Ethereum

Solana flips Ethereum, and that means SOL prices will now…

Credit : ambcrypto.com

- Solana’s value momentum is approaching key resistance ranges as whale accumulation will increase.

- Rising open curiosity and vital liquidations point out larger market volatility for Solana.

Solana [SOL] has rotated Ethereum in a shocking transfer, taking the highest spot in 7-day DEX (Decentralized Change) quantity with $11.8 billion in comparison with Ethereum’s $9.2 billion. This rise has many questioning if Solana is gearing up for a serious bull run.

Due to this fact, a deeper investigation into Solana’s value motion, whale exercise, liquidation information, and open curiosity ranges is critical to know whether or not this might be a defining second within the crypto market.

Can Solana break the resistance and get well?

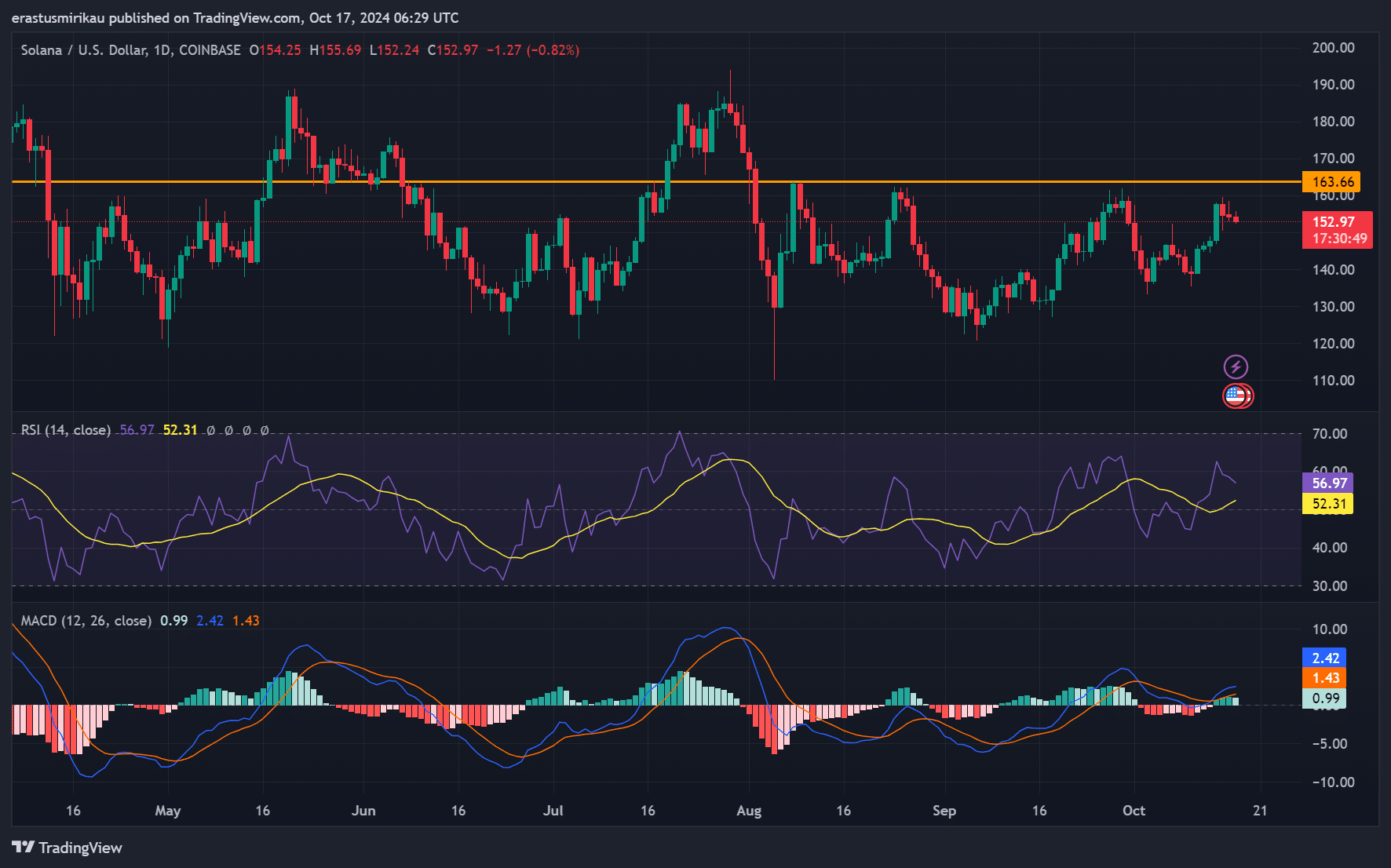

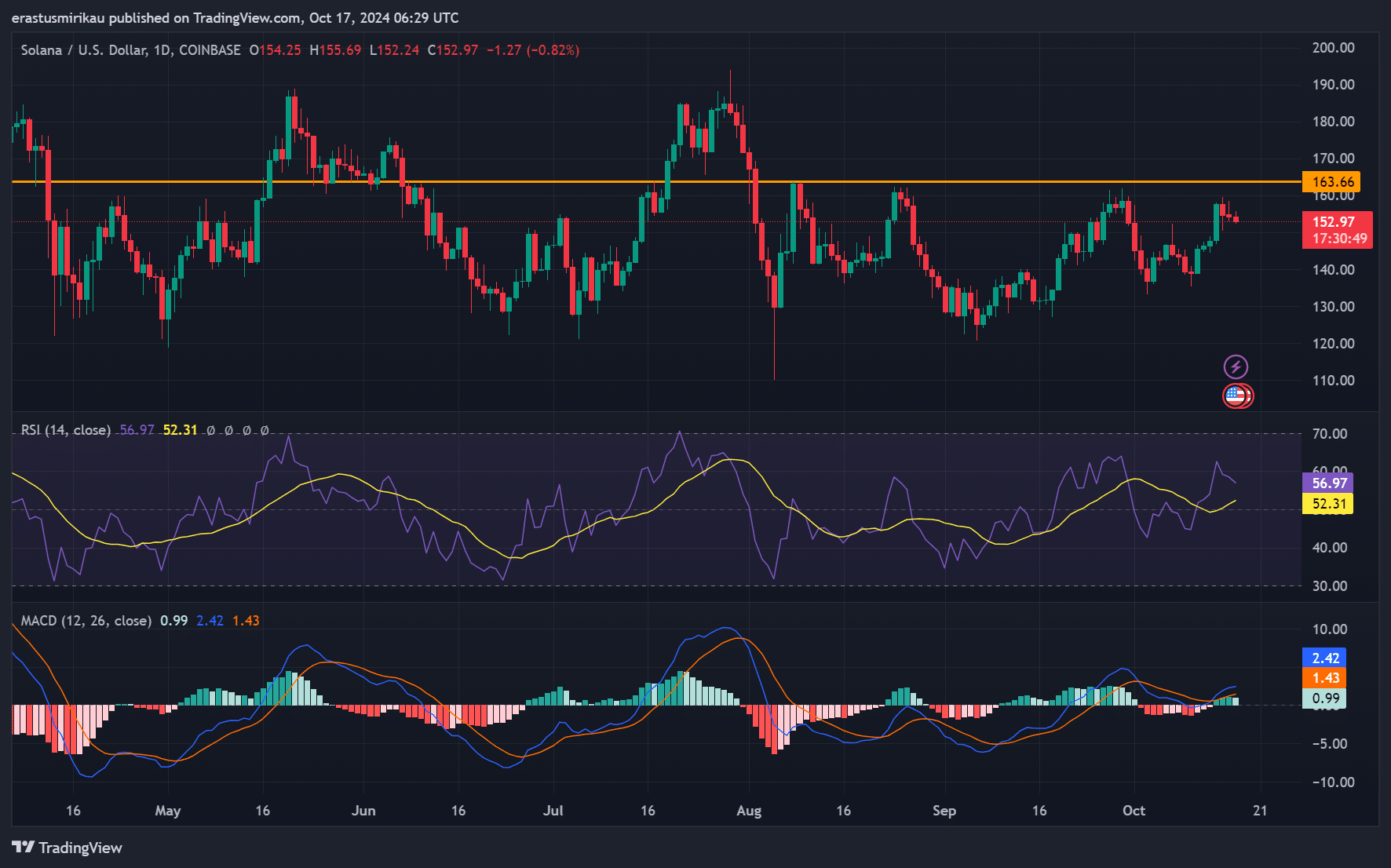

On the time of writing, SOL was buying and selling at $153.09, reflecting a decline of 0.99% over the previous day. Nonetheless, regardless of the small decline, the worth continues to comply with an upward trajectory.

Extra importantly, the $163.66 degree represents a key resistance level. If Solana breaks this degree, a rally may comply with.

Furthermore, the RSI studying of 52.31 exhibits impartial momentum, whereas the MACD signifies potential build-up of bullish energy. Due to this fact, all eyes are on whether or not Solana can keep the momentum and transfer up the ranks.

