Blockchain

Scaling Ethereum with Multi-Chain Tech

Credit : cryptonews.net

Polygon is a Layer 2 blockchain platform that scales Ethereum by processing transactions off-chain earlier than committing checkpoints to Ethereum’s mainnet, enabling quick and low-cost transactions whereas sustaining safety. The platform features as a multi-chain ecosystem that addresses Ethereum’s scalability limitations via varied technical approaches, together with sidechains, plasma chains, and zero-knowledge rollups.

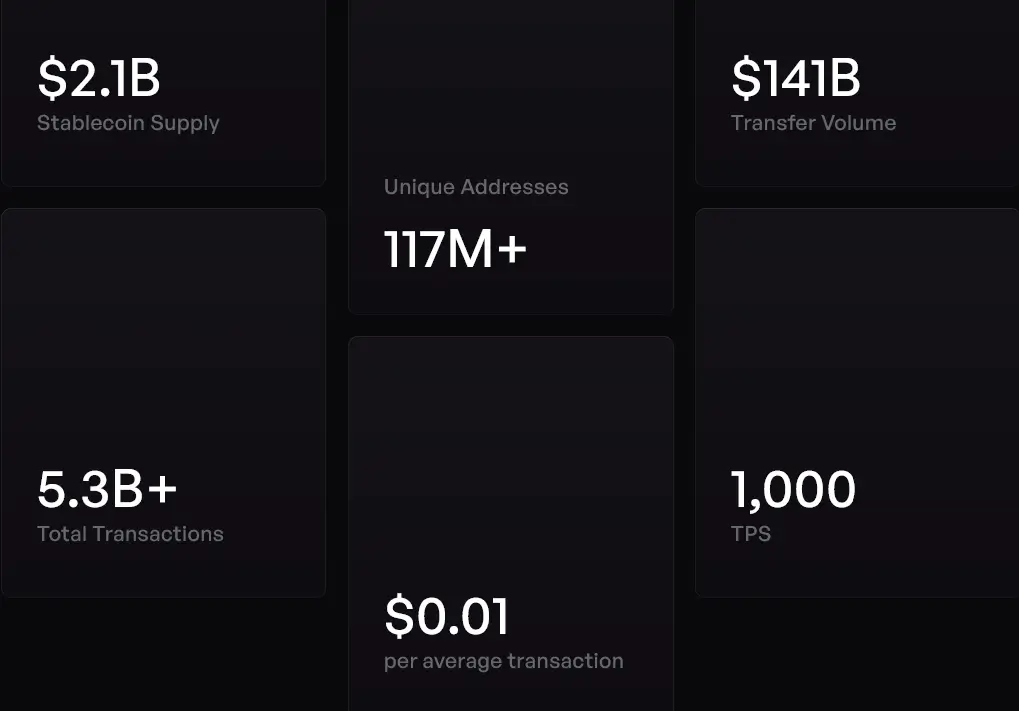

What began as Matic Community in 2017 has grown right into a blockchain infrastructure big. As we speak, Polygon processes 4 million each day transactions throughout 117+ million complete distinctive wallets—greater than most standalone blockchains obtain. The platform hosts $1.13 billion in tokenized real-world property throughout 268+ issuances, whereas sustaining transaction prices averaging $0.01 and attaining a present measured throughput of 1,000 transactions per second.

What Is Polygon and How Does It Scale Ethereum?

Polygon is a Layer 2 scaling answer that processes transactions off-chain earlier than committing periodic checkpoints to Ethereum’s mainnet utilizing Merkle roots. This allows quicker settlement whereas sustaining Ethereum’s safety ensures. Not like Bitcoin’s Lightning Community, which requires channels, or Optimism’s optimistic rollups that assume validity, Polygon combines a number of scaling approaches inside a unified framework.

The technical basis helps sidechains, plasma chains (initially proposed by Vitalik Buterin), zero-knowledge rollups (like zkSync), and validium implementations (much like StarkEx) concurrently. This multi-pronged method contrasts with single-solution rivals, akin to Arbitrum’s optimistic rollups or Base’s OP Stack implementation.

