Blockchain

Sector rotation ‘tailwind’ for L2s: Kaiko

Credit : cryptonews.net

This can be a section of the Empire e-newsletter. To learn full editions, subscribe.

What is an effective strategy to gauge how crypto does with out being too depending on worth motion?

When you ask Kaiko, it is L2S.

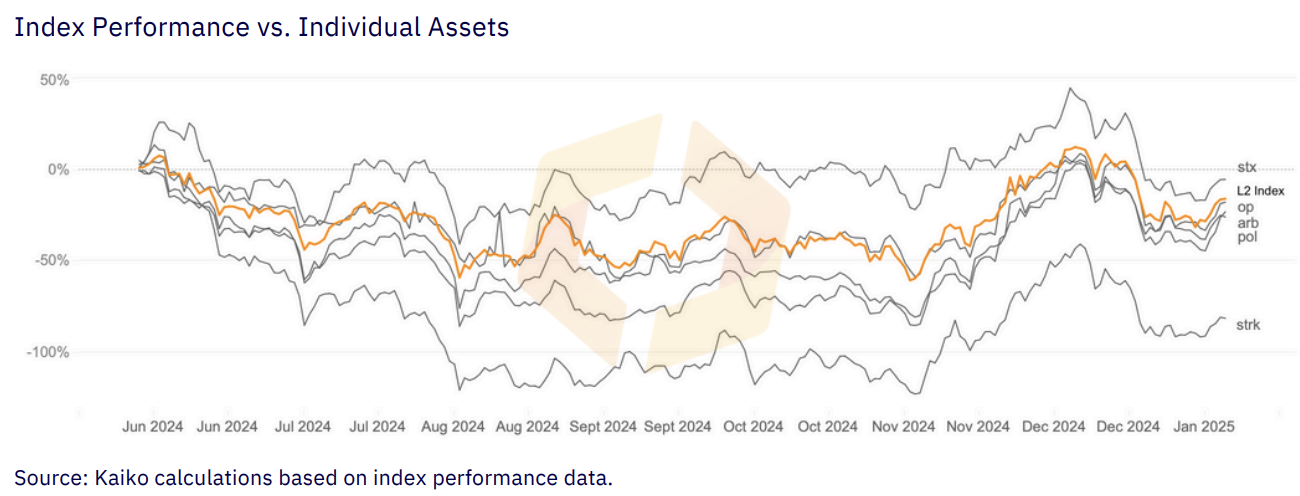

Till now, because the election, the L2 index of the analysis company has traded increased, which – albeit – maybe not one huge Shock, on condition that very crypto acquired optimistic prospects from November.

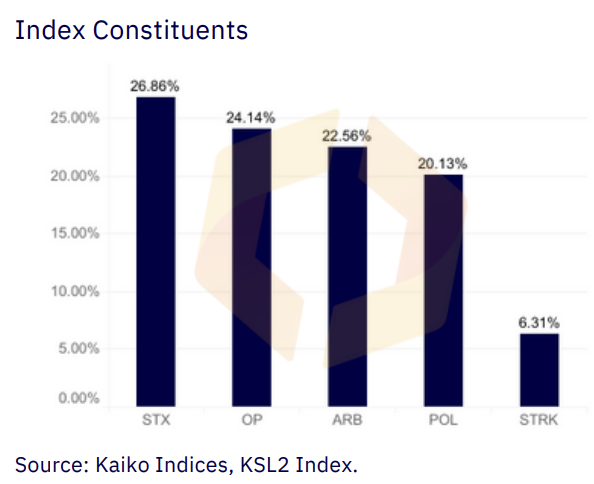

The index follows 5 L2s in Bitcoin and Ethereum. It additionally follows polygon.

As you’ll be able to see above, we’ve piles, optimism, arbitrum, polygoon and starknet in the identical bucket.

Needless to say L2s have made a comeback thus far after he bought behind the market final yr. And there was a whole lot of dialogue about whether or not we’ve too many L2s.

That doesn’t imply that there’s nonetheless no query.

Take a Galaxy report from November, for instance, that tasks that $ 47 billion in Bitcoin may be “bridged in Bitcoins L2S by 2030” – or about 2% of Bitcoin’s circulating vary.

Anyway, again to the info: there could also be extra constructive catalysts in retailer for L2S, particularly if Bitcoin doesn’t dominate the story that a lot.

“Sector rotation is one other potential wind wind for L2 property. BTC dominated the crypto market in 2024 and established document heights earlier than and after the American elections, whereas institutional traders flowed billions in spot BTC exchange-bound funds. Nevertheless, the rally has not gone past BTC, as has been the case traditionally. Though the crypto-market construction has advanced, a rotation to smaller property in all probability stays as a result of traders are in search of the next upward potential by means of high-beta tokens, ”wrote Kaiko analyst Adam McCarthy.

Making an allowance for that the altering headwind of the laws performs an enormous issue right here – particularly within the case of polygon, on condition that the SEC has beforehand labeled a safety of Matic – and maybe the longer term seems to be a bit brighter.

Though investing in Bitcoin is accessible to the lots, it’s troublesome to search out alternatives behind it, McCarthy wrote.

“Though the broader crypto bull market shouldn’t absolutely prolong to altcoins, the evolving authorized dynamics may function a catalyst for renewed curiosity. As coverage shifts in Washington and traders discover alternatives that transcend Bitcoin, “his L2S” positioned for appreciable development in 2025 “, he continued.

Man, it is arduous to be pessimistic in crypto.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now