Altcoin

Solana crashes 10% while Binance dumps $ 32 million – a classic market wash?

Credit : ambcrypto.com

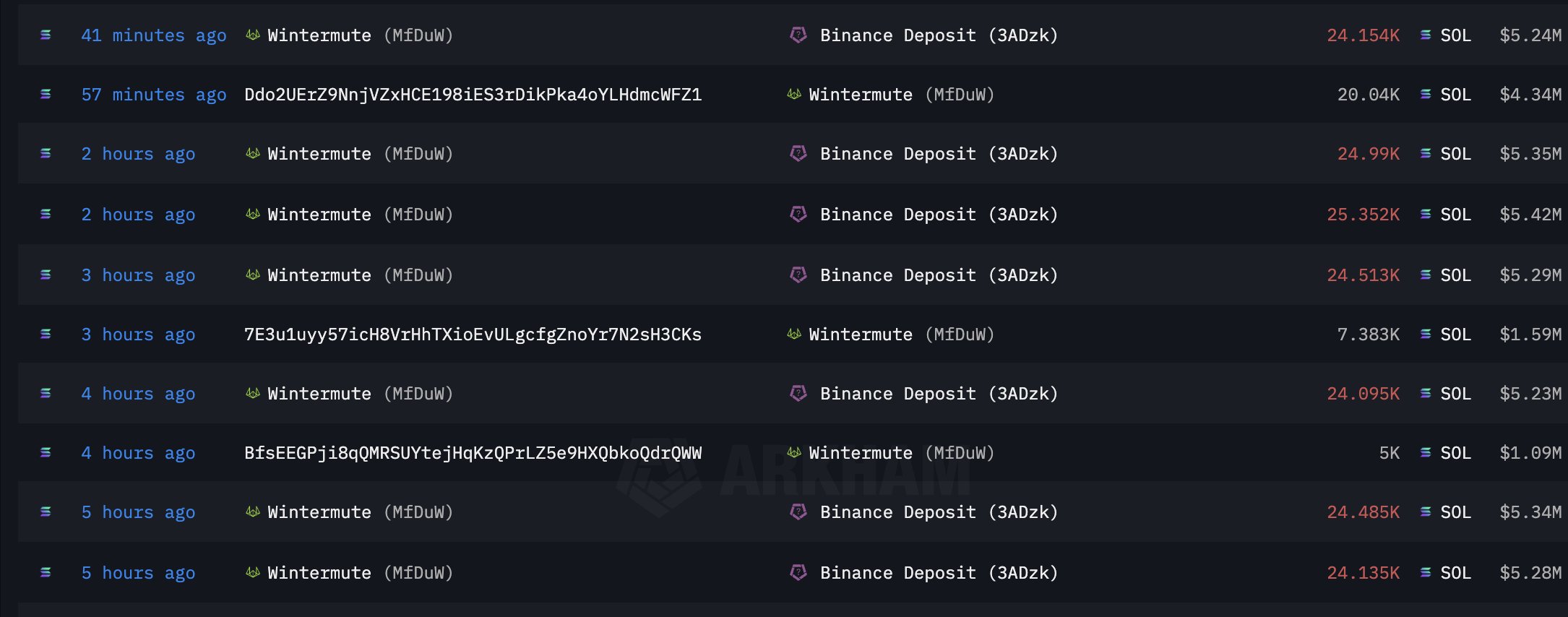

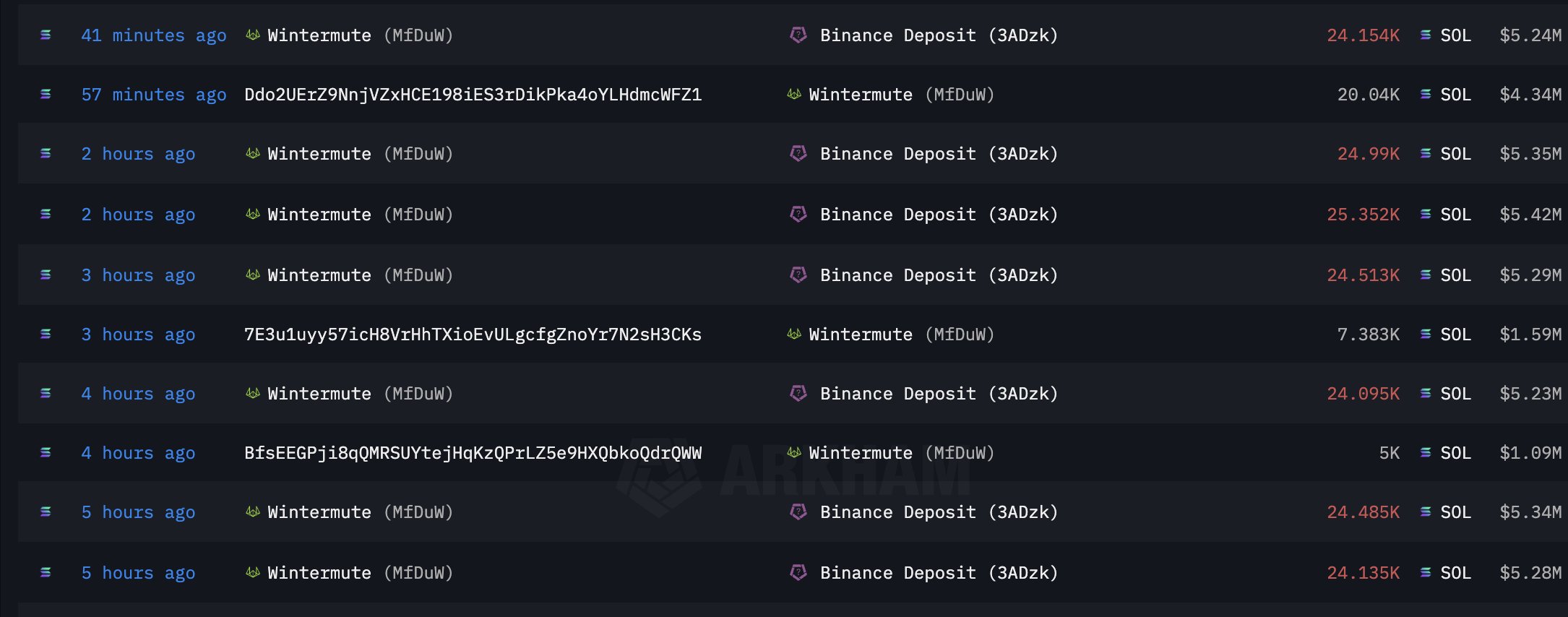

- Binance despatched $ 32 million Sol to Wintermute, whereas Coinbase despatched $ 30 USDC to presumably purchase the dip.

- The Solana market fell greater than 10percentin the course of the weekend, presumably attributable to the alleged manipulation of Binance.

The Binance Change was reportedly concerned in “flushing” or “liquidation hunt” by sending greater than $ 32 million to Solana [SOL] To market maker Wintermute throughout a weekend with a low quantity.

The intention was clear: to push the worth of Sol down into the decrease vary, forcing lengthy -term leverage merchants to liquidate their positions.

This technique is especially efficient on weekends, when commerce volumes are naturally decrease, making markets extra delicate to manipulation.

In keeping with Ambcrypttos’s view of Arkham’s information, Wintermute performed its position by promoting the SOL at a cheaper price, in order that the worth is additional dumped, solely to purchase it again on the synthetic depressive charges.

Supply: Arkham

After the dip was manufactured, Wintermute reportedly returned to Binance than it had initially acquired, in order that the worth distinction used.

This was a win-win situation for each entities, however based on crypto-commentator Martyparty”

“The losers are the leverage merchants and the panic sellers.”

Likewise, Coinbase had despatched $ 30 million in USDC to Wintermute on Solana, reportedly to benefit from the dip, in response to current claims of inadequate solholdings that imply that customers acquired delays of their Solana recordings.

Supply: Arkham

This step advised a coordinated effort to make use of market situations, presumably to stabilize and even profit synthetic volatility.

How one can profit from Sol -Manipulation

Understanding these techniques could be essential for merchants. By checking uncommon main transactions from commerce gala’s to market makers, merchants can predict potential value drops, on this case Solana.