The platform features because the “Worth Layer for the Web” – a multi-chain infrastructure corresponding to how TCP/IP permits web communication.

Core Technical Elements

4 major elements coordinate to ship a complete scaling infrastructure:

- Polygon PoS chain – EVM compatibility with quick transactions that mirror Ethereum’s good contract performance

- zkEVM – Zero-knowledge proofs for enhanced scalability, implementing SNARK expertise for normal computation

- Miden rollup – Privateness-preserving functions utilizing STARK proofs

- Chain Growth Package (CDK) – Permits groups to construct customized Layer 2 options for application-specific blockchains

Current upgrades via Polygon 2.0 have unified these beforehand separate protocols underneath a single architectural framework. The AggLayer v0.2 and Heimdall v2 implementations diminished transaction finality to 4-6 seconds whereas reducing block intervals to 2 seconds, positioning the community for its formidable roadmap goal of 100,000 transactions per second via the Gigagas initiative.

How Did Polygon Evolve From Its Authentic Design?

Polygon’s transformation from a easy sidechain to a complete multi-chain ecosystem represents one among blockchain’s most profitable pivots. The journey spans a number of phases, every marked by strategic choices that formed at this time’s platform.

Early Growth (2017-2020)

Polygon’s journey started in 2017 when Indian builders launched Matic Community in Mumbai as a Plasma-based sidechain. They have been implementing the scaling framework proposed initially by Ethereum co-founder Vitalik Buterin and Lightning Community creator Joseph Poon. The mission represented one of many first sensible implementations of the Plasma whitepaper for Ethereum scaling.

The preliminary mainnet launch in 2020 featured each Proof-of-Stake and Plasma chains designed to deal with totally different transaction sorts. This method was much like Ethereum’s deliberate sharding technique earlier than the community pivoted to rollup-centric scaling. The twin-chain method supplied flexibility however lacked the unified imaginative and prescient that characterizes trendy Layer 2 networks.

Strategic Rebrand and Growth (2021-2022)

The pivotal transformation occurred in February 2021 with the strategic rebrand from Matic to Polygon. This alteration mirrored an growth of ambitions past easy sidechains to embody a number of scaling options, together with zkRollups, Optimistic Rollups, and inter-chain protocols.

Strategic acquisitions accelerated technical capabilities all through 2021 and 2022:

- Hermez Community acquisition – $250 million funding to strengthen zero-knowledge proof capabilities

- Main funding spherical – $450 million raised in 2022 to assist formidable growth targets

- zkEVM testnet launch – Sensible implementation of theoretical scaling options demonstrated

Polygon 2.0 Structure (2023-Current)

The introduction of Polygon 2.0 in 2023 represented probably the most complete architectural evolution since inception. This improve proposed a unified structure with the brand new POL token changing MATIC, together with governance reforms and technical standardization throughout all community elements.

Implementation accelerated via 2024-2025 with key milestones:

- POL migration launch – September 4, 2024, attaining 99.18% completion by August 2025

- Ecosystem growth – Development from 3,000 decentralized functions in 2021 to 120+ CDK-built chains by 2025

- Efficiency enhancements – Enhanced transaction speeds and diminished prices

Who Based Polygon and What Drives Its Management?

The success of any blockchain mission finally is dependent upon the folks behind it. Polygon’s founding staff introduced collectively various experience that proved important for navigating the complicated challenges of constructing scalable blockchain infrastructure.

Founding Group

4 co-founders established Polygon, bringing complementary experience in blockchain engineering, entrepreneurship, and product growth.

Sandeep Nailwal is the present CEO of Polygon Labs. He contributes blockchain programming experience alongside entrepreneurship expertise from founding well being expertise startups. His enterprise growth expertise proved essential in securing main company partnerships, which display institutional confidence within the platform.

Jaynti Kanani served as the unique CEO, bringing deep blockchain engineering expertise, with a selected experience in Ethereum protocol growth and Web3 infrastructure.

Anurag Arjun centered on product administration as former Chief Product Officer, guaranteeing technical capabilities translated into developer-friendly instruments and consumer experiences.

