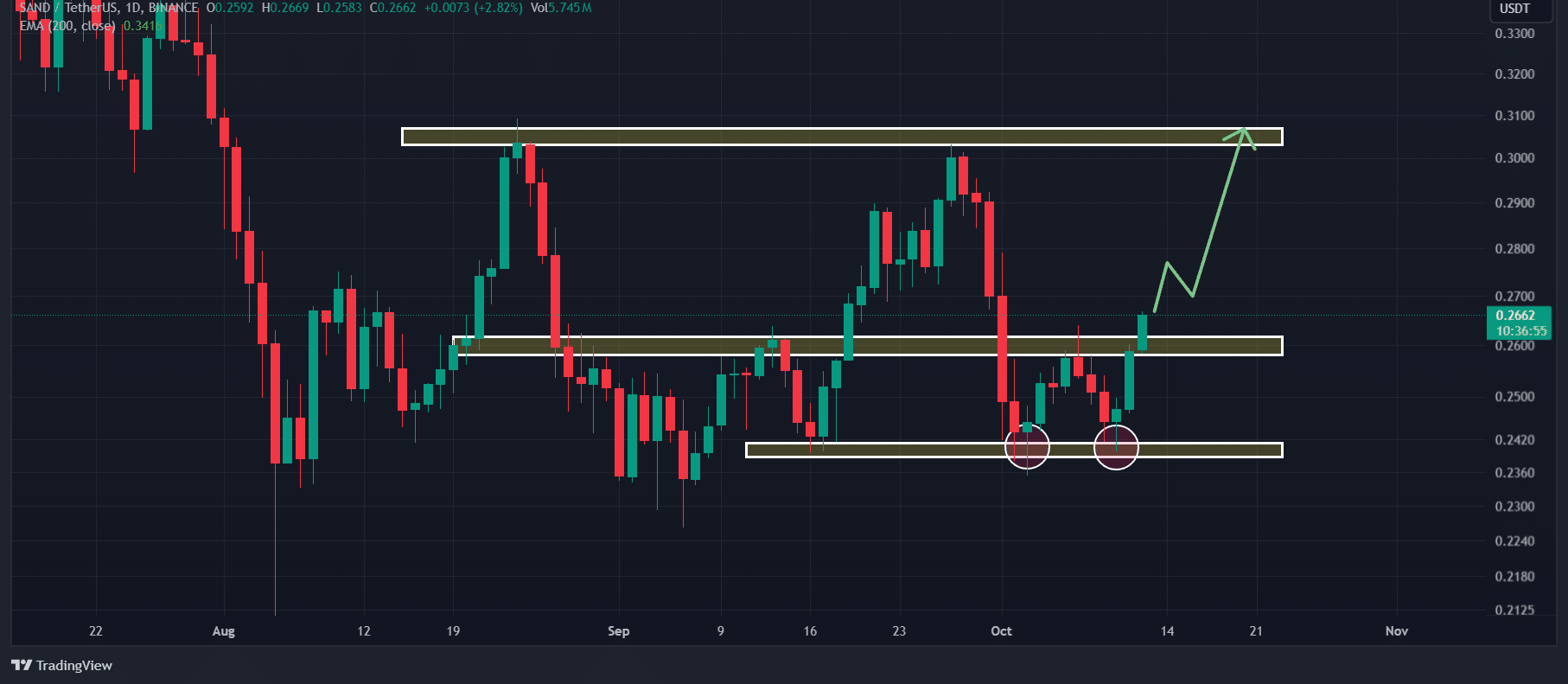

In keeping with AMBCrypto’s technical evaluation, on the time of writing, SAND appeared bullish because it broke out of a double backside value motion sample. The breakout was confirmed by the day by day candle closing above the neckline.

Supply: TradingView

Primarily based on the latest value motion, if SAND closes a day by day candle above $0.264, there’s a excessive probability that the value will rise by 15% to achieve the $0.305 degree within the coming days.

