Policy & Regulation

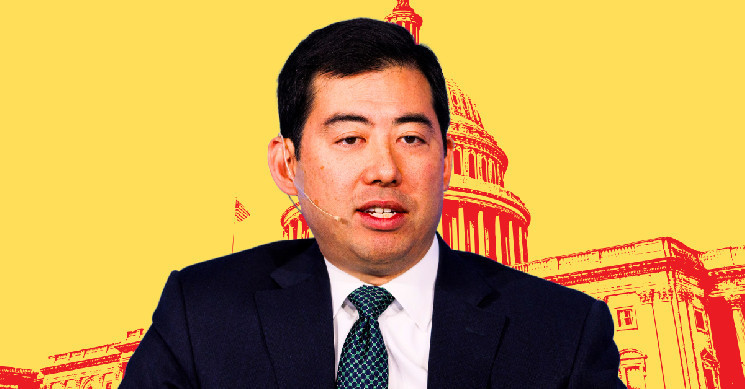

SEC’s Mark Uyeda Investigates Bill Hinman’s 2018 Crypto Speech

Credit : cryptonews.net

Nice information from the SEC – working chairman Mark Uyeda has requested the crew to take a contemporary take a look at how the federal government is at the moment coping with crypto dangers and laws. That is as a part of an try to adapt to Govt Order 14192, which focuses on chopping forms and making it extra company pleasant.

One of many first targets is the 2019 framework for funding evaluation of digital belongings. This doc was based mostly on a speech of 2018 by former SEC -Invoice Hinman, the place he advised that both a crypto is taken into account a safety relies upon extra on how centralized the undertaking is, as an alternative of the way it was bought. That concept has been fairly controversial within the crypto world, and it appears that evidently the sec is able to rethink it.

Declaration of performing chairman Mark Uyeda: in accordance with Govt Order 14192, the unleashed of prosperity by Deregulation, along with suggestions from Doge, I instantly requested the employees of Securities and Trade Fee to revise the next personnel statements.

– US Securities and Trade Fee (@secgov) April 5, 2025

Uyeda not solely seems on the crypto speech by Invoice Hinman 2018 – He has additionally considered necessary paperwork, together with:

- A 2022 information for crypto firms about market chaos and bankruptcies.

- A 2021 danger -alert on crypto investor threats because of unclear guidelines.

- A memo of 2020 wonders whether or not banks can legally hold digital belongings.

- A 2021 recommendation on funding funds that put money into Bitcoin -Futures.

- A remark from 2020 in regards to the influence of COVID-19 on the disclosure of the corporate.

The evaluation is meant to reverse among the stricter guidelines that had been launched as SEC chairman throughout Gary Genler’s time. Gensler was identified for his heavy angle on Crypto, lots of whom thought it was extra about blocking innovation than defending traders. His method was much more than as soon as referred to as ‘random and fickle’ by the courts.

Now, with Uyeda who’s in cost and other people similar to Hester Peirce and Paul Atkins insist on extra transparency, it appears that evidently the SEC is open. They’ve held crypto spherical tables, met the market leaders and even a sit-down with BlackRock not too long ago needed to focus on crypto ETFs and associated points.

It’s clear that the SEC begins to wash the home, take away outdated guidelines and make room for a crypto-friendly future. Traders and crypto fanatics definitely hold an in depth eye on to see what modifications are coming subsequent.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024