Mihailo Bjelic contributed experience in info methods engineering, important for scalable infrastructure design, significantly in addressing multi-chain coordination challenges.

Present Organizational Construction

The founding staff’s composition contains three Indian-origin founders and one Serbian founder, reflecting a world perspective from inception. This worldwide method proved advantageous for constructing relationships throughout totally different regulatory environments and market circumstances.

The present organizational construction divides obligations throughout three specialised entities:

- Polygon Labs – Growth and technical development

- Polygon Basis – Analysis, training, and governance initiatives

- Polygon Ecosystem – Grants and neighborhood growth with 1 billion POL tokens allotted for neighborhood grants in 2025

Technical management contains notable blockchain builders like Daniel Lubarov, Antoni Martin, Jordi Baylina, Bobbin Threadbare, and Brendan Farmer. This expanded staff brings specialised experience in zero-knowledge proofs, cryptographic safety, and scalable blockchain structure.

What Expertise Makes Polygon Totally different From Rivals?

Polygon’s technical structure units it aside from different Layer 2 options via a number of key improvements that tackle elementary blockchain limitations. Somewhat than specializing in a single scaling method, the platform combines a number of applied sciences to create a complete infrastructure answer.

Zero-Data Proof Implementation

Polygon’s technical differentiation facilities on zero-knowledge proofs and multi-chain validation capabilities that distinguish it from single-purpose scaling options like Optimism or Arbitrum. The platform’s ZK-based options allow considerably greater throughput whereas pessimistic proofs present extra safety layers for complicated cross-chain operations.

Zero-knowledge proof implementation extends past easy transaction verification to allow complicated privacy-preserving functions. The system helps confidential transactions whereas sustaining community auditability, addressing regulatory necessities that have an effect on privacy-focused options like Monero or Zcash.

Multi-Chain Validation and Staking

The multi-role validator system represents elementary innovation in blockchain staking economics. Validators can stake throughout totally different chains throughout the ecosystem concurrently, maximizing capital effectivity in comparison with conventional single-chain fashions.

The POL token serves as a “hyperproductive token,” fulfilling a number of simultaneous functions throughout the ecosystem. Token holders use POL for fuel funds, take part in staking rewards throughout a number of chains, and interact in governance choices.

