Policy & Regulation

Senate Draft Bill Gains Community Praise for Strongest Developer Protections in Crypto Law

Credit : cryptonews.net

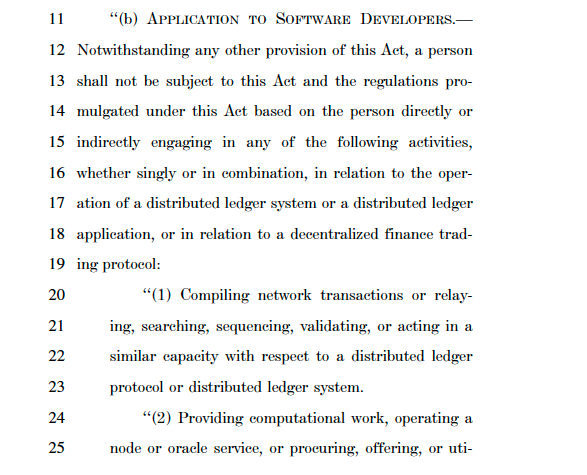

The most recent market construction of the Senate Financial institution Committee has acquired optimistic preliminary reactions from leaders of the cryptocurrency business. The textual content of 182 pages “Accountable Monetary Innovation Act of 2025”, launched on Friday afternoon, accommodates what specialists describe as probably the most in depth language safety language that’s seen in federal laws thus far.

Amanda Tuminelli, govt director and CLO at Defi Training Fund, praised the safety of the builders of the design and referred to as them the perfect language that was noticed in an earlier legislative proposal. Authorized skilled Gabriel Shapiro emphasised the improved strategy to the invoice for decentralized administration techniques. He additionally famous that the laws tackles earlier issues about administrative vessels that will create problems for securities laws.

Supply: X

Legislative framework offers with an important considerations of business

Shapiro particularly praised the dealing with of the design of decentralized autonomous organizations. This consists of blockchain-based Governance tokens (Borgs). The laws limits “disqualifying monetary rights” carve-outs to precise results as an alternative of making use of broader restrictions to fee and Nutstokens.

The invoice creates readability about decentralized administration, deployment mechanisms, airdrops, tokenization processes and self -herb safety. Extra provisions embody ensures for present non-fraudulent tokens towards future sec sustaining actions and exemptions for decentralized bodily infrastructure networks and defi-protocols.

Colin McLaren emphasised the significance of democratic help for laws, with the argument that Senate Democrats should give precedence to innovation over regulatory restrictions. McLaren referred to the potential for constructing “the following Nice American Startup” as an alternative of enriching authorized professionals by lengthy -term regulatory uncertainty.

The design units a double regulation construction

The design establishes a double regulatory construction that divides supervisory tasks between the Securities and Trade Fee and the Commodity Futures Buying and selling Fee. This framework is meant to resolve the paradox of jurisdiction that has influenced the digital belongings laws by creating clear limits on the premise of actions and useful traits.

Beneath the proposed construction, the CFTC would take major authority on digital uncooked supplies -tokens which are intrinsically linked to blockchain techniques that derive worth from blockchain performance. The SEC would keep supervision of securities and keep the authority on funding contracts with digital uncooked supplies throughout major market transactions.

The following step consists of the banking committee that has entered a proper account and performing Markup procedures, presumably by the tip of the month. The development of timeline is dependent upon the democratic response and the willingness to barter divisional provisions throughout the draft laws.

Associated: SEC and CFTC concern imprecise crypto declaration, however legal professionals say nothing has modified

Safeguard: The knowledge offered on this article is just for informative and academic functions. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be chargeable for any losses on account of the usage of the aforementioned content material, services or products. Readers are suggested to watch out earlier than taking motion with regard to the corporate.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024