Ethereum

Solana vs Ethereum: Is SOL’s lead a sign of a new crypto pecking order?

Credit : ambcrypto.com

- Solana has benefited from Bitcoin’s pullback and left Ethereum behind.

- With momentum shifting, can ETH make a comeback?

Loosely referred to as the ‘Ethereum Killer’ Solana [SOL] has proven spectacular resilience on this bull cycle. It has earned this title not solely primarily based on market capitalization, but additionally by constantly being among the many high weekly gainers Ethereum [ETH] stays flat.

On this cycle, SOL is booming as BTC reaches key psychological ranges and attracts traders trying to shift capital to restrict danger – an edge ETH as soon as had.

SOL takes management of ETH

Regardless of ETH’s main market cap of $300 billion being considerably bigger than SOL’s $81 billion, latest shifts present that SOL’s market cap has elevated by over 5%, whereas ETH has fallen by 3%.

This development is especially notable as a result of it coincides with it Bitcoins latest improve to nearly $70,000, representing a achieve of 16.67% in simply ten days.

Usually, an overheated market attracts liquidity into high-cap altcoins as risk-averse traders look to redistribute their income.

Then, when BTC would attain market tops, ETH would publish important positive aspects. Nonetheless, in contrast to earlier cycles, SOL seems to have taken the lead this time.