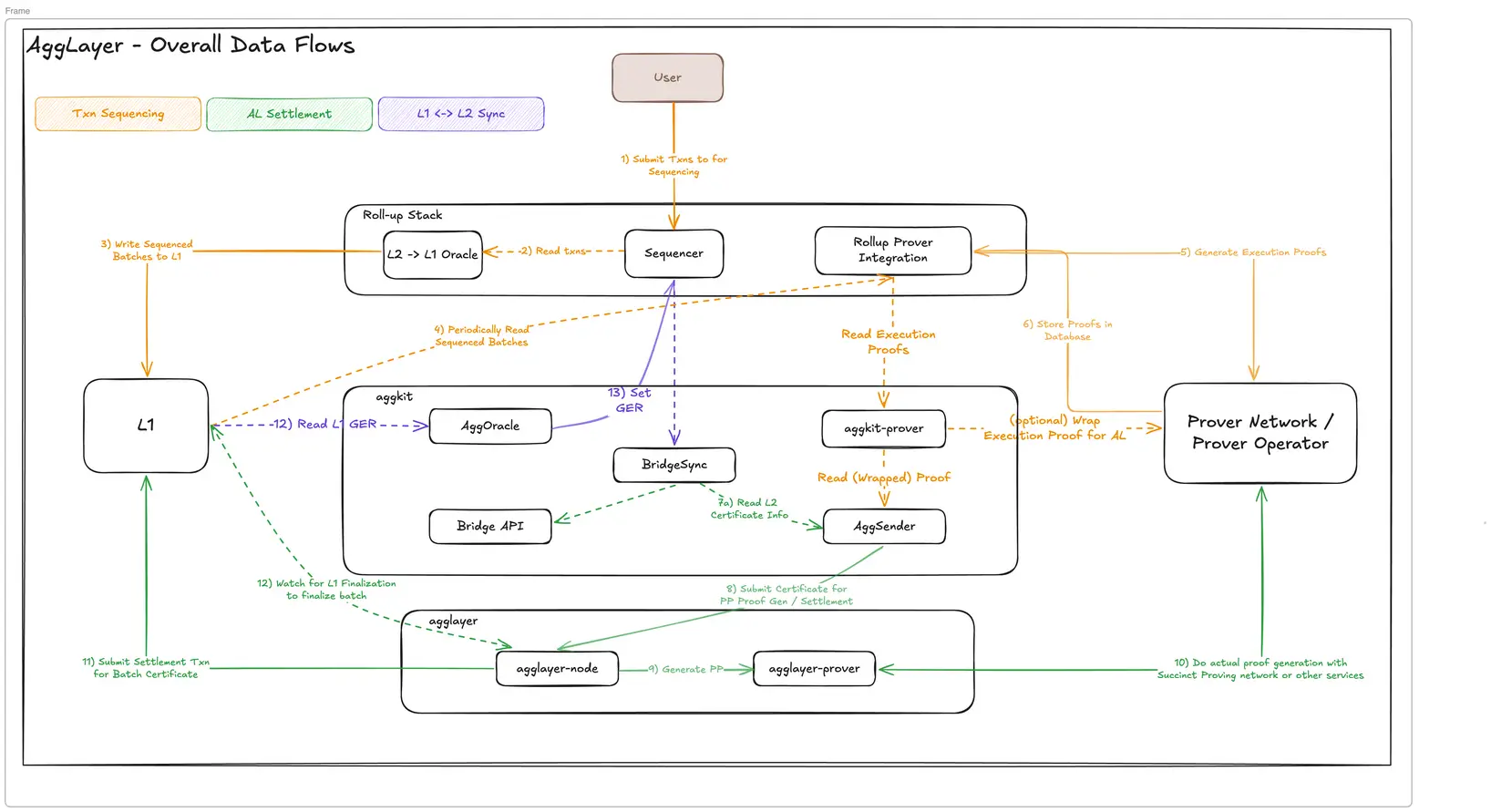

AggLayer Innovation

The AggLayer represents Polygon’s most vital innovation for addressing blockchain interoperability challenges. This technique features as a liquidity aggregation protocol that connects a number of chains with out requiring belief assumptions between validators. This method differs from conventional bridge protocols that require separate validator units, as an alternative creating unified liquidity swimming pools accessible throughout linked networks.

AGGlayer infrastructure visible (AGGlayer docs)

Privateness and Safety Options

Privateness and safety enhancements embrace native execution capabilities in Miden for functions requiring enhanced confidentiality. The implementation of EIP-1559 payment market enhancements offers extra predictable transaction prices in comparison with the straightforward auction-based methods utilized by earlier blockchain networks.

Superior cryptographic strategies allow functions that require each transparency and selective privateness, addressing the elemental blockchain trilemma of scalability, safety, and decentralization via mathematical proofs quite than relying solely on financial incentives.

How Massive Has Polygon’s Ecosystem Grown?

The true measure of any blockchain platform lies not in its technical specs however in real-world adoption. Polygon’s ecosystem demonstrates substantial progress throughout a number of software classes, with explicit power in areas requiring excessive transaction throughput and low prices.

Decentralized Finance Functions

The platform at the moment hosts over 120 chains constructed utilizing the Chain Growth Package. This represents vital adoption of its infrastructure-as-a-service method.

Decentralized finance functions lead adoption metrics, with established platforms sustaining vital worth locked in good contracts. Quickswap, the most important decentralized trade on Polygon, holds a complete worth locked of $398 million (Sept. 2025) whereas processing hundreds of each day transactions at considerably decrease prices in comparison with Uniswap on the Ethereum mainnet.

Gaming and NFT Platforms

Gaming functions leverage Polygon’s price benefits for in-game transactions, NFT minting, and complicated good contract interactions that will be prohibitively costly on Ethereum. Tasks like Decentraland, The Sandbox, and Aavegotchi display sensible blockchain gaming functions requiring frequent micro-transactions with blockchain possession ensures.

