Altcoin

Solana shows signs of warming as TVL soars to new highs in 2024

Credit : ambcrypto.com

- Solana’s community exercise maintains a optimistic trajectory beneath bearish market circumstances.

- Assessing the probabilities of SOL coming into restoration mode after a bearish week.

The Solana [SOL] blockchain continues to indicate indicators of sturdy community exercise regardless of the current market cooldown. The bears are accountable for dampening the market pleasure seen earlier in November and earlier this month.

For Solana, it is enterprise as traditional, as evidenced by the most recent spike in exercise. For context, the community’s TVL simply hit a brand new excessive in 2024 at 55.37 million SOL. TVL efficiency is extra correct by way of SOL than greenback worth because of SOL value fluctuations.

supply: DeFiLlama

Constructive TVL development is usually related to long-term optimism and wholesome community exercise. Solana’s on-chain quantity remained excessive regardless of current bearish sentiments out there. Over the previous two days, day by day quantity has averaged greater than $3 billion.

Transaction information from Solana additionally indicated rising community exercise. Transactions have been on an upward development for months and peaked at 67.77 million TXS prior to now 24 hours. This was the best recorded variety of transactions on the Solana community prior to now eleven months.

Supply; DeFiLlama

Is SOL prepared for a bullish comeback?

The current surge in community exercise may point out an increase in natural demand for Solana’s native crypto. Nevertheless, general market efficiency has been bearish particularly this previous week, and Solana’s native cryptocurrency was not spared.

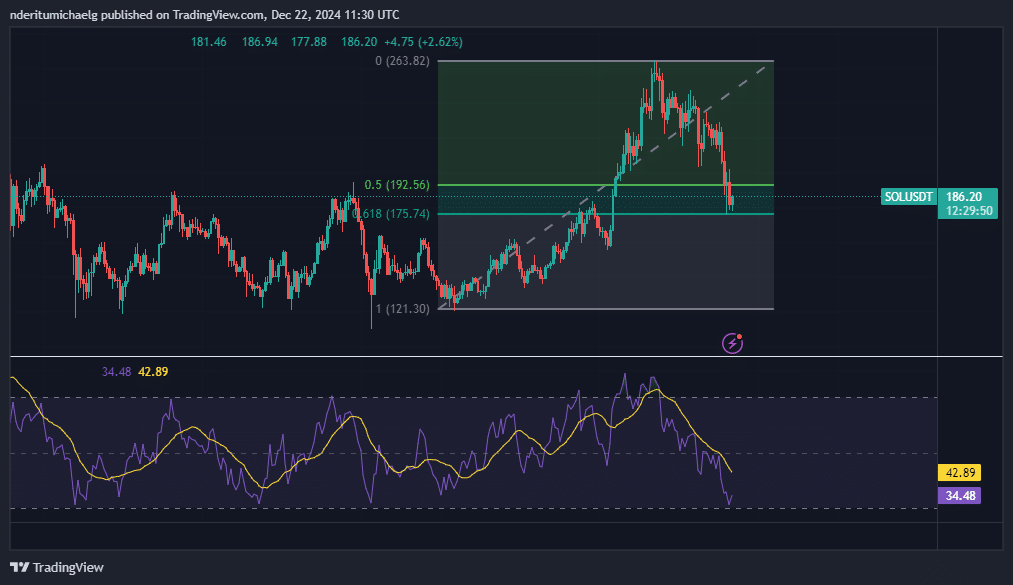

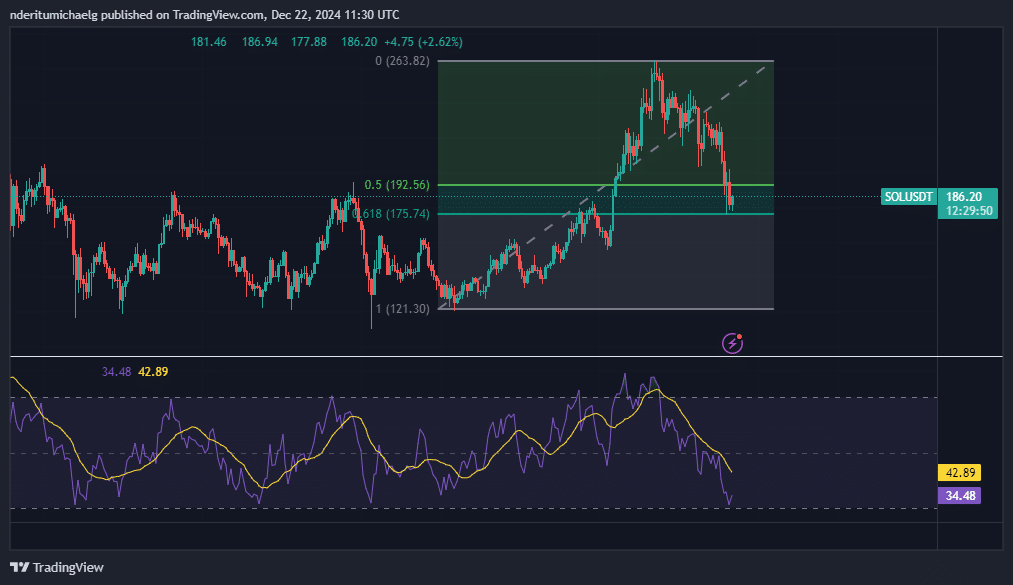

SOL dropped 23% from its highest to its lowest stage final week. Nevertheless, this additionally meant that an essential stage was being retested. The value fluctuated inside the Fibonacci retracement stage of 0.5 and 0.618, primarily based on the September lows and the November excessive.

Supply: TradingView

The RSI virtually dipped into oversold territory over the last dip. This might point out that there will likely be extra detrimental penalties within the coming days. Nevertheless, on the time of writing, the value was already exhibiting indicators of bearish exhaustion.

If a bullish restoration from the Fibonacci vary is in retailer, merchants can count on to see indicators. Thus far, the bearish assault has cooled. Nevertheless, spot flows have been nonetheless detrimental, though it’s value noting that the depth of outflows has decreased over the previous 4 days.

supply: Coinglass

The declining outflows on the spot market may pave the best way for some restoration. Nevertheless, the derivatives market additionally confirmed that SOL might not but be prepared for a robust comeback.

Is your portfolio inexperienced? View the SOL Revenue Calculator

Open interest-weighted financing charges have been detrimental for the previous two days. This was the primary time within the final six weeks that SOL financing charges have been detrimental.

supply: Coinglass

Nevertheless, take into account that Solana’s funding charges have began to indicate indicators of returning to the upside over the previous 24 hours.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now