Bitcoin

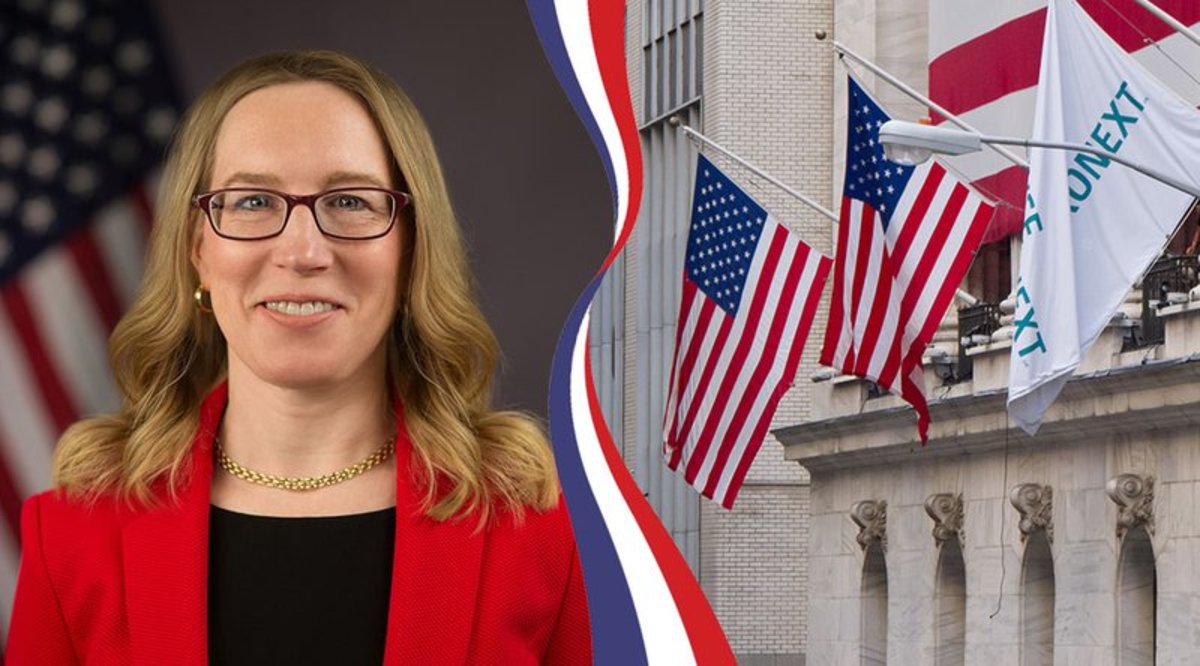

SEC Rescinds SAB 121, Permitting Banks to Custody Bitcoin

Credit : bitcoinmagazine.com

In a historic resolution, the US Securities and Trade Fee (SEC) has officially withdrawn Personnel spending Bulletin (SAB) No. 121, a controversial rule that banks had lengthy hindered from providing Bitcoin and Cryptody Custody Companies. This step, introduced on Thursday, signifies an vital shift in tackling the SEC to control Bitcoin and Crypto and releases the way in which for higher monetary integration.

Break: 🇺🇸 sec Kindt SAB 121 formally in, in order that banks weren’t saved #Bitcoin pic.twitter.com/vcnggkcgml

– Bitcoin Journal (@BitcoinMagazine) January 23, 2025

Launched in March 2022 below former SEC chairman Gary Gender, required SAB 121 establishments that Bitcoin and Crypto activa had for patrons to report these corporations as obligations on their steadiness sheets. This accounting customary created appreciable operational and monetary burdens for banks and preservators, which successfully discourages them from offering Bitcoin-related providers. The rule was typically criticized by the crypto business and legislators, the place SEC commissioner Hester Peirce referred to as it well-known in April 2023.

“Whats up, bye SAB 121! It is not enjoyable,” Peirce wrote in a message about X (previously Twitter) On Thursday, after the problem of the SEC of personnel bookkehoud bulletin no. 122, who formally withdraw the steerage.

The step of the SAB to revoke SAB 121 comes only some days after Genler’s resignation and marks the beginning of a brand new period below Republican management. Appearing SEC chairman Mark Uyeda, who took on the function on Monday, Quickly announced The formation of a crypto activity drive led by Peirce to make clearer and extra sensible regulatory frameworks for business.

“So far, the SEC has based totally on enforcement actions to control crypto with retroactive impact and reactive, usually settle for new and non -tested authorized interpretations,” the company acknowledged in a statement On Tuesday.

With the removing of SAB 121, giant banks at the moment are anticipated to go rapidly to combine bitcoin and crypto guardianship providers into their provide. This is a crucial milestone within the financialization of Bitcoin, making it nearer to the common acceptance.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now