NFT platforms profit from cost-effective minting and buying and selling capabilities supporting each particular person creators and large-scale industrial operations. The Instagram integration resulted in 2.5 million pockets creations, demonstrating mainstream accessibility for customers with out prior cryptocurrency expertise.

Actual-World Asset Tokenization

Actual-world asset tokenization represents the fastest-growing software class with $1.13 billion in property tokenized throughout 268+ distinct issuances. These functions span a number of asset courses:

- Authorities securities and municipal bonds

- Actual property funding automobiles and REITs

- Commodity-backed tokens together with gold and agricultural merchandise

- Company debt devices and commerce finance

- Infrastructure mission financing and inexperienced bonds

Enterprise and Authorities Partnerships

Enterprise partnerships display institutional confidence spanning a number of industries. Meta built-in Polygon for Instagram NFT performance, enabling hundreds of thousands of customers to work together with blockchain expertise via acquainted social media interfaces. Starbucks carried out loyalty applications utilizing blockchain expertise, whereas Reddit deployed neighborhood tokens for subreddit governance. JPMorgan constructed buying and selling functions leveraging Polygon’s infrastructure, and Fox Community makes use of it for content material distribution. Flipkart’s built-in e-commerce options display sensible adoption by conventional companies.

Authorities adoption showcases public sector confidence with the Philippines’ funds tokenization mission representing the most important authorities blockchain implementation so far. The Division of Finances and Administration launched this absolutely operational system in July 2025, utilizing Polygon to notarize and publicly monitor key funds paperwork together with Particular Allotment Launch Orders and Notices of Money Allocation. This software demonstrates sensible use instances for public finance administration, transparency, and audit capabilities that conventional methods can’t present.

What Are POL Tokenomics and How Do They Work?

Polygon’s financial mannequin underwent a elementary transformation with the introduction of POL tokens. This shift represented greater than a easy rebrand—it established the muse for multi-chain operations and sustainable ecosystem progress.

Token Provide and Distribution

The $POL token changed MATIC in 2024 because the cornerstone of Polygon 2.0’s unified tokenomics mannequin. This design helps multi-chain validation and ecosystem growth.

Not like MATIC’s fastened 10 billion token provide, POL options an infinite provide mechanism. This allows sustainable long-term community progress with out synthetic shortage constraints. Nonetheless, community charges partially burn POL tokens underneath particular circumstances, creating deflationary stress that helps stability the infinite provide mechanism in periods of excessive exercise.

Present circulation: 10.49 billion POL tokens as of September 2025

Authentic MATIC distribution construction:

- Ecosystem growth initiatives: 23.33%

- Basis operations: 21.86%

- IEO buyers: 19%

- Group members: 16%

- Staking rewards: 12%

- Advisors: 4%

- Personal buyers: 3.8%

This represents a extra balanced distribution than many initiatives the place groups and early buyers maintain majority stakes.

Migration Course of

The migration course of from MATIC to POL achieved 99.18% completion by August 2025 via a simple good contract swap mechanism, preserving all holder balances and staking positions. This technical achievement demonstrates the community’s means to execute complicated protocol upgrades with out disrupting consumer expertise or safety.

Multi-Chain Staking Mannequin

Staking mechanisms allow POL holders to safe a number of networks concurrently quite than limiting participation to single-chain validation. This implements ideas much like shared safety fashions. The multi-role validation system creates alternatives for greater yields and improved capital effectivity. At the moment, 2.55 billion tokens are locked in staking.

Governance and Treasury Administration

The governance framework advanced from centralized decision-making to community-driven proposals via Polygon Enchancment Proposals (PIPs). Token holders take part in protocol choices, useful resource allocation, and technical improve approvals via clear voting mechanisms.

Group treasury administration demonstrates sensible governance with the allocation of 1 billion POL tokens for grants in 2025, supporting:

- Developer incentives and recruitment

- Ecosystem progress initiatives

- Analysis initiatives and innovation

- Public items growth

Offering a sustainable funding mannequin for long-term ecosystem growth.

