Policy & Regulation

SEC crypto fines spiked 3,018% in one year

Credit : cryptonews.net

The SEC’s aggressive enforcement actions in digital property have yielded billions in settlements, most of which occurred this 12 months.

For the reason that U.S. Securities and Trade Fee expanded its oversight to the nascent crypto trade in 2013, civil fines towards crypto corporations have totaled greater than $7.42 billion, based on a Social Capital Markets examine shared with crypto.information on September 9. was shared.

Notably, 68% of the SEC’s lifetime fines, price $4.68 billion, have been imposed on crypto corporations in 2024 because the company intensified its crackdown on Web3.

The SEC’s Terraform Labs and Do Kwon reached a report $4.68 billion settlement, eclipsing the $4.3 billion deal between the U.S. Division of Justice crypto alternate Binance and its founder, Changpeng Zhao, in 2023.

Though the SEC has already dealt with 11 instances this 12 months, 2023 has been probably the most lively interval for crypto-related enforcement actions, with the company submitting 30 lawsuits towards Web3 service suppliers and securing $150 million in settlements.

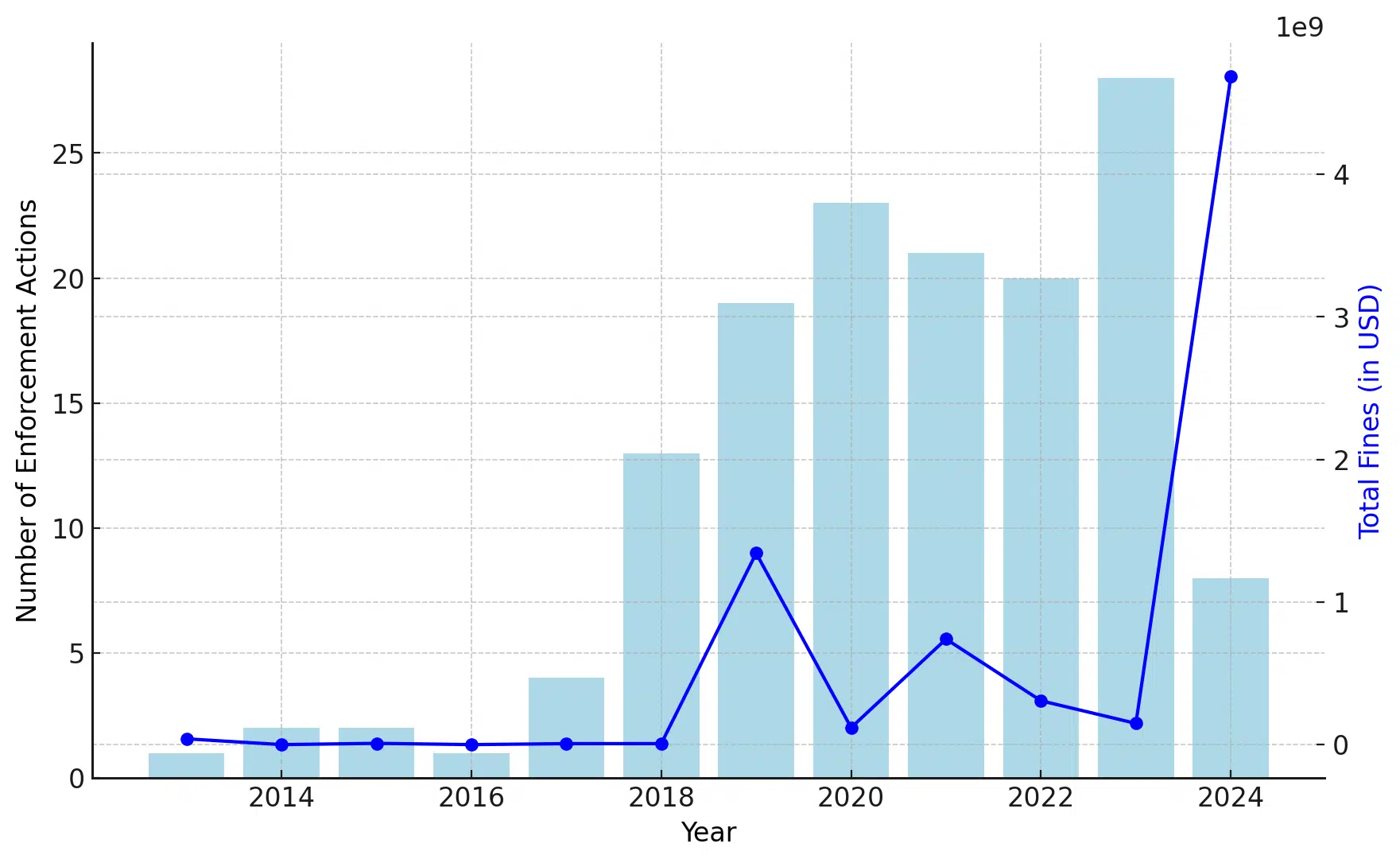

SEC Lawsuits In opposition to Cryptocurrency Firms | Supply: Social Capital Markets

You may also like: Bitcoin will attain $13 million inside 21 years, Michael Saylor predicts

SEC fits have elevated since 2018

The SEC’s crypto crackdown accelerated in 2018, marking the primary time that fines on digital asset corporations reached double digits.

In 2019, the typical annual nice towards crypto corporations shot up 2,000%, primarily as a result of a $1.2 billion civil nice imposed on Pavel Durov’s Telegram Group Inc. and its subsidiary, The Open Community (TON) Issuer, which drove this soar.

This sample of litigation confirms that the SEC’s “regulation by enforcement” method predates the appointment of Gary Gensler as chairman.

For a lot of in web3, Gensler’s face is excessive within the anti-crypto rhetoric. About 20,000 Bitcoin (BTC) 2024 attendees thunderously applauded former President Donald Trump for his promise to fireplace Gensler if re-elected.

As of now, Gensler stays chairman of the SEC and the company continues its broad crackdown on cryptocurrencies. The multi-agency effort is named “Operation Choke Level 2.0.”

A number of crypto corporations, reminiscent of Coinbase and Ripple (XRP), are in authorized battles with the SEC. Gensler has acknowledged that almost all digital property are securities and subsequently don’t adjust to federal regulation.

Learn extra: Audit Finds $230 Million WazirX Hack Originated Exterior Liminal Custody

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024