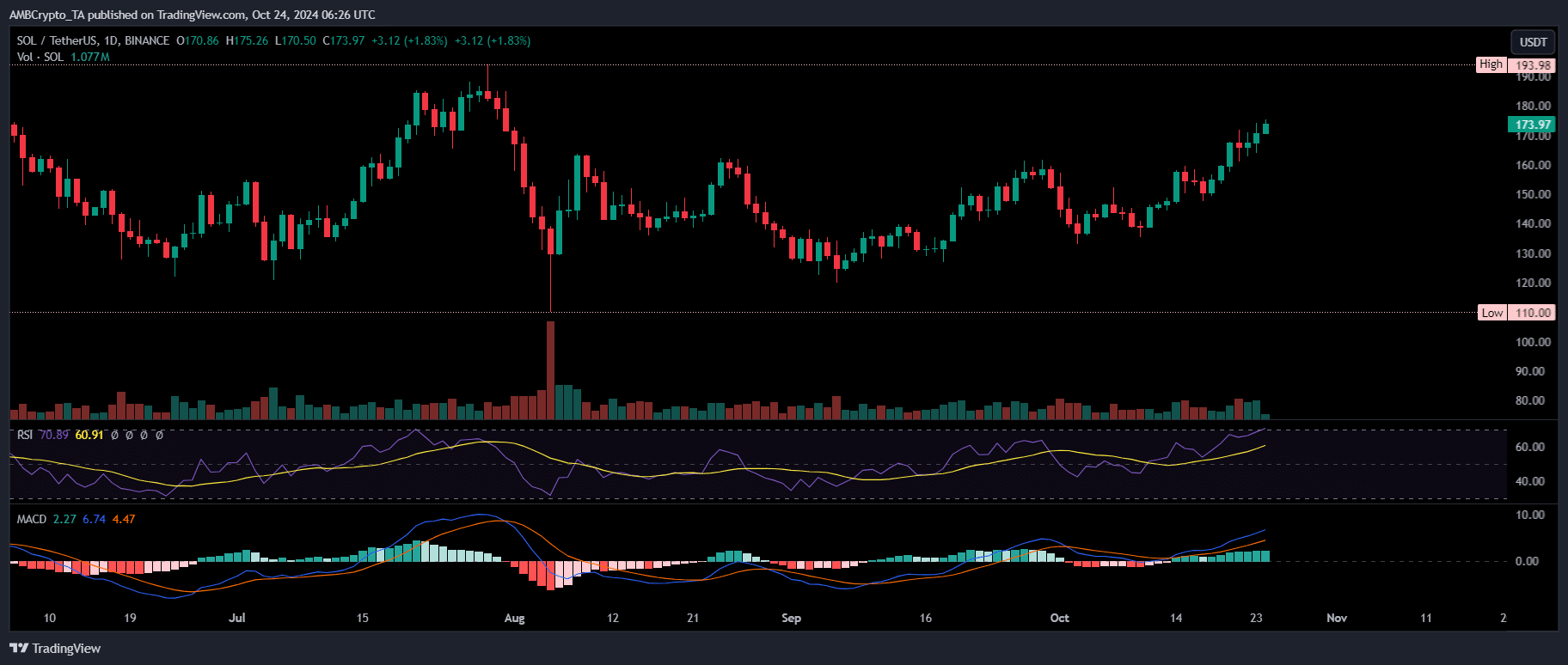

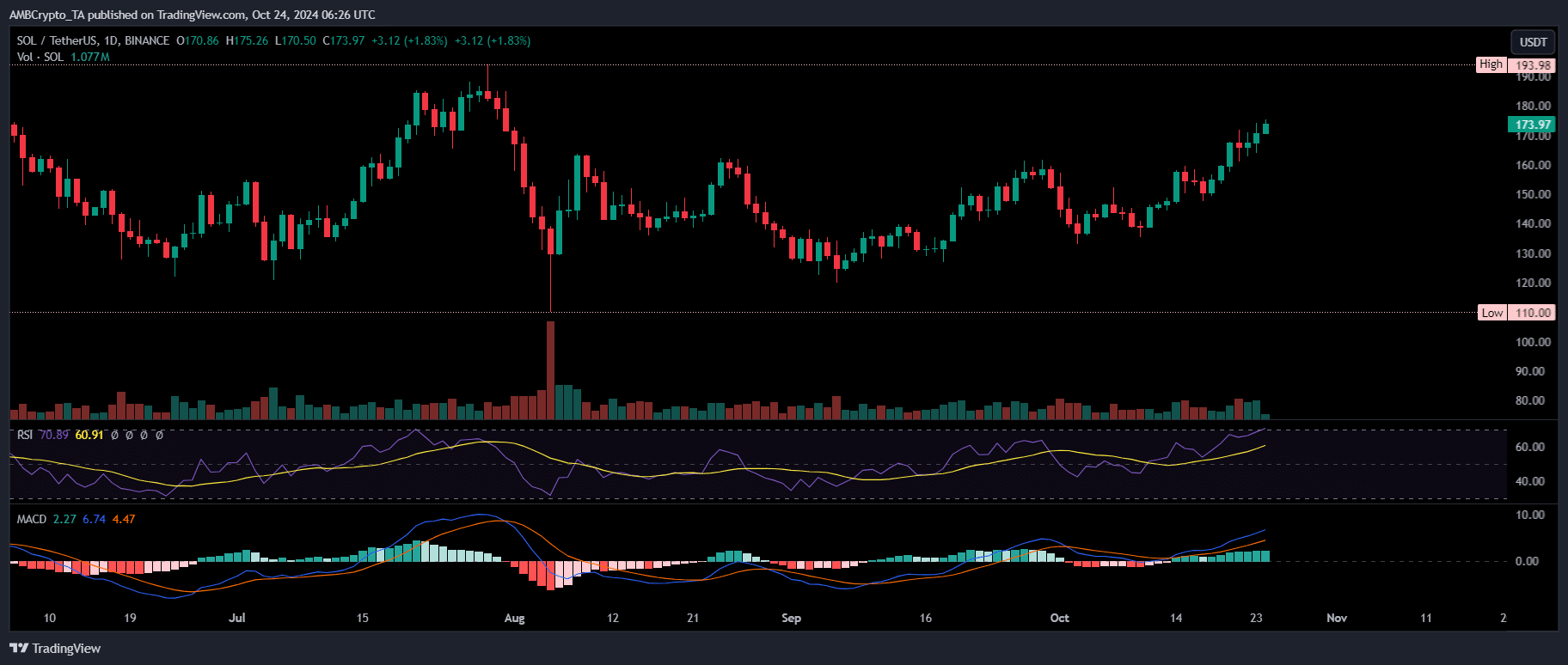

Supply: TradingView

Simply 4 days in the past, as BTC encountered resistance as the value broke above its four-month droop, SOL posted a every day achieve of 4% – the best prior to now week – marking a vital turning level.