1 Billion POL tokens neighborhood Grants program (Polygon.technolgy)

Financial Mechanisms

Protocol emissions supply sustainable incentives for community safety via validator rewards, supplemented by extra income streams from linked chains that course of stablecoin transactions. Community charges partially burn POL tokens underneath particular circumstances, creating deflationary stress that balances the infinite provide mechanism in periods of excessive exercise.

How Does Polygon’s Governance System Perform?

Efficient governance represents one among blockchain’s best challenges. Polygon strives to strike a stability between neighborhood participation and the technical experience essential for making complicated infrastructure choices.

Proposal and Determination-Making Course of

Polygon makes use of a decentralized governance mannequin, placing a stability between neighborhood participation and the technical experience essential for complicated blockchain infrastructure choices. The system acknowledges that blockchain networks require each democratic enter and specialised data for optimum operation.

The Polygon Enchancment Proposal system permits any neighborhood member to counsel protocol modifications, ecosystem enhancements, or useful resource allocation modifications. Proposals progress via structured evaluation phases, together with technical analysis, neighborhood dialogue, and formal voting processes.

Three-Pillar Governance Construction

The three-pillar governance construction underneath Polygon 2.0 encompasses:

- Protocol growth – Technical upgrades and infrastructure enhancements

- Tokenomics – POL provide, distribution, and utility choices

- Group oversight – Useful resource allocation and ecosystem course

POL holders take part in staking choices and voting processes, whereas technical choices require extra enter from certified builders and researchers with related experience. This creates checks and balances between totally different stakeholder teams.

Ecosystem Council Position

The Ecosystem Council serves as a specialised technical physique answerable for good contract upgrades and protocol safety choices. This construction strikes a stability between broad neighborhood enter and the concentrated technical experience required for complicated modifications that would influence community safety or performance.

Implementation and Security Measures

Implementation of governance choices follows established timelines and procedures designed to forestall hasty modifications that would compromise community stability:

- Prolonged dialogue durations for main protocol upgrades

- Technical audits earlier than implementation

- Staged deployment processes enabling thorough testing

Following the most effective practices established by crucial infrastructure initiatives.

Sensible Governance Examples

Group treasury administration is probably the most seen facet of governance in follow, demonstrating the system’s means to make vital monetary choices via collaborative processes that incorporate various stakeholder views. This creates accountability mechanisms for useful resource allocation choices.

Validator governance addresses community safety and operational issues via mechanisms enabling validator enter on technical parameters. These choices have an effect on block manufacturing, transaction processing, and community improve coordination, requiring specialised operational data.

Transparency and Accountability

Transparency mechanisms guarantee governance choices and their implementation stay seen to all stakeholders. Common studies, public discussions, and open growth processes allow neighborhood oversight of each technical growth and useful resource allocation choices.

What Current Developments Are Shaping Polygon’s Course?

Polygon’s growth tempo accelerated considerably from 2024 to 2025, marked by main technical milestones and increasing real-world adoption. These latest developments present perception into the platform’s strategic course and execution capabilities.

Technical Infrastructure Upgrades

Current protocol upgrades display Polygon’s means to execute complicated technical transitions whereas sustaining operational continuity. The transition of the unique PoS chain to zkEVM validium structure enhances safety properties whereas sustaining backward compatibility with current functions.

Structure Transitions:

- PoS to zkEVM validium – Enhanced safety properties whereas sustaining backward compatibility

- AggLayer v0.2 deployment – Lowered transaction finality to 4-6 seconds

- Heimdall v2 implementation – Reduce block intervals to 2 seconds for improved consumer expertise

Multi-Chain Ecosystem Development

AggLayer adoption accelerated considerably with 120+ chains connecting to the aggregated liquidity system all through 2025. This progress demonstrates market demand for interoperable blockchain infrastructure and validates Polygon’s strategic give attention to multi-chain coordination quite than single-chain optimization.

Actual-World Functions Growth

Actual-world asset tokenization progress exceeded expectations with $1.13 billion in property tokenized throughout 268+ issuances by September 2025. This adoption demonstrates institutional confidence in blockchain infrastructure for conventional finance functions.