Moreover, SAND’s Relative Energy Index (RSI) stood at 52.30 on the time of writing, indicating a possible upward rally is in retailer.

Regardless of SAND’s bullish outlook, the 200 Exponential Shifting Common (EMA) indicated a downtrend. When an asset trades under the 200 EMA, merchants and buyers usually take into account it to be in a downtrend, and vice versa.

SAND’s bullish on-chain metrics

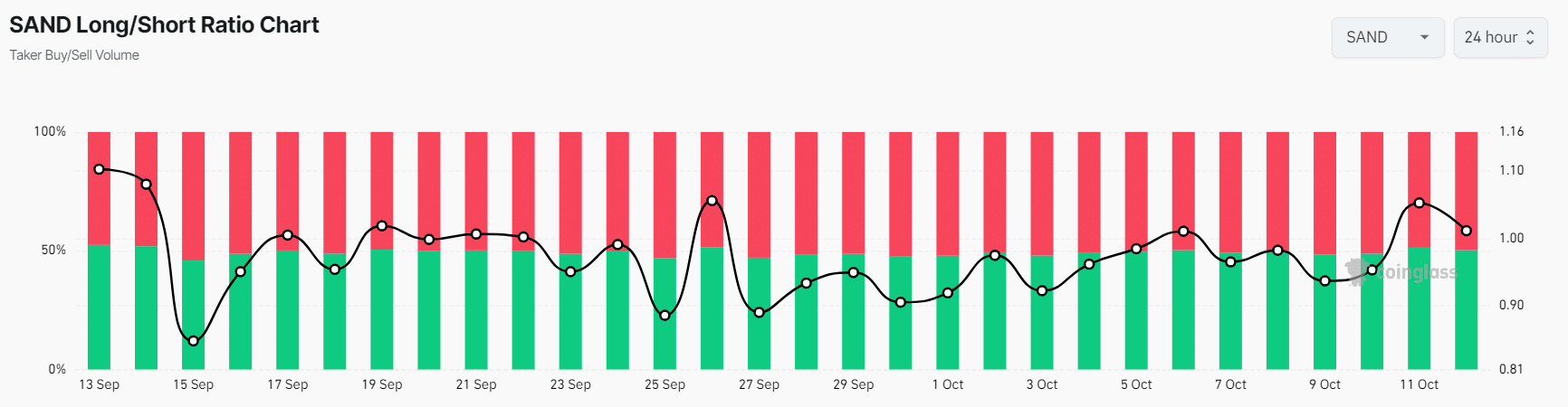

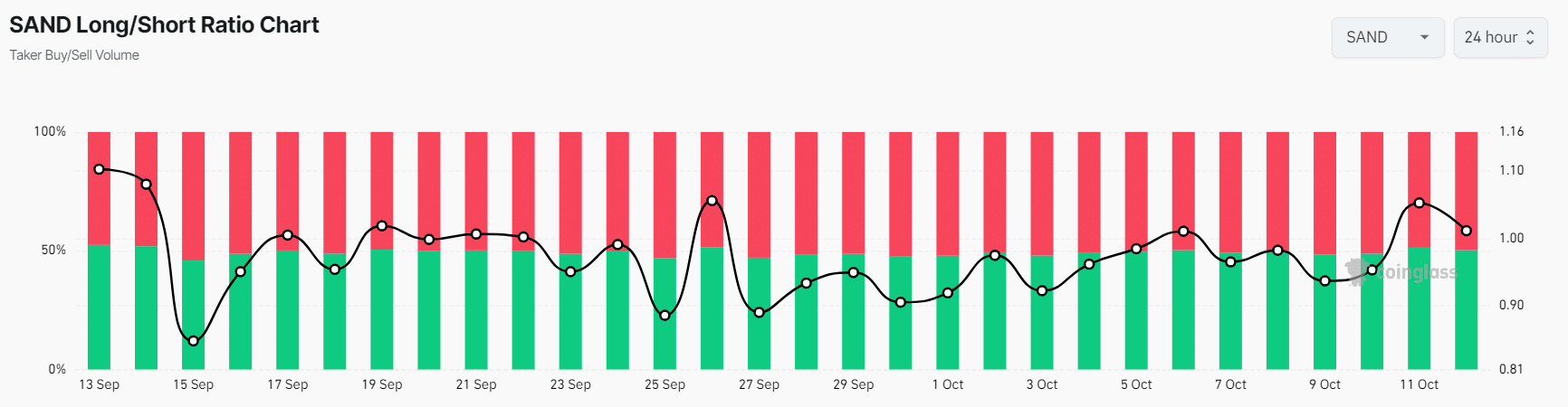

SAND’s bullish outlook is additional supported by on-chain metrics. In keeping with the on-chain analytics firm Mint glassSAND’s lengthy/quick ratio stood at 1.03 on the time of writing, indicating bullish market sentiment.

Supply: Coinglass

Furthermore, the Futures Open Curiosity is up 5.6% within the final 24 hours and three.91% within the final 4 hours.

This steered rising curiosity from merchants within the SAND token after the breakout of the double backside value motion sample.