The following day, BTC skilled a 2% pullback, establishing $70K as the brand new native excessive. In response, ETH mirrored this conduct, falling almost 3% and persevering with the retracement.

Conversely, SOL bulls have successfully prevented an analogous relapse. In reality, SOL is on the rise after breaking the USD 160 resistance, reaching this milestone on the fourth try after three earlier failures.

The SOL is at the moment buying and selling at $173 and could also be due for a correction because the RSI exhibits an overbought standing. Since 83% of worth strikes over the previous two weeks have been upwards, a trend A turnaround could possibly be on the horizon.

May this carry traders’ consideration again to ETH?

A development reversal could possibly be close to, however be alert to this

Quite, a report from AMBCrypto highlighted ETH’s present pullback as a strategic transfer by merchants, geared toward flushing out weak arms.

This dip may set the stage for an impending breakout, attracting new consumers and inspiring whales to proceed their accumulation, probably pushing ETH above $2,700.

Nonetheless, ETH’s restoration on this cycle is intently tied to SOL. Whereas ETH could possibly be poised for a near-term turnaround if it positive aspects help, reaching a breakout will depend upon rigorously monitoring SOL primarily based on numerous metrics.

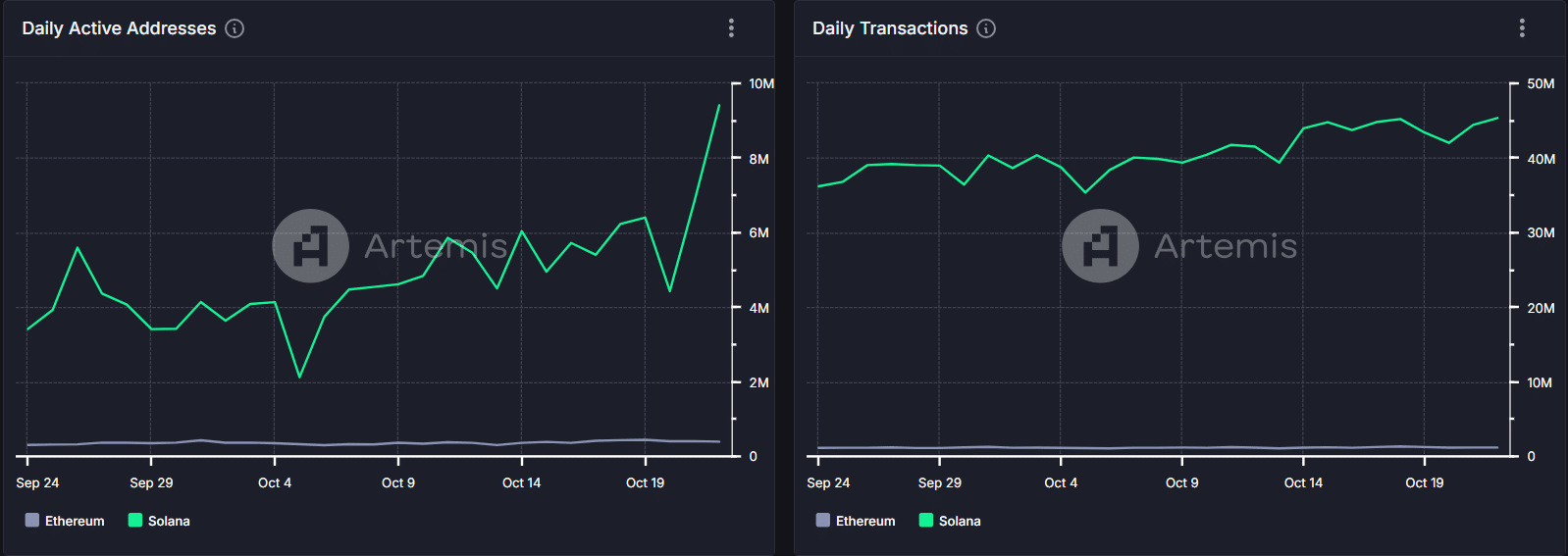

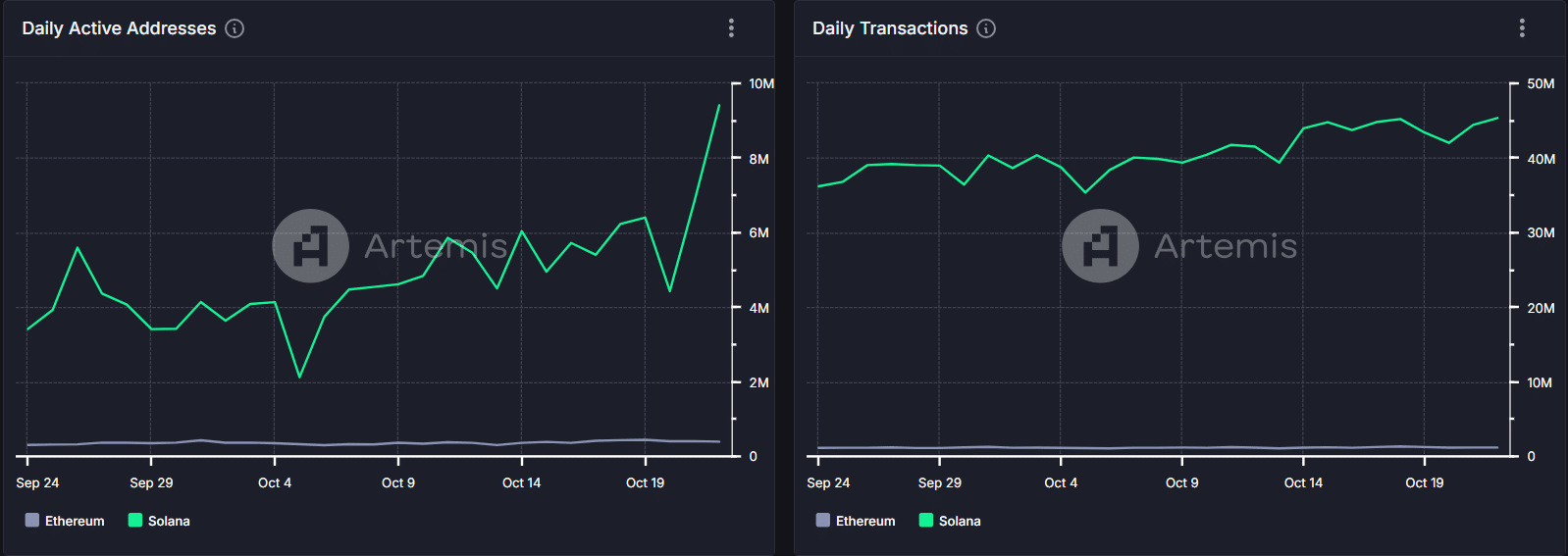

Supply: Artemis Terminal

Over the previous month, every day lively addresses on Solana have elevated by 175%, whereas Ethereum has solely seen a modest double-digit improve.

This spike in exercise is not any coincidence. Solana has strategically positioned itself to surpass ETH by leveraging its excessive throughput, permitting for sooner and extra reasonably priced transactions.

Up to now, this technique has paid off. SOL has successfully benefited from the rising price of ETH, producing exceptional momentum this cycle and likewise attracting important curiosity from BTC traders.

Learn Solana’s [SOL] Worth forecast 2024–2025

In different phrases, SOL’s general prospects seem a lot brighter than ETH’s, making it the main long-term altcoin.

Whereas a correction may push SOL beneath $170, it’s nonetheless poised to surpass ETH, probably testing ETH’s path to a straightforward $2.7K.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now