Asset Tokenization Milestones:

- $1.13 billion in property tokenized throughout 268+ issuances by September 2025

- Authorities securities, actual property, commodities, and company debt devices

- Institutional confidence in blockchain infrastructure for conventional finance functions

Authorities and Enterprise Adoption

Authorities blockchain adoption exhibits accelerating momentum, significantly in funds administration and public finance functions. The Philippines mission serves as a profitable mannequin for different jurisdictions contemplating blockchain implementation for enhanced transparency and operational effectivity.

Strategic partnerships proceed to develop with enterprise shoppers implementing blockchain options tailor-made to particular enterprise necessities. These relationships present sustainable income streams whereas demonstrating sensible blockchain functions that stretch past speculative buying and selling or easy token transfers.

Efficiency and Scalability Roadmap

The Gigagas roadmap progress towards 100,000 transactions per second continues via systematic technical optimizations and architectural enhancements. These developments purpose to realize efficiency ranges corresponding to these of conventional cost processors.

Key growth areas embrace:

- zkEVM mainnet deployment – Enhanced zero-knowledge proof capabilities

- Miden rollout growth – Privateness-preserving functions for specialised use instances

- Efficiency targets – Aiming for throughput ranges corresponding to conventional cost processors

Present Polygon metrics (polygon.expertise)

What Challenges Does Polygon Face in As we speak’s Market?

Regardless of its technical achievements and rising adoption, Polygon faces a actuality test in 2025. The Layer 2 panorama has change into fiercely aggressive, and the numbers inform a narrative that Polygon’s management cannot ignore.

Aggressive Strain Metrics

Base has emerged because the elephant within the room. Coinbase’s Layer 2 answer leads with 21.7 million month-to-month energetic addresses versus Polygon’s 5.96 million—a spot that is solely widening due to Coinbase’s huge consumer base and advertising and marketing muscle. Whereas Polygon boasts 117+ million complete distinctive wallets, the truth is that solely a fraction stay actively used, a standard sample throughout blockchain networks that reveals the distinction between hype and sustained engagement.

The entire worth locked additionally exhibits some crucial observations. Arbitrum maintains $3.22 billion in comparison with Polygon’s $1.2 billion as of September 2025. These aren’t simply numbers—they characterize actual developer and consumer preferences voting with their wallets.

Efficiency Issues

The aggressive stress exhibits up in Polygon’s personal metrics, and the traits aren’t encouraging. Lively addresses dropped 12% in Q1 2025, whereas payment income plummeted 38% to only $835,000. Weekly decentralized trade quantity fell 20% to $1.2 billion, suggesting customers are migrating to options that supply higher liquidity or consumer expertise.

These declines matter as a result of they create a adverse suggestions loop. Decrease exercise means much less payment income, which impacts the platform’s means to fund growth and compete with well-funded rivals.

Technical and Operational Challenges

Centralization issues persist regardless of ongoing decentralization efforts:

- High 10 token holders management roughly 88% of the availability (although most are good contracts and trade pockets addresses)

- High 5 validators management 47% of staked POL

- Validator set stays capped at simply 100 contributors

This creates extra centralization than rivals like Ethereum’s proof-of-stake system.

Technical debt from speedy growth creates its personal issues. The platform should assist legacy infrastructure whereas implementing next-generation options, forcing troublesome tradeoffs between backward compatibility and innovation. Useful resource allocation turns into a zero-sum sport if you’re attempting to take care of outdated methods whereas constructing new ones.

Regulatory uncertainty provides one other layer of complexity. As governments worldwide develop blockchain insurance policies, compliance necessities fluctuate dramatically throughout jurisdictions. For a world platform serving various markets, this creates operational complications that smaller, extra centered rivals can keep away from.

How Is Polygon Addressing These Aggressive Pressures?

Somewhat than merely acknowledging challenges, Polygon has carried out particular methods to take care of and develop its market place. The method focuses on technical differentiation and sustainable aggressive benefits that rivals can’t simply replicate.

Technical Differentiation Technique

Polygon’s response to aggressive challenges focuses on technical differentiation via superior zero-knowledge proof implementation and distinctive aggregated liquidity options that rivals can’t simply replicate.

