Bitcoin

Significant $83 million daily inflows recorded for Ethereum ETF by Fidelity – What’s next?

Credit : ambcrypto.com

- Ethereum ETFs staged a restoration, bringing reduction to the 17 million holders within the purple.

- ETH should go one step additional to remain forward within the aggressive altcoin race.

The New Yr buzz continues to be fairly lively now, particularly with Bitcoin [BTC] consolidate on graphs. Traditionally, the primary quarter has been bullish for the crypto market, usually creating an surroundings effectively suited to altcoins to boost capital.

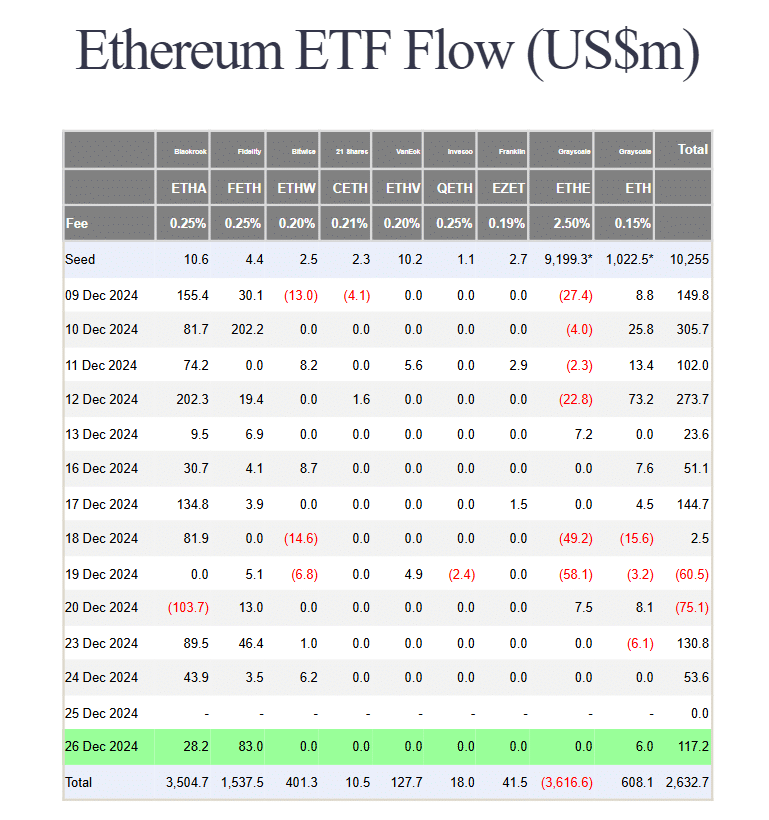

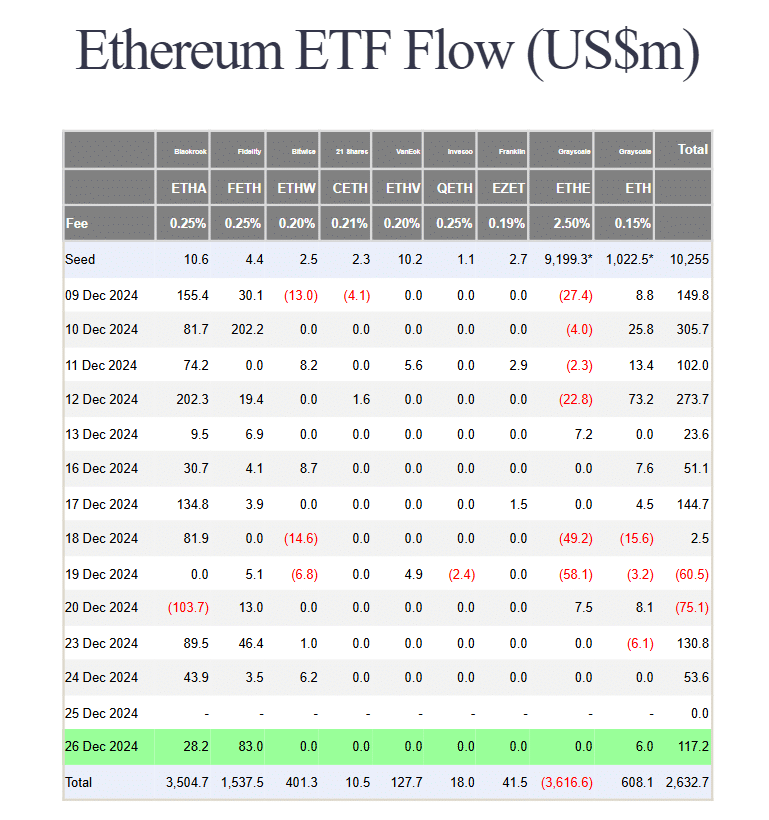

In the meantime, Ethereum [ETH] ETFs are additionally gaining reputation, with spectacular inflows. Actually, Constancy’s Ethereum ETF (FETH) noticed web inflows of $83 million — an indication that traders could also be beginning 2025 with an emphasis on diversification.

Whereas it could be too early to attract agency conclusions, Ethereum’s 1.04% worth enhance appeared to level to an rising development value maintaining a tally of.

There’s nonetheless a protracted option to go for Ethereum

For the reason that ‘Trump pump’, the market has seen a number of momentum shifts. What initially seemed like a powerful bull rally, with Bitcoin reaching the $100,000 mark on the finish of the yr, has since tapered off. Because of this, ‘excessive threat’ sentiment is clearly conserving traders cautious.

Ethereum just isn’t resistant to this shift both. After the preliminary rise, the worth fell again to the extent of a month in the past, wiping out a lot of the election-related positive factors. With roughly 17 million Ethereum addresses Now that it’s within the purple, the stress for a rebound will increase.

And but, amid the uncertainty, web inflows of $117 million by ETH ETFs are offering much-needed reduction.

Supply: Farside Traders

This can be a optimistic signal, particularly after two consecutive days of subdued institutional curiosity. An indication that Ethereum should still be prepared for restoration.

That mentioned, a full restoration to $4,000 nonetheless appears distant. Technically this may require an 18% bounce. And given the current efficiency over the previous thirty days, this will likely appear a bit too optimistic within the brief time period.

There are different gamers within the race for dominance

Like Ethereum, different altcoins are enhancing their underlying know-how to supply traders engaging long-term prospects. One which significantly stands out is XRP.

Curiously, XRP’s day by day worth motion on the time of writing revealed indicators of consolidation, with intense shopping for and promoting stress making a stalemate. This tug-of-war has caught the eye of main gamers, and it has wager on XRP for probably large returns.

With its spectacular triple-digit income, sensible instance integrations and powerful help from whales,

Learn Ethereum [ETH] Worth forecast 2025-2026

Then again, Ethereum’s chart has been extra unstable. After reaching its yearly excessive of $4,106 simply 10 days in the past, ETH fell as a lot as 21% in per week. So whereas a restoration is feasible, it’s gradual, indicating an absence of fast shopping for curiosity available in the market.

Wanting forward, the subsequent few days may very well be a make-or-break for Ethereum. Whereas new capital may push BTC into consolidation, probably benefiting altcoins like Ethereum, the present lack of constant help in ETH’s worth means a fast restoration is unlikely.

Moreover, competitors between altcoins is growing and Ethereum might want to present extra consistency if it desires to remain on the forefront of the pack.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024