Solana worth is displaying the primary indicators of stabilization after weeks of sustained downward stress, as each on-chain information and technical indicators level to cooling promoting momentum. Because the broader development stays beneath stress, merchants are more and more seeking to see if SOL can defend vital assist ranges and spark a restoration rally heading into the top of the 12 months.

Solana on-chain information indicators point out profit-taking is cooling

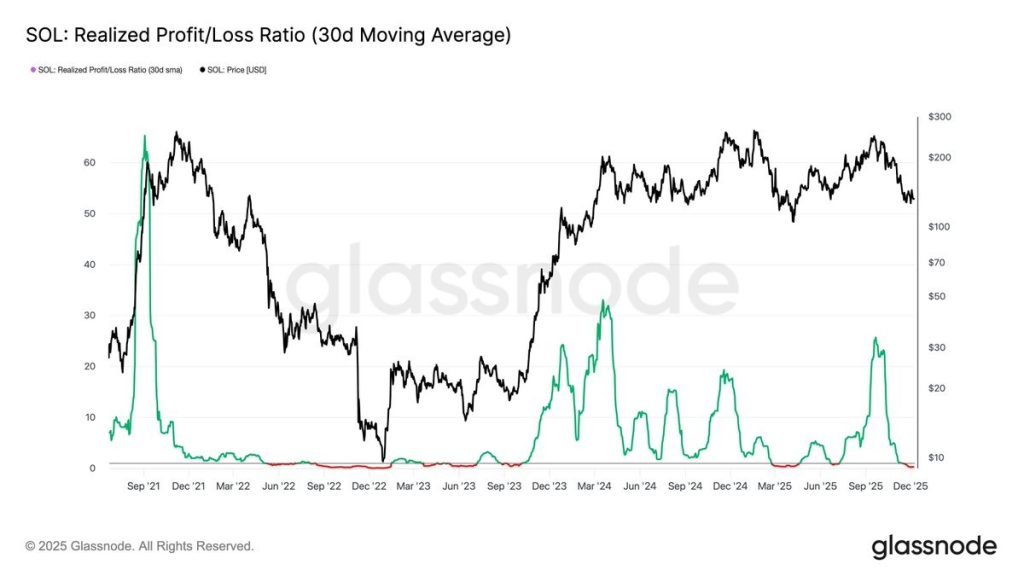

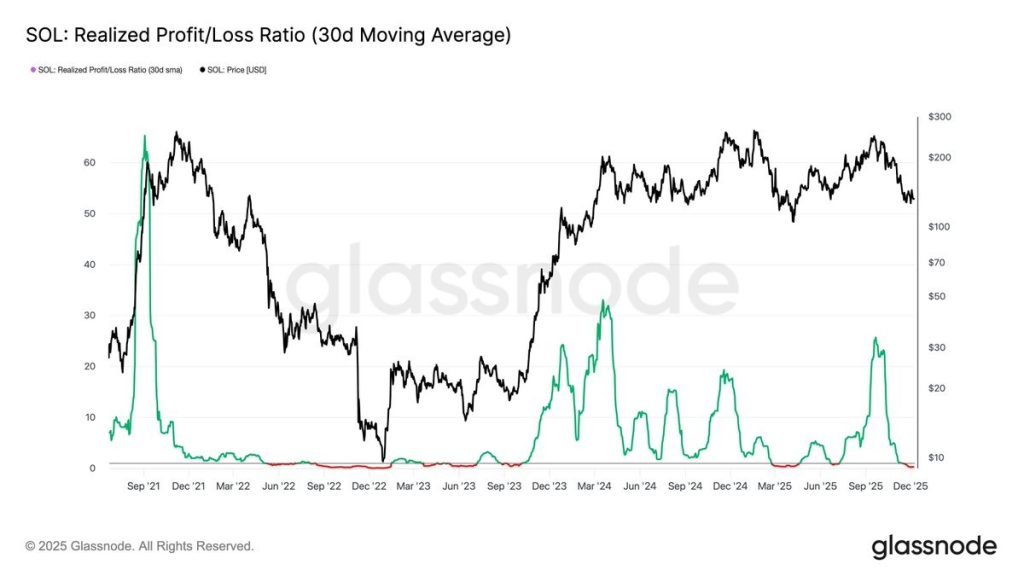

Statistics within the chain Glass junction recommend that promoting stress could also be easing. Solana’s realized revenue/loss ratio, which tracks whether or not buyers are promoting tokens at a revenue or loss, has fallen sharply after a latest spike. Traditionally, such cool-down phases typically mark the top of aggressive distribution intervals quite than quick development reversals.

This shift signifies that many merchants who purchased decrease have already locked in earnings, lowering short-term promoting stress. Whereas this doesn’t assure larger costs, it does create the situations for consolidation, particularly if spot demand begins to stabilize.

SOL worth buying and selling inside a descending channel

From a technical perspective, SOL stays trapped in a well-defined descending channel that has pushed worth motion since late summer time. Nevertheless, latest worth conduct exhibits that the downtrend is shedding momentum.

On the time of writing, Solana is buying and selling across the $139 degree – an space that aligns with the Bollinger Bands and has served as a short-term equilibrium zone in latest weeks. Staying above the quick assist at $135 is essential to keep away from a continuation in the direction of the decrease restrict of the channel.

RSI and Bollinger bands recommend stabilization

Momentum indicators assist the concept of a slowdown in gross sales. The Relative Power Index (RSI) has recovered from oversold situations and is at the moment close to 48, indicating impartial momentum. This vary typically precedes focused breakouts, particularly after prolonged sell-offs.

In the meantime, the Bollinger Bands start to slim, indicating lowered volatility. Such compression phases typically disappear with sharp strikes as soon as the value strikes out of its vary.

Key ranges that would outline SOL’s subsequent transfer

For bulls, reclaiming the $145-$150 resistance zone is essential. This space coincides with the higher Bollinger Band and falling channel resistance. A every day shut above this space would sign a structural shift and will open the door for a restoration rally in the direction of $155 and presumably $170.

Then again, the lack to carry $135 would weaken the stabilization narrative and expose SOL to a deeper pullback in the direction of the $125 assist zone.

Solana worth outlook: finish of 12 months and starting of 2026

The Solana sell-off seems to be cooling off, however the development has not but reversed. On-chain information helps lowered promoting stress, whereas technical indicators recommend the market is shifting right into a consolidation part. Whether or not this may result in a rebound in early 2026 will rely on SOL’s capacity to interrupt above key resistance ranges within the coming days.