The AggLayer particularly addresses fragmentation issues by enabling seamless cross-chain liquidity sharing with out requiring guide asset bridging. This creates technical benefits via proprietary infrastructure and ecosystem integration.

Core Aggressive Benefits:

- AggLayer implementation – Seamless cross-chain liquidity sharing with out guide asset bridging

- Multi-chain validation – Community results that strengthen as extra chains hook up with the ecosystem

- Zero-knowledge proofs – Superior cryptographic options for scalability and privateness

Multi-Chain Community Results

The multi-chain validation mannequin creates sustainable aggressive benefits via community results that strengthen as extra chains hook up with the ecosystem. Every extra chain will increase the worth proposition for validators and customers whereas creating greater obstacles to exit in comparison with single-chain options.

Efficiency and Effectivity Enhancements

Protocol effectivity enhancements via systematic upgrades display dedication to technical development regardless of market pressures. These present measurable efficiency enhancements whereas decreasing operational prices for customers and builders.

Current technical achievements embrace:

- zkEVM validium transition – Enhanced safety with maintained compatibility

- Heimdall v2 implementation – Quicker transaction processing and diminished prices

- AggLayer optimization – Improved cross-chain liquidity aggregation

Strategic Market Positioning

Strategic positioning in real-world asset tokenization and authorities functions creates defensible market niches that require regulatory compliance and technical reliability. These use instances favor established platforms with confirmed monitor data over newer options that lack operational historical past and established regulatory relationships.

This creates switching prices for enterprise shoppers via compliance certifications and integration complexity.

Defensible Market Niches:

- Actual-world asset tokenization – Regulatory compliance and technical reliability necessities

- Authorities functions – Confirmed monitor report and institutional relationships

- Enterprise partnerships – Sustainable income via precise utility quite than hypothesis

Developer Ecosystem Funding

The neighborhood treasury’s allocation of 1 billion POL tokens for grants and ecosystem growth creates highly effective incentives for developer retention and attracting new initiatives. The funding permits aggressive compensation for high builders whereas supporting progressive initiatives which may not obtain conventional enterprise capital funding.

The method implements methods utilized by main expertise firms to take care of ecosystem management.

Group Funding Technique:

- 1 billion POL grant allocation – Aggressive compensation for high builders

- Ecosystem growth – Help for progressive initiatives missing conventional VC funding

- Developer instruments – Enhanced infrastructure and documentation

Innovation and Analysis Focus

Technical innovation continues via analysis and growth investments in next-generation scaling options. The Gigagasroadmap and superior cryptographic implementations place Polygon for future market cycles whereas addressing present efficiency limitations.

Evolution of governance towards real decentralization addresses issues about centralization via a scientific redistribution of energy and affect. Group treasury management and validator diversification initiatives work to cut back focus dangers over time.

Conclusion

Polygon has grown from an experimental Ethereum sidechain right into a multi-chain platform that really works. The numbers communicate for themselves: 4 million each day transactions throughout 117+ million wallets, with charges averaging only one cent. The platform maintains $1.2 billion in complete worth locked throughout DeFi protocols and $1.13 billion in tokenized real-world property.

The platform’s true power lies in its sensible functions quite than its guarantees. Firms like Meta and Starbucks put it to use for real-world merchandise, governments just like the Philippines run funds methods on it, and $1.13 billion in conventional property now reside on Polygon chains. The profitable MATIC to POL token migration, reaching 99.18% completion, demonstrated that the staff can execute complicated technical upgrades with out compromising stability—no small feat in blockchain.

Go to the official Polygonweb site and comply with@0xPolygon on X for updates.

Sources:

- Polygon Labs Official Documentation

- DeFiLlama – Polygon market knowledge

- CoinMarketCap – Market and token knowledge

- Polygon Basis – Polygon Group Treasury Board and Governance Framework.

- Philippines Division of Finances and Administration – Blockchain Implementation

- RWA.xyz – Polygon Community Knowledge

- Official Polygon X account – Current updates

- Wikipedia – Polygon

- Agglayer – documentation

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024