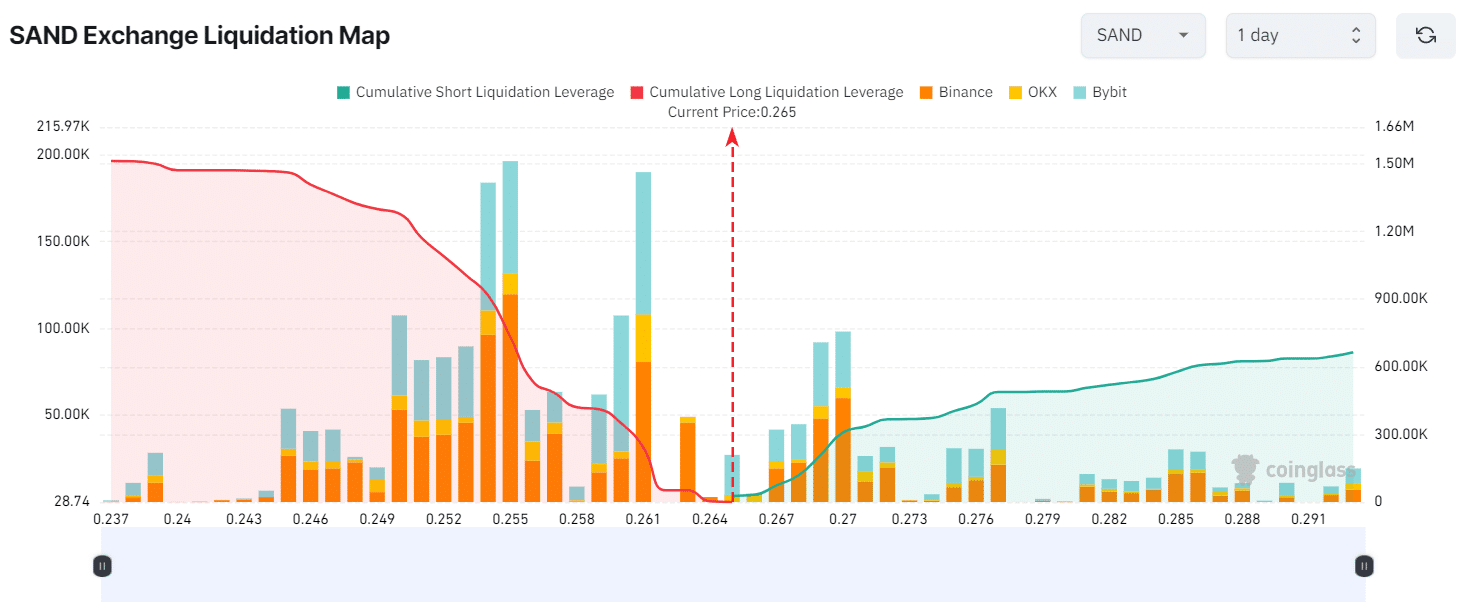

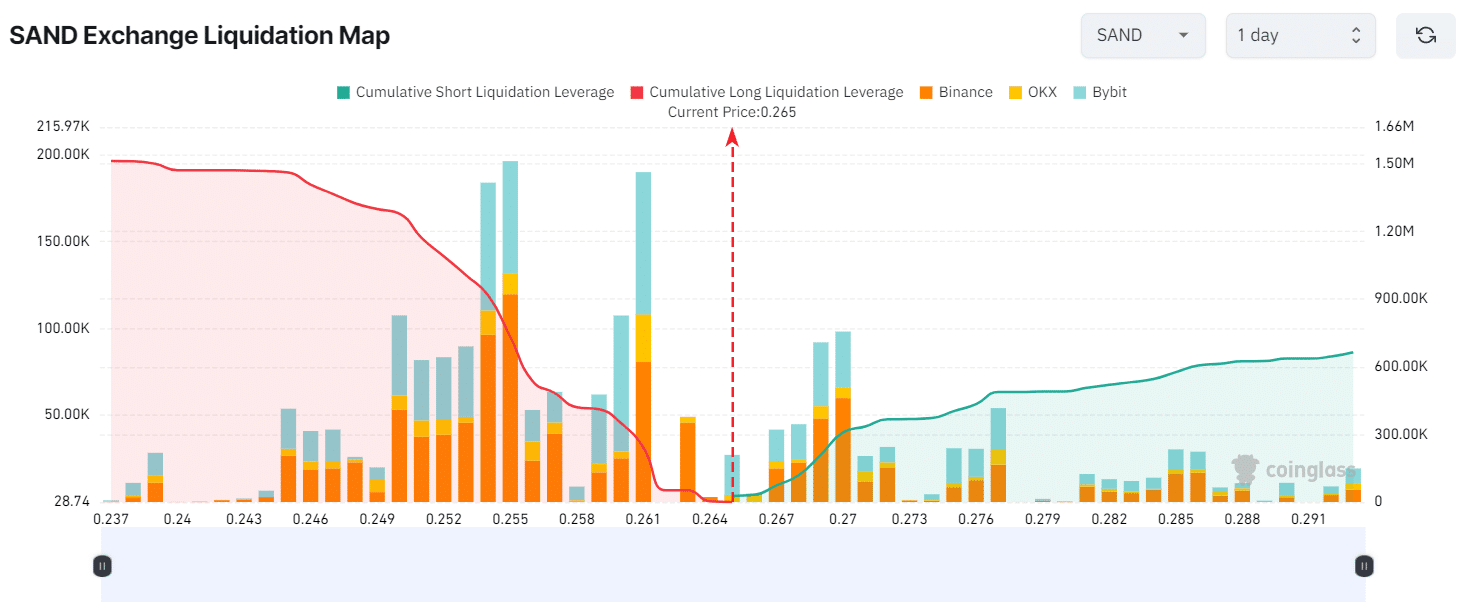

Excessive liquidation ranges

Presently, the important thing liquidation ranges are at $0.255 on the draw back and $0.27 on the upside, with merchants at these ranges being over-leveraged, in line with Coinglass.

Supply: Coinglass

If market sentiment stays unchanged and the value rises to the $0.27 degree, quick positions price nearly $308,620 shall be liquidated.

Conversely, if sentiment adjustments and the value falls to the $0.255 degree, lengthy positions price roughly $732,960 shall be liquidated.

This liquidation information exhibits that bulls’ lengthy positions are greater than double bears’ quick positions.

Combining all these on-chain metrics with technical evaluation, it seems that bulls are at the moment dominating the asset and have the potential to help SAND within the upcoming upside rally.

Learn The Sandbox [SAND] Value forecast 2024–2025

Present value momentum

On the time of writing, SAND is buying and selling round $0.266 and has skilled a value enhance of over 5.2% within the final 24 hours.

Throughout the identical interval, buying and selling quantity fell by 6%, indicating decrease participation from merchants and buyers.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024