Solana

Solana Price Set to Soar? Whale Purchases $1.37M Worth of SOL

Credit : coinpedia.org

After a big breakout above $138, it seems like crypto whales are inserting massive bets on Solana (SOL) and are presently shopping for. On September 14, 2024, on-chain analytics agency Lookonchain posted on

Crypto Whale buys Solana for $1.37 million

The publish on As well as, it acquired a reward of greater than 174 SOL, value $23,700.

Solana worth momentum

Regardless of this large buy, it seems that SOL might retest its breakout stage to verify the profitable breakout. On the time of writing, SOL is buying and selling round $137 and has skilled a worth enhance of over 3.75% within the final 24 hours. Throughout the identical interval, buying and selling quantity elevated by 20%, indicating higher participation from merchants and buyers after the outbreak.

Solana technical evaluation and upcoming ranges

In keeping with the knowledgeable technical evaluation, SOL seems bullish and is presently dealing with robust resistance from the 200 Exponential Shifting Common (EMA) on the each day time-frame. At this level, it’s essential for SOL to shut a each day candle above the 200 EMA to set off a big upside rally.

If SOL closes its each day candle above $140, there’s a robust chance that the value might rise 18% to $165 and additional to $185 if the bullish sentiment continues. Nonetheless, this bullish assertion solely holds true if SOL closes the each day candle above the $140 stage, in any other case it might fail.

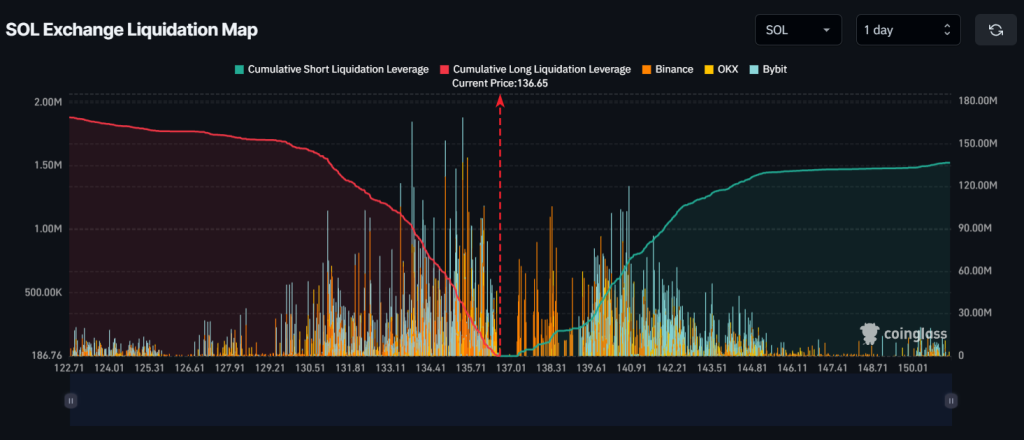

Excessive liquidation ranges

At the moment, the important thing liquidation ranges are round $135 on the draw back and $140.81 on the upside. Merchants are over-leveraged at these ranges, the mint glass Information.

If market sentiment stays bullish and the value rises to the $140.81 stage, quick positions value almost $65 million can be liquidated. Conversely, if market sentiment modifications and the value falls to the $135 stage, lengthy positions value roughly $38.5 million can be liquidated.

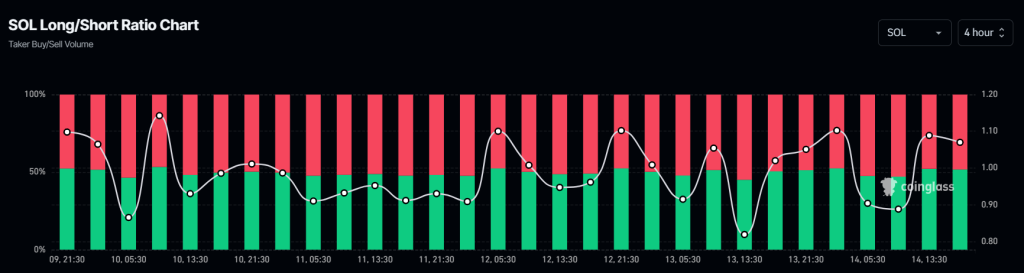

Merchants’ bullish market sentiment

Moreover, SOL’s Lengthy/Brief ratio presently stands at 1.0695, indicating merchants’ bullish market sentiment. Merchants and buyers use this ratio to find out whether or not an asset is bullish and assist them determine whether or not to construct lengthy or quick positions. A worth above 1 signifies bullish market sentiment, whereas a price beneath 1 signifies bearish sentiment.

The info additionally reveals that presently 52.68% of Solana’s prime merchants have lengthy positions, whereas 48.32% have quick positions.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024