One technique to benefit from such manipulations contains ready for a pressured liquidation occasion after which shopping for within the dip, anticipating a quick restoration when the market corrects itself.

Sol has already been restored round a 3rd of the weekend lure.

Nevertheless, this strategy requires a pointy sense of market timing and an understanding of the chance concerned, as a result of not all market manipulations result in predictable restoration.

For these with excessive threat tolerance, such methods can provide alternatives to benefit from the volatility that others concern.

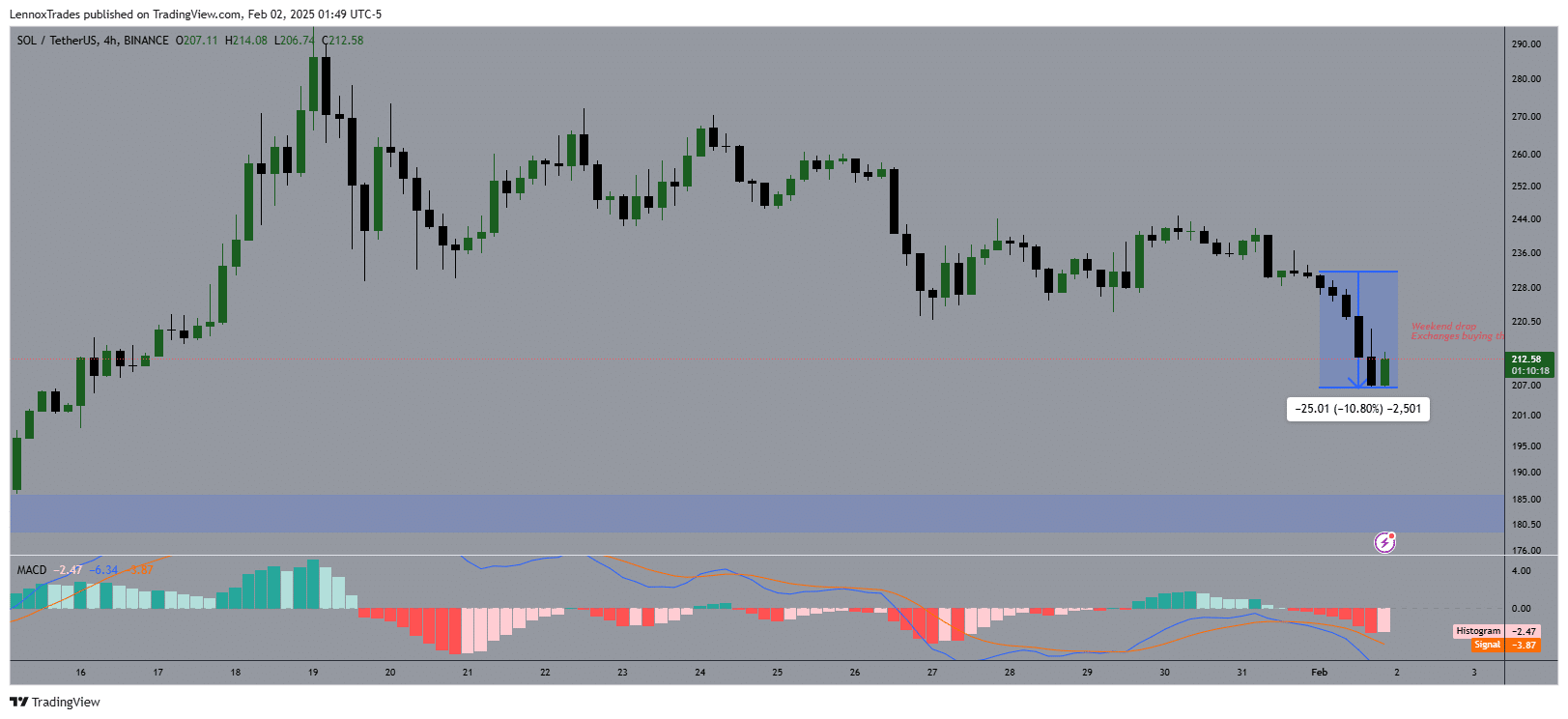

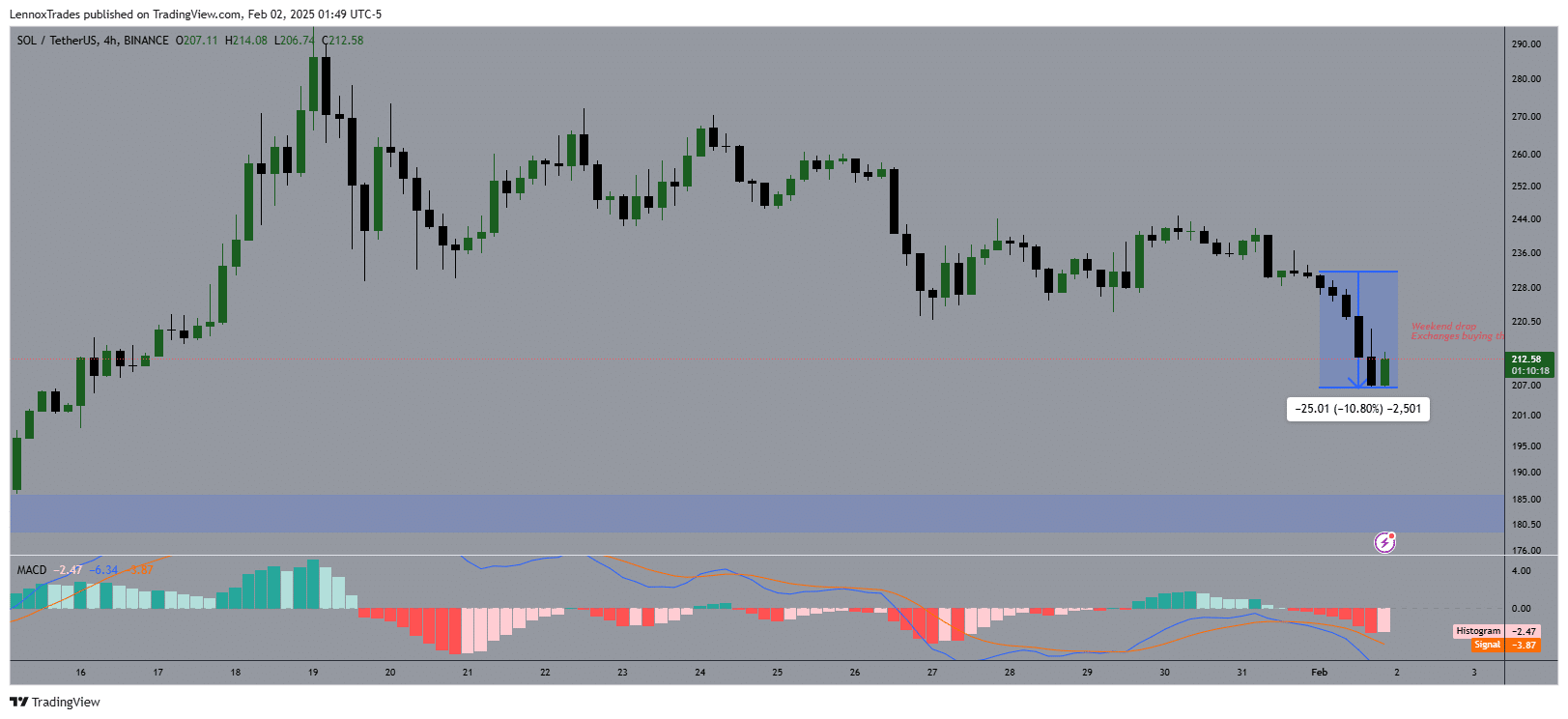

Supply: TradingView

Sol’s value exercise confirmed a pointy fall and reached a low level of $ 207 earlier than they returned when inventory exchanges arrived. Shopping for the weekend by exchanges advised a strategic buy in the course of the DIP on this level.

Learn Solana’s [SOL] Worth forecast 2025–2026

This promotion correlated with a decline in MACD values, which signifies at a lowering momentum, which shifted positively after shopping for.

If these shopping for patterns proceed, Sol might check increased resistors close to $ 235. Conversely, it can not retain this assist to a retest of decrease ranges.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now