Supply: TradingView

The buildup of SOL whales signifies a possible wave

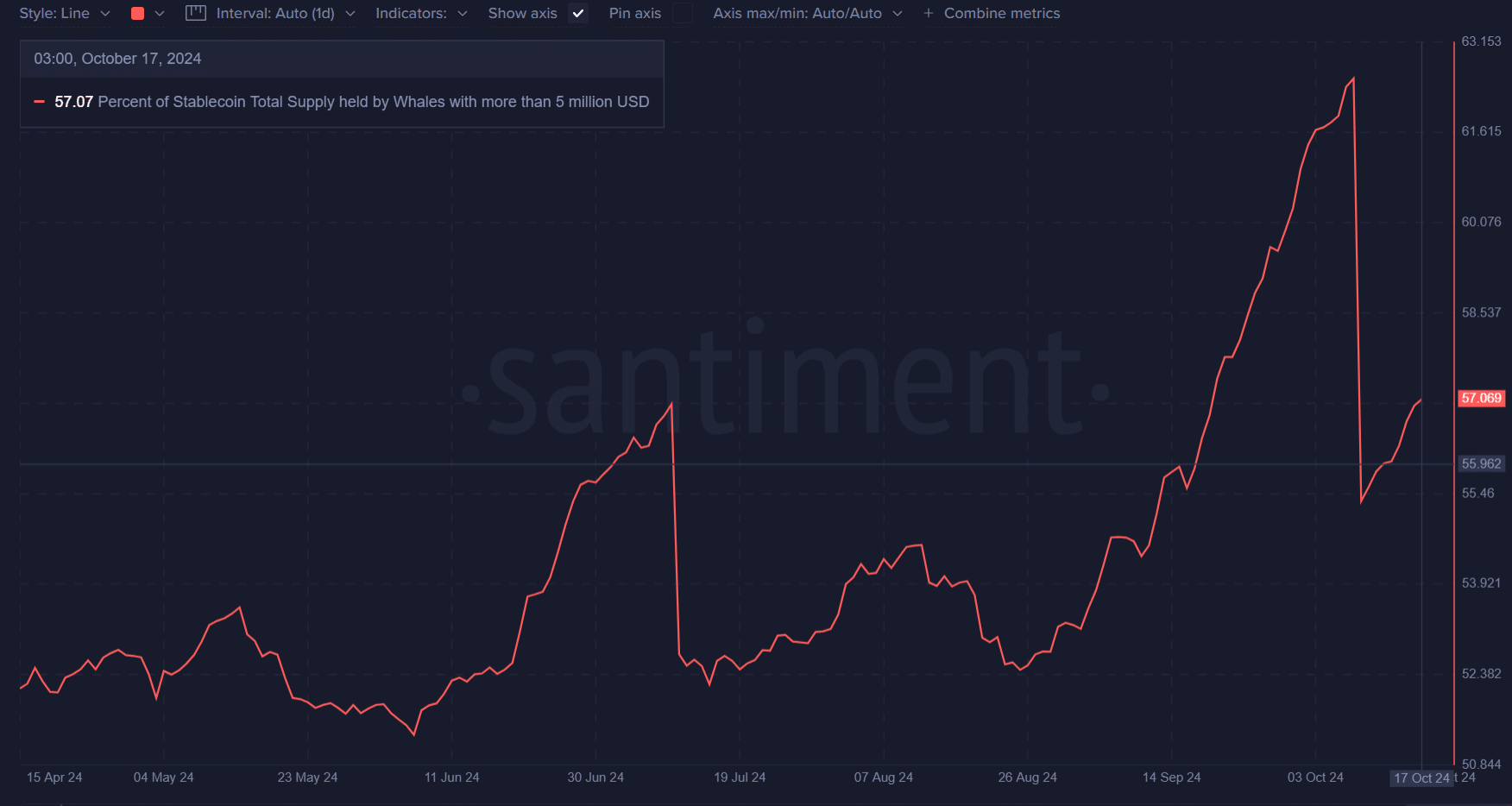

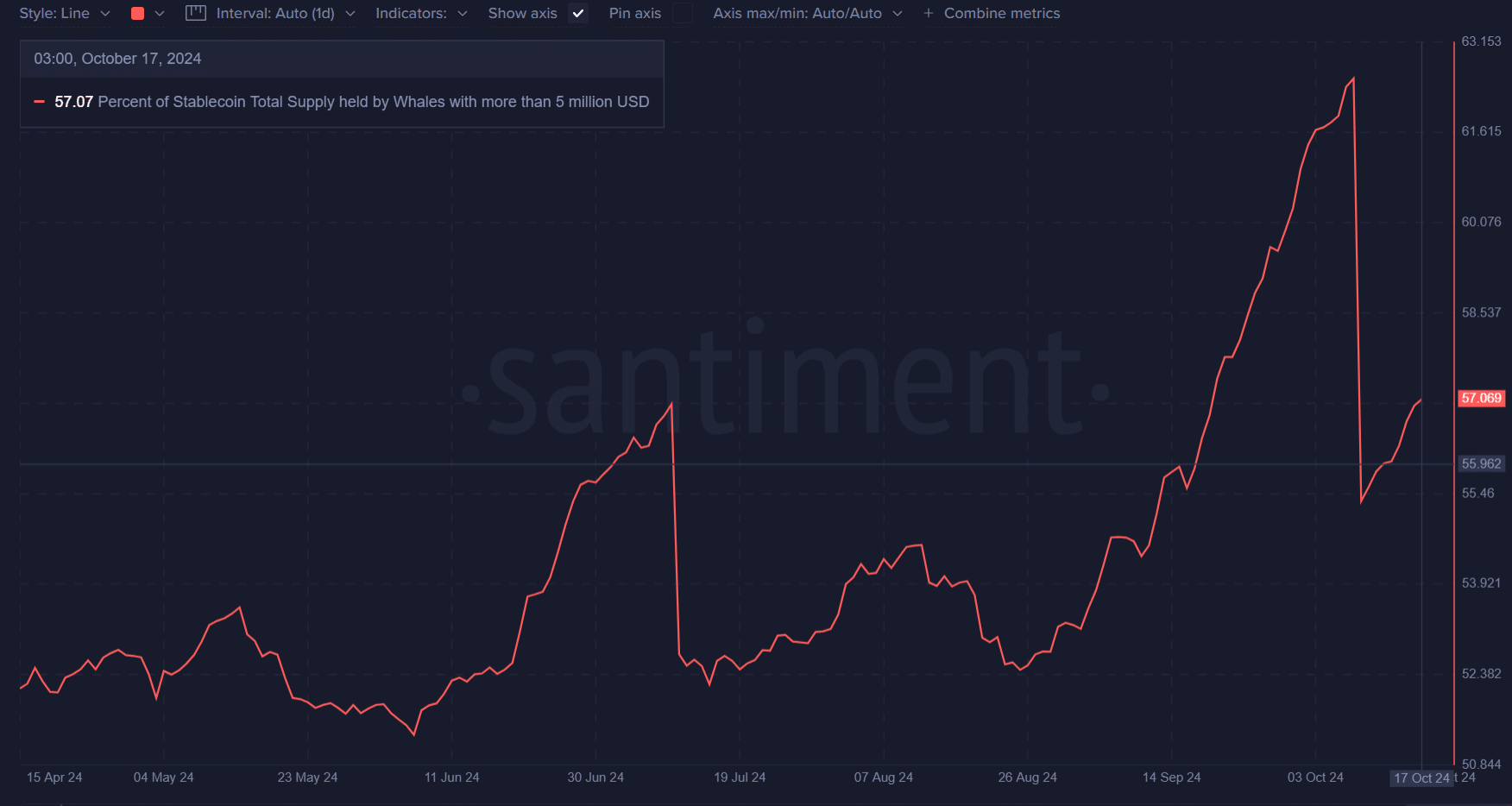

Curiously, Solana’s high holders – whales with over $5 million – now management 57.07% of the stablecoin provide. This improve in whale focus signifies strategic accumulation. Traditionally, such conduct by giant farmers has usually preceded value will increase.

Consequently, this build-up raises expectations that SOL may see vital upward motion quickly. The Whales are seemingly positioning themselves for sturdy momentum, indicating confidence in Solana’s long-term prospects.

Supply: Santiment

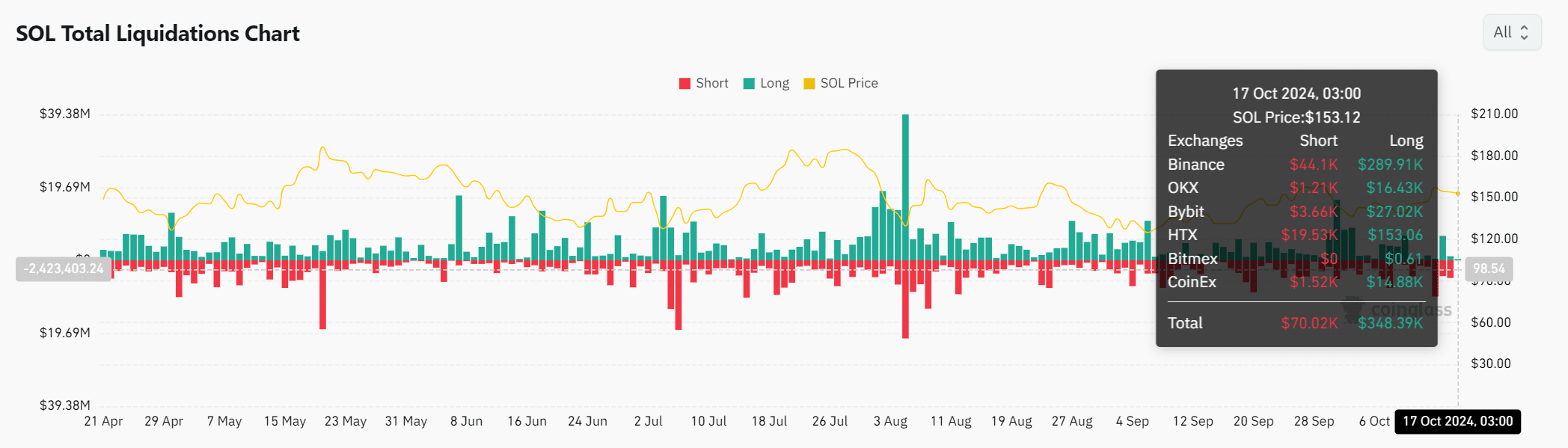

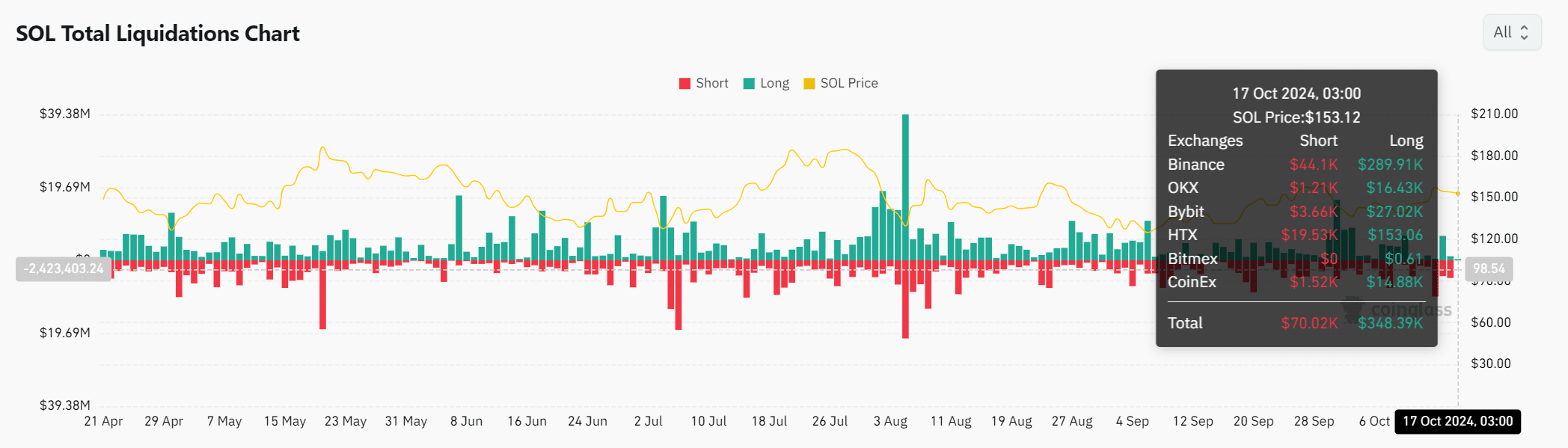

Do SOL Liquidations Improve Volatility?

Liquidation information exhibits that $348.39K value of lengthy positions had been liquidated within the final 24 hours, along with $70.02K for shorts. This excessive degree of liquidation in lengthy positions signifies that merchants are betting on a continued rise.

Nonetheless, it additionally signifies a excessive degree of leverage out there, which may backfire if key resistance ranges don’t maintain. Consequently, additional value swings can happen because the market strikes towards overloaded merchants.

Supply: Coinglass

Rising open curiosity signifies market optimism

Open curiosity in SOL elevated 2.26% to $2.45 billion. This improve signifies rising curiosity from merchants and the expectation of elevated volatility within the close to future.

Moreover, as a result of Solana dominates DEX quantity, merchants are betting on its potential to outperform the broader market.

Supply: Coinglass

Is your portfolio inexperienced? View the Solana Revenue Calculator

Given SOL’s sturdy efficiency and whale accumulation, the potential for a bull run is simple. If the worth breaks by the resistance and avoids additional liquidations, the market may expertise a speedy rise.

Nonetheless, merchants ought to proceed with warning as a result of liquidation dangers. However, Solana is effectively positioned to guide the subsequent huge